US sanctions and slow IMF talks prompt warnings that El Salvador may be the next debt crisis

El Salvador's President Nayib Bukele participates in the closing ceremony of a congress for cryptocurrency investors in Santa Maria Mizata, El Salvador, Saturday, Nov. 20, 2021. Bukele announced during the rock concert-like atmosphere at the gathering that his government will build an oceanside "Bitcoin City" at the base of a volcano. (AP Photo/Salvador Melendez)

