Frontier Markets Weekly, November 12th 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Saudi Arabia invests more than half a billion dollars in Africa

The Saudi Development Fund plans to sign deals worth $553 million with African countries, the Saudi finance minister Mohammed al-Jadaan said at the Saudi-Arab-African Economic Conference in Riyadh on Thursday.

Part of that investment will go toward supporting Ghana and other highly leveraged African economies to ease their debt, al-Jadaan said, possibly hinting at a more active leadership role by Saudi Arabia in tackling what some, including the UN, see as a burgeoning sovereign debt crisis.

The Saudi investments will also cover energy. At the conference, the Saudi energy minister signed agreements with Chad, Ethiopia, Nigeria, Rwanda and Senegal, Al-Monitor reports. Meanwhile, the Saudi investment minister said his country’s $700 billion sovereign wealth fund would make “game changing” investments on the continent, and Mozambique announced that it had signed a $158 million financing agreement with the Gulf country to fund infrastructure projects including hospitals and a dam, RFI reports.

Africa ‘should collaborate with Caribbean’ on development and trade

At a conference in Marrakech this week, Mia Mottley, the Prime Minister of Barbados urged African leaders to collaborate more effectively to bring down the cost of finance for developing countries. In a discussion with Samia Suluhu Hassan, President of Tanzania, Julius Maada Bio, President of Sierra Leone, and Edouard Ngirente, the Prime Minister of Rwanda, at the Africa Investment Forum, Mottley said, “We face the common difficulties of the Global South not being able to access capital at rates that make investments palatable. The cost of capital is simply too high.”

Mottley’s comments echoed a persistent theme among speakers at the conference of the need for greater cooperation between developing countries. Emphasizing the historical ties between the Caribbean and Africa, she suggested the Caribbean could be a sixth region of the African Union, giving African nations increased access to trade with the Americas and beyond.

“Working together in substantive ways to be able to expand markets for each other, through expanded connectivity, will create the platform that will give us the financial and economic capacity to become more resilient,” she added.

DRC trucker strike strands critical minerals

A truckers’ strike that began last week has stranded tens of thousands of tons of copper and cobalt in the southern Congolese city of Kolwezi.

Minerals mined by companies including Glencore and CMOC are stuck on 2,700 trucks in the city, Reuters reports. The 89,000 metric tons of copper stuck in limbo could trigger a shortage of the minerals, threatening to slow the supply of the two minerals that are an essential part of the global transition to clean energy. Copper is a key material in the wiring and construction of electric vehicles, and cobalt is used in their batteries.

The Democratic Republic of the Congo is the world’s third-largest copper producer and the largest cobalt producer, according to the US Geological Survey. Truck drivers, who transport the minerals from mines to nearby Zambia before continuing on to coastal ports in Namibia, South Africa, and Tanzania, have demanded additional risk allowance payments from international logistics firms.

Asia

Central Asia’s leaders seek greater global role

Uzbekistan’s President Shavkat Mirziyoyev this week urged leaders of other Central Asian nations to work harder to develop partnerships that would help the region capitalize on its strategically important location astride a number of major trade routes, AP reports.

At a conference of the Economic Cooperation Organization, a grouping of Central Asian nations that also includes Iran, Pakistanand Turkey,Mirziyoyev said, “Our vast region, which is home to half a billion people, has a great potential for developing cooperation in trade, economy, industry, investment, innovation and transport.”

Turkish President Recep Tayyip Erdoğan said the group’s many landlocked countries should boost intraregional trade by developing trade routes across the Caspian Sea. The conference also noted that Pakistan could provide wider access to international waters.

Russia sought to boost its ties in Central Asia this week too. On the same day as the ECO summit, Russian President Vladimir Putin held talks with KazakhPresident Kassym-Jomart Tokayev in Kazakhstan’s capital Astana, where they signed deals on energy, customs and labor issues, Al Jazeera reports. The meetings highlighted Central Asia’s growing role as a battleground where Western states and their adversaries jockey for influence. French President Emmanuel Macron visited Kazakhstan last week.

