Frontier Markets Weekly, November 5th 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

US revokes trade preferences for four African countries

The US removed the Central African Republic, Gabon, Nigerand Uganda from a preferential trading list on Tuesday. US President Joe Biden said the countries’ involvement in “gross violations” of human rights and lack of progress toward democracy made them ineligible for trade benefits.

Biden has criticized Uganda for human rights violations after the country passed a law that criminalized same-sex relations. Militaries in both Gabon and Niger overthrew civilian governments in coups this year. Meanwhile, CAR likely had its privileges revoked because of its ties to Russia’s paramilitary Wagner Group, FT reports.

From January, the four countries will lose their privileges under the African Growth and Opportunity Act, which provides duty-free access to the US market for sub-Saharan African states in exchange for adherence to human rights standards and commitments to democratic progress.

South Africa, which some US lawmakers had said should lose its AGOA privileges after the US ambassador to Pretoria accused the country of smuggling arms to Russia, will retain its access.

China piles into mining and energy in Zimbabwe

Zimbabwe awarded licenses worth up to $2.8 billion to Chinese companies in the third quarter, the majority of which are for mining and energy production.

China is expanding its mining footprint in Africa as it continues to build out a supply chain for electric vehicles. The investment last quarter was 10 times larger than over the same period last year, Bloomberg reports. Zimbabwe is home to Africa’s largest known deposits of lithium, a key ingredient in EV batteries.

In total, Zimbabwe awarded $3.4 billion in licenses. The second-largest recipient was the UAE, which has also sought to expand its footprint in Africa. Last week, the Emirati multinational logistics company DP World signed a deal to operate one-third of the berths at Tanzania’s Dar Es Salaam port.

Podcast: Drea Burbank, Savimbo

Deep in the Colombian Amazon, a group of indigenous leaders are working to protect and restore the rainforest using innovative techniques funded by carbon- and biodiversity credits.

In our latest podcast we talk to Drea Burbank, founder of grassroots conservation-focused nonprofit Savimbo, which is helping create a new market for authentic, verifiable credits that can channel funding direct to the people stewarding the forest.

Asia

Indonesia unveils JETP emissions target

Indonesia announced plans on Wednesday to decrease carbon emissions and increase renewable energy production as part of an agreement to unlock billions in financing from wealthy nations. The country plans to cut carbon emissions from on-grid power to 250 million metric tons by 2030 and increase the proportion of renewables in its energy mix to 44%, Reuters reports.

The public release of the plan is aimed at assuaging concerns from G7 nations, who pledged at a summit last year to mobilize $20 billion to help Indonesia meet its climate goals. That plan has since run into problems, including concerns about a lack of transparency and the country’s ongoing dependence on coal, Bloomberg reports.

Despite the G7 funding, Indonesian officials said the country still faces a financing need of almost $70 billion to achieve its carbon-reduction targets.

US ramps up sanctions on Myanmar

The US announced partial sanctions on Myanmar’s state-owned oil company on Tuesday. The curbs on Myanma Oil and Gas Enterprise (MOGE) represent one of the most significant moves yet to limit Myanmar’s ruling military junta from generating revenue to pay for weapons, Bloomberg reports.

The restrictions will prevent Americans from providing, exporting, or re-exporting financial services, directly or indirectly, to or for the benefit of MOGE. US Secretary of State Antony Blinken said in a statement that he hoped the move would “disrupt the regime’s access to the US financial system and curtail its ability to perpetrate atrocities.”

Human rights groups have for months been urging the US to do more to restrict the junta’s cash flow as Myanmar’s military becomes increasingly repressive toward civilians. The US is coordinating with Canada and the UK to impose the penalties, which take effect on December 15.

Pakistan expels Afghan migrants

Thousands of Afghan migrants fled Pakistan this week after Islamabad set a Wednesday deadline for their departure, citing security concerns. Pakistani officials said they would set up deportation centers to detain migrants who did not leave by the deadline.

International human rights groups condemned the move. “Deportation will expose [migrants] to significant security risks, including threats to their lives and well-being,” said Fereshta Abbasi, an Afghanistan researcher at Human Rights Watch. Up to 100,000 Afghans have voluntarily fled Pakistan this month, Deutsche Welle reports. Still, that marks just a small exodus compared to the number of undocumented migrants Pakistani officials say are in Pakistan.

Pakistan says it hosts four million Afghan migrants, almost half of whom are undocumented, Reuters reports. Pakistani officials say migration accelerated after the Taliban took power in 2021, with an additional 600,000 to 800,000 Afghans crossing the border into Pakistan. Since then, Pakistan has experienced a surge in armed attacks, which the government has blamed on groups in Afghanistan, Al Jazeera reports.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Yemen’s Houthis declare war on Israel and renew border clashes with Saudi Arabia

Yemen’s Houthi government—part of the so-called “Axis of Resistance” supported by Iran—announced this week that it has started drone and missile attacks on Israel in order to “help the Palstinians to victory,” Reuters reports. While the Houthis are not the internationally recognized government of Yemen, their control of the territory and significant Iranian support indicates a widening of Israel’s localized war with Hamas in Gaza to a broader conflict with Iran’s regional proxies.

