Frontier Markets Weekly, January 23rd 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share the link with any friends or colleagues you think would enjoy it.

Africa

Sudan protesters begin strike as conflict with generals worsens. Pro-democracy groups began two days of strikes and civil disobedience in Sudan on Tuesday, a day after security forces fired live rounds and used tear gas to disperse protesters in some of the deadliest clashes since a military coup last year, Nicholas Bariyo reports in the Wall Street Journal.

At least seven people were killed and hundreds injured in clashes on Monday as security forces repelled crowds attempting to advance on the presidential palace in Khartoum. The standoff marked a major escalation in tensions between the coup leaders and the growing protest movement, as diplomatic efforts to end the unrest faltered.

Photo: Marwan Ali/Associated Press

Protests, sometimes involving tens of thousands of people, have frequently broken out in the Sudanese capital after the country’s generals toppled a hybrid military-civilian administration that had held power after the ouster of Islamist autocrat Omar al-Bashir in 2019. The protests have spiraled into a broader outpouring of grievances against the military. The protest leaders have accused generals of mismanaging Sudan’s economy and squandering proceeds from the country’s gold and oil. The military leaders deny the accusations.

Asia

Multinationals pull out as Myanmar descends further into chaos. Oil firms Total and Chevron this week announced they were pulling out of Myanmar because of a worsening humanitarian environment, Reuters reports. Fellow oil-giant Shell also revealed it no longer holds any exploration licenses in the troubled Southeast Asian nation, the news agency said.

Total said in a statement that the decision was prompted by a deterioration in “human rights and more generally the rule of law, which have kept worsening in Myanmar since the coup of February 2021.”

- Myanmar’s pro-democracy forces resist with cryptocurrency (Nikkei Asia)

- UN seeks Thailand’s help to halt Myanmar crisis deterioration. (Al Jazeera)

The military regime this week moved to tighten its control of citizens’ access to the internet, proposing a rule to ban the use of VPNs and force service providers to provide the personal information of users. The move is meant to reduce internet access and limit money going to pro-democracy groups Nikkei Asia reports.

China’s lending comes under fire as Sri Lankan debt crisis deepens. A deepening debt crisis has left Sri Lanka struggling to pay for imports and stoked political controversy over Chinese lending to the South Asian nation as part of Beijing’s global Belt and Road infrastructure program, the WSJ’s Philip Wen writes. The crisis has also opened a window for India, which provided financial relief to Sri Lanka last week shortly before a $500 million bond matured, to push back against Chinese influence in the Indian Ocean region.

- Sri Lankan MP accuses Beijing of pushing Colombo into debt trap Economic Times

Ajith Nivard Cabraal, Sri Lanka’s central bank governor, said on his official Twitter account that the country had repaid the bond, which matured on Tuesday. It was the first major tranche of $4.5 billion total sovereign-debt repayments due in 2022.

But with around two-thirds of government revenue already going toward interest payments, President Gotabaya Rajapaksa warned in a speech to Parliament that the country had insufficient foreign-currency reserves to pay for the imports it needed. That warning followed his appeal last week to visiting Chinese Foreign Minister Wang Yi for Beijing to restructure its debt, provide concessional trade terms, and lift Covid-related restrictions on Chinese tourists visiting Sri Lanka.