US counters Chinese investment with $553m funding for Sri Lanka port

The US government’s private sector lending arm, the Development Finance Corporation, is providing Sri Lanka with more than half a billion dollars to support construction of a new deepwater terminal at Colombo port, the New York Times reports. The money will support a project led by Indian conglomerate the Adani Group, which has close ties to Indian Prime Minister Narendra Modi and whose valuation plunged earlier this year after a short seller accused the company of fraud.

The terminal would become the DFC’s largest investment in Asia and one of its biggest globally. The financing comes as the US scales up its global infrastructure spending in a bid to counter China’s flagship Belt and Road Initiative.

The CEO of the DFC, Scott Nathan, said being active in the Indo-Pacific was a “high priority” for the US, calling the region “an engine of economic growth for the world,” Bloomberg reports.

Pakistan gains share in frontier markets index

The weight of Pakistani securities in the MSCI Frontier Markets index is expected to increase next week, reflecting their gains in market capitalization and index performance over the past three months. The 17 Pakistani stocks in the index, which are concentrated in the energy and financial services industries, have exceeded their peers’ performance during that period, the News International reports.

Pakistan’s weight in the index also increased in August, moving up from 0.6% to 2.7% after MSCI added a number of Pakistani firms to the index.

Currently the FM index is dominated by Vietnam, which has a near-30% weight in the index. The Southeast Asian nation is reportedly eying reforms aimed at moving up to the MSCI Emerging Markets index, which could provide a further boost to Pakistan, as well as to other FM countries such as Romania, Iceland, Kazakhstan and Slovenia.

Myanmar’s resistance gains momentum

An alliance of rebel groups fighting the ruling military junta in Myanmar has overrun government forces in parts of the country’s north, according to multiple media reports from inside the country. Their battlefield success marks the most significant win for the resistance movement since the military took power in a coup almost three years ago, Reuters reports.

Anti-junta fighters operating with “unprecedented coordination” have seized more than 100 military outposts over the past two weeks in Shan state, which borders China, according to the US Institute of Peace. The junta is now on the verge of losing access to border crossings that handle some 40% of cross-border trade.

On Thursday, Myanmar’s military-appointed president said that the country is at risk of breaking apart, Bangkok Post reports. The conflict could also threaten the junta’s relationship with Beijing, which has been one of its strongest international supporters. China’s foreign ministry spokesman said on Friday that China would ensure security and stability at the border with Myanmar and called for an immediate ceasefire.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Saudi Arabia marks progress on NEOM

Saudi Arabia’s NEOM, a special economic zone featuring interconnected urban, commercial, tourist, and green energy developments on the kingdom’s Red Sea coast, received its first major delivery of wind turbines this week. The turbines are the first of over 250 that will help power a green hydrogen plant that its developers say will “produce up to 600 tonnes of carbon-free hydrogen daily.”

NEOM is a major part of Saudi Arabia’s Vision2030 strategy, intended to reduce its reliance on petroleum and transform it into a tech and tourism hub. Initially expected to cost some $500 billion—mostly funded by the PIF sovereign wealth fund NEOM City was scheduled for completion by 2026, but a completion date of 2030 is now considered more likely.

Ras Al-Khaimah and Oman ramp up tourism cooperation

The UAE Emirate of Ras Al Khaimah and Oman this week announced a plan to cooperate on cross-destination tourism on the Musandam Peninsula—a point on the Strait of Hormuz shared by the UAE and Oman that bisects the Gulf of Oman and the Persian Gulf.

Oman is already seeing strong tourism growth due to its emerging position as a regional cruise destination. Cruise-ship tourist arrivals have grown 43.6% since 2019, and are expected to increase 25% in 2023. Oman’s tourism sector generated OMR1.9 billion ($4.9 billion) in 2022, up 47.3% from 2021.

Oman’s tourism growth is in part a product of the trend in Gulf Cooperation Council member states seeking to diversify their economies from oil and gas into high-tech and tourism, to which end it has recently announced a GCC unified tourist visa to be introduced in 2024, Al Monitor reports. GCC Secretary-General Jasem Mohamed Albudaiwi said that the universal visa “will contribute to facilitating and streamlining the movement of residents and tourists between the six GCC countries and will, undoubtedly, have a positive [impact] on the economic and tourism sectors.”

