Frontier Markets Weekly, November 19th 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Kenya hosts talks on global plastics treaty

Governments gathered in Nairobi this week to attempt to lay the groundwork for a global treaty to end plastic pollution. The conference marked the third of five planned meetings aimed at completing negotiations for the treaty by the end of next year.

At the summit, countries diverged on whether they should be able to set their own targets to restrict their production of plastics or agree to universal standards. Large carbon emitters, including the United States, China, India, and Saudi Arabia, have previously pushed for countries to be able to set their own plastics targets, favoring a similar framework to the 2015 Paris Agreement’s stance on emissions.

Kenya is a world leader in fighting plastic production. It has banned several single-use plastics, including plastic bags and cutlery, and imposes strict penalties for lawbreakers.

Malawi secures IMF bailout

The IMF executive board approved a $178 million loan to Malawi on Wednesday, clearing the way for an immediate $35 million disbursement. Malawian President Lazarus Chakwera said the bailout would unlock financial support from other development partners, Reuters reports. The World Bank could soon provide the country with more than $500 million in funding, he said.

Malawi has struggled to sustain growth for decades despite large inflows of development assistance, and the country’s economy has stagnated over the past three years, with debt rising as cyclones and cholera struck its population.

Malawi is facing a challenging macroeconomic environment, the IMF said in a statement. The country devalued its currency by 30% earlier this month amid shortages of fuel, medicine, and fertilizer and a dearth of foreign currency reserves.

Ethiopia reaches debt-service suspension deal

Ethiopia agreed in principle to an interim debt service suspension deal with its bilateral creditors this week. The Ethiopian finance ministry expects the agreement to mirror a previous deal the country made with China to suspend debt service obligations, Yahoo reports.

The finance ministry also said that the country will soon begin talks to restructure a $1 billion eurobond maturing next year, Reuters reports. In February, some international bondholders proposed extending the maturity of that bond to 2029 or 2030. The country has more than $28 billion in external debt, and its economy is reeling from high inflation and mounting interest payments.

Ethiopia is pursuing restructuring under the G20 common framework, which the world’s largest economies established in 2020 to help lower-income countries manage their debts. Chad, Ghana and Zambia are also pursuing restructuring under the program, although critics argue it has failed to improve outcomes for highly indebted nations.

Asia

Indonesia upgrades ties with US

The US and Indonesia agreed to cooperate in a rage of areas including critical minerals, climate, digital connectivity and defense during a meeting of their presidents at the White House on Monday. The leaders upgraded US-Indonesia ties to a “comprehensive strategic partnership,” the same level to which the US and Vietnam elevated their ties in September.

Much of the talks focused on critical minerals, with Washington and Jakarta agreeing to develop an “action plan” to increase high standards investment from both countries. Indonesia has the world’s largest reserves of nickel, which is a crucial component of the lithium batteries that power electric vehicles.

Developing that plan may prove complicated in practice. Several US policymakers have raised concerns about Indonesia’s labor and environmental protections and oppose expanding trade with the country, Nikkei reports. Those concerns have scuttled proposals to include Indonesia in limited free trade agreements with the United States.

As part of the talks, the countries also announced that US oil giant ExxonMobil will invest up to $15 billion in Indonesia to boost industrial growth and promote decarbonization. In partnership with an Indonesian state-owned oil company, Exxon will also assess the potential for a carbon sequestration hub beneath the Java Sea.

Thailand pitches $28b supply-chain project

Thailand’s prime minister advocated for a $28 billion project to cut shipping times between the Indian and Pacific Oceans by building a land bridge across Thailand.

By bypassing the Malacca Strait, a narrow channel that runs between Indonesia and Malaysia, shippers can cut travel times by an average of four days and lower costs by 15%. The “Landbridge” project would see ports built on either side of Thailand’s southern peninsula, connected by 62 miles of highway and rail networks, Time reports.

About a quarter of the world’s traded goods currently pass through the Malacca Strait, which is the shortest sea route between the Asia-Pacific and India. If it secures the funding, Thailand will aim to complete the project by 2030, with foreign firms permitted to own more than 50% of ports and related infrastructure in joint ventures with Thai companies, Bloomberg reports. The project would raise Thailand’s economic growth rate to 5.5%, up from a forecasted 2.7% this year, Srettha said.

Nepal bans TikTok

Nepal banned the video-sharing app TikTok on Monday, citing its disruption to the country’s “social harmony.”

