Data center investment shifts to emerging markets amid regulatory scrutiny and rising energy needs

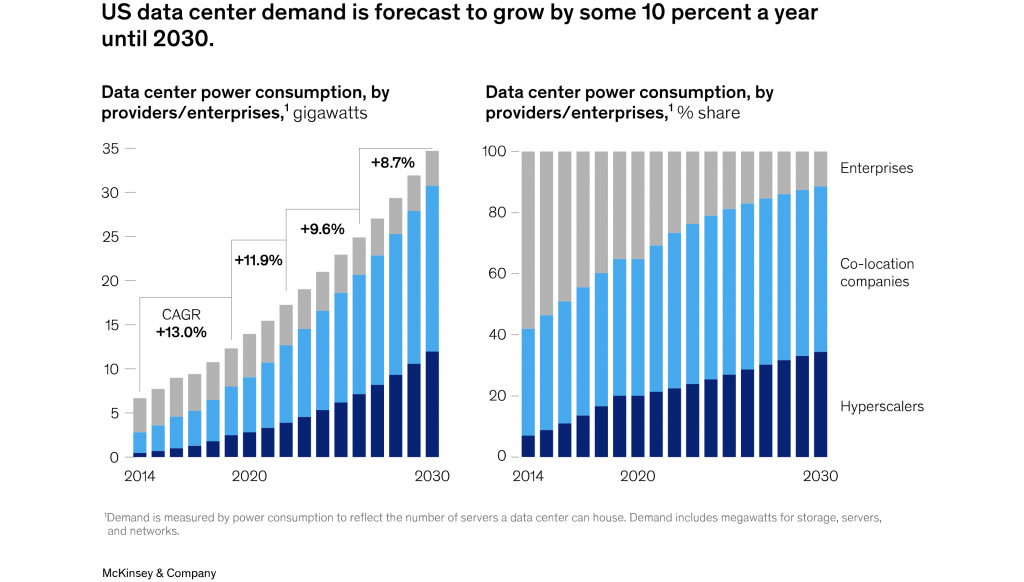

The boom in artificial intelligence use and investment is creating a surge of demand for data centers, the massive facilities which house and transmit the vast amounts of data needed to train and run algorithms. However, increased regulations, rising energy costs, and environmental scrutiny in traditional data center hubs are incentivizing investments in emerging markets’ burgeoning digital economies. The International Energy Agency found data centers, cryptocurrencies and AI accounted for almost 2 percent of global power demand in 2022 and forecasts that figure nearly doubling by 2026 to the entire electricity consumption of Japan.

Ireland, a hub for digital infrastructure, is now limiting new data center connections to the power grid and other countries like Germany are exploring whether to do the same. The EU’s sustainability reporting rules require disclosure of centers’ environmental footprints and the regulatory bloc is considering going further. Some US legislators proposed creating AI impact standards as critics argue voluntary frameworks don’t effectively address data centers’ massive energy needs.

Given the regulatory uncertainty and rising pushback in traditional markets, the large populations and growing connectivity needs of Africa and Latin America are offering significant growth potential for domestic and offshore data storage alike. Putting data centers closer to in-build sources of energy like in renewable energy giants such as Brazil or near large data operations as in Kenya offers a strong business case.

Equinix recently announced plans to invest $390 million in African data centers over five years, citing the continent’s youthful, tech-savvy demographics. Competitors like Amazon, Microsoft and Huawei have also been investing in Africa, which currently accounts for just 1% of global data center capacity.

Local operators like South Africa’s Teraco are increasingly building their renewable energy capacity to power data center operations. The company raised $104 million to construct solar and wind farms that will meet 60% of its needs by 2025, reducing reliance on South Africa’s coal-dependent grid. Self-generation helps firms deal with frequent blackouts while improving sustainability.

However the availability of water for cooling, unreliable power infrastructure, and political backlash from rising electricity costs for retail consumers create additional levels of complexity. While major data center developers were announcing a spree of investment, Chile partially revoked the license of a $200 million Google data center over concerns of lax environmental regulation.

As data explodes globally and centers’ power consumption rises, changing investment patterns create potential for dozens of emerging markets to attract large scale projects. However only if they can address the environmental costs and operational limitations faced by the growing sector.