Frontier Markets Weekly, January 16th 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share the link with any friends or colleagues you think would enjoy it.

Africa

Ethiopian government repels rebels and pledges peace talks. In a sharp reversal of fortunes over just a few weeks, Ethiopian government forces have repelled rebel fighters who had appeared poised to seize the country’s capital, Addis Ababa, and threaten the government led by Ethiopia’s Nobel Peace Prize-winning prime minister, the Wall Street Journal’s Nicholas Bariyo reports.

Photo: Getty Images

Troops under Prime Minister Abiy Ahmed have forced Tigray People’s Liberation Front fighters back into their mountainous homeland in the country’s north, capturing several towns where rebels had holed up after their drive toward the capital faltered, according to government and rebel fighters. Diplomats and analysts said drones secretly supplied by Turkey, the UAE, Iran and others, turned the tide in the government’s favor.

Riding the military successes, Ahmed in recent days has freed several opposition figures from prison and pledged to talk peace with his opponents. “There is need to foster national reconciliation and to promote unity,” he said in a national address.

Kenya’s currency hits all-time low against dollar. Kenya’s shilling slumped to a new low this week, Reuters reported. According to the news agency, traders said strong demand for dollars across a number of sectors was driving the value of Kenya’s currency down, while inflows of foreign currency were weak.

The shilling is likely to continue losing value throughout the year, according to Matthew Kindinger, practice leader for sub-Saharan Africa at consultancy FrontierView.“Downward pressure will be most pronounced in [the second half] because softer commodity prices will curtail export revenues,” he said.

Kindinger also warned there could be “short periods of significant volatility around the August 2022 election, especially if the outcome is close or one side challenges the result.

Asia

India sells anti-ship missiles to the Philippines as concern over China grows.India has agreed to supply the Philippines with the BrahMos anti-ship cruise-missile system in a deal that could help counterbalance recent Chinese assertiveness over disputes in the region, Rajesh Roy and Jon Emont report in the WSJ. The sale comes as India expands defense ties with the U.S. and its allies in response to China’s growing military heft.

Philippine Defense Secretary Delfin Lorenzana said in a Facebook post on Friday that the missiles would be operated primarily by the Philippine marines’ coastal defense regiment and that the deal included training for operators and logistics support.

Retired Rear Adm. Rommel Ong, who served as the Philippine Navy’s second-in-command until 2019, said the missiles were designed in part to counter China, which contests the Philippines’ claims to land features and fishing grounds in the South China Sea. Disagreements have flared recently, such as in mid-November when Philippine officials accused Chinese coast guard ships of deploying water cannons against Philippine resupply vessels heading to a disputed shoal in the South China Sea.

