Frontier Markets Weekly, March 27th 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

US increases engagement with Africa, carving out role in previously distant states. US diplomats ramped up engagement this week with African countries it has long held at arm’s length as the Biden administration looks to counter Russian influence and address a wave of coups across sub-Saharan Africa. Assistant Secretary of State for African Affairs Molly Phee met with the president of Mali’s Transitional Military Council, Mahamat Idriss Déby, in a move that suggests the US is beginning to stop viewing the strategically important Sahelian country as a “French problem.”

France’s troop drawdown and eroding control of the Sahel security situation is helping Russia build a line of influence from the Red Sea in Sudan to the western Sahel, Africa Report writes. As the French disengage, the Biden administration has been under Congressional pressure to act as top foreign policy leaders have criticized the State Department while urging a rethink of America’s security-heavy counter-terrorism strategy for the Sahel.

Meanwhile, in DC, the President of Somaliland, Muse Bihi Abdi secured meetings with top US administration officials and members of Congress. The visit caps a months long campaign to boost bilateral ties with the US and other countries amid continued political instability in Somalia, conflict in Ethiopia and Sudan and worsening drought in the region. —Ken Stibler

Truce called in Ethiopia. The Ethiopian government announced on Thursday that it would pause fighting to allow humanitarian aid to reach war-torn northern regions. Tigray rebels, the government’s foe in the country’s raging civil war, committed to “implementing a cessation of hostilities effective immediately” on Friday, Voice of America reports.

Since the war began 17 months ago, over 1.7 million people have been displaced and 400,000 “have crossed the threshold into famine,” according to the United Nations. A January World Food Program report called for food assistance for 9 million Ethiopians and assessed 40% of Tigrayans to be suffering “an extreme lack of food.” Food aid has not been delivered to Tigray since December, when government forces cut off key highways used for its delivery.

The Ethiopian government previously called a unilateral truce in June of 2021 as Tigrayan rebels closed in on the country’s capital. Fighting intensified shortly thereafter. Western officials are hopeful this week’s bilateral truce will lead to a more lasting ceasefire. —Noah Berman

Zimbabwean elections to test new opposition party. Voters cast ballots in byelections in Zimbabwe this week that will be seen as a yardstick for the country’s 2023 general election. The polls will test the “readiness” of new opposition party Citizens Coalition for Change (CCC). The country’s ruling Zanu-PF party is not at risk of losing its parliamentary majority.

The Zanu-PF party, led by Robert Mugabe for 37 years until he was removed after a military coup in late 2017, has controlled the Zimbabwean government since the country gained independence in 1980. The party has been known for “severe and violent crackdowns on the political opposition, critical media and other sources of dissent,” according to Freedom House, a nonprofit that researches democracy and political freedom. Zanu-PF has also repeatedly been accused of rigging elections.

The current elections come amid a free-fall of Zimbabwe’s economy, with inflation high and purchasing power low and the local currency, the Zimbabwe dollar, suffering a lasting and painful decline, Al Jazeera reports. —Noah Berman

Egypt requests IMF support as economy comes under stress from price of food imports and energy. Egypt requested IMF assistance this week as Russia’s invasion of Ukraine has put the economy under stress, raising concerns about popular discontent and default in the world’s largest importer of wheat. The country’s third request in five years reflects a weakening currency, ballooning deficit, and balance of payments pressure as the Russia-Ukraine war has sent oil and grain prices soaring and the key tourism sector reeling, reports the FT’s Heba Saleh.

The price of bread is especially sensitive in a country where roughly 70 million people rely on subsidized bread, with 85% of wheat coming from Ukraine and Russia. Rising food prices are regarded as one of the broad conditions leading to the 2011 uprising that ousted former president Hosni Mubarak.

In a frantic response, the government imposed new price controls on unsubsidized bread. The central bank also devalued the currency, which fell over 10% this week, to protect precious FX reserves while raising interest rates by 1 percentage point at a surprise meeting—the first increase since 2017. —Ken Stibler

Asia

US declares genocide in Myanmar. US Secretary of State Antony Blinken this week officially labeled Myanmar’s extrajudicial killings of the Rohingya Muslim minority a genocide. Myanmar’s Rohingya have long faced violence and discrimination, but the attacks against them intensified in 2017, and more than 880,000 Rohingya have since fled to refugee camps in Bangladesh, according to the United Nations.

