Frontier Markets Weekly, December 3rd 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

South Africa to inject $2.5 billion in state-owned logistics company

South Africa’s government announced on Friday that it would invest $2.5 billion in the Transnet group, a state-owned rail and ports company.

The announcement comes amid massive congestion at South Africa’s largest port, which is managed by Transnet. The Durban port had 15 freight vessels carrying 40,000 containers waiting to dock on Friday, Africanews reports. Even that logjam marked an improvement from last week, when ships carrying some 70,000 containers were waiting to dock. The traffic cleared in part because many ships were redirected to Mauritius.

The port of Durban handles 60% of the country’s annual container traffic, TRT World reports, and Transnet’s troubles could have an equally outsized impact on South Africa’s economy. In September, South African research consultancy Gain Group predicted the company’s woes would cost the South African economy the equivalent of 5% of GDP.

In a statement announcing the funding on Friday, South Africa’s government said the company has “suffered significant operational, financial and governance challenges in recent times and is struggling to fulfill this strategic role.”

Analysts fear Tunisia default

Growing financial headwinds have led economists to worry that Tunisia could soon default on its sovereign debt.

Tunisian President Kais Saied has publicly sparred with the IMF in recent months, rejecting the terms attached to the fund’s loans. Meanwhile, foreign debt payments are mounting, with $2.6 billion in foreign liability repayments due next year, and no clear path toward securing the sufficient funds to meet those liabilities.

“Tunisia’s large upcoming public debt repayments, President Saied’s opposition to the IMF and lack of fiscal consolidation make a sovereign default highly likely,” Capital Economics analyst James Swanston wrote in a note.

Asia

Vietnam and EU finalize green investment plan

One year after agreeing to a climate finance framework, Vietnam and the EU finalized a $15.5 billion deal on Friday that will help the Southeast Asian country move away from coal.

Vietnamese and European negotiators for the so-called Just Energy Transition Partnership (JETP) announced the initiative last December, in conjunction with the G7, Denmark, and Norway. About half of the funding was to come from wealthy countries, with the other half coming from the private sector, but disbursement has been challenged by a dearth of details on how Vietnam would spend the money.

That roadblock could now be resolved with a plan, announced on the sidelines of the COP28 climate conference in Dubai, UAE, that identifies more than 200 investment projects and 60 technical assistance projects focusing on initiatives such as deploying renewable energy, transforming power grids and reducing coal power pipelines, Nikkei reports.

Pakistan launches sovereign VC

Pakistan will soon launch a venture capital fund for local early-stage startups, technology minister Umar Saif told Bloomberg.

The fund, which will distribute up to $10 million annually, will back companies seeking $2 million to $3 million that draw most of their investments from other sources. Saif said the firm seeks to revive global investor interest in Pakistan’s startup industry, which has seen investments dry up this year amid high inflation and interest rates.

While frontier markets across the world have seen investors pull back recently, a series of economic, political, and security crises in Pakistan have made investment particularly challenging. Foreign direct investment into the country fell by 44% during the first seven months of this fiscal year, and its current caretaker government has shown little interest in enacting significant reforms ahead of elections scheduled for February of next year.