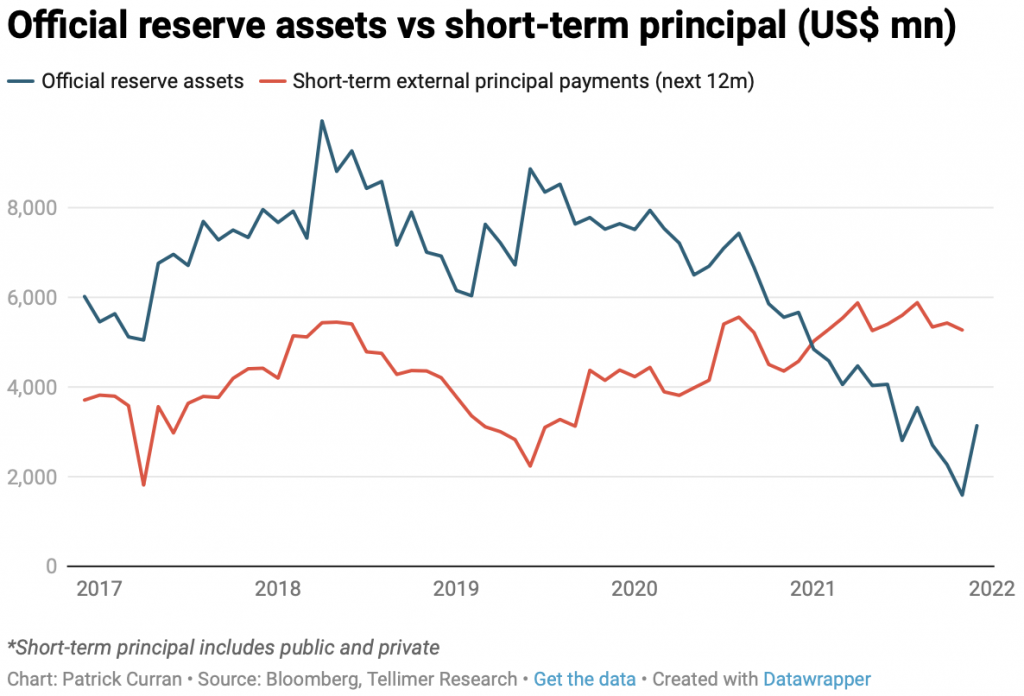

Sri Lanka asks China for help on debt as S&P downgrades credit. Sri Lanka’s President Gotabaya Rajapaksa this week asked China to help restructure the island nation’s heavy foreign debt burden, Asia News reported. Sri Lanka is suffering a deepening foreign-exchange crisis fueled in part by the decimation by the pandemic of its crucial tourism sector, which compounded problems caused by the South Asian nation’s already high international debt load.

Top emerging-market bond fund bets on Sri Lanka default gain (Bloomberg)

Rajapaksa reportedly made the request during a meeting in Sri Lanka with Chinese Foreign Minister Wang Yi.

Later in the week, hours after central bank governor Ajith Nivard Cabraal announced that new money might be available from China to cover loan repayments, ratings firm S&P downgraded the country’s credit rating from CCC+ to CCC with a negative outlook. The central bank condemned the decision, commenting that the move failed “to recognize the positive developments taking place in Sri Lanka,” according to the Colombo Gazette.

London-based research firm Tellimer said this week there was a greater than 50% chance that Sri Lanka would default on its debts. “The economic picture for Sri Lanka remains quite grim and authorities continue to keep their heads in the sand,” the firm’s chief economist Patrick Curran said.

Afghanistan’s Taliban face challenge from ethnic-minority fighters. Afghanistan’s Taliban are battling a rebellion by ethnic minority fighters in their own ranks in the country’s north, a sign that ties are fraying within the alliance built by the Islamist group that seized control of the country in August, Ehsanullah Amiri and Saeed Shah report in the WSJ.

Some Uzbeks who joined the Taliban, which is dominated by Pashtuns from the country’s south and east, along with other Uzbeks, fought Taliban forces in Faryab province this week. At least four people were killed and others wounded in clashes on Friday, local residents said.

Ethnic divisions run deep in Afghanistan, but some members of the northern ethnic groups joined the Taliban and played an important role in its conquest of the country last year. Most senior positions in the Taliban government, however, have remained in the hands of Pashtuns, and the international community has criticized the new government for not being representative, a charge rejected by the Taliban.

Europe

Russia edges toward brink of conflict. ‘Our patience has run out.’ Intensive talks between Russia and Western nations this week yielded posturing and threats but concluded with the two sides seemingly no closer to resolving a standoff that could spiral into one of Europe’s worst security crises in decades, William Mauldin, Vivian Salama and Ann M. Simmons report in the Wall Street Journal.

Photo: Anatolii Stepanov/Agence France-Presse/Getty Images

On Friday, tensions ticked up further. Ukraine said it was targeted by a massive cyberattack that it attributed to Russia, and the White House said it had intelligence that Moscow had planned “false-flag” operations in Eastern Ukraine that would create a pretext for an invasion.

- Behind united front, U.S. approach on Russia unsettles some allies (WSJ)

- The Putin puzzle: Why Ukraine? Why now? (WSJ)

Adding to anxiety in the West, Russian Foreign Minister Sergei Lavrov warned on Friday that Moscow was running out of patience. Russia had asked the U.S. in December to respond in writing to its demands of the North Atlantic Treaty Organization. “We will not wait forever,” Mr. Lavrov said. “The potential for conflict is growing.”

No further talks have been scheduled, and the U.S. signaled that the ball is in Russia’s court.

