Frontier Markets Weekly, November 26 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Zambia debt restructuring hits a snag

Zambia’s debt restructuring is back to the drawing board after the country’s bilateral creditors forced it to suspend a deal it reached with private bondholders last month.

Creditors led by China now say the IMF-approved agreement, which extended bond maturities and forgave some $700 million in debt, is too generous to private bondholders. A group representing the bondholders said it was “deeply concerned” about the collapse in talks, which they said threatens the credibility of the G20 common framework for debt restructuring, the FT reports. Zambia needs agreements with its external creditors to continue receiving disbursements under its $1.3 billion bailout program with the IMF.

Zambia defaulted on its debt in 2020. Soon thereafter, it became one of the first countries to pursue debt treatment under the G20 common framework, which wealthy nations introduced during the Covid-19 pandemic to help low-income countries handle mounting debt loads.

Germany pledges $4.4 billion in African green energy

Germany will invest $4.4 billion in African green energy projects over the next six years, Chancellor Olaf Scholz said on Monday. The money will be pledged through the Africa-EU Green Energy Initiative.

Scholz did not specify any projects that the funding will support, but said that African countries should process the raw materials used in renewable energy production. Africa contains 30% of the world’s mineral reserves, including the largest reserves of cobalt, diamonds, platinum and uranium, according to the UN. Most of those minerals are exported and processed elsewhere.

An area of focus for the financing could be green hydrogen, with Scholz emphasizing that Germany will import ”a large proportion” of its green hydrogen needs by 2030, Bloomberg reports. Scholz also urged African leaders to expedite the creation of a functioning continental free-trade area, which he said would increase the market potential for foreign investors.

Kenya privatizes 35 state companies

Kenya will privatize 35 state-owned companies and open another 100 to investment, the country’s President William Ruto said on Thursday.

Following earlier pressure from the IMF to reform state-owned businesses including electricity provider Kenya Power and airline Kenya Airways, Ruto passed a law allowing for the privatization of public companies. “We have identified the first 35 companies that we are going to offer to the private sector, and we have nearly 100 others,” Ruto said this week. Just one week earlier, Kenya received a $938 million disbursement from the lender.

Kenya’s economy is contending with ongoing fallout from the Covid-19 pandemic and Russia’s invasion of Ukraine. Its debt has climbed to two-thirds of GDP, while foreign reserves have fallen to a five-year low. Meanwhile, the country’s IMF loans are conditioned on painful financial reforms, including a plan to hike taxes that has spurred violent protests.

Asia

Kyrgyzstan seeks cooperation with Japan

The President of Kyrgyzstan and Japan’s prime minister agreed at a meeting in Tokyo on Monday to deepen the two country’s cooperation in infrastructure and other arenas, including pursuing shared initiatives on sustainable development and decarbonization. As part of the agreement, Japan will start projects to reduce greenhouse gas emissions in Kyrgyzstan.

After years of relative disinterest from Western economies, Kyrgyzstan and Central Asian states gained renewed import after the Russia’s invasion of Ukraine last year. Japan, the US, and other wealthy nations are now seeking economic cooperation with the so-called C5 group in a bid to reduce their dependence on Russia and China.

Kyrgyzstan is particularly dependent on those countries. Remittances from Russia make up 30% of its GDP, and China owns 40% of its state debt, Nikkei reports.

Under shadow of war, Sri Lankan workers head to Israel

Sri Lanka plans to send 20,000 farm and construction workers to Israel next month, as an economic crisis at home overshadows the risks of moving to a country at war.

Despite signs of improvement, Sri Lanka’s economy continues to struggle with a shortage of foreign exchange reserves and remittances, which fell from 8% of GDP before the pandemic to 5% last year, according to World Bank statistics. Last year, the island nation’s economy contracted by almost 8% amid its worst economic crisis in 70 years, pushing 2.5 million people into poverty.

Israeli farms usually rely on Palestinian and Thai workers, but after the breakout of war between Israel and Hamas last month, Thai workers fled the country and Palestinians were largely banned from the workforce. Migrant farmhands in Israel can earn almost 10 times as much as they would in Sri Lanka, South China Morning Post reports.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Hostages and prisoners released amid Israel-Hamas ceasefire

Hamas has freed dozens of hostages via Egypt as part of its temporary four-day ceasefire agreement with Israel, Reuters reports. Qatar, acting as a mediator, said that 13 Israelis and 14 Thais and Filipinos were freed in exchange for 39 Palestinians who were released from Israeli jails.