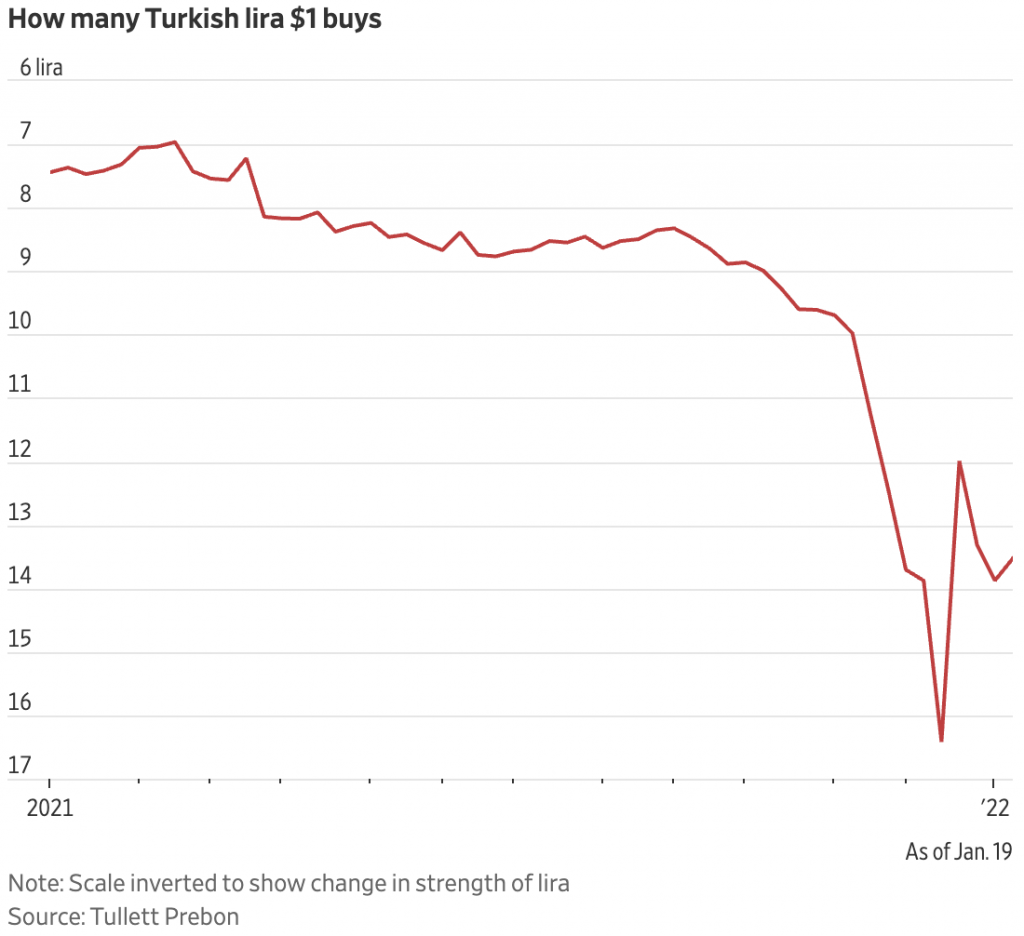

Turkey takes $5 billion lifeline from old rival U.A.E. The United Arab Emirates and Turkey agreed to a currency swap equivalent to nearly $5 billion that reinforces an economic partnership between two rivals and provides Ankara with a badly needed infusion of foreign funds, Jared Malsin and Caitlin Ostroff report in the Journal. The deal, announced on Wednesday, deepens the detente between Turkey and the U.A.E., powers that until recently were on opposite sides of a Middle Eastern cold war and remain at odds over conflicts in the region.

The two struggled for supremacy in the aftermath of the 2011 Arab Spring uprisings and later backed opposing sides in the civil war in Libya and in Saudi Arabia’s blockade of Qatar.

- F-16 sale could mend US, Turkey ties, but tension with Russia intrudes (WSJ)

The injection of Emirati funds will help Turkey’s central bank as it burns through foreign currency reserves to prop up the lira, which lost 40% of its value against the dollar last year. The amount exchanged is modest compared with Turkey’s financial needs, however.

Europe

Tensions rise further at Ukraine’s border with Russia. Russia sent more troops to its border with Ukraine this week, increasing already heightened tensions between the Kremlin and the West and intensifying fears over a potential invasion, according to the AP.