Latin America

Rio’s buying crypto and it won’t be long until other governments get FOMO.Brazil’s second-largest city Rio de Janeiro is allocating 1% of its treasury to cryptocurrencies in a move that other cities are expected to mimic, Blockworks’ Casey Wagner reports. The announcement by mayor Eduardo Paes confirms a 2022 prediction from Fidelity Digital Asset researchers that more governments and central banks will acquire digital assets.

Other cities and sovereign states are going to have to start thinking ahead if they want to maintain an edge, even if the value proposition of cryptocurrencies is not immediately clear, researchers said. “While Rio de Janeiro is a city, and technically the mayor mentioned cryptocurrency, not bitcoin specifically, we see the overall game theory as the same,” said Chris Kuiper, head of research at Fidelity Digital Assets.

Paes also mentioned plans to offer citizens who pay property taxes in bitcoins a discount, according to a report from the Brazilian newspaper O Globo.

Latin America’s central bankers are taking bold action against inflation. It isn’t working. The Central Bank of Brazil announced this week that it would miss its 2022 inflation targets, Bloomberg reports. This comes on the heels of Peru’s sixth consecutive interest rate increase last week amid inflation that reached 6.4% in December, led by food and energy costs. While Peru’s inflation is well over its 1%-3% target, it pales in comparison to the pace of price rises in countries such as Argentina, Brazil and Mexico, which late last year were suffering inflation at 45%, 10.4%, and 7.5%, respectively.

Central bankers across the region have responded with rapid rate increases, but the effects have been underwhelming. Inflation across the region this year stands at almost 12%, compared with 10.6% in Africa and 1.2% in Asia. Large social spending combined with “imported” inflation from rising commodity costs conspired to push the region’s inflation well past others, leading to its role at the forefront of central bank tightening.

Such ineffectiveness reflects the large unbanked population whose lack of access to conventional financial products undermines the effects of tighter credit. Continued supply chain snarls and investor sensitivity to political risk are also reducing the efficacy of monetary policy, reports Bloomberg. – Ken Stibler

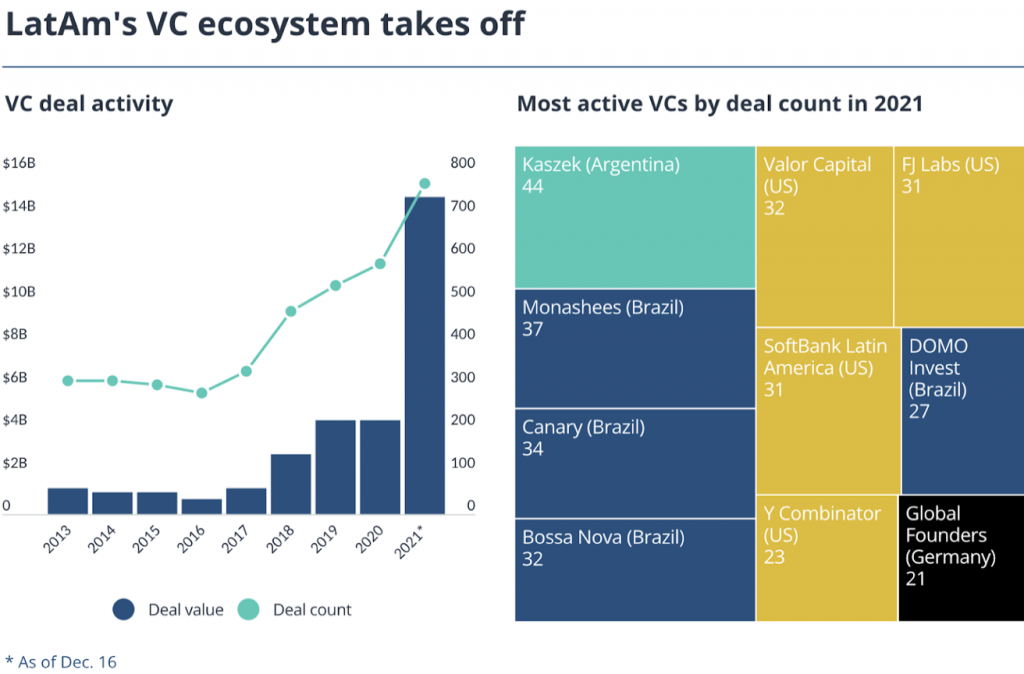

Venture capital flocks to Latin American startups. Latin America has traditionally been passed over by venture capital firms despite high levels of human capital and their populations having triple the average purchasing power of those in Southeast Asia. But last year that trend changed, according to data from Pitchbook, which shows the region attracted almost $15 billion across 772 deals. Total funding was greater than the previous six years combined.