Saudi Arabia said four soldiers were killed in renewed fighting with the Houthison its southwestern border with Yemen, and that it had shot down Houthi missiles fired at Israel through Saudi airspace. Saudi Defense Minister Khalid Bin Salman flew to the US last week for high-level discussions on regional security and the escalating threat from Iran’s Houthi proxies.

Israel claims encirclement of Gaza City, rejects calls for ceasefire

The Israeli Defence Force on Thursday claimed it had encircled Gaza City, which it claims is “the focal point of the Hamas terror organizations,” Reuters reports. Israel’s Prime Minister Benjamin Netanyahu said in a statement that Israel is “at the height of the battle” but has had “impressive successes,” claiming large numbers of Hamas fighters killed as it maneuvered to cut Gaza effectively in half.

The rising intensity of Israel’s ground offensive into the densely populated Gaza City has prompted calls for a ceasefire even amongst its allies. US Secretary of State Antony Blinken has tried striking a balance between supporting Israel and protecting civilians, calling for “humanitarian pauses” that the US believes “can be a critical mechanism for protecting civilians while enabling Israel to achieve its objectives of defeating Hamas.”

However, on Friday, Netanyahu said Israel “refuses a temporary ceasefire that doesn’t include a return of our hostages”. Meanwhile, Hezbollah’s leader Hassan Nasrallah signaled in a highly anticipated speech on Friday that while the Lebanon-based Iranian-proxy has indeed been engaged in skirmishes with the IDF on the Israel-Lebanon border, it did not have any involvement in planning the October 7th attack.

Europe

EU moves to store natural gas surplus in Ukraine

European energy companies are increasingly turning to Ukraine to store excess gas reserves built up in response to fears over energy security in the wake of Russia’s invasion, the FT reports. Despite ongoing risks from the war, Ukraine has emerged as a storage alternative due to incentives such as low storage tariffs and customs duty exemptions for three years.

The EU’s build-up of natural gas reserves has exceeded the bloc’s target of 90% of storage capacity, with storage chambers currently at almost 99% capacity.

Ukraine’s gas storage tanks are mainly situated underground in the western part of the country, far from the front lines, and currently hold over two billion cubic meters of gas from EU entities. The EU and Ukraine are also exploring the possibility of insuring storage facilities against war-related damage, which could further boost the use of Ukrainian storage.

Latin America

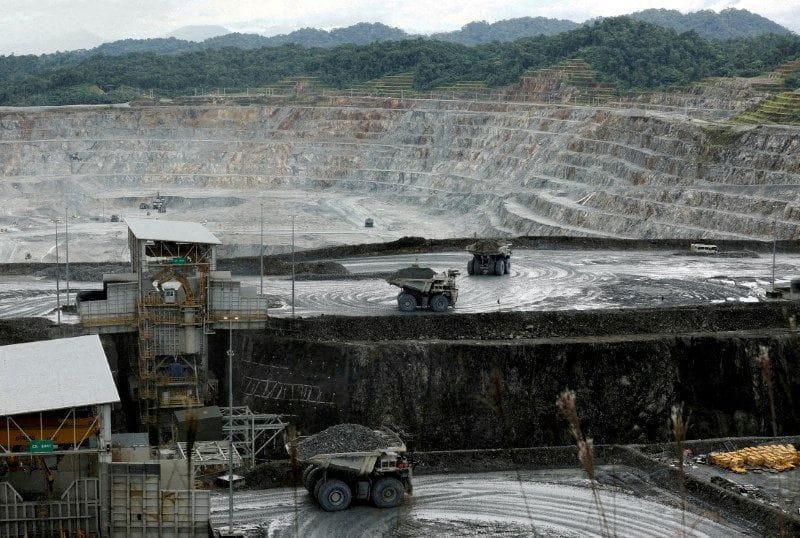

Panama protests threaten to derail mining contract

Canadian mining firm First Quantum Minerals’ share price plunged 48% this week as lawmakers in Panama considered revoking its 20-year contract to run the giant Cobre Panama copper mine. The government was responding to weeks of escalating protests over environmental concerns and fears that the contract handed too much control to the miner.

The campaign to suspend the contract is controversial as the mine accounts for some 5% of Panama’s GDP and employs a meaningful percentage of the country’s workforce. The potential hit to the country’s GDP from canceling the contract was sharply in focus this week as ratings firm Fitch downgraded Panama’s credit outlook.