- Russian stocks take biggest tumble since March 2020 (FT)

Russia also moved troops into Ukraine’s northern neighbor Belarus, prompting sharp criticism from the US State Department, Politico reports. “This is neither an exercise nor normal troop movement,” the website quoted a senior State Department official as saying. “It is a show of strength designed to cause or give false pretext for a crisis as Russia plans for a possible invasion. And let’s be clear: It’s extremely dangerous.”

Ukrainian soldiers on the front lines are convinced Russia will invade at some point, according to CNN. The Kremlin has denied it is planning to attack, arguing it is responding to a growing threat from NATO on Russia’s western flank, but locals in Muratove, a town near the front lines in Ukraine, are unconvinced. “It will happen,” one resident said, according to CNN. “There’s nothing anyone can do to stop it.”

Latin America

Funding woes, fraud and a president who won’t quit: El Salvador’s bitcoin experiment. At a packed convention center in Miami in early June 2021, El Salvador’s President Nayib Bukele announced in a prerecorded video that the Central American country would soon be making bitcoin a legal currency in El Salvador. Today, four months into El Salvador’s bitcoin experiment, the reviews are mixed, Blockworks’ Casey Wagner reports. Some praise the move as the most progressive step in history toward granting financial access while others claim it’s an irresponsible gamble and a credit-rating nightmare.

Progress has been slower than anticipated. Bukele has been faced with a myriad of challenges, including a botched wallet launch, accusations of fraud, slow adoption and dwindling funds. Public perception is deteriorating, too, thanks to a series of tweetsfrom Bukele making light of the situation. Bukele trades bitcoin on behalf of El Salvador on his cellphone, he admitted in another tweet.

The IMF has criticized El Salvador’s bitcoin adoption, and discussions over a $1.3 billion loan Bukele was seeking have stalled. “Given bitcoin’s high price volatility, its use as a legal tender entails significant risks to consumer protection, financial integrity, and financial stability,” the IMF said in a concluding statement in its 2021 Article IV mission to El Salvador.

Bitcoin was trading at around $35,000 on Saturday evening, down from around $47,000 when El Salvador officially adopted it as a currency.

Fears over Russia’s moves in the Americas might be overplayed. The potential for a Russian military deployment in Venezuela or Cuba kept the region on edge this week, Al Jazeera reports. Such a move would bring the standoff over Ukraine to the US’s doorstep and generate instability across the region.

Moscow has in recent years increased its regional presence through propaganda, arms and equipment sales, counterdrug agreements and trade. This pattern of increased engagement since 2008 includes a range of economic and security agreements with Cuba, Argentina, Brazil, and Nicaragua.

Despite Russia’s apparent ambition, though, its arms sales to the region have been steadily declining since the end of the Cold War and any Russian resurgence is undermined by a large soft-power deficit. A 2020 Pew Research Survey revealed that confidence in Russian president Vladimir Putin’s leadership stood at just 34% in Brazil, 36% in Argentina, and 39% in Mexico. Such figures have not been boosted by Russia’s problem-plagued rollout of the Sputnik-V Covid-19 vaccine. —Ken Stibler

Argentina tries to outgrow its problems, but skepticism about recovery remains. An unlikely bullish narrative about Argentina has emerged in recent weeks, with investors and business planners taking another look at the country after a string of positive data confounded expectations and raised optimism about the serial defaulter.

First, December saw oil output hitting a near 10-year high as the high-quality Vaca Muerta oil deposit increased production. Then, end-of-year data saw a decrease in the fiscal deficit from over 6% to 3% for 2021.

Argentina’s copper reserves are also attracting attention from mining companies, Bloomberg reported, noting that Argentina could benefit from recent moves in established producers Chile and Peru towards increasing taxes and restricting mining operations. If such interest pans out, it could provide the cash-strapped government with a new source of hard currency.