The AP reports as of Saturday afternoon that the truce remains intact, with more hostages to be released every day of the ceasefire, and the UN claiming the pause enabled deliveries of food, water and medicine to reach the largest volume since October. Despite the pause in fighting, the US carried out a fourth round of retaliatory airstrikes against Iranian proxies in Iraq, responding to reported ballistic missile attacks against a US base—reportedly the 60th such attack since October 7th.

Earlier this week ahead of the ceasefire, China welcomed Arab and Muslim foreign ministers to Beijing for talks on the crisis, resulting in a joint statement calling for an immediate halt to the “military escalation” and a political process to “hold the Israeli occupation accountable for the blatant violations and crimes” against Palestinians. In his opening remarks to his peers, Chinese Foreign Minister Wang Yi said that “China is a good friend and brother of Arab and Islamic countries” that has “always firmly safeguarded the legitimate rights and interests of Arab (and) Islamic countries.”

Europe

Polish growth outlook strengthens as EU releases recovery funding

Brussels approved an advance payment of €5.1 billion to Poland as part of long-delayed EU pandemic recovery funds, the FT reports. The move comes ahead of the expected return to office of pro-European premier Donald Tusk in Warsaw.

This marks the first payout since recovery funds were frozen in 2021 over rule-of-law concerns under the outgoing nationalist Law and Justice (PiS) government. The recent parliamentary elections saw Tusk’s pro-European coalition triumph, promising to restore judicial independence and unblock Poland’s share of EU funding.

Poland is anticipated to receive around €60 billion from the EU’s recovery fund, with most funds contingent on the reversal of judicial reforms criticized by the European Commission for limiting judges’ independence. However, the conditions for the €5.1 billion advance payment, approved on Tuesday, are tied to emergency measures related to energy and the green transition, addressing additional costs prompted by the Ukraine conflict.

Latin America

Investors celebrate Milei’s win but Argentina faces difficult path

Investors are celebrating the unexpected victory of radical libertarian Javier Milei in Argentina’s presidential election, as both stocks and bonds experienced a surge in international trading, the FT reports. Drawing inspiration from the campaign strategies of Donald Trump and Jair Bolsonaro, Milei secured 56% of the vote, defying expectations.

However, concerns loom over the incoming leader’s ability to navigate a challenging economic landscape marked by 143% annual inflation, soaring debt levels, and an empty treasury. Analysts suggest this could be Argentina’s most turbulent presidential transition in at least a decade.

Milei, an economist with a penchant for drastic reforms, has vowed to overhaul the Argentine state, privatize extensively, and implement economic shock therapy. Despite retreating on some controversial proposals before the election, he asserted in his victory speech that there is “no room for gradualism.” While international markets responded positively, economists caution that Argentina faces the risk of economic collapse unless swift measures are taken to restore confidence.

Argentina’s dollar bonds gained 5% to reach their highest level since September—although they remain significantly below face value. Milei’s promise to fully privatize state-controlled energy company YPF SA led to a nearly 40% surge in US-listed shares.

Panama growth fears increase as challenges persist

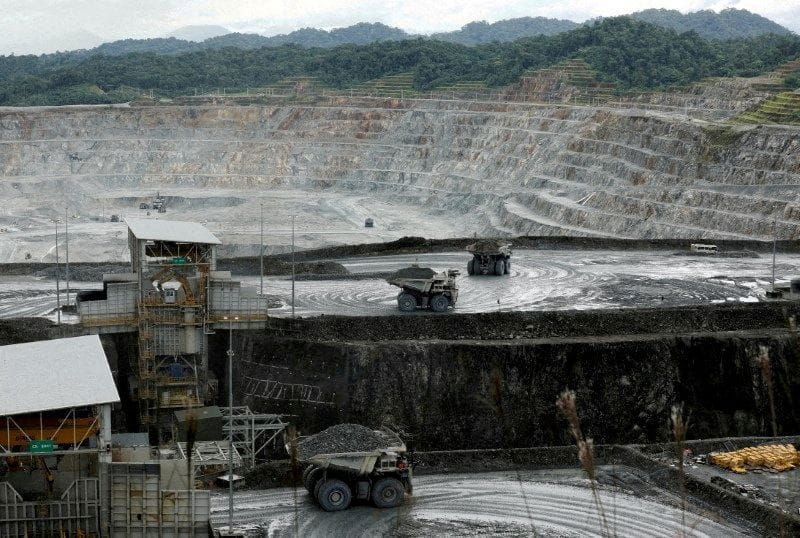

Canadian mining firm First Quantum Minerals has suspended commercial production at its Cobre Panama mine, one of the world’s largest and newest copper mines, due to a port blockade hindering the delivery of crucial supplies, Bloomberg reports. Widespread demonstrations against the mine, which generates some 5% of Panama’s GDP, prompted a review of the company’s contract with Panama that is now being considered by the country’s highest court.