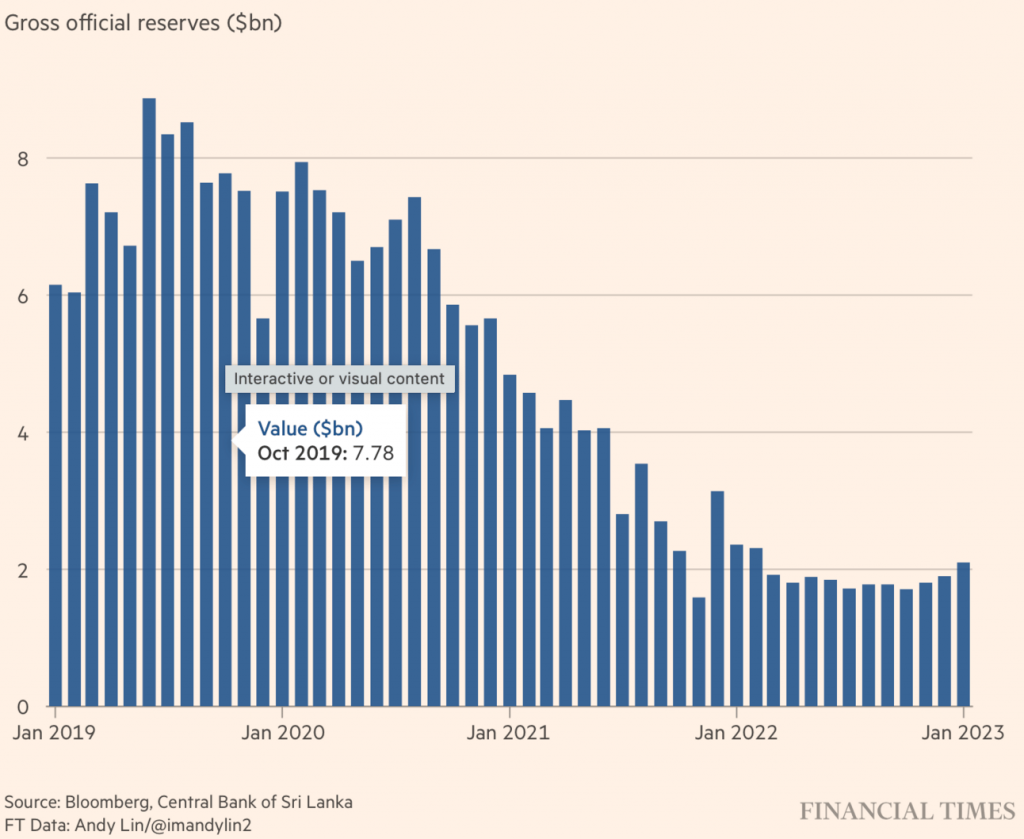

Sri Lanka seals debt restructuring

Sri Lanka reached a preliminary debt restructuring deal with a group of bilateral creditors on Wednesday, clearing a path toward resuming a stalled IMF program.

The deal with France, India, Japan and other lenders will help Sri Lanka receive the next tranche of its $3 billion IMF package, worth more than $300 million, Reuters reports. The tranche had stalled since September while Sri Lanka negotiated restructuring terms with its bilateral creditors. Last month, it reached a similar deal with China, the island nation’s largest bilateral creditor.

If the IMF disbursement goes through, Sri Lanka could receive similar levels of loan funding from the World Bank and the Asian Development Bank, bringing in a total of around $900 million, the governor of Sri Lanka’s central bank said last week.

Sri Lanka defaulted on its debt last year amid a political and economic crisis. It owes about $40 billion in foreign debt, and the country still has not reached a restructuring arrangement with its commercial bondholders, potentially slowing a return to economic stability, FT reports.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Saudi Arabia and Brazil look to expand trade and investment links

Brazil’s President Luiz Inácio Lula da Silva was in the Middle East this week, meeting with Saudi Crown Prince Mohammed bin Salman to discuss strengthening bilateral relations in trade and cooperating on joint-investment projects. Among a flurry of deals, Brazil’s presidency said the country secured a $10 billion commitment from Saudi Arabia’s Public Investment Fund to fund clean energy, green hydrogen, agriculture and infrastructure projects in Brazil.

The PIF investment was announced just days after Brazil’s national oil company Petrobras released its 2024-2028 budget, which follows through on Lula’s campaign promise to expand the firm’s exploration and development budget, and earmarked some $11.5 billion for energy transition projects. Earlier this year PIF took a 10% stake in a Brazilian base metals firm to “expand the production” of resources “critical to the development of new technologies that will benefit the global energy transition.”

The two countries’ delegations also discussed deepening cooperation on defense, infrastructure and agriculture. Brazilian food processing giant JBS said it is “more interested in exploring” new investments in Saudi Arabia, potentially expanding on existing halal meat joint-ventures in the kingdom. Defense giant Embraer is reportedly in talks with Saudi Arabia Military Industries (SAMI) on creating an aerospace plant to locally produce C-390 military transport and logistics aircraft.

The Public Investment Fund will reportedly be partnering with a Latin American asset manager to fund a $1.2 billion, 30-year toll-road concession in Brazil’s Parana—a rapidly developing agricultural hub.

Iran and Syria move away from dollar for trade

Iran and Syria are looking to bypass the dollar-based international finance system by “enhancing monetary-banking relations” and opening Iranian bank branches in Syria, Iranian state media reported this week. The reports follow talks between Syrian Prime Minister Hussein Arnous and Iran’s central bank chief Mohammad Reza Farzin in Damascus on Wednesday, where the two reportedly discussed cooperation on new technologies to circumvent the dollar system and conduct trade in local currencies.

