Frontier Markets Weekly, April 3rd 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

Famine strikes east Africa. A severe drought has brought countries in the Horn of Africa region into crisis, as livestock die and people flee their homes in search of food. Kenya and Somalia have declared national emergencies and Ethiopia is experiencing its worst food insecurity for six years, according to a USAID report. The UN expects the drought and a likely famine to become “one of the worst climate-induced emergenciesin recent history in the Horn of Africa.”

The pandemic and the war in Ukraine have exacerbated the crisis, as supply-chain bottlenecks have caused the cost of staples such as wheat and cooking oil to balloon. Bread prices have doubled in Sudan, and Somalian cooking oil prices have increased by 72%, the New York Times reports.

East African states have received just a fraction of the foreign aid necessary to avert the crisis, according to Oxfam, a charity focused on ending global poverty. —Noah Berman

Tunisian president dissolves parliament in perceived power grab. Tunisia’s President Kais Saied announced the dissolution of the country’s parliament on Wednesday, the latest move in what critics characterize as a monthslong effort to consolidate power.

The president accused the parliament of “an unprecedented coup” and of having “lost its legitimacy,” Deutsche Welle reports.

Once seen as the lone success story of the Arab Spring, Tunisia has been a functional democracy since 2011. Like other emerging markets, the country has been hit especially hard by the pandemic and the war in Ukraine and the country is among those most at risk of defaulting on its debts according to a study by London-based research firm Capital Economics. —Noah Berman

Asia

Vietnam to devise legal framework for digital assets. Vietnam’s Deputy Prime Minister Le Minh Khai has tasked the country’s finance ministry with spearheading research for the implementation of a legal framework governing digital assets, Sebastian Sinclair writes in Blockworks. According to a report by local news outlet Vietnamnet on Monday, the ministry must identify specific legal documents requiring amendment or enactment for the management of the nascent asset class.

The research is being conducted alongside the ministries of justice, information and communications, as well as the State Bank of Vietnam. The move is another step in the country’s march to formally legislate digital assets.

The nation’s central bank in 2017 banned bitcoin and other cryptocurrencies for use as a means of payment, but the government has not banned crypto trading and allows citizens to hold them as assets. Despite the country’s lack of a legal framework for owning, trading and using them, Vietnam’s adoption of digital assets—by total population—is among the highest in the world.

Pakistan’s Imran Khan blocks no-confidence vote and calls for elections. Prime Minister Imran Khan blocked a no-confidence vote against him in Pakistan’s Parliament and called for fresh elections, Saeed Shah reports in the WSJ. The Supreme Court immediately opened hearings, using its legal powers to intervene.

The opposition also filed a petition to the court challenging the constitutionality of the move. The court, which held a brief initial hearing on Sunday, said it would take up the case in detail on Monday and directed government officials to maintain law and order.

The court will now decide whether the no-confidence vote is held, as the opposition wants, or elections take place. Whichever way the court goes, Mr. Khan’s term will come to an end, a year and a half shy of his full five-year term—whether through his preferred path of dissolving Parliament and holding new elections or the opposition’s attempt to knock him out through a vote of no confidence.

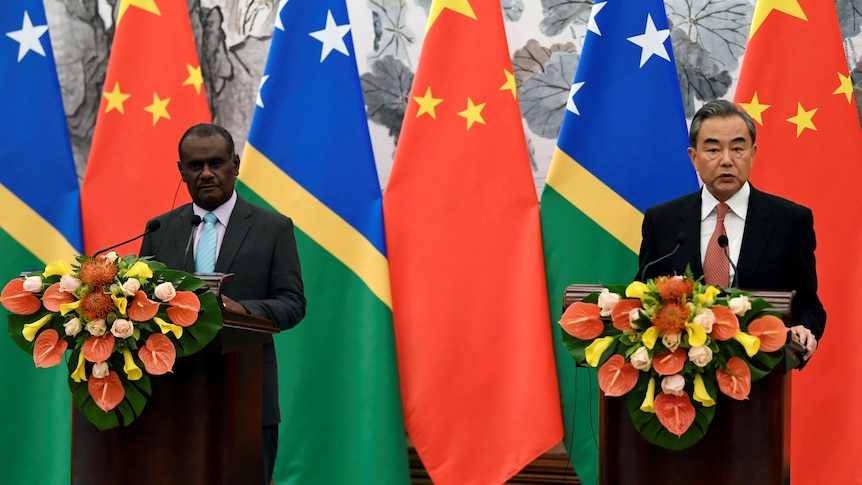

Chinese deal with Solomon Islands stokes fear in Oceania. China and the Solomon Islands are negotiating a security agreement that could grant China the right to police the strategic waterways surrounding the island nation in the South Pacific. A leakeddraft of the security agreement suggested that China could send troops or navy vessels to the Solomon Islands, though the criteria under which deployment could occur remained unclear, ABC News reports.

While the Solomon Islands has a security agreement with Australia, its neighbor 1,400 miles to the South and the largest aid donor to the small Pacific nation, the deal with China is more far-reaching, the BBC reports. Australia and Western nations worry that the deal may allow China to block shipping lanes in the South Pacific as global supply chains stretch thinner.

Western influence in the Solomon Islands has been waning, despite US plans to open an embassy in the country’s capital of Honiara. In 2019, officials in Honiara announced an end to its 36-year diplomatic relationship with Taiwan, a sign of stronger ties with mainland China. —Noah Berman

Central Asian states grapple with Russian invasion of Ukraine. Governments in the former soviet states of Kazakhstan, Tajikistan, Kyrgyzstan, Uzbekistan and Turkmenistan have attempted to remain neutral in the face of growing domestic pressure to take a stance on the war in Ukraine.

The post-soviet Central Asian nations have found themselves having to balance strongman leadership and an economic dependence on Russia alongside the fear of being the next victim of an expansionist Russian foreign policy. None of the five states voted either for or against a UN resolution to condemn Russia over the invasion. Kazakhstan, Kyrgyzstan and Uzbekistan have allowed some anti-war protests, while Tajikistan and Turkmenistan have not publicly addressed the war, according to the Carnegie Endowment for International Peace, a nonpartisan think tank.

Many citizens of Central Asian states seek employment in Russia and send remittances home. By putting pressure on the ruble, Western sanctions are expected to decrease the value of remittances by 21% in Uzbekistan, 22% in Tajikistan and 33% in Kyrgyzstan, according to data from the World Bank. 31% of Kyrgyzstan’s GDP and 27% of Tajikistan’s depend on Russian remittances, the World Bank says. —Noah Berman

India considers plan to bypass Russian sanctions. The government in New Delhi is considering a Russian proposal to use a Russian SWIFT competitor for bilateral payments between the two nations. The proposal calls for rubles to be deposited into Indian banks via Russian messaging system SPFS before being converted to rupees, Bloomberg reports.

The announced discussion comes as Russian foreign minister Sergei Lavrov visits India for the first time since Russia’s invasion of Ukraine. Lavrov arrived Thursday, the same day as British foreign minister Liz Truss, a sign of competition over India’s loyalties.

India has a history of circumventing Western sanctions against Russia that dates back to the Cold War. New Delhi has responded to US opposition to its plans by claiming a need for Russian arms, which account for about 60% of India’s military hardware, to more effectively counter China. —Noah Berman

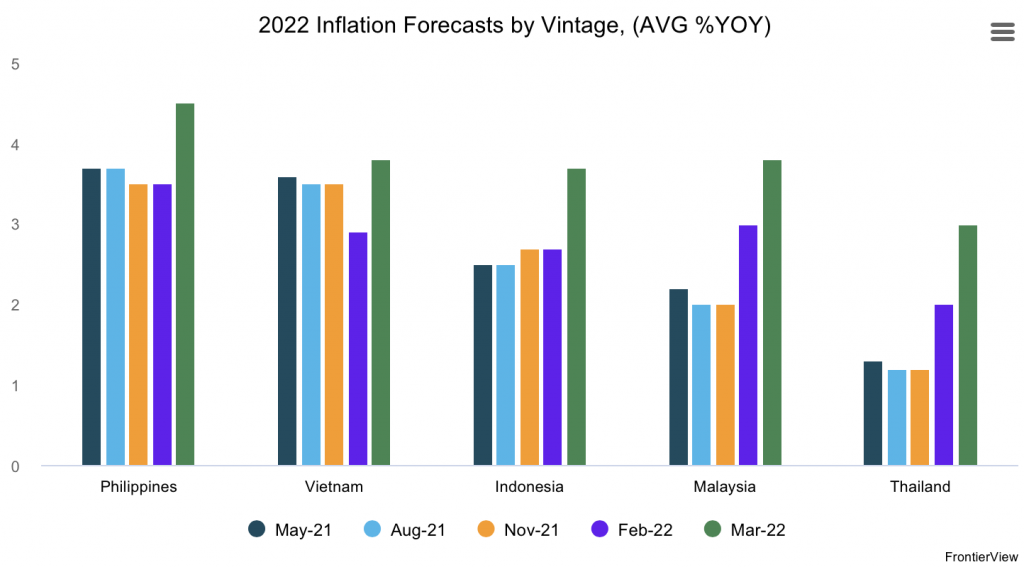

Analysis: Long-dormant inflation rises across Southeast Asia, prompting radical responses to cost-of-living crises. Smaller pandemic aid packages and more-moderate central-bank quantitative easing programs have largely spared Southeast Asian economies from the inflation plaguing the Americas and Europe. However, that is changing as the conflict in Ukraine and global prices rises in food and fuel are putting increasing pressure on the region, consultancy FrontierView reports.

Even without Russia’s invasion of Ukraine unsettling global commodity markets, Southeast Asia was feeling pressure from costlier meat, fish and other foods. Indonesia’s inflation hit a 20-month high in January, while Thailand’s CPI rose 5.28% on the year in February—the highest inflation in 13 years.

n response, governments have begun introducing measures such as subsidies and tax cuts to blunt the impact of inflation on restive populations. The Philippines has allocated $60 million for fuel subsidies, while Vietnam is planning to cut its environmental tax on fuel.

Thailand went even further in the wake of cost-of-living protests, approving a wide range of measures including fuel subsidies, direct payments, price controls, lowering social security contributions, and suspending debt payments, Reuters reported last week. —Ken Stibler

Middle East

Yemen parties agree to two-month truce. Saudi Arabia and Iran-backed Houthi fighters agreed on Friday to a two-month truce, bringing a temporary halt to a seven-year-old war in Yemen that could create new momentum for a diplomatic end to the conflict, Dion Nissenbaum reports in the Journal.

For the first time since 2016, the rival parties agreed to bring a unified halt to fighting in Yemen, a conflict the United Nations says has created the world’s worst humanitarian crisis.

The truce, which was scheduled to start on Saturday as Muslims around the world began the first day of fasting during the holy month of Ramadan, is expected to be followed by more steps meant to build trust between the two sides.

Saudis and UAE rebuff calls to sever Russian oil alliance. Two influential OPEC members, Saudi Arabia and the United Arab Emirates, rebuffed calls to expel Russia from a larger oil-production alliance with almost two dozen countries, saying the group had a long history of working together through armed conflicts, the Wall Street Journal’s Benoit Faucon and Summer Said report. A partnership, dubbed OPEC+, between the Saudi-led Organization of the Petroleum Exporting Countries and Russia, has refused to pump more oil while oil prices have rocketed above $100 a barrel.

“The US and its partners are asking to politicize [OPEC’s relationship with Russia.] We will not do it,” Emirati Energy Minister Suhail bin Mohammed al-Mazrouei said Tuesday in Dubai. Mr. Mazrouei said he hadn’t been contacted by the US, but he had heard from OPEC colleagues and public statements that the OPEC alliance with Russia had been condemned in the US.

Saudi Energy Minister Prince Abdulaziz bin Salman framed OPEC’s decision to stick with Russia as the group’s way of looking past disagreements among members. The Saudis and Emiratis have condemned Russia’s invasion of Ukraine in votes at the United Nations General Assembly.

Europe

Hungary’s Viktor Orban wins another term in office. Hungarian Prime Minister Viktor Orban, the closest thing Russian President Vladimir Putin has to a friend in the club of European Union leaders, won a fifth term in power on Sunday in an election that became a referendum on his promise to block support for Ukraine in its war with Russia, Drew Hinshaw and Ian Lovett report in the WSJ.

With 90% of the vote processed, Orban had won a majority, according to official results, and the coalition led by his nationalist Fidesz party was on track to win 135 of 199 seats in parliament. His opponent, a staunchly conservative small-town mayor, Peter Marki-Zay, failed to win even his own district.

Orban’s victory gives him four more years in power and sets up some enormous fights for Europe. Even as Western leaders expressed shock on Sunday over alleged war crimes committed by Russian troops outside Kyiv, the Hungarian’s victory was likely to exacerbate disagreements in the Western alliance over how much voters should be asked to sacrifice for Ukraine—and will help dim the chances for further sanctions, especially on energy.

Latin America

Killings surge in El Salvador as truce with gangs appears to fall apart. Last weekend, El Salvador experienced the bloodiest 24-hour period since the end of its civil war in 1992. Beginning on Friday and throughout the day on Saturday, suspected gang members carried out attacks across the country, killing shoppers, bus passengers, and other passersby.

With over 70 people dead by Sunday, President Nayib Bukele invoked emergency powers, flooded the capital with military personnel, restricted some constitutional rights, pushed through legislation to substantially increase prison sentences, and arrested over 2,500 gang members for possible “acts of terrorism,” Reuters reports.

The violence was all the more shocking considering that, since 2015, El Salvador’s annual homicide rate has been falling dramatically: from a towering 105 homicides per 100,000 people that year to just 17.6 in 2021. El Faro reported that many victims had no connection to Salvadoran gangs, suggesting the killings aimed to send a messageto the Salvadoran government that the gangs were displeased with a truce believed to have lowered crime rates under Bukele, Foreign Policy reports.

If the current truce is broken, El Salvador could return to the ranks of the world’s most dangerous countries. The uptick in violence and apparent breakdown of the government’s truce could undermine Bukele’s high approval ratings—and further impede his already troubled bitcoin experiment. —Ken Stibler

Argentina set for tough winter in face of high oil prices and currency shortages. Despite having vast gas reserves, Argentina faces the prospect of energy rationing as domestic production lags, and imports become costlier, Bloomberg’s Jonathan Gilbert and Peter Millard report. With the combination of price spikes and a shortage of hard currency to support imports, the country looks exposed to an increasingly competitive LNG import market.

Its shale-gas deposits rival the US’s biggest fields, but the Argentine energy industry has faced years of underinvestment and is far from meeting domestic demand. Without willing business partners to develop the vast Vaca Muerta shale deposit, Argentina became a large importer of US and Qatari LNG.

Discussions to increase imports from Bolivia have failed, with Brazil scooping up the majority of output amid its own energy crisis. Argentina currently imports 7.5 million cubic meters of Bolivian gas per day but needs double that in the cold stretch from May to September. However, Bolivia’s output has fallen over 20% in the last half-decade as nationalizations spooked investors, leaving little hope for reprieve from the Andes. —Ken Stibler

Global

Credit default risks rise in emerging markets. Sovereign bond spreads have widened across frontier markets, with particular risk of default in Sri Lanka and Tunisia, according to a report from Capital Economics. Yields in the two markets have widened over recent weeks as they continue to negotiate debt relief with the IMF.

In both countries, the mix of low foreign currency reserves and significant public sector external foreign-currency-denominated debts has made debt repayments more difficult. Tourism, a large source of foreign currency, made up 12.6% of Sri Lanka’s and 16.1% of Tunisia’s GDP in 2019, according to data technology company Knoema’s world data atlas. Tourism in both countries contracted significantly during the Covid-19 pandemic.

Significant credit risk may also materialize in Ethiopia, Kenya or Ghana, the Capital Economics report said. The Ghanain cedi has fallen 20% against the dollar this year, and fragile political situations in Ethiopia and Kenya may compound existing debt woes. —Noah Berman

What we’re reading

Ghana faces tough decisions to prop up Africa’s worst-performing currency. (The Africa Report)

Mozambique on cusp of new IMF program after six-year hiatus. (Bloomberg)

South Africa jobless rate at record as work seekers’ ranks grow. (Bloomberg)

Qatar plans $5b Egypt investments. (Bloomberg)

Saudi Arabia sends $5b to help Egypt’s economy. (FT)

New Zealand and Fiji sign partnership agreement. (RNZ)

Anger rises in Sri Lanka as economic crisis worsens. (WSJ)

Indian power projects replace Chinese ventures in Sri Lanka. (The Hindu)

India starts supplying rice to Sri Lanka in first major food aid. (Al Jazeera)

Afghanistan’s Taliban ban poppy cultivation. (WSJ)

China signs cooperation deal with Cambodia army amid US strain. (AFP/Bangkok Post)

Kazakhstan says it will help EU companies sell T-shirts and sneakers to Russia. (Politico)

Top official says Kazakhstan won’t help Russia evade Western sanctions. (Radio Free Europe)

Credit card tourism: Russians avoid sanctions by flying to Uzbekistan for VISA, Mastercards. (Radio Free Europe)

The Taliban didn’t get Chinese recognition, but they’re getting Chinese help. (Foreign Policy)

South Ossetian leader says breakaway Georgian region seeks vote to join Russia. (Radio Free Europe)

Israel–Turkey gas pipeline discussed as European alternative to Russian energy. (Reuters)

Israel and UAE finalize free trade deal. (Reuters)

Internet provider to Ukrainian military hit with major cyberattack. (WSJ)

Russia built parallel payments system that escaped Western sanctions. (WSJ)

Japan’s top banks face hefty losses on $8bn Russia exposure. (Nikkei)

North Macedonia census reveals big drop in population. (BalkanInsight)

Russian corporate bonds rebound as investors embrace risks. (WSJ)

Bulgaria blames Russian spies for tensions with North Macedonia. (BalkanInsight)

ECB supports Poland’s currency with €10b financing deal. (FT)

Former Honduras president to be extradited to the US on drug-trafficking charges. (WSJ)

El Salvador courts crypto ‘whales’ as traditional investors shun bitcoin bond. (FT)

Peru’s Castillo survives impeachment vote in Congress. (Reuters)

Number of Venezuelans crossing the Darien Gap soars. (UNHCR)

International Criminal Court to open office in Venezuela. (AP)

Venezuelan army ‘collaborated with Colombian rebels.’ (AP)

Paraguay and Taiwan to bolster cooperation. (MercoPress)