China in talks to build military base in Oman

China has reportedly been engaged in private deliberations with Oman on building a military base in the Sultanate, raising concerns in the US, Bloomberg reports. China’s Foreign Ministry says the two sides “have a high degree of consensus on further developing bilateral relations and deepening cooperation.”

A base in Oman—which sits on the strategic Strait of Hormuz and has traditionally been a neutral player and diplomatic mediator in the Middle East—would complicate the US’ relationship with China in the region, and complement China’s growing global network of strategically vital ports. China’s “maritime silk road” has grown to include more than 100 ports from just 44 less than a decade ago, and runs through some of the world’s most important maritime choke points.

Kuwait’s national oil firm needs to fill $45 billion funding hole

Documents leaked to Reuters this week suggest the state-owned Kuwait Petroleum Corporation must borrow or sell assets to fill a $45 billion spending shortfall to meet its five-year plan. The agency also reported that KPC chairman Saad Al Barrak intends to reinvest company dividends rather than transfer them to the state treasury over the next five years, delay or cancel several projects, sell leases on its subsidiary oil pipelines, auction 50% of a petrochemical complex, and raise KWD1.55 billion ($5 billion) in external financing, among other measures.

KPC reportedly confirmed the numbers, but refused to comment. KPC recently posted a decade-high net profit of KWD2.6 billion for the financial year ending 31 March 2023, and Kuwait reported a budget surplus of KWD6.4 billion for the year, a 55% increase on the previous year.

Europe

EC recommends EU membership for Bosnia, Moldova, and Ukraine

The European Commission has recommended the EU begin membership talkswith Ukraine on condition that the country adopts laws related to political asset declarations, anti-oligarch measures, lobbying, and guarantees for national minorities. The recommendation reflects Brussels’ pivot to viewing enlargement as a necessity amid Russian regional aggression.

The EC also recommended opening accession negotiations with Moldova, acknowledging the country’s progress in judicial reform. The EC also noted, however, that Moldova must make more progress tackling corruption and organized crime. Moldova’s President Maia Sandu, said the recommendation was recognition of joint efforts by state institutions and citizens.

EC President Ursula von der Leyen said the EU should also consider admittingBosnia Herzegovina, although in a report on the country, the EC said it had made “some progress” in the area of judiciary, “no progress” in the fight against corruption and a “backsliding” in guaranteeing freedom of expression and freedom of the media, Balkan Insights reports.

Bulgarian oil loophole helps Russia fund war in Ukraine

The Kremlin reportedly boosted its revenues by at least €1 billion this year through the exploitation of an EU sanctions loophole originally intended to secure Bulgaria’s fuel supplies and allow fuel sales to Ukraine, according to an investigation by Global Witness and the Centre for Research on Energy and Clean Air. According to the report, a Bulgarian oil refinery majority-owned by Russian oil giant Lukoil is buying Russian oil at a steep discount and selling refined petroleum products on the global market.

While Bulgaria and Lukoil argue that these actions comply with existing laws, critics are calling for a reevaluation of sanctions and the closure of these loopholes as the EU faces challenges in creating effective measures against Russia.

The issue is complicated by the fact that Bulgaria relies heavily on the Lukoil refinery, which, according to Politico, accounts for a 10th of the country’s economic output.

Latin America

IMF hardens stance on failing Argentina program

The IMF has intensified its scrutiny of Argentina’s $44 billion loan program as the country grapples with triple-digit inflation and dwindling net reserves ahead of a presidential vote this month. The IMF is particularly concerned about a rapid depletion of international reserves since the August program review and board members have reportedly criticized Argentina’s government for “mismanagement” rather than using softer terms such as “policy slippages” or “underperformance.”

Argentina’s central bank has intervened significantly in the foreign exchange market, injecting $2.7 billion in the last three months to alleviate pressure amid the election cycle. Argentina’s net foreign currency reserves are negative $15.3 billion, and the country’s economic challenges have been exacerbated by severe droughts affecting agricultural exports.

The IMF’s more stringent position comes ahead of a scheduled review of the program in early November, a pivotal step for the country to secure the next tranche of financing, contingent on meeting program objectives.