The state-controlled Tehran Times reports that new joint-venture banking and insurance companies in Syria “will be realized soon” at scale, following up on the August launch of an Iran-led banking and insurance consortium in Damascus. Iran’s finance minister Ehsan Khandouzi said Iran is “also ready to welcome Syrian investors and businessmen” following the institutionalization of a formal banking and insurance network between the two allies, which is a “necessary prelude to advancing business and investment goals.”

Middle East nations counter criticism with climate funding pledges

Ahead of a string of climate fund commitments at this week’s COP28 Summit in the UAE, Bahrain’s sovereign wealth fund announced that it is to anchor a $750 million regional climate fund managed by local asset management giant Investcorp. Not to be outdone, host UAE announced the launch of Alterra, a $30 billion climate financing vehicle with the backing of US financial giants Blackrock, TPG, and Brookfield, with $5 billion earmarked as “risk mitigation capital in the Global South.”

Abu Dhabi Global Market, the UAE’s international financial hub and host to Alterra, claims the fund will “be able to mobilize $250 billion globally by 2030” to focus on “transforming emerging markets and developing economies.”

UAE faced criticism and accusations of greenwashing ahead of COP28 after reports suggested it was using the summit to broker oil sales. But the host nation claimed an early win when COP28 participants committed real money to a “loss and damage fund” through which wealthier states will pay for climate-change mitigation measures in poorer countries that are being disproportionately affected by climate change.

Europe

Ukraine strikes damage Russia-China trade route

Ukrainian media reported this week that the country’s security service, the SBU, orchestrated two explosions on the key Baikal-Amur Mainline railway connecting Russia and China. The attacks reportedly targeted tanker trains loaded with fuel, causing significant disruptions.

Reports suggest the explosions occurred in the Severomuysky tunnel in Buryatia and on a high bridge, paralyzing a vital trade and military supply route between Russia and China, Politico reported.

Russia’s state railroad company RZHD acknowledged the tunnel explosion, but neither Russian media nor the SBU has officially confirmed the attack. The reported attacks on Russian transport infrastructure points to potential risks to Russia’s burgeoning trade with China, and could inflame tensions with Beijing, which has little patience for attacks on what it sees as its interests in other countries.

Next Polish government faces fiscal test over energy bill

Incoming Prime Minister Donald Tusk’s plan to move Poland toward green energy has triggered early tensions within his pro-EU coalition, the FT reports. The Civic Coalition’s plan compels Orlen, the state-controlled oil and gas company, to fund household energy subsidies while easing wind farm restrictions. The proposal has strained coalition relations and knocked 6.6% off Orlen’s valuation.

The plan also ratchets up government intervention in the economy and increases state spending despite continual ‘fiscal slippages’ as the war in Ukraine has structurally raised spending across the region. In a review of Polish debt this week, rating agency S&P warned that short term risks abound in loose fiscal policy and inflation despite tailwinds from unlocked EU funds.

Latin America

Venezuela rattles Guyana with referendum on territorial tussle

Venezuelans are voting today in a referendum over potentially annexing an oil-rich part of neighboring Guyana, raising concerns about another conflict in a traditionally peaceful region. Caracas has long claimed rights over territory that is considered part of Guyana and which is home to one of the world’s most significant recent oil discoveries.

In response to threats and the deployment of troops to the border by Caracas, Brazil deployed troops to the region and Guyana entered talks with the US to host military bases in the country.

The moves are likely just bluster designed to rally Venezuelans around the flag before upcoming presidential elections, which are expected to be fiercely contested, while also generating leverage in ongoing negotiations with the US. However, the apparent willingness to use force as a tool is worrying oil producers in Guyana and raising the complexity of operating in the world’s fastest-growing economy.

Milei’s presidency takes shape during US trip

After a volatile campaign, the contours of Argentina’s incoming government became clearer this week. The self-styled anarcho-capitalist President-elect Javier Milei followed the playbook of outsider and leftist politicians elected across the region by selecting a well-respected and moderate finance minister who is close to the center-right camp of former President Mauricio Macri.

