Frontier Markets Weekly, March 20th 2023

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

Fuel shortages disrupt Nigerian economy. As supply shrinks and prices skyrocket, gasoline has increasingly become a luxury item for Nigerian consumers. Nigeria is one of Africa’s top producers of oil, but without the refinery infrastructure necessary to turn crude oil into usable petrol, Nigeria is vulnerable to supply shocks when imports are withdrawn. Nigerians this week reported camping out overnight and paying nearly triple previous rates for taxis, according to the Associated Press.

Nigeria is also wrestling with a foreign-currency shortage, and in a bid on Monday to keep foreign reserves from leaving the country a slew of Nigerian banks announced a ban on debit card withdrawals from abroad, Reuters reports. Banks will also lower ceilings on online purchases in foreign currencies.

Air Peace and Arik Air, two of the largest domestic Nigerian airlines, canceled or delayed flights last week, citing fuel shortages. Three other airlines released statements on the dearth of jet fuel. Nigeria imports most of its jet fuel, which has nearly doubled in price since December, Al Jazeera reports. —Noah Berman

Mali bans French media. One month after France declared a withdrawal of its troops from Mali, the Sahel country’s ruling military junta has announced it will censor France24 and Radio France Internationale, two of the largest French media outlets. The two outlets have reported numerous human rights violations committed by the junta.

In a statement, the Malian junta said France24 and RFI have “a premeditated strategy aimed at destabilizing the political transition, demoralizing the Malian people and discrediting the Malian army,” France24 reports.

The timing of the announcement coincided with the release of a report on Tuesday by Human Rights Watch that accused Mali’s military of killing at least 107 civilians since December. The report was publicized by France24 and RFI. The Malian army has staged two coups since 2020. As of Thursday, both outlets remained on the air in Mali, Reuters reports.

Asia

Sri Lanka looks to IMF and India to ease debt crisis. Sri Lanka’s President Gotabaya Rajapaksa is aiming to calm increasingly vocal Sri Lankans with a pledge to seek help from the IMF to deal with the country’s mushrooming debt crisis, Deutsche Welle reports. If signed, the program would be Sri Lanka’s 17th IMF relief package.

Supplementing the IMF commitment, finance minister and presidential sibling Basil Rajapaksa signed a $1 billion credit line with India on Thursday, according to the Hindu. India has contributed a total of $1.4 billion to Sri Lanka in 2022.

The relief deals come as patience among the Sri Lankan populace wears thin. Inflation has reached a high of 15% in the small island nation, the highest rate in Asia, and fuel shortages and blackouts have become normal. Gas prices are up 50% this month and 88% year over year, the Straits Times reports.

Markets have so far responded positively to the prospect of a solution to the country’s debt crisis. An international bond due 2030 increased to 49 cents to the dollar from a low of 38.9 cents on March 9, and one-year default probability has shrunk to 18.2% from as high as 31.3% at the end of 2021, according to data from Bloomberg. —Noah Berman

Pakistan’s PM at risk of expulsion. A no-confidence vote sought by the opposition to Pakistani Prime Minister Imran Khan gained steam this week as coalition parties and members of Khan’s own Pakistan Tehreek-e-Insaf (PTI) party withdrew their support for the embattled leader.

A defecting PTI member of parliament said there are more than 20 dissidents in the party, Reuters reports. With the loss of fellow PTI lawmakers and coalition partners, Khan’s party would have 155 seats in Pakistan’s National Assembly, falling short of the 172 necessary to stay in power.

The motion to hold a vote of no-confidence, a regulatory proceeding by which a simple majority of lawmakers can vote to depose the prime minister, was raised in parliament last week. The vote is expected after March 27 but as soon as the end of the month, Times of India reports.

Afghans turn to cryptocurrencies as bank infrastructure crumbles. While many are not directly sanctioned by the West, Afghan financial institutions that are tied to sanctioned Russian banks through SWIFT have fallen victim to the widespread Western sanctions effort. In 2021, 80% of Afghanistan’s GDP came from foreign aid and donors, much of which was facilitated by SWIFT, the BBC reports.

Cryptocurrencies are not currently subject to the same restrictions. After the Taliban took over, Afghan crypto usage soared. The country ranked 20th in Chanalysis’ crypto adoption index for 2021, after appearing unranked in previous years. According to Cointelegraph, crypto has become the only way to wirelessly transfer money into Afghanistan. —Noah Berman

Faltering growth prospects prompts Beijing to reconsider policies. Facing dimming growth prospects and a dearth of market confidence, China has begun pivoting to more growth-friendly policies in a major turn from a “common prosperity” push which saw Beijing take a markedly anti-business stance. International investors in China have been spooked by slowing economic growth, the inflationary aftershocks of Russia’s Ukraine invasion, and a long-running crackdown by President Xi Jinping’s administration on previously fast-growing companies in the technology, education, and property sectors, reports the FT.