Accompanying the designation, the US will provide $1 million to a UN investigation into atrocities in Myanmar. Experts anticipate that US willingness to decry the genocide in Myanmar may be followed by harsher sanctions against the ruling military junta, limits on aid, or broader international isolation, Al Jazeera reports.

A study published this week by the human rights group Fortify Rights in conjunction with Yale Law School found that Myanmar’s junta committed crimes against humanity after its February 2021 coup. Myanmar is currently being sued by Gambia in the International Court of Justice. The government of Myanmar has denied all accusations of wrongdoing. —Noah Berman

Bangladesh launches food subsidies to offset price increases driven by Russia’s invasion of Ukraine. Bangladesh has launched a subsidy program aimed at offsetting spiraling prices of cooking oils, lentils, grains and fertilizer that have become collateral damage from Russia’s invasion of Ukraine. Russia and Ukraine combine for about half of Bangladesh’s wheat imports, The Diplomat reports.

The subsidies will apply to 10 million Bangladeshis, about 6% of the country’s population, and run until the beginning of May, coinciding with the end of Ramadan, France 24 reports. An estimated 26% of Bangladesh’s population lives below the international poverty line.

The government has previously announced subsidies for energy and fertilizer. State-owned Bangladesh Petroleum Corporation has been reporting losses of about €2 million per day since mid-March, and garment exporters have reported a 450% increase in shipping costs out of the country compared to pre-pandemic levels, according to Deutsche Welle. Total subsidies for 2022 could exceed $1.1 billion, Arab News reports. —Noah Berman

Philippines relaxes foreign investment rules. Foreigners will now be allowed to fully own businesses in the Philippines’ telecommunication, airlines, railways and shipping sectors. The new legislation amends the 1936 Public Service Act, which restricted foreign ownership in Philippine companies to 40%. The restriction will remain in the power transmission and distribution, water pipelines and sewage, seaports, petroleum pipelines, and public utility vehicle industries.

Lawmakers supporting the bill say it will boost foreign direct investment by $5.7 billion over the next five years, Reuters reports.

Critics argue that the loosened investment rules will give China the opportunity it has been waiting for to gain leverage over the Philippines, with whom it has been sparring over territorial disputes in the South China Sea. China Telecom owns 40% of Philippine telecommunications company Dito Telecomunity, and State Grid Corporation of China owns 40% of the National Grid Corporation of the Philippines, Nikkei Asia reports. Philippine senators have accused Dito of being a trojan horse for Chinese espionage. —Noah Berman

Middle East

New Taliban rules impose chaperones on Afghan women. Women in Afghanistan are facing new Taliban rules requiring them to be accompanied by a male relative, one in a series of measures that they say threaten to squeeze them out of public and professional life, Margherita Stancati and Ehsanullah Amiri report in the Wall Street Journal. The official new rules don’t bar women from traveling alone near their homes.

The Taliban, who took power in Afghanistan in August, banned women last month from traveling more than 48 miles without a mahram, or male guardian, based on the group’s hard-line interpretation of Islam. However, women across the country say guardianship rules are being imposed on a far wider scale, and include needing a male relative to join them for basic tasks such as entering government buildings, seeing a doctor or catching a taxi.

The guardianship rules come as the Taliban are curbing women’s rights in other ways. On Wednesday, the Taliban reneged on their promise to reopen schools for girls over sixth grade, which had been closed since the Islamist group captured Afghanistan. Teenage boys returned to secondary school in September.

Europe

Ukraine and Moldova integrate into EU grid but EU and NATO membership remain a distant prospect. The first tangible progress on Ukraine and Moldova’s efforts to tighten ties with Western economic and security blocs materialized this week as both countries were integrated into the European power grid, Balkan Insights reports. The move helps shore up energy security for Moldova, which was facing Gazprom pressure earlier this year, and serves as a lifeline for embattled Ukraine.

Other applications to the EU for access to funding, arms and protection look likely to remain stalled amid wariness in the bloc over enlargement and internal conflict. The European Commission refused to fast-track membership for Ukraine, instead responding with an intentionally vague approval of Kyiv as part of “the European family.”