The year saw top-tier growth firms such as Tiger Global, D1, DST, and Coatueincreasing their focus on Latin America with early-stage investors Andreessen Horowitz, Sequoia, and Benchmark also starting to fund a wide range of startups across the region. This trend looks likely to continue as venture funds with mountains of cash on their hands look for investment targets in a startup ecosystem supercharged by pandemic-driven digitization. – Ken Stibler

Global

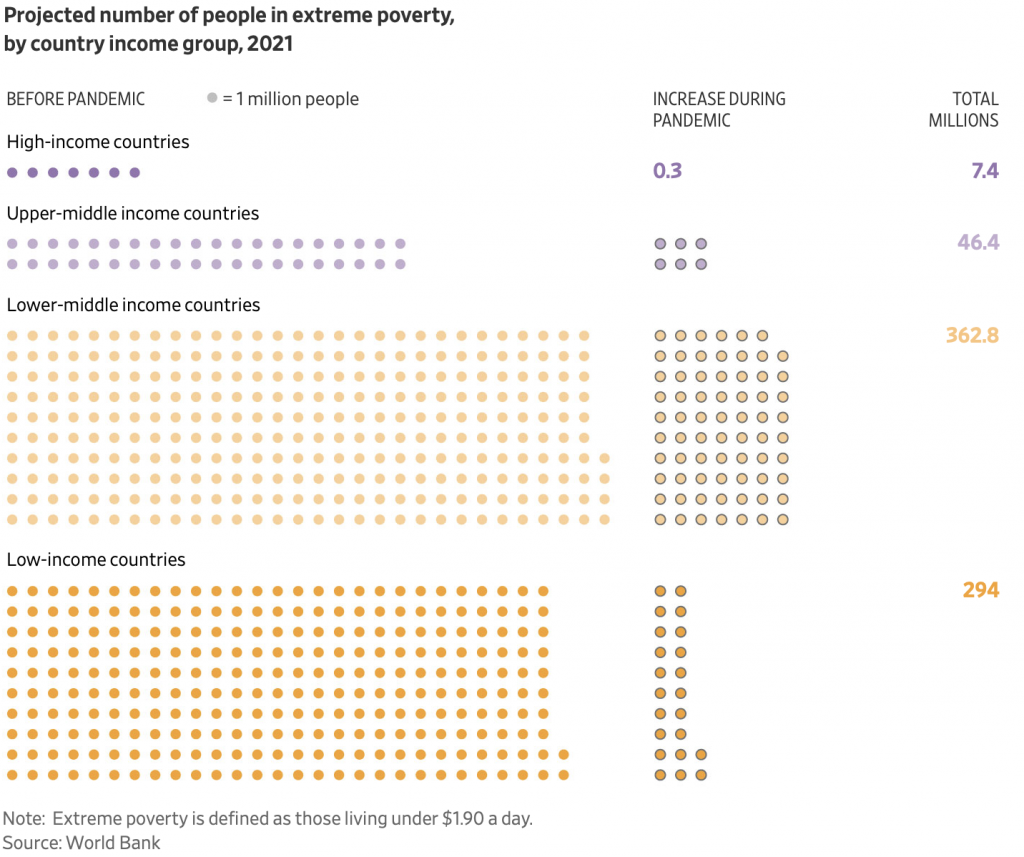

How Covid-19 has widened the gap between rich and poor countries. The Covid-19 pandemic is widening the gap between rich and poor countries, has reversed years of economic progress and set back efforts to alleviate global poverty, Jason Douglas and Andrew Barnett report in the WSJ.

Widespread access to vaccines in richer countries and lavish programs to support businesses and workers through lockdown are helping big economies to quickly recover to their pre-pandemic size. The economies of many developing nations, however, could take years to regain their 2019 size.