Argentina faces significant headwinds, though. Record temperatures recently caused prices to spike and raised energy use, draining already scarce hard currency. Macro risk from tenuous negotiations with the IMF, 40%-plus inflation and the specter of rising debt-service costs on Argentina’s large dollar-denominated loan stock add to the pressure. —Ken Stibler

Chile’s incoming leftist president moves to calm markets. Chile’s President-elect Gabriel Boric said he would appoint central bank chief Mario Marcel as finance minister, seeking to ease concerns among investors worried the incoming administration will move the country far to the left, the Wall Street Journal’s Ryan Dube reports. The December election of Mr. Boric, a former student protest leader whose coalition includes the Communist Party, rattled investors concerned he would carry out a major economic overhaul of Latin America’s most successful model of free market orthodoxy and home to the world’s biggest copper mines.

The appointment of Mr. Marcel, a 62-year-old economist who has held high-ranking economic posts under center-left presidents, signals that the 35-year-old president-elect may follow a market-friendly path once he is inaugurated on March 11. Early on Friday, the Santiago Stock Exchange was up 2.27% while the peso was trading slightly stronger against the dollar after appreciating more than 6% against the greenback so far this year amid growing expectations Mr. Boric will follow more moderate policies.

“It’s a positive development, there is no doubt about it. It is an early sign of policy pragmatism,” said Alberto Ramos, a Goldman Sachs economist who tracks Chile. “Marcel is a low-key, highly-trained technocrat with vast experience in the public sector.”

What we’re reading

Ghana turns to domestic taxes to finance development over money market woes. (Africa Report)

Video: Kenya on track to reach energy self-sufficiency. (Al Jazeera)

Peril and promise: poisonous gas from ‘killer lake’ powers Rwanda. (Fin24)

Zambia has more than copper, and offers unexplored potential. (Africa Report)

Covid-19 shots risk displacing immunizations against childhood killers in developing countries. (WSJ)

Egypt and Algeria call for mercenaries and foreign fighters to leave Libya. (Arab News)

South Korea inks deal to lend Egypt $1bn for infrastructure. (Nikkei)

Bitcoin miners eye Kazakhstan as industry execs make US case (Blockworks)

Kazakhstan’s Nazarbayev appears for first time since unrest. (Intellinews)

Pakistan’s economic woes put PM Imran Khan’s future in doubt. (Economic Times)

A journey along Afghanistan’s main highway leads through a country in transition. (WSJ)

India’s biggest cities see Covid-19 cases fall sharply, raising hopes for Omicron peak. (WSJ)

China cuts benchmark rates to bolster flagging economy. (WSJ)

Crypto exchange Binance seeks to re-establish itself in Thailand. (Blockworks)

Indonesia passes law to move capital from Jakarta to Borneo. (Washington Post)

Why Indonesia is jolting markets by curbing commodity exports. (Bloomberg)

North Korea considers restarting long-range and nuclear weapons tests. (WSJ)

South Korea’s presidential candidates look to reintroduce ICOs following 4-year ban. (Blockworks)

People urged to be vigilant as more thunderstorms and snow forecast for Saudi Arabia. (Arab News)

Airstrikes in Yemen kill at least 70 people as Saudi-led coalition ramps up offensive. (WSJ)

Houthis fired drones and missiles in Abu Dhabi attack, investigation finds. (WSJ)

Slovenia irks China with decision to upgrade Taiwan ties. (AP)

Proposed Russian crypto ban may push miners west. (Blockworks)

Russia’s Putin Loves to Roll the Dice. Ukraine Is His Biggest Gamble Yet. (WSJ)

Serbia pulls plug on planned Rio Tinto lithium mine. (FT)

Romania offers Moldova financial aid to ease gas crisis. (BalkanInsight)

Illicit crime cash ‘flowing’ through Bosnia, Serbia, and Montenegro – Report. (BalkanInsight)

Slovak–US Defense Pact Encounters fierce resistance. (BalkanInsight)

Afghans housed at military base in Kosovo could be denied entry to U.S. for alleged terrorist ties. (WSJ)