Moldova, Europe’s poorest country, meanwhile desperately needs help hosting over 300,000 refugees as it braces for more direct hostilities, the FT reports. Recent history, though, suggests the country is likely to face similar struggles to other nations such as North Macedonia and Albania as some EU members, including France, are wary of adding more countries to the bloc. —Ken Stibler

Latin America

Anti-corruption judge flees Guatemala. Erika Aifán, a Guatemalan judge, considered key in fighting corruption, fled for her safety on Monday. Her resignation came as Guatemala’s Supreme Court was considering removing her judicial immunity and she faces over 20 legal complaints about “overstepping.” The pressure emerged as the judge has presided over corruption cases against businessmen, officials, judges, and lawmakers.

Aifán recently began overseeing an investigation into allegations that current president Alejandro Giammattei financed his 2019 campaign with $2.6 million in bribes from construction firms.

For months, the US State Department and the UN have warned about the attacks on Aifán, but the US continues to cooperate with Guatemalan agencies, and a full-pressure campaign is unlikely given collaboration on reducing migration through Mexico. —Ken Stibler

Mexican president leaks monetary policy as critics warn of threat to central bank autonomy. Mexico’s President Andrés Manuel López Obrador (AMLO) was forced into a rare apology after leaking news of a 0.5% rate hike by the Bank of Mexico. The move rattled the Mexican financial sector and raised further questions about the bank’s independence amid broader concerns about the erosion of Mexican institutions under AMLO, the FT reported.

The blunder comes as the central bank struggles to get inflation under control while retaining hard-won independence. Just this month, the central bank has warned of the Ukraine war’s knock-on effects, with inflation over 7% in March and supply chain disruptions expected to reduce GDP by a full percentage point in 2022. —Ken Stibler

Global

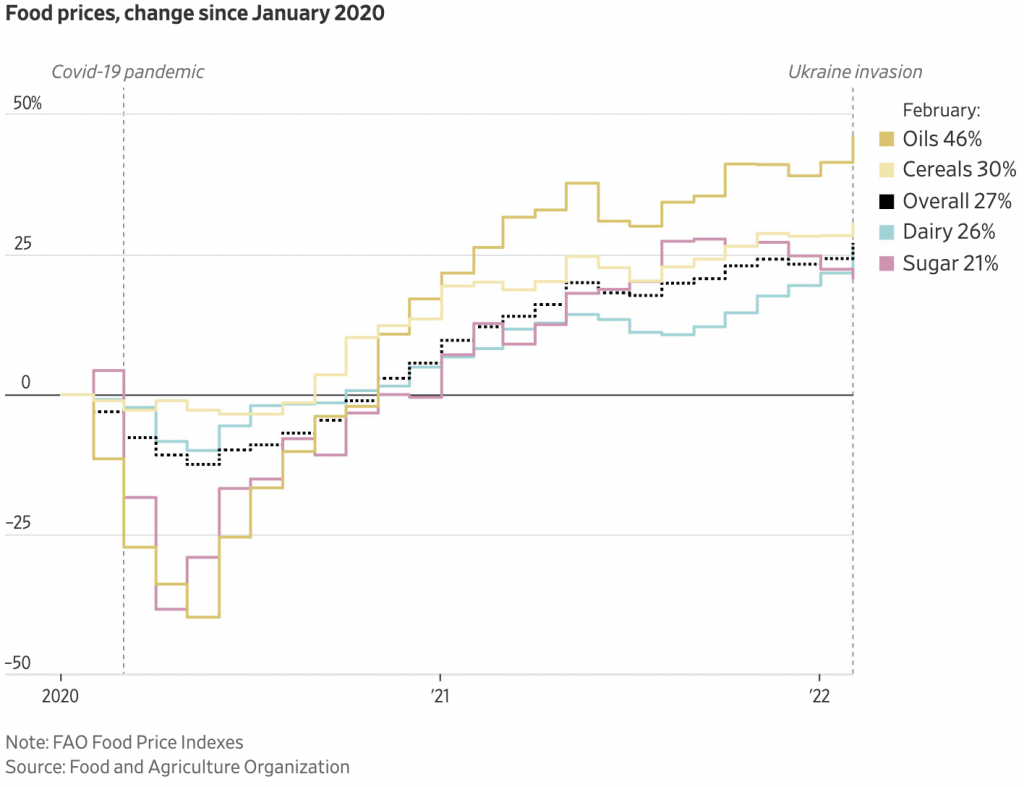

Ukraine war’s spillover swamps poor countries still reeling from Covid-19. Russia’s invasion of Ukraine has spread pain across the developing world, Saeed Shah, Nazih Osseiran and Nicholas Bariyo write in the Wall Street Journal. It has spurred the biggest price shock in decades and choked imports of basic commodities such as wheat and oil, triggering shortages especially tough for poorer nations that were already far behind in their economic recovery from the pandemic.

