G20 sees broad support for international debt reforms but approaches remain unaligned

The G20 is in agreement that proactive support and systematic change is needed to the international debt architecture, but relevant players are unlikely to agree on specific policy approaches

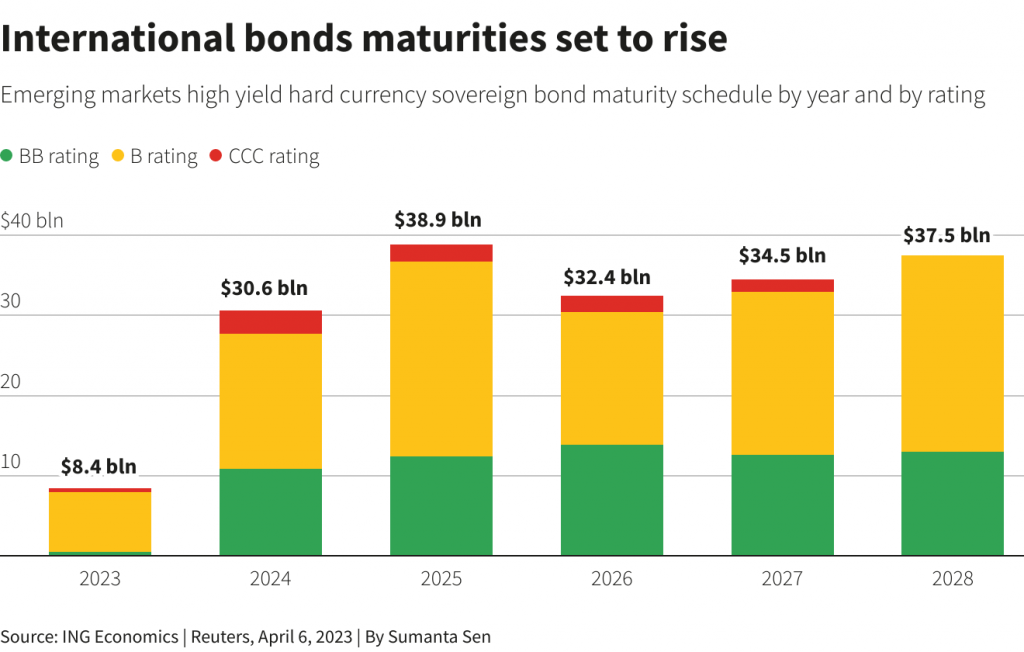

A silent debt crisis continues to threaten vulnerable emerging markets, as existing tools have proven ineffective in the face of an increasingly complex debt policy landscape. Over $400 billion in annual debt service weighs on developing countries with large walls of maturities facing much of the developing world in the late 2020s and early 2030s.

Meanwhile, the G20 and Paris Club’s Common DSSI Framework has failed to quickly restructure distressed debt as fragmenting creditor composition and geopolitical wrangling have left defaulted nations like Zambia in limbo for years.

This week, on the sidelines of the G20, the US and China opened the potential for collaborating on new measures to stave off sovereign defaults through preemptive debt extensions. While still in the early stages, talks have considered channeling more financing through the World Bank and other multilateral lenders before countries formally default. The goal is to bring a proposal to G20 leaders in November, though follow-through and buy-in from critical private creditors remain uncertain.

Despite the otherwise promising sign, emerging markets on the front lines have increasingly heterodox views on how they want the international community to respond. Barbados’ Prime Minister Mia Mottley has linked debt relief to climate change vulnerability, calling for a “Jubilee moment” of debt cancellation for island nations. Mottley said, “We need to have a different deal for island countries and the poor countries of the world” devastated by disasters, enabling reconstruction over debt payments.

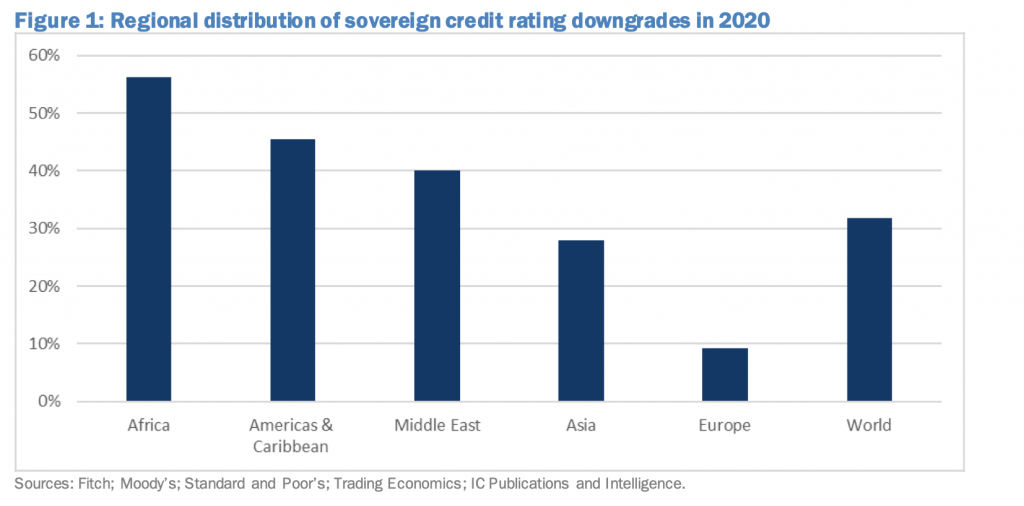

Meanwhile, in a different approach that has become more popular in recent years, Brazilian President Lula de Silva critiqued the credit ratings agencies and multilateral financial institutions that “strangle poor countries.” It advocates transforming debt into productive investments in infrastructure and education while pushing for the AU to join the G20, adding another voice to the cacophony of positions on the EM debt crisis.

While countries across the G20 format recognize that the current international debt architecture is no longer fit for purpose, durable solutions seem distant as crisis brews. In that way, the debate around debt reforms mirrors the increased difficulty of agreement internationally as more countries and companies have effective vetoes by dragging their feet than in the past.

For governments facing challenging tradeoffs and years of delays for debt restructuring, planning for macroeconomic management amid default, rather than expecting reforms or forgiveness, appears to be the next step.

Ken Stibler is the lead analyst at the Center for Emerging Economies and a global macro contributor for FMN