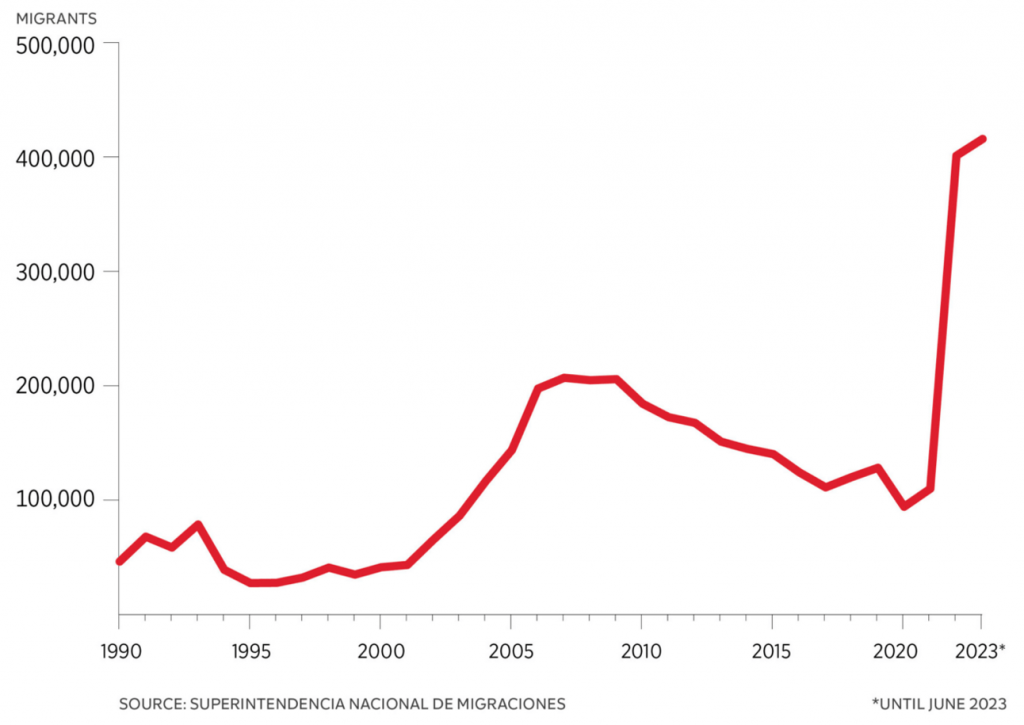

Peru’s economic woes propagate brain drain

A lackluster economy is driving growing numbers of Peruvians to leave—or consider leaving—the country, according to a poll by the Instituto de Estudios Peruanos. Some 60% of those aged 18 to 24 and 51% of individuals between 25 and 39 plan to depart in the next three years.

Even before the country’s economy started contracting this year, emigration had climbed sharply with a fourfold increase in the number of Peruvians leaving the country in 2022. Economic challenges, including rising crime rates and personal insecurity, appear to be pushing young people away.

The long-term impact is a potential loss of a promising generation that could contribute to Peru’s political and economic revitalization. With the “Peruvian miracle” seemingly over, the country faces an additional challenge retaining its educated and ambitious youth.

Venezuela lands oil partnerships as sector reopens

Venezuela’s state-owned oil firm PDVSA is signing deals with local and international equipment and services firms as it works to rejuvenate its struggling oil output following the relaxation of US sanctions. The US Treasury Department granted a six-month authorization in October for activities including the production and export of Venezuelan hydrocarbons, as well as investments and payments to PDVSA.

International companies including Chevron and France’s Maurel & Prom are positioning themselves to participate and Qatar’s Ghanim Bin Saad has signed a preliminary agreement to restart an oil refinery and terminal in Curaçao, near Venezuela’s coast. But while Venezuela aims to revive thousands of wells, experts caution that achieving a substantial increase from the current output of 780,000 barrels per day may necessitate a decade of concerted effort and sustained investment.