China’s potential compromise comes as the country’s top economic official Liu He on Wednesday reassured investors that Beijing would take measures to support the economy and financial markets after a sharp sell-off in Chinese equities that was exacerbated by Russia’s invasion of Ukraine.

Liu went on to say that said the government would introduce “policies that are favorable to the market,” including sharing audit information to prevent the delisting of Chinese tech companies, supportive monetary policy, and halting a broader deleveraging effort to ease pressure on a highly indebted property sector. —Ken Stibler

Middle East

Saudi Arabia considers accepting yuan instead of dollars for Chinese oil sales. Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the US dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia, Summer Said and Stephen Kalin report in the WSJ.

Talks have accelerated this year as the Saudis have grown increasingly unhappy with decades-old US security commitments to defend the kingdom, the people said. The Saudis are angry over the US’s lack of support for their intervention in the Yemen civil war, and over the Biden administration’s attempt to strike a deal with Iran over its nuclear program.

China buys more than 25% of the oil that Saudi Arabia exports, and if priced in yuan those sales would boost the standing of China’s currency. The Saudis are also considering including yuan-denominated futures contracts, known as the petroyuan, in the pricing model of Saudi Arabian Oil Co., known as Aramco.

Clandestine finance system helped Iran withstand sanctions. Iran established a clandestine banking and finance system to handle tens of billions of dollars in annual trade banned under US-led sanctions, enabling Tehran to endure the economic siege and giving it leverage in multilateral nuclear talks, the Wall Street Journal’s Ian Talley reports.

According to Western diplomats, intelligence officials and documents, the system, which comprises accounts in foreign commercial banks, proxy companies registered outside the country, firms that coordinate the banned trade, and a transaction clearinghouse within Iran, has helped Tehran resist the Biden administration’s pressure to rejoin the 2015 nuclear deal, buying it time to advance its nuclear program even while negotiations were under way.

The Western officials say the clandestine system has worked well enough that Iranian authorities aim to make it a permanent part of the economy, not only to shield Iran from future possible sanctions campaigns but also to enable it to conduct trade without scrutiny from abroad.

“This is an unprecedented governmental money-laundering operation,” one of the Western officials said of the clandestine system.

Syria’s Assad makes surprise visit to the UAE. Syrian President Bashar al-Assad met with Emirati leaders on Friday during a surprise visit to the United Arab Emirates, his first trip to an Arab country since launching a brutal crackdown on opponents that plunged the country into civil war 11 years ago, Stephen Kalin and Nazih Osseiran write in the Journal. The hourslong trip by Mr. Assad, who is sanctioned by the US government, comes amid an Arab effort to bring Syria in from the cold as well as tensions between the US and Gulf countries over Russia’s invasion of Ukraine and Washington’s response to recent drone attacks from Yemen.

The US has maintained its hard-line position on the Syrian regime and in recent years sought to increase international pressure on him to accept a broader role for his opponents.

Mr. Assad was received by the UAE’s de facto leader Abu Dhabi Crown Prince Sheikh Mohammed bin Zayed al Nahyan at his palace and separately in Dubai by its ruler Sheikh Mohammed bin Rashid al Maktoum, according to U.A.E. and Syrian state media. Photographs showed him smiling and relaxed in meetings with Emirati officials, who embraced him.

Latin America

Argentina avoids default as Congress passes IMF agreement. The Argentine Senate passed the country’s most recent agreement with the IMF over the resistance of influential politicians, including the vice president’s son. Passage of the bill should prevent a default on $19 billion of government debt, Al Jazeera reports, and delays IMF debt repayments until 2026. However, the final 56 to 13 vote came amid fierce street protests against spending reductions.

The traditionally anti-austerity Peronist government committed to eliminating certain subsidies, reducing spending, halting monetary financing, devaluing the peso even more, and further increasing interest rates. Investors, however, are skeptical that a divided and unpopular administration facing elections in 2023 can keep the new arrangement on track and deliver on the IMF’s conditions, the FT’s Lucinda Elliott reports.

While a delay might stay default, the Argentine economy remains in critical condition with inflation over 50%, pressure building on the local exchange rate, and dollar reserves so low that some analysts estimate that central bank reserves are in negative territory. —Ken Stibler

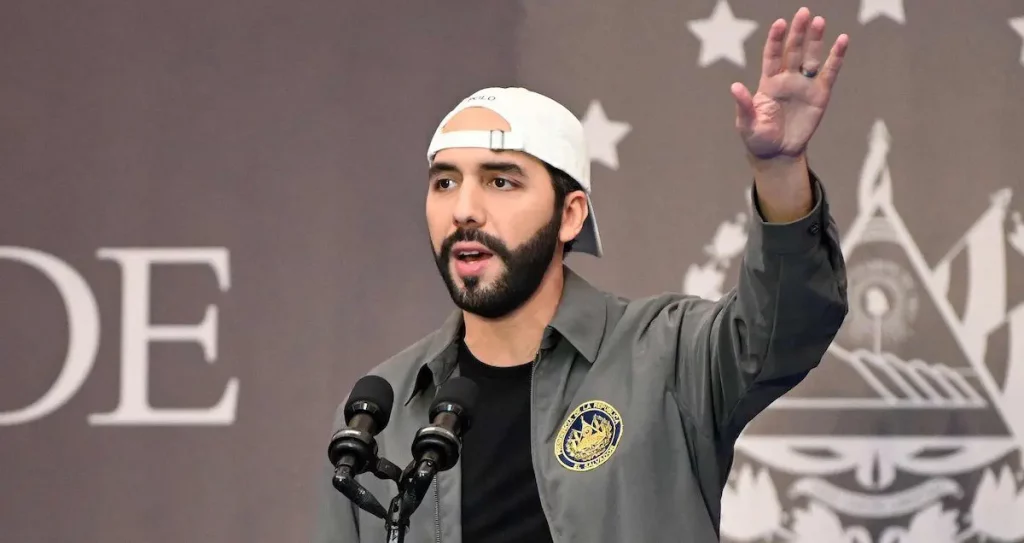

El Salvador’s bitcoin experiment reaches a critical inflection point. After much anticipation, El Salvador delayed the offer of the world’s first bitcoin bond issuances amid heightened criticism and increased cryptocurrency volatility stemming from the Russia-Ukraine conflict. The $1 billion bond offer was meant to fund additional digital currency purchases and build a new city to use energy from a nearby volcano to mine crypto, Blockworks reported. Previous statements from the Finance Minister suggested that the issuance would come this week, but the paperwork has still not been presented to Congress, leaving the “volcano bonds” mired in uncertainty.

Public adoption of cryptocurrency has been spotty since it was made legal tender in September. In January, only 2% of remittances—a key component of the El Salvadoran economy—were sent using digital wallets, according to the central bank. Further, a Salvadoran Chamber of Commerce survey conducted in January and February found 86% of Salvadoran businesses contacted had never conducted a sale in bitcoin, reported Rest of the World.

President Nayib Bukele has pitched the adoption of bitcoin as a way to make El Salvador less dependent on the international financial system, reduce fees on sending remittances to the country, and boost investment in local businesses. However, the IMF has warned of cryptocurrencies’ potential negative effects on public finances, and JPMorgan downgraded El Salvador’s sovereign debt to the second-worst in Latin America. —Ken Stibler

Left wing finds its footing in Colombian primaries. Strong primary turnout and a record vote count for left-wing presidential candidate Gustavo Petro threatens to end nearly two decades of right-wing rule in Colombia. Petro’s coalition looked sure to be the biggest bloc in a fragmented senate while right-wing president Ivan Duque’s party suffered a sharp drop in its share of seats. The senator, former congressman, and ex-mayor of Bogotá has pledged wholesale land reform, a wealth tax on top families, and to repeal laws that liberalized labor markets.

The results offered a surprise for a political left saddled with ties to the unpopular FARC and suggested that mass protests and pandemic dislocations have finally eroded the long-dominant right-wing. Consultancy FrontierView concluded that Sunday’s results make Petro’s victory in May’s election most likely. But while Colombia’s perspective shift to the left carries some negative implications for GDP growth and the peso, a fractured Congress and barriers in the courts make the more radical elements of Petro’s agenda unlikely. —Ken Stibler

What we’re reading

Looting and attacks on aid workers rise as hunger adds to unrest in South Sudan. (The Guardian)

Uganda leader says China-style diplomacy better than the West’s. (Nikkei)

Turkmenistan leader’s son wins presidential election. (AP)

MEA countries introduce food export bans. (FrontierView)

Kazakh president pledges reforms in wake of deadly protests. (Radio Free Europe)

Turkey rules out sanctioning Russia, citing risk to economy. (BalkanInsight)

Iran releases British prisoner amid hopes of breakthrough in nuclear talks. (WSJ)

What is the Iran nuclear deal and what does it mean? (WSJ)

Hungary’s Orban pivots away from Putin as elections loom. (Foreign Policy)

Czech, Polish, and Slovenian PMs visit Zelenskiy in Kyiv. (Radio Free Europe)

UN: 90% of Ukrainians could slip into poverty if war drags on. (Radio Free Europe)

Albanians continue protesting against rising prices despite PM’s promises. (Balkan Insight)

Russia’s default swaps signal $40 billion payday is imminent. (Bloomberg)

Peru’s top court reinstates pardon for former president Alberto Fujimori. (NYT)

Peru Congress votes to begin impeachment of Castillo at second attempt. (Reuters)

US retreats on Venezuela oil talks after Maduro meeting criticism. (FT)

Honduras judge rules ex-president can be extradited to US on drug charges. (FT)

Brazil supreme court justice orders suspension of Telegram app over alleged disinformation campaigns. (WSJ)