Frontier Markets Weekly, March 6th 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

Militants are edging south toward West Africa’s most stable and prosperous states. The Islamist militants who have rampaged through the heart of West Africa in recent years are now spreading toward the Gulf of Guinea coast, including some of the continent’s most stable and prosperous countries, Michael M. Phillips writes in the Wall Street Journal. The past year has seen an uptick in violence instigated by Al Qaeda affiliates along the northern borders of Benin and Togo, with militant cells infiltrating as far as Ghana and Côte d’Ivoire, the world’s top cocoa producers.

The attacks on countries along the bend in Africa’s Atlantic coast appear to confirm warnings that U.S. military commanders have issued for several years: Unless stopped, militant violence won’t remain contained in the landlocked nations of the Sahel, the semiarid expanses directly south of the Sahara.

“It does look like the jihadists have the aim of getting to the sea.”

Ghanaian army Brig. Gen. Felicia Twum-Barima.

The jihadists’ southward push marks a new chapter in a decadelong security crisis that has claimed thousands of lives since Al Qaeda-linked fighters swept through northern Mali in 2012, triggering the deployment of thousands of troops by France to reinforce its former colony. The fighting ebbed, then surged again across the Sahel, with jihadist factions loyal to Al Qaeda and Islamic State attacking local and allied forces, as well as each other. Since 2020, the region has seen a wave of coups by soldiers pledging to restore security.

African states divided over Ukraine invasion. Twenty-four African nations abstained from a UN vote denouncing Russia’s invasion of Ukraine on Wednesday. A 25th state, Eritrea, joined Russia, Belarus, Syria, and North Korea in voting against the resolution. While Uganda abstained from voting, the son of its president voiced support for Russia on Twitter. An additional 25 states voted in favor of the resolution.

Russia’s influence in Africa stretches back to the Cold War, when Russia presented itself as an ally to revolutionary movements that sought to topple governments backed by the West. Under Vladimir Putin, Russia has been increasing weapons sales to African states, and now supplies around half of Africa’s arms, according to Deutsche Welle.

African support for Russia’s war in Ukraine comes on the heels of greater continental instability. Burkina Faso, Mali, Chad, Guinea and Sudan have all experienced coups in the past 18 months, and critics suspect Russian involvement in Burkina Faso and Mali. Mali and Sudan were among those that abstained from Wednesday’s UN resolution, and Chad voted in favor. Burkina Faso and Guinea did not record votes. —Noah Berman

US worries Sudan is close to leasing Russia a Red Sea base. US officials are increasingly concerned that Sudan’s military junta will allow Russia to build a naval base on the country’s strategic Red Sea coast, Michael M. Phillips reports in the WSJ. Sudanese officials have suggested in recent weeks that they plan to resurrect a suspended 2020 agreement that would give Moscow a 25-year lease on a base in Port Sudan—a pact the US had done its utmost to quash.

The Sudanese junta’s No. 2, Lt. Gen. Mohamed Hamdan Dagalo, returned Wednesday from Moscow. He told reporters in Khartoum that the deal to build the naval base on the Red Sea coast was still being considered by Sudan’s Defense Ministry, Sudan state television reported. He said that during his trip to Moscow, Russia expressed readiness to invest in Sudan.

“We have no problem dealing with Russia or anyone to build a naval base along our Red Sea coast as long as it doesn’t threaten our security interests,” he said. Gen. Dagalo “would eagerly trade a Russian base in Port Sudan for their direct and indirect support,” a U.S. military official said.