Additionally, Milei made an official visit to Washington, where his team met with the White House, IMF, World Bank, and US national security organizations. Upon return, Milei’s pick for foreign minister announced that Buenos Aires was rejecting an invitation to join the BRICS group of nations, suggesting Milei is keen to maintain strong ties with the US that would be critical to support more radical reforms like dollarization.

- ‘Leaving without leaving’: Argentines are flocking to Uruguay to avoid a high tax burden (FT)

The moderation and pro-US stance raises hopes for a business-friendly administration, yet repeatedly antagonizing China risks punitive action by Argentina’s largest commodity buyer.

What we’re reading

Mozambique to present new $80bn energy transition plan at COP28 (Al Jazeera)

Niger coup leaders repeal law against migrant smuggling (BBC)

Chocolate prices rise as cocoa rots in West Africa (Bloomberg)

Death toll rises as extreme flooding hits Kenya, Somalia and Ethiopia in wake of devastating drought (DW, BBC, Crisis24)

Ethiopia secures $1.5b in debt relief (AFP)

Ethiopia aims to cement financial liberalization with 2024 stock market launch (The Africa Report)

Kenyan communities are battling disruptive carbon credit schemes (Semafor)

Somalia joins East African Community (BBC)

Ramaphosa kicks off campaign as South African voters lose faith in ANC (FT)

Inside Morocco’s efforts to corrupt the European Parliament (Politico)

Battle for influence rages in heart of Wagner’s operations in Africa (NYT)

Africa ‘will overtake Europe’ in geothermal capacity by 2030 (Rystad Energy)

Sovereign debt, inflation crises ‘spell Africa capital flight’ (The Africa Report)

Russia woos Africa with free grain and fertilizer (Bloomberg)

With eye on China, Japan and Vietnam take ties to ‘new heights’ (Japan Times)

Vietnam raises multinational corporate tax rate in blow to Samsung and Intel (FT)

Vietnam is jailing environmentalists who helped it secure billions (NY Times)

Cambodia scraps $1.5 billion coal project (Barron’s)

Myanmar’s spiraling violence spawns strategic risks for India (Nikkei)

Myanmar armed group claims capture of key border crossing (VoA)

Philippine government and communist rebels agree to resume talks on ending their protracted conflict (AP)

Malaysia to offer visa-free entry to China and India nationals to boost economy (Nikkei)

Sri Lanka approves Sinopec’s $4.5 billion refinery proposal (Reuters)

Bangladesh opposition leader confirms election boycott (Al Jazeera)

Foreign buying at four-year high fuels Pakistan stock rally (Yahoo)

Oman and Switzerland to forge deeper bilateral ties (Zawya)

ENVI Lodges announces second resort in Oman (Business Traveller)

Iraq explores carbon credits to reduce gas flaring (Iraq Oil Report)

Saudi Arabia offers Iran investment to blunt Gaza war (Bloomberg)

Saudi Arabia wins bid for 2030 world fair (Reuters)

Iran expects less income from oil and gas exports in the coming year (Iran International)

UAE planned to use COP28 summit for oil deals, documents show (FT)

US ‘profoundly’ worried over Turkey’s financial links to Hamas (FT)

The crackdown on Ukraine’s oligarchs (FT)

Ukrainian truckers still stuck at Polish border after weeks of blockades (Radio Free Europe)

Turkey’s exports of military-linked goods to Russia soar (FT)

Currency clashes sour Russia’s oil trade with Asia (Reuters)

Revenues of Russia’s top oil and gas producers fall 41% in first 9 months of 2023 (Reuters)

Russian Duma to discuss ‘loyalty’ obligation for foreign visitors (Radio Free Europe)

Bulgaria approves Lavrov’s flight to OSCE meeting, sparking boycott (Radio Free Europe)

Bolivia gets green light for full Mercosur membership (Reuters)

Deadly harvest: how demand for palm oil is fueling corruption in Honduras (The Guardian)

Gustavo Petro 3.0: Colombia’s president is once again open to a national agreement (El País)

Rancor soars between Ecuador VP and president just a week into office (AFP)

Ecuador arrests alleged leader of powerful Los Lobos drug gang (FT)

Panama judges throw doubt on future of First Quantum mine (Bloomberg)

El Salvador’s President Nayib Bukele steps down for contentious re-election bid (FT)

Oil executives flock to Venezuela, braving risk of US snapback sanctions (Energy Now)

Brazil to become member of OPEC+ coalition (Oil & Gas Journal)