Panama’s Supreme Court started deliberations on the case on Friday, Reuters reports. The news agency said a majority of lawyers it surveyed about the case expect the court to rule against the company, citing a precedent.

Panama’s economy is facing an additional challenge after an unusually dry spell has led to water shortages and reduced the number of vessels allowed to pass through the Panama Canal. Traffic jams caused by the restrictions are prompting vessels to consider bypassing the choke point by going around the south coast of Chile.

Colombia strengthens Venezuela partnership

Colombia’s state-owned oil company, Ecopetrol, is considering importing gasfrom Venezuela’s PDVSA from December 2024, Reuters reports. Colombia’s President Gustavo Petro, during a recent visit to Venezuela, flagged a potential collaboration between Ecopetrol and PDVSA that could include bilateral projects using the Antonio Ricaurte pipeline for gas supply to Colombia.

Importing gas from Venezuela could slash Colombia’s cost from $15 per million cubic feet to $5, Minister of Mines and Energy Andres Camacho said. However, potential challenges may arise given the geopolitical context, as Washington has eased some oil sanctions on Venezuela but retains the option to reinstate them based on political developments.

- Amid collapse in investment, Colombia posts weaker-than-expected Q3 results (FrontierView)

Petro also earlier proposed the US pay an “economic stabilization” bonus for Venezuelan migrants who stop in Colombia en route to the US. Petro emphasized the need for an agreement with the US on migration, suggesting that these bonuses could facilitate the return of families to their home countries.

What we’re reading

Liberia’s George Weah concedes defeat to former VP after tight vote (FT)

Ghana to sign costliest loan ever for cocoa as debt crisis bites (Bloomberg)

Mali signs agreement with Russia to build gold refinery (Reuters)

Standard Chartered slashes Kenya government debt as sovereign risks climb (Bloomberg)

DRC’s new rules could force banks to sell stakes of up to 45% (Bloomberg)

South Africa’s quest for energy security threatens climate goals (Bloomberg)

Key African economies set to deviate from global rates path (Bloomberg)

Pakistan expands security for Chinese after Beijing’s pressure (Nikkei)

Rising gold-backed loans elevate risks for Sri Lankan finance companies (Fitch Ratings)

Geothermal energy projects heat up in Philippines and Indonesia (Nikkei)

Why Indonesia has not captured more of the ‘China +1’ diversification (FT)

Anwar struggles to boost Malaysian economy (Nikkei)

Central Asia’s critical cotton crops ‘delivering diminishing returns’ (Radio Free Europe)

ASEAN economies await a cloudy 2024 (Nikkei)

Attacks mount on Israel-linked ships (Barron’s)

‘No hope for the future’: Iran faces brain drain as emigration surges (FT)

Iranian poverty spread in ‘lost decade’ of sanctions and oil swings, World Bank says (Bloomberg)

China and Saudi Arabia sign $7b currency swap (Bloomberg)

Saudi Arabia raises $11b loan to help fund deficit (Bloomberg)

Maersk ceases operations in Syria (Port Technology International)

Middle East sees year-end IPO rush, despite war and global gloom (Bloomberg)

Albanian PM calls for more significant increase in NATO troops in Kosovo (Radio Free Europe)

Hungary’s Chinese EV ambitions thwarted by anti-immigration grief (Nikkei)

Ukraine’s coal mines turn to women to solve staff shortages amid war (Radio Free Europe)

Russian military manpower shortage in Ukraine becomes a political problem (Radio Free Europe)

North Macedonia completes training first batch of Ukrainian soldiers (BalkanInsight)

Treat Bosnia on par with Ukraine over accession talks, Austria tells EU (FT)

Millennial leader takes over broke and crime-wracked Ecuador (Bloomberg)

Venezuela ‘close to approving’ offshore gas license with Trinidad and Shell (Reuters)

China’s growing space program in Latin America concerns US (Washington Post)

Colombia’s leader promised ‘total peace.’ Then violence surged (FT)

EM currencies gain as dollar weakens (Bloomberg)

Developing markets fight drugmakers over access to TB and HIV drugs (AP)