Asia

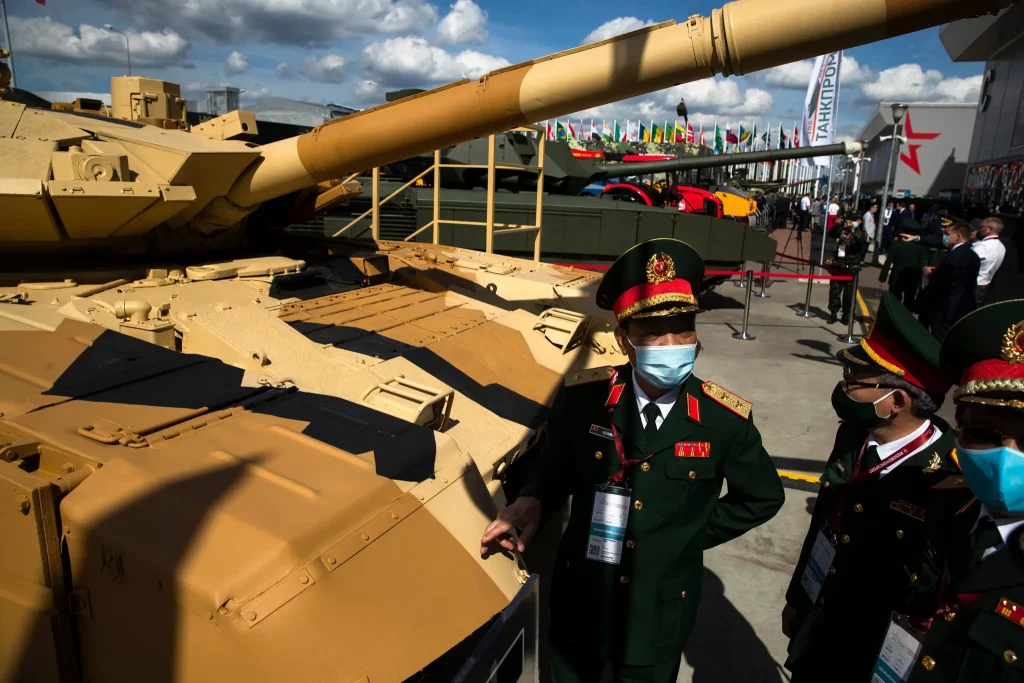

Southeast Asian states grapple with Russia dilemma. As the US and the EU have led global sanctions efforts against Russia following its illegal invasion of Ukraine, ASEAN states have up to this point been reluctant to take sides. While only Myanmarhas openly supported Russia, governments in the Philippines, Vietnam and Thailandhave called for peace without formally condemning Russia.

The past decade has seen a deepening of ties between Russia and Southeast Asia, as Russia has become the primary arms dealer for a region that is expanding militarily. From 2000 to 2019, Vietnam obtained 84% of its imported weaponry from Russia, the New York Times reports. Last year, Russia sold fighter jets to Malaysia and Myanmar, and Indonesia hosted the first joint maritime exercise between Russia and the ASEAN states. Bilateral trade between Indonesia and Russia rose 42.2% from 2020 to 2021, reaching $2.74 billion, according to the Times.

Russia made the importance of these ties clear last week, announcing it would pivot to Asia in the hopes of enervating Western sanctions. Japan, Singapore, Taiwan and South Korea have announced their participation in the Western sanction effort, so this pivot will likely focus on China and emerging Asian states. The US plans to host a summit with ASEAN leaders at the end of March, Reuters reports. —Noah Berman

Mongolia signs deal to build Russia-China gas pipeline. Mongolia signed a contract this week with Gazprom, the Russian state-owned gas giant, to build the Mongolian section of the Power of Siberia II pipeline, Bloomberg reports. The pipeline will allow Russia to funnel up to 50 billion cubic meters of gas a year across Mongolia and into neighboring China, and should help offset lost gas sales from the suspended Nord Stream II pipeline in Germany.

Like other emerging Asian states, Mongolia has kept mum about the Russian invasion of Ukraine, aside from reiterating its commitment to freedom and democracy. Mongolia was one of 34 states to abstain from Wednesday’s UN resolution demanding the withdrawal of Russian troops from Ukraine.

Many Mongolian banks depend on transfers from Russian banks, so the SWIFT sanctions on Russia are expected to impact Mongolian import and export revenue, Reuters reports. Wedged between Russia and China, Mongolia has historically referred to the US and its allies as its “third neighbors,” but the proliferation of global sanctions may inhibit Mongolia’s ability to balance the neighbors it can see and those it cannot. —Noah Berman

Indian markets wobble as country balances Russia and the West. Benchmark Indian indexes fell this week as investors considered looming rises in oil prices and concomitant worries about inflation. India is the world’s third largest importer of crude oil and relies on imports for nearly 80% of its energy. Economists expect a rise in gas prices to exacerbate inflation as the nation’s economy slows. Indian GDP growth shrunk to 5.4% last quarter, missing economists estimates of 6% growth.

