Frontier Markets Weekly, March 13th 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

Guinea junta halts mining activities at huge Simandou iron-ore deposit. The governing military junta in Guinea has ordered a halt to mining activities at the West African nation’s huge Simandou iron-ore deposit, Emmanuel Tumanjong wrote on Dow Jones’ newswire. The decision on the deposit, which is one of the world’s largest untapped deposits of iron ore, was made on Thursday by the military leader Colonel Mamady Doumbouya during a government cabinet meeting.

The government said in a statement that Col. Doumbouya had in December requested that exploitation of the Simandou deposit, in which mining giant Rio Tinto owns a stake, take into account “the interests of Guinea” but that there had been no progress on this matter.

The junta leader didn’t specify the content of his requests to the operators of the site. Rio Tinto, Chinese-backed Boke Mining, Aluminum Corp. of China, and the government of Guinea all have interests in the iron-ore and bauxite deposit.

US military urges Biden to place commandos in Somalia as militant threat worsens. The American military is asking President Biden to station several hundred commandos in Somalia to help blunt the spread of al Qaeda’s aggressive local affiliate, al-Shabaab, Michael M. Phillips reports in the Wall Street Journal.

According to US officials, military commanders want the White House to reverse then-President Donald Trump’s last-minute order to withdraw some 700 Army Green Berets, Navy SEALs and Marine Raiders from bases in Somalia, where they had been training an elite local unit to fight al-Shabaab. The Pentagon moved most of the American commandos to neighboring Djibouti and Kenya.

“Since US forces have come out of Somalia last January, we assess there is an uptick in al-Shabaab activities,” said a senior US intelligence official. Senior officers argue that local soldiers fight more effectively when consistently side-by-side with experienced US special-operators, even if the Americans avoid ground combat and limit their role to training and air support.

In Congo, China hits roadblock in global race for cobalt. For more than a decade, Chinese companies have spent billions of dollars buying out US and European miners in the Democratic Republic of Congo’s cobalt belt—the world’s richest source of a mineral that has become critical to the global transition to cleaner energy. Now the Chinese firms are running into trouble after a court ordered one of the largest to temporarily cede control of one of its mines, Nicholas Bariyo reports in the WSJ.

DRC accounted for 70% of the world’s total output of cobalt last year, with Chinese investors controlling a similar proportion of cobalt production. Now DRC’s government is pressing for a larger slice of the market, pushing back against China’s growing economic footprint in Africa, after a court last week stripped Hong Kong-listed China Molybdenum of management control of its Tenke Fungurume mine.

China Molybdenum will have to sit on the sidelines for six months after state miner Gécamines SA accused it of trying to evade millions of dollars in royalty payments by under-declaring reserves. China Molybdenum, which bought the mine for $2.65 billion from Freeport McMoRan, has said that it hopes the matter will soon be resolved, but now investigations have expanded into several other Chinese mining companies.

The standoff has the potential to become a turning point in China’s involvement with the continent, where until now it has run into relatively little opposition as it goes about securing supplies of valuable minerals, often in exchange for building roads and other important infrastructure. “The DRC can stand its ground for a while, especially since the court can extend its ruling for another six months,” said Geraud Neema, an analyst and editor with the China Africa Project, a nonprofit.

Asia

Russia sanctions intensify calls for Myanmar fuel ban. As the US, European Union and others hit Russia with crippling economic sanctions in response to Vladimir Putin’s invasion of Ukraine, they are facing demands to go hard against Myanmar’s military junta, Feliz Solomon reports in the Wall Street Journal. Opponents of the leaders of last year’s military coup in Myanmar are pushing for a ban on the sale of jet fuel to Myanmar. Such a move, they say, would hobble the air force that for months has hit rebel strongholds with bombs and mortar shells.

According to a UN report released last month, the Myanmar military has used jet fighters, combat helicopters, bombs and rockets in dozens of airstrikes, killing scores of civilians including children as young as 5. Human-rights groups and local media have documented fighter planes dropping munitions on or near civilian structures including homes and camps for people displaced by the conflict.

“Without fuel, the military can’t use their air force,” said Zin Mar Aung, foreign minister of the National Unity Government, which sees itself as a parallel administration composed of ousted civilian leaders and their allies. “If the jets can’t fly, they can’t bomb. It is as simple as that.”

Western policy makers are reluctant to tighten sanctions, though, because severe trade and travel bans imposed on Myanmar’s earlier regimes crushed its economy and pushed it toward greater reliance on China and Russia.

Thailand curbs crypto taxes. Thai cryptocurrency investors will no longer be subject to a controversial 7% value-added tax on government-authorized cryptocurrency exchanges, Coindesk writes. Under the new rules, crypto traders will also be able to write off losses against the previous year’s gains as they can with conventional investments. The exemption will take effect in April of this year and is set to expire in December 2023.

The move marks an about-face on cryptocurrencies from the Thai government, which abandoned a 15% tax on crypto gains after investor pushback. Investment in digital assets is rapidly growing in popularity in Thailand, with the number of digital trading accounts increasing from under 170,000 to over two million in 2021.

According to the Bangkok Post, the number of cryptocurrency trading accounts has seen much stronger growth than that of stock trading accounts. —Noah Berman

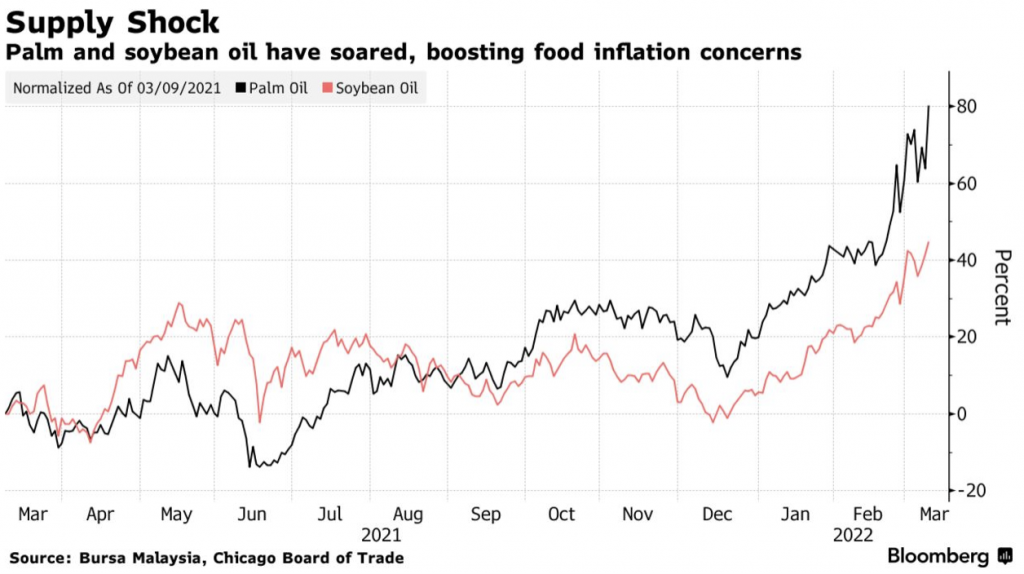

Palm oil latest casualty of Russia-Ukraine fallout. Indonesia, the world’s biggest palm oil producer, announced restrictions to further curtail exports of the key cooking oil ingredient, Bloomberg reports. For the next six months at least, Indonesian palm oil producers will need to sell 30% of their planned palm oil exports at home, the nation’s government said. The government had previously announced an obligation of 20%.

The prices of vegetable oils have soared this year as the world has dealt with global supply shocks, labor shortages, unpredictable weather, and war. Soybean producers in South America have been battered by unusually arid growing conditions, while Russia and Ukraine combine for nearly 80% of the world’s supply of sunflower oil.

The policy change is expected to remove up to 100,000 tons of palm oil from global markets each month. Malaysia palm oil futures surged to an all-time high on Wednesday, and soybean oil reached a 14-year high. With its export controls, Indonesia joins a growing trend of food protectionism. Argentina, Turkey and Moldova have each announced policies in recent weeks to prevent edible goods from being exported. —Noah Berman

Middle East

Russian demand could scupper Iran nuclear deal. Russia appeared willing to crush a revived nuclear deal between Iran and the West this week unless the US agreed to written guarantees that sanctions imposed over the war in Ukraine would not inhibit economic and military cooperation between Moscow and Tehran. US Secretary of State Antony Blinken seemed to reject Russia’s demand, saying that Washington’s sanctions on Russia “have nothing to do with the Iran deal.”

On Thursday, Tehran announced that talks had reached an impasse, Politico reported.

A new deal is likely to release Iran from the stranglehold of US sanctions at a time when oil, the state’s number one export, has reached near-record highs. Estimates suggest Iranian oil production slumped 75% after sanctions were re-imposed in 2018, according to DW.

However, time for the deal is running out, as Iran has continued enriching uranium. Uranium levels have now reached 15 times the JCPOA limit, according to the International Atomic Energy Agency. —Noah Berman

Latin America

Latin American currencies strengthen on commodity prices. Latin American commodity exporters have seen the value of their exports surge and currencies strength following Russia’s invasion of Ukraine. The rising importance of major Latin American exports and investors’ flight from eastern European currencies have seen the region’s currencies recover from poor performance during the pandemic, Bloomberg’s Carolina Wilson and George Lei report.

Brazil has seen its currency surge 11%, oil-exporting Colombia has seen a 9% appreciation, and copper producers Peru and Chile have also seen their currencies gain 7% and 6%, respectively. This newfound strength helps counter runaway inflation and has pushed up local-currency bonds this year, with South and Central American paper yielding over 5%, according to a Bloomberg index.

Despite the strong performance so far this year, concerns are rising that higher prices for imports of products such as wheat and refined oil could undermine the benefits. Further, aggressive tightening by global central banks and continued political instability have tended to drive demand for dollars and work against Latin American currencies. —Ken Stibler

Barbados defends new oil projects in a reflection of smaller producers’ newfound influence. Barbados’ environmentalist prime minister Mia Mottley, speaking at the FT’s climate conference this week, defended her country’s plans to resume fossil fuel exploration off its coast, saying that developing nations deserved “equity” and needed the revenue from oil and gas sales to finance the shift to clean energy.

Leaders from other small island states have pressed for developed rather than developing countries to shoulder the costs of adapting to the effects of climate change. Mottley also defended the rights of emerging economies such as Barbados to extract and export fossil fuels, pointing out that their use would not end entirely even if global net-zero emissions goals were met.

The sentiments represent an about-face for a climate leader and reflect an increasing rejection of the premature underinvestment in oil which saw smaller and emerging producers less able to profit from new oil discoveries and newly recoverable reserves. In 2020, Barbados granted hydrocarbon exploration licenses to BHP, and the company plans to conduct surveys in two regions in search of petroleum reserves. —Ken Stibler

US designates Colombia a major non-NATO ally amid efforts to counter Russia in the region. The White House this week announced that Colombia would be made a major non-NATO ally—becoming only the third Latin American country with the status alongside Brazil and Argentina. The largely symbolic designation marks Colombia’s importance in a neighborhood that has been more receptive to Russian and Chinese overtures.

Practically, Bogota will gain trade benefits, the potential for enhanced security cooperation and eligibility to purchase advanced military hardware such as depleted uranium munitions.

The move also comes as the US has considered sanctions relief for Venezuela to enable it to help make up for lost Russian oil supplies. Colombia strongly opposes such talks, though, after dealing with floods of refugees and continued security threats from Venezuela, the minister of energy and mining, Diego Mesa Puyo, told the Financial Times.

“If you’ve just banned oil from what they call the Russian dictator, it’s difficult to explain why are you going to be buying oil from the Venezuelan dictator.” —Ken Stibler

Global

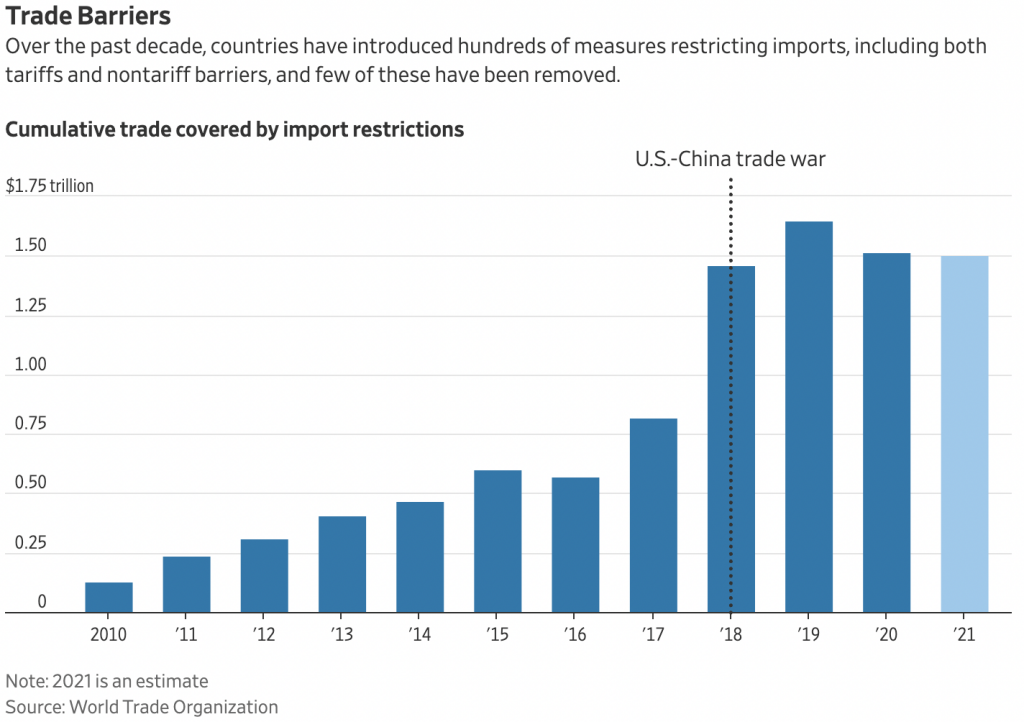

Sanctions against Russia deliver a blow to globalization dream. The US-led effort to expel Russia from international commerce marks another fracture in the free-trade vision that guided American policy for nearly 30 years, signaling a future where nations and companies shift away from trading with adversaries and focus more on like-minded partners, Josh Zumbrun reports in the WSJ.

The actions taken since Russia invaded Ukraine have been swift and punishing and could remake the global trade structure. “The trading system as we’ve known it, with the World Trade Organization at its core and with a basic set of rules that everyone traded under, is coming apart,” said Jennifer Hillman, a trade lawyer and former jurist on the WTO’s trade court who now teaches international law at Georgetown University.

Hillman believes the future of global trade agreements could be in large regional pacts where the participants share more common interests, such as the US-Canada-Mexico Agreement signed in 2020. “I think we’re going to see increasingly blocs, where there are coalitions of the like-minded,” Hillman said. “Whether it gets to formal clubs that trade with each other and not others or not, that’s hard to know.”

What we’re reading

Ghanaian fintech firm Dash raises $32.8m to build connected wallets for Africans. (TechCrunch)

Côte d’Ivoire mobilizes over $88m to combat soaring prices. (The Africa Report)

US Senate rejects bid to block $2b sale of military planes to Egypt. (Politico)

Egyptian pound devaluation ‘likely to be required.’ (Reuters)

US stresses support for Morocco over Western Sahara. (AFP via Arab News)

IMF chief says Africa vulnerable to higher food, fuel prices due to Ukraine war. (Reuters)

Sri Lanka’s debt crisis lingers as foreign-currency reserves slip. (Bloomberg)

Pakistan opposition prepares no-confidence vote against PM Khan amid fears of failing economy. (Nikkei)

Bangladesh ‘will pay for its support’ of Russia in canceled vaccine donations. (Quartz)

Pro-crypto candidate Yoon Suk Yeol wins South Korea’s presidency. (Blockworks)

Thailand’s SCB launches virtual headquarters in The Sandbox metaverse. (Blockworks)

Philippines willing to open bases to US if Ukraine conflict spreads. (Benar News)

SoftBank pulls out of Indonesia’s new capital project. (Nikkei)

Turkey’s steelmakers grab for market share from China, Russia and Ukraine. (Nikkei)

Israeli president in Turkey in effort to mend ties. (Al Jazeera)

Dubai is the latest government to roll out crypto law, set up regulator. (Blockworks)

Saudi and UAE leaders ‘want change in US Middle East policy’ before they’ll help on oil shortage. (WSJ)

Ukraine war pushes Biden toward Venezuela, Iran and Saudi Arabia in oil hunt. (WSJ)

Goldman Sachs and JPMorgan withdraw from Russia as Wall Street joins exodus. (FT)

Russia adds Montenegro, Albania and North Macedonia to ‘enemy’ list. (BalkanInsight)

UniCredit warns €7b is at risk in ‘extreme scenario’ of Russia unit being wiped out. (FT)

Serbia, Russia, China, condemned for selling arms to Myanmar junta. (BalkanInsight)

EU agrees to extend the scope of sanctions on Russia and Belarus. (European Commission)

How Russia sanctions threaten Latin America. (Axios)

Peru’s leftist leader faces impeachment bid. (Bloomberg)

US talks to ease oil sanctions on Venezuela get blowback. (WSJ)