First Quantum has remained relatively tight-lipped about the protests, but a source close to the firm told Frontier Markets News the company would do “whatever it takes” to resolve the issues over the contract. “If this means we have to go back to the negotiating table, we will,” the source said.

Paraguay sees record FDI on strong macroeconomic stability

Foreign direct investment into Paraguay almost quadrupled last year to hit an all-time high of $725 million, according to the country’s central bank. The Latin American nation is increasingly attracting the attention of foreign investors with a stable macroeconomic environment and the pro-business policies implemented by the new government under President Santiago Peña.

A volatile global economic landscape has also helped Paraguay attract investments originally earmarked for other regions, solidifying its status as an attractive destination for investors, Mercopress reports.

Net direct investment flows increased notably in sectors such as financial intermediation, commerce, chemical production, oil processing and metal products. On the flip side, sectors such as communication, livestock, transportation, and machinery and equipment experienced a decrease in net flows.

Local elections deal stinging rebuke to Colombia’s Petro

Opposition candidates secured sweeping victories in mayoral, gubernatorial and council elections across Colombia last week, dealing a powerful blow to embattled President Gustavo Petro, the FT reports. Voters in major cities, including the capital Bogotá, decisively rejected Petro’s political allies in mayoral races, while only two out of 32 provinces elected governors backed by his Historic Pact coalition.

Despite his ambitious agenda—including progressive tax reforms—Petro has struggled to get cross-party support in the country’s congress for his efforts to overhaul health, pension and labor laws. The president’s popularity rating has plummeted from 56% to 32%, according to local pollster Invamer. His cause hasn’t been helped by the fact that his government and family have been mired in controversy, including over the arrest of his son Nicolás on money laundering charges, and allegations of wiretapping involving his former chief of staff and campaign manager.

Gustavo Bolívar, a staunch ally of President Petro, finished third in the race to become mayor of Bogotá and said the result was a “punishment vote” for the government. Consultancy FrontierView said the result could reduce the so-called “Petro Risk” and pave the way for an easier operating environment in Colombia for companies.

What we’re reading

Blended-finance impact firm ABC pours €800,000 into Ugandan coffee supplier (Farmers Review Africa)

EU to invest €60m upgrading Uganda power plant (Reuters)

How hydrocarbon investments are turning around Uganda’s economy (The Africa Report)

Kenya to become visa-free to African visitors (BBC)

DRC ends visa fees for Uganda, Kenya and Tanzania (The Africa Report)

EU gives Ghana 100 military vehicles seized from Libya-bound ship (FT)

Niger’s economy in tatters after toppling of president (The Africa Report)

North Korea closes multiple embassies around the world as sanctions pressure state spending (Reuters)

Japan envisages ‘quasi-alliance’ with Philippines (Nikkei)

Malaysia’s Petronas to invest $1.6b in Indian green ammonia (FT)

Macron in Central Asia to boost France’s profile in a region dominated by Russia and China (France24)

Kazakh export ban shocks Tajikistan’s fuel market (Radio Free Europe)

Private credit catches on in Asia as high rates squeeze other funding routes (Nikkei)

Israel war fears batter Lebanon’s struggling economy (Al Jazeera)

Israeli airline El Al stops flying over Oman as ‘war-time precaution’ (Times of Israel)

Iran and Turkey call for meeting to avert spread of Israel-Hamas war (VOA)

Jordan recalls envoy in Israel over Gaza bombardment (Reuters)

Bahrain says envoy to Israel returned home, Israel says ties stable (Reuters)

Iraq seeks $6b joint funds with foreign investors (Zawya)

Saudi Arabia GDP sags asoil cuts weigh on economy (Al Monitor)

Saudi Arabia seeks trade deals, mulls BRICS offer to lift exports (Bloomberg)

Saudi Arabia explores women’s buying power with 30% entering work force (Al Monitor)

Saudi Arabia’s lavish sports push earns it the 2034 World Cup (WSJ)

Montenegro finally gets new government and PM in time for high profile EU visits (Politico)

Slovakia’s new government still faces fiscal and governance challenges (Fitch)

Russia tightens capital controls on western companies (FT)

Guyana’s new oil wealth brings a jarring new reality (WSJ)

How Nicaragua is helping—and charging—Haitians who want to reach the US (Miami Herald)

Venezuelan supreme court annuls Machado’s win in primaries (Mercopress)

Colombia to supply electricity to Ecuador to solve energy crisis (Mercopress)

Amid fuel shortage, Argentina’s Massa vows to bar oil exports (Buenos Aires Times)

South American countries recall ambassadors and cut ties with Israel over war with Hamas (The Guardian)

Vietnam, Poland, Mexico, Morocco and Indonesia: Key economic ‘connectors’ in a fragmenting world (Bloomberg)