India so far has resisted the urging of its Quad allies—the US, Japan and Australia—to criticize Russia over Ukraine. India obtains close to 50% of its defense equipment from Russia and trades around $9 billion of goods, most of which is imported Russian oil, according to Deutsche Welle. Over half of India’s tanks and fighter jets are Russian-made and the country imported $52.9 billion worth of weapons from Russia between 2000 and 2020, Bloomberg reports.

India has a history of working around American sanctions with relatively few consequences. Following the announcement of sanctions against Iran, India continuedimporting oil by paying in Indian currency. India is widely viewed as an important counterbalance to China and the US has been hesitant to penalize it for previous deviations from its sanctions policies. —Noah Berman

Middle East

US and Iran split over key nuclear issues as deal deadline nears. Iranian and US officials are entering a crucial week of negotiations to restore the 2015 nuclear deal, with significant differences remaining on several key issues and new concerns that Russia’s invasion of Ukraine could complicate the talks, Laurence Norman reports in the WSJ. Iran’s chief negotiator, Ali Bagheri-Kani, arrived in Vienna on Monday morning with positions that could prove difficult to bridge with his Western counterparts, diplomats said.

With Iran continuing to expand its nuclear work, Western diplomats have warned that the negotiations could collapse if a deal isn’t reached this week. American and Iranian officials say the differences include the scope of American sanctions relief, continued Iranian demands that the US provide stronger guarantees that it won’t again exit the deal and the US push to ensure that a prisoner swap occurs alongside restoring the nuclear pact.

Another issue has emerged as a critical last-minute obstacle: Iran’s efforts to shut down an International Atomic Energy Agency probe into nuclear material found there. The Vienna talks are aimed at agreeing on the steps Iran and the US must take to return to compliance with the 2015 deal, which strictly but temporarily limited Iran’s nuclear work in exchange for a lifting of most international sanctions on Tehran.

Europe

Countries in Russia’s orbit feel pain of sanctions faster than expected. As the impact of sanctions imposed against Russia over its invasion of Ukraine became clearer this week, the spillover in Moscow’s backyard materialized faster than observers initially expected. In the Balkans, long lines at banks and panicked buyinghighlighted the role of Russian banks such as Sberbank, Balkan Insight reports.

Meanwhile, Western Asian currencies were trading lower across the region, mirroring the fall in the ruble.

Even in countries with some protection through high commodity prices, those with large trade partners of Russia have little room to respond. For example, in energy-rich Kazakhstan, the tenge’s decline mirrored the ruble’s and forced the central bank to use more than $270 million in reserves to prop up the currency.

However, experts believe the National Bank does not have the reserves to support the tenge for long and anticipate a devaluation, potentially aggravating tensions over inflation that triggered anti-government protests earlier this year. —Ken Stibler

Latin America

Venezuelan oil industry senses an opening for US sanctions relief. With oil remaining above $100 a barrel and Russian supply in flux, the need for more global capacity is leading some in the Biden administration to consider rolling back sanctions on Venezuela, the WSJ’s Patricia Garip reports. The change in thinking comes amid a lobbying surge on Wall Street by the Maduro regime.

More than two dozen financial-sector executives from American, European, and Venezuelan firms met with Patricio Rivera, a former economy minister of Ecuador who is lobbying on behalf of Maduro. In the meeting, Rivera touted Venezuela’s growing oil production, progress against inflation, and structural reforms, including lower gasoline-price subsidies.

While Wall Street might be warming to the prospects of a detente with Caracas, the country’s $90 billion-plus debt load poses a substantial challenge. The country has significant outstanding debts that could lead to seizures of exports if trade with the US or Europe were to materialize. —Ken Stibler

Argentina makes progress on IMF deal but droughts, inflation and debt weigh on economy. The IMF and Argentina this week inked the final terms of a deal to reschedule some $40 billion in debt after weeks of negotiations and just before a $1.1 billion coupon payment was due. While some remain optimistic about the deal, President Alberto Fernández said the agreement forgoes austerity policies, increases real spending every year, and does not include pension or labor reforms.