In Kenya, bread prices recently jumped by 40% in some areas. In Indonesia, the government has imposed price controls on cooking oil. In Brazil, the state-owned energy-giant Petrobras said earlier this month it couldn’t hold off inflationary pressures and raised gasoline prices to distributors by 19%. In Turkey, a sharp increase in the price of sunflower oil sparked panic buying.

“If this conflict continues, the impact will probably be more consequential than the coronavirus crisis,” said Indermit Gill, a World Bank vice president who oversees economic policy. With debt levels in developing countries at a 50-year high, price increases driven by the war in Ukraine could scare off investment in emerging markets, Mr. Gill said.

Russia is the world’s second-largest exporter of crude oil behind Saudi Arabia, making up 12% of global supply, according to the Paris-based International Energy Agency. It is also the world’s largest exporter of natural gas and the biggest producer of fertilizer. Higher fertilizer costs mean farmers will likely use less, reducing harvest yields and pushing up food prices around the globe, but hitting hardest in countries that can least afford it. —Ken Stibler

Fed warns of global recession from Russia sanctions. A sustained halt in Russian energy exports could have a dire effect on the global economy, a report from the Federal Reserve Bank of Dallas said on Tuesday, the Wall Street Journal’s Michael S. Derby writes. The staff economist report noted that there are few options to replace Russian energy and that the knock-on effects through production costs and supply shocks are influencing key food and commodity prices as well.

“If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable. This slowdown could be more protracted than that in 1991,” the report’s authors Lutz Kilian and Michael Plante wrote.

The combination of higher import prices and increased global borrowing costs threatens broader damage across global markets as riskier sovereign borrowers face greater borrowing needs and less ability to repay or roll over existing debt. —Ken Stibler

What we’re reading

West African court orders lifting of some sanctions against Mali. (Reuters)

Nigeria: 7,000 Boko Haram, other fighters surrender in a week. (Al Jazeera)

Nigeria opens Africa’s largest fertilizer plant amid price surge. (Bloomberg)

Ghana’s central bank aims to check inflation with biggest rate rise in 20 years. (The Africa Report)

Zambia cancels $1.2 billion Chinese road project linking Lusaka and Ndola. (The Africa Report)

Russia diamond supply curb may benefit Zimbabwe miner’s gems. (Bloomberg)

Western Sahara: Algeria sees betrayal in Spain’s sudden support for Morocco plan. (Middle East Eye)

Sri Lanka deploys troops as fuel shortage sparks protests. (Al Jazeera)

Thailand bans bitcoin and other crypto payments starting in April. (Nikkei)

Rifts in Thailand’s fractious coalition threaten early election. (Nikkei)

Timor-Leste vote highlights young nation’s political impasse. (The Diplomat)

Duterte’s party backs front-runner Marcos for Philippine president. (Nikkei)

China ramps up arms exports to Pakistan, aiming to squeeze India. (Nikkei)

China and India try to improve ties damaged by deadly border clash. (WSJ)

Aramco profit hits $110 billion as Saudis seek to expand investments. (WSJ)

Lebanon’s central bank chief charged with money laundering. (Bloomberg)

Israel to host first-ever summit of Arab diplomats. (WSJ)

Europe’s determination to reduce reliance on Russian gas creates headache for some, including Bulgaria, Hungary and Serbia. (Balkan Insight)

Slovenia to reopen Kyiv embassy, urges EU to follow. (BalkanInsight)

Moscow warns ‘unfriendly’ Bulgaria after Russian diplomats expelled. (BalkanInsight)

El Salvador delays ‘Volcano Bond’ issue, unveils state-owned company backing. (Blockworks)

Chevron, waiting it out in Venezuela, tells US now is the time to pump oil. (WSJ)

Nicaragua’s OAS envoy blasts his own government as dictatorship. (WSJ)