Global

Emerging market vulnerability on the rise

Recent shocks have left the world’s developing markets in a more fragile state than in 2019, a study by the Center for Global Development has concluded. The CGD’s 2023 edition of the Resilience Indicator—a model that assesses which emerging markets would be most affected by external macroeconomic shocks—found emerging markets are more vulnerable overall than in 2019, largely due to the “scars of…multiple shocks” such as the Covid pandemic, Russia’s war on Ukraine, and increasing interest rates that have weakened emerging market economies.

Twelve of the 37 countries covered by the study have external financing needs ratios above 100% (up from just four in 2019), 60% have fiscal deficits above 4% (double that in 2019), and 54% have passed the 60% public-debt-to-GDP ratio (up from 30% in 2019). Argentina, Pakistan, Sri Lanka, and Tunisia are, as they were in 2019, the most vulnerable countries per the indicator, while Indonesia, Bulgaria, and Peru are the three most resilient. Notably, China was named “the most weakened country.”

CDG’s assessment reflects growing concern worldwide about debt levels in the most vulnerable states, which prompted the IMF to reevaluate its debt restructuring principles and the US Federal Reserve to analyze the impact of a potential EM sovereign debt crisis on the US economy. A recent Capital Economics report concludes that stress on Central and Eastern Europe markets, for example, will force them to “deliver significant fiscal tightening,” with Romania and Hungary particularly standing out.

What we’re reading

Ghana borrows up to $200m from cocoa traders to plug funding gap (Reuters)

Nigeria’s government budgets for SUVs and president’s wife while millions struggle to make ends meet (AP)

Kenya declares a surprise public holiday to support national campaign to plant 15 billion trees (AP)

Kenya manufacturer is first in Africa to get WHO approval for malaria drug (The Guardian)

Tanzanian bank raises $68m in green bonds (Afrik21)

Mozambicans call for tighter environmental protection regulations (AllAfrica)

DRC offers free maternity care to cut death rate among mothers and babies (The Guardian)

Namibia breaks ground on Africa’s first green iron facility (Business Daily Zambia)

In Africa, will Big Tech and telcos split bill for more bandwidth? (The Africa Report)

US Export-Import Bank pushes Africa renewables (Bloomberg)

Vietnam turns to rooftop solar as government aims for 50% coverage by 2030 (Nikkei)

Vietnam rapidly builds up South China Sea reef (Radio Free Asia)

Bangladesh garment worker dies after police open fire during pay protests (Al Jazeera)

Bangladeshi political violence poses ‘high risk’ to economy (Nikkei)

China lent Pakistan $21b more than reported, study finds (Nikkei)

Afghanistan opium cultivation in 2023 declined 95% following drug ban (UN)

Myanmar and Russia stage first-ever joint naval drills as Western economic sanctions bite (Nikkei)

New Thai government takes aggressive action to boost economic growth (FrontierView)

Oman suspends issuing visas to Bangladeshis (Muscat Daily)

Iranian president’s visit to Tajikistan symbolic of growing rapprochement (Radio Free Europe)

Egypt imports rare LNG cargo amid scarcity of Israeli gas (S&P Ratings)

Investors pull record sums from Saudi Arabia in Middle East fund flight (Reuters)

Italy announces deal to build migrant centers in Albania (Politico)

Polish truckers block border crossings with Ukraine in protest at ‘unfair competition’ (BalkanInsight)

Anti-Ukraine party gathers strength in Romania (FT)

Ukraine to Putin: You cut our power, we kneecap your biggest economic driver (Politico)

Soaring wage growth risks blunting Eastern Europe’s edge, IMF warns (FT)

Costa Rica, Uruguay and Colombia seek to take advantage of declining borrowing costs (Latin Finance)

Uruguay reflects Latin American drift from US to China (WSJ)

Argentina’s next president will face an economy in crisis (WSJ)

Argentina and Bolivia hope to surpass Chile as a long-awaited lithium boom gains speed (Americas Quarterly)

US market reopened for Paraguayan beef in a boost for critical sector (Mercopress)

Widespread protests over mining contract threaten Panama’s pro-business reputation (FrontierView)

Nicaragua must still respect human rights outside of OAS, members of the organization said (Mercopress)

Guyana asks The Hague court to stop Venezuelan referendum on the annexation of half of its territory (Mercopress)