The economic hits add up to a significant projected increase in the number of people living in extreme poverty, defined by the World Bank as less than $1.90 a day, compared with pre-pandemic expectations. And economists say some of the pandemic’s potential longer-term effects include a squeeze on poorer countries’ room for growth. In education, for instance, it isn’t known if girls will return to the classroom as quickly as boys when Covid-19 recedes, undermining progress on narrowing attainment gaps between the sexes in poorer countries.

South-South trade takes sting out of Western governments’ economic sanctions. Growing trade between emerging markets is reducing the effectiveness of sanctions imposed by developed economies such as the US and EU on regimes whose behavior they seek to change through economic pressure. This week’s attendance by Iran’sVice President Mohsen Rezaee at the inauguration of Nicaragua’s President Daniel Ortega clearly telegraphed that the two nations would continue to do business despitethe imposition of a raft of joint US-EU economic sanctions on Nicaragua in response to increased repression and the recent discredited election.

From Myanmar to North Korea to Belarus, sanctions have failed to constrain regimes in the way their instigators intended. Belarus, for example, saw 331 new sanctions designations following its crackdown on opposition and subsequent “weaponization” of migrants. Despite the new sanctons’ dwarfing those imposed on any other country for the year, trade between the bloc and Belarus almost doubled in 2021, EU data showed.

Additionally, India and China have continued to provide a market for Iranian crude, even as “max sanctions” and diplomatic pressure eventually reduced Spanish and Turkish purchases. Meanwhile, Iranian condensate has allowed Venezuela to double its oil exports in 2021. Thailand’s lobbying against sanctions on Myanmar’s oil sector, the military regime’s biggest source of foreign currency, also highlights how south-south trade is thriving in spite of sanctions. – Ken Stibler

What we’re reading

Burkina Faso soldiers accused of plot to ‘destabilize institutions.’ (VoA)

Mali’s ousted president dies, Ecowas imposes sanctions over poll delay, and Malians take to the streets in protest. (Al Jazeera)

Sweden to withdraw from French-led special forces mission in Mali. (Reuters)

Ghana debt moves deeper into distress as investors lose patience. (Bloomberg)

Nigeria ends Twitter ban after seven months. (Bloomberg)

Separatists blamed for Cameroonian senator’s killing. (The Guardian)

BHP takes $100m stake in Tanzania nickel project with an eye on environment. (Bloomberg)

China’s Huayou buys lithium mine in Zimbabwe for $422 million. (ZimLive)

Vietnam approves $15.2 billion aid for Covid-hit economy. (Bloomberg)

Malaysia faces long recovery after devastating floods. (CNA)

China’s export machine notches new record as pandemic grinds on. (WSJ)

India ‘considering easing curbs’ on some Chinese investment. (Bloomberg)

As Omicron cases rise in India, hundreds of thousands to attend Hindu festival. (WSJ)

Pakistan asks IMF to delay review to end of January. (Reuters)

Why Pakistan’s crypto ban won’t work. (Tellimer)

North Korea fires two missiles after angry rant about U.S. sanctions. (WSJ)

Mongolia stock market turns heads with 133% gain. (Nikkei Asia)

Uzbekistan reduces electricity supply to Afghanistan by 60%. (ANI News)

Taliban meet opposition militia representatives in Iran. (Washington Post)

Iran navy port emerges as ‘key’ to alleged weapons smuggling to Yemen. (WSJ)

Outspoken Saudi princess returns home after nearly three years in jail. (The Guardian)

EU threatens Bosnian Serb leaders with sanctions over secessionist bid. (Radio Free Europe)

How tycoon’s purchase of Southampton FC could undermine democracy in Serbia. (Radio Free Europe)

Kosovo intensifies hunt for banned crypto mining machinery. (Balkan Insight)

Anti-vaccine protestors attempt to storm Bulgaria’s parliament. (Reuters)

Hungary caps prices on basic foods as inflation pinches families ahead of elections. (Radio Free Europe)

Lithuania wins potential microchip windfall from Taiwan in China clash. (Politico)

Costa Rica hydro plant gets new lease on life from crypto mining. (Reuters)

Pegasus spyware deployed against El Salvador journalists and activists. (WSJ)

Venezuelan opposition defeats Maduro candidate in Chávez’s home state. (The Guardian)