The restriction took effect almost immediately. Nepal’s government did not say what led to the decision, but the country’s cabinet created regulatory guidelines for all social media apps last week, the Washington Post reports. Included in those guidelines is the requirement for all social media platforms to establish an office in Nepal.

Over the past four years, TikTok has been implicated in more than 1,600 cyber crime cases in Nepal. Still, some Nepalese officials and civil society groups criticized the ban, saying that it constituted an attempt to curb freedom of speech, BBC reports.

South Asia has proved resistant to China-owned TikTok’s soaring global popularity. India banned the app in 2020 citing national security concerns; Pakistan has banned it at least four times since then, though it is not currently prohibited.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Iran reassures US over Israel-Gaza conflict

Iran has reportedly told the US through backchannels that it does not want the war between Israel and Gaza to spread any further, the FT reports. Foreign Minister Hossein Amirabdollahian has confirmed that “messages have been exchanged between Iran and the US, via the US interests section at the Swiss embassy in Tehran” since the October 7 attack on Israel by Hamas, but said no direct talks have taken place.

The FT’s report follows a Reuters scoop—citing unnamed insiders in Iran’s government—that claimed Ayatollah Ali Khamenei rebuked Hamas leader Ismail Haniyeh for failing to give advance notice of the October 7 attack, and told him to cease public calls for Iranian intervention. Hamas has denied the report, saying no such meeting took place, while Iran did not respond to a request for comment.

Both reports indicate an apparent interest by Iran and the US to tone down the conflict and avoid an accidental outbreak of a wider war.

France issues arrest warrant for Syrian president

A judge in France has issued an international arrest warrant for Syrian President Bashar al-Assad and three of his top generals, including his brother, for alleged war crimes and crimes against humanity, the AP reports. The warrant stems from a complaint filed by lawyers representing Syrian victims, and focuses primarily on Assad’s role in chemical weapons attacks on eastern Ghouta and Douma.

Lawyers for the victims say the warrant “marks a crucial milestone in the battle against impunity” and “signifies a positive evolution in case law” on chemical weapons use and war crimes against civilians. The French court’s decision comes in the wake of Syria’s being welcomed back into the Arab League as part of a wider process of regional detente between Iran and Saudi Arabia and their respective allies, and as Assad was in Riyadh for a summit on finding an end to theIsrael-Gaza war.

Oman-led meeting greenlights 2030 launch for Gulf Cooperation Council regional railway

This week, ministers of transport and communications of Gulf Cooperation Council members met in Oman to recommit to launching the long-awaited GCC Railway by 2030. The railway project, which has been in limbo since a sharp drop in oil prices in 2014, was revived after member states this week sanctioned a new construction budget for 2024 and approved new regulatory frameworks on administration, financing and procurement for the project.

Oman’s Minister of Transport, Communications and Information Technology Said Hamoud al Maawali said that the project will lend support to economic growth and sustainable development in the region and facilitate “sound exploitation of natural resources.”

Europe

Turkish economic improvement drives fixed income frenzy

Turkey surprised analysts by posting a $1.9 billion current-account surplus in September, only its second since 2021, Morningstar reports. While the government still projects a current-account deficit of 4% of GDP this year, the unexpected improvement reflects both a strong tourism sector and the impact of tightening monetary policy, which is curtailing credit growth and reducing demand for foreign goods.

Rising lira deposit rates have also slowed gold purchases—historically a drag on the current account—and improved the balance of trade.

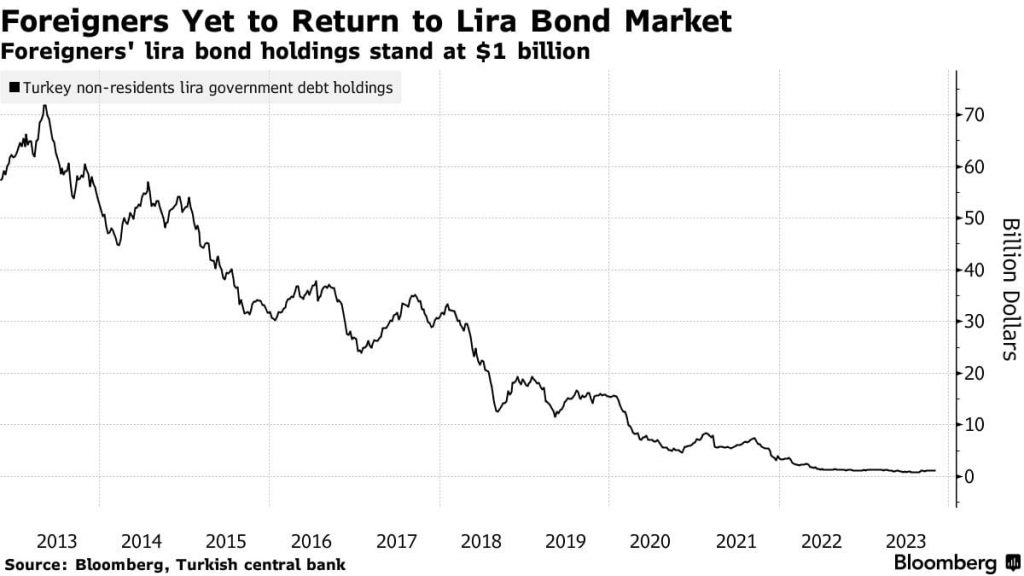

Analysts are turning bullish on the macroeconomic performance, expecting Turkish lira bonds to go from the worst-performing local debt market in developing nations in 2023 to the best in 2024, Bloomberg reports. Despite short-term challenges such as high inflation and elevated borrowing, Deutsche Bank predicts a structural turnaround that will prompt foreign investors to consider buying back into the Turkish bond market.

Serbia inks Azerbaijan gas deal

Serbia this week became the eighth European country to sign gas supply agreements with Azerbaijan. The two nations solidified nascent energy ties with Azerbaijan agreeing to export 400 million cubic meters of gas annually starting in 2024, Balkan Insight reports.

The agreement opens avenues for further cooperation, including the delivery of liquefied natural gas and joint efforts to develop gas power plants and storage facilities. Serbian energy minister Djedovic Handanovic noted that the completion of the Balkan Stream gas pipeline will enhance Serbia’s role as a transit country for gas supply to Central European nations.

This move marks a significant shift for Belgrade, which currently relies heavily on gas imports from Russia’s Gazprom. The flurry of deals with Baku over the past two years also highlights continued European energy insecurity as the pivot from Russian supplies set off a scramble to secure stable energy supplies.

Ukraine secures key wins as Western support falters

The US congress this week passed a budget that conspicuously lacked Ukraine funding, further raising concerns that critical Western aid to Kyiv is slowing. Despite the prospect of less assertive patrons, Ukraine was securing wins on and off the battlefield.

Kyiv secured a deal with global insurers to provide more affordable insurance, offering up to $50 million in war risk cover for ships carrying agricultural commodities from its Black Sea ports. The insurance facility is expected to reduce grain insurance costs by around 2.5%, boosting the economy and tax revenues for the Ukrainian government.

Meanwhile on the battlefield, Ukrainian marines reported crossing the Dnipro river and fortifying several bridgeheads in the Russian controlled east of the country. The breakthrough represents the most substantial victory in an otherwise stalled counteroffensive by Kyiv.

Latin America

Guatemalan president elect warns ‘slow coup’ threatens the economy

Guatemalan authorities are intensifying efforts to strip president-elect Bernardo Arévalo’s immunity from criminal prosecution, alleging his involvement in a violent takeover of the University of San Carlos. Arévalo, an anti-corruption crusader, denounced the investigation as a continuation of a “soft coup” as incumbent authorities have elected new judges and initiated proceedings to revoke immunity from electoral authority magistrates, Bloomberg reported.

The Biden administration warned against any attempts to prevent Arévalo from assuming office, with Assistant Secretary of State Brian Nichols stating that such actions will be met with new sanctions. Arévalo warned that blocking the transition of power could undermine investor confidence, trigger US sanctions and increase the country’s brain drain.

Guatemala has the region’s lowest public debt levels and a track record of macroeconomic stability. Yet the country has fallen short of an investment grade rating—one of Arévalo’s campaign promises—with S&P and Fitch previously saying that strengthening the country’s regulatory and legal framework could trigger an upgrade.

Investors pile into Brazilian ESG bond

Investor demand drove a strong performance by Brazil’s first sustainable bond. The sale raised $2 billion on Monday, with yields of 6.5%, the lowest for Brazil in almost a decade and comparable to investment-grade issues, despite the country’s BBB rating, Latin Finance reported.

Brazil is jumping on the ESG finance bandwagon later than regional peers: Programs in eight other Latin American economies have already raised over $40 billion. Proceeds from the notes will be directed to green and social projects under Brazil’s newly approved framework for sustainable bonds.

The sale capped off a busy two weeks in bond markets that saw Colombia, Costa Rica, Uruguay and Barbados issuing sustainable and regular bonds alike.

US threatens to reimpose sanctions on Venezuela

The Biden administration threatened to revoke recently granted sanctions relieffor Venezuela if President Nicolás Maduro fails to offer a ‘credible’ plan for fairer 2024 elections by the end of November, Bloomberg reports. The warning follows moves by the Maduro regime to suppress key opposition figures and renege on an agreement to allow electoral observers from the EU.

Despite high political uncertainty, energy companies and bond investors are pushing into Venezuela. This week Chevron expanded an oil swap deal with the country while commodity trader Vitol moved to export Venezuelan crude.

What we’re reading

Ghana plans more flexible oil royalties regime to spur investment (Reuters)

Nigeria’s economy bleeds as striking workers shut ports and offices (The Africa Report)

Ethiopia’s flower business is set to take a hit due to the Amhara conflict (Semafor)

Ethiopia ‘working on full banking-sector opening’ (The Africa Report)

Ethiopia’s new debt-service suspension to mirror China deal – finance ministry (Yahoo)

IMF loans to Kenya triple to Sh336b (Business Daily Africa)

Opposition rejects Madagascar vote as counting underway (Reuters)

South Africa government faces calls to tap foreign exchange gains to ease debt burden (FT)

Africa’s barter agreements ‘not a solution’ to foreign currency crunch (The Africa Report)

Corruption and rights ‘abuses are flourishing’ in lithium mining across Africa (Inside Climate News)

Bangladesh garment industry wage fight shakes core economic pillar (Nikkei)

Japan to provide patrol ships to Bangladesh with eye on China (Business Standard)

Sri Lanka’s election-year budget straddles line between IMF and voters (Nikkei)

Sri Lanka puts IMF targets at risk with ‘ambitious’ tax goals (Bloomberg)

China holds naval drills with Pakistan in Arabian Sea (VoA)

Pakistan to get IMF payout, buoying economy before election (Bloomberg)

Afghan traders seek the release of stranded imports in Pakistan (Radio Free Europe)

Thousands of homes underwater after floods hit Vietnam (France24)

Southeast Asia’s digital battle: Chinese and US big tech face off over $1tn market (Nikkei)

Is Indonesia finally set to become an economic superpower? (FT)

Focus intensifies on Central Asia’s ‘Middle Corridor’ (FrontierView)

Can Central Asia sustain surge of newfound diplomatic activity without Russia? (Radio Free Europe)

Iraq becomes EBRD shareholder. Senegal and Ghana apply to join (Reuters)

Omani fuel marketers expand EV charging networks (Zawya)

Nigeria gets refineries investment and forex pledge from Saudi Arabia (Reuters)

Saudi Arabia opens bidding for 3.7GW of solar projects (PV Tech)

Saudi Arabia’s development fund signs two framework MoUs for Caribbeaninfrastructure and energy projects (BusinessWire)

Chevron resumes natural gas supply from Israel’s Tamar offshore field (Reuters)

US hits three UAE shipowners with sanctions for violating Russian oil price cap (FT)

Almost no Russian oil is sold below $60 cap, say Western officials (FT)

New US sanctions take aim at ‘Russia’s malign influence’ in Balkans (Radio Free Europe)

In Serbia’s collaboration with a UAE tech firm, fears of ‘digital autocracy’ (BalkanInsight)

Argentina’s Massa ‘will renegotiate IMF deal’ if he wins election (Reuters)

Is Argentina the first AI election? (NY Times)

Hard times ahead for wine in Chile (Mercopress)

Ecuador: Petroecuador to close Amazon oil block after referendum (Reuters)

Paraguay’s agriculture exports grows 24% compared to last year (Mercopress)

Multiple researchers corroborate the scale of Paraguay’s economic progress (Mercopress)

Latin America’s mining backlash has global implications (World Politics Review)

Oil still looks like an easier bet for Latin America than renewables (FT Opinion)

US, Russia, China and Southeast Asia defense officials meet at ASEAN meetings amid crises (Reuters)