Markets reacted tepidly, with Argentine bonds remaining at around 30 cents on the dollar on expectations that the country’s IMF program would face political headwinds while not addressing structural economic problems.

Whether the deal restores investor interest in new Argentine bond issuance has yet to be seen. However, severe droughts and high inflation amid a backdrop of policy tightening by the US Federal Reserve are expected to offset the benefits of high commodity prices. —Ken Stibler

Global

EMs set to gain from Russia’s MSCI exit. Index provider MSCI reclassified Russiafrom emerging markets to standalone market status, dropping Russian equities from its widely tracked developing-nations indexes, Bloomberg reports. While the reclassification has battered European stocks and makes Russia “almost uninvestable,” other emerging markets in Latin America and Asia stand to gain.

Nathalie Marshik, head of emerging-market research at investment bank Stifel, told Frontier Markets News that fund managers had no choice but to redeploy their funds. “The funds have to disinvest from Russia but have to put the money to work. Many are choosing to move it into Latin American equities.”

Brazilian equities are expected to receive $1.3 billion in inflows given high yields and cheap stocks. The country’s benchmark Bovespa index has gained 22% in US dollar terms so far this year, partly because its currency has strengthened 11%. Meanwhile, several Asia banks suggest that capital outflows will also land in India, China, Indonesia, and Malaysia, with the latter being commodity backed-economies similar to Russia. —Ken Stibler/Dan Keeler

What we’re reading

Chinese company removed as operator of DRC cobalt mine. (NYT)

DRC signs deal with Israeli tycoon Gertler to recover mining assets. (The East African)

Kenya’s ruling party backs opposition leader Odinga for presidency. (Reuters)

Angola: ‘We look to our creditors for space to breathe and grow.’ (Africa Report)

Algeria ready to provide more gas to Europe. (Africa Report)

Libya’s biggest oil field stops producing as crisis deepens. (Bloomberg)

In some African nations, armed police enforce Covid-19 vaccinations. (WSJ)

Pakistan will cut energy prices to offset rising costs after Ukraine invasion. (NYT)

UN experts call out ‘shocking abuses’ in Indonesia’s Papua region. (The Diplomat)

Nepal’s parliament approves $500 million in US aid despite China’s objections. (WSJ)

In Taiwan, Russia’s war in Ukraine stirs new interest in self-defense. (WSJ)

1MDB trial shows the depths of Malaysia’s economic woes. (Nikkei)

North Korea fires suspected ballistic missile. (WSJ)

Shunned Russian oil may be grabbed by hungry Chinese buyers. (Bloomberg)

Turkey in Africa pitches non-Chinese, non-Western model. (Nikkei)

Turkish opposition vows return to parliamentary democracy. (AP)

Ukraine conflict could hit food supplies, worsening Yemen hunger crisis. (Reuters)

Israel can be a ‘potential ally,’ Saudi Arabia’s Mohammed bin Salman says. (Middle East Eye)

UAE placed on global watch list for money laundering, terrorism financing. (WSJ)

World Bank Ukraine loan disbursement ‘grows to €460 million.’ (Reuters)

Kosovo echoes calls for NATO ‘accelerated’ membership. (BalkanInsight)

Georgia and Moldova formally apply for EU membership. (Radio Free Europe)

Hungary won’t cancel Russia-backed nuclear project, Orban says. (Bloomberg)

Czechia and Romania accelerate escape from Soviet-era ‘spy’ banks. (BalkanInsight)

Protesters in Tbilisi decry Georgian government’s ‘inadequate’ support for Ukraine.(Radio Free Europe)

BP’s 2003 investment in Russia heralded a new era. Will its exit do the same? (Radio Free Europe)

Dominicans turn over to Haiti ex-cop sought in Moïse slaying. (AP)

Chile’s economy posts back-to-back drops as recovery dims. (Bloomberg)

Paraguay capital choked by colossal smog cloud from Argentina wildfires. (The Gaurdian)

‘Mexico is on the list’—Other countries could soon follow El Salvador into bitcoin. (Forbes)

Brazil’s central bank selects nine CBDC projects to move forward in innovation challenge. (The Block)

Brazil’s Lula aims for closer ties with Mexico’s leftist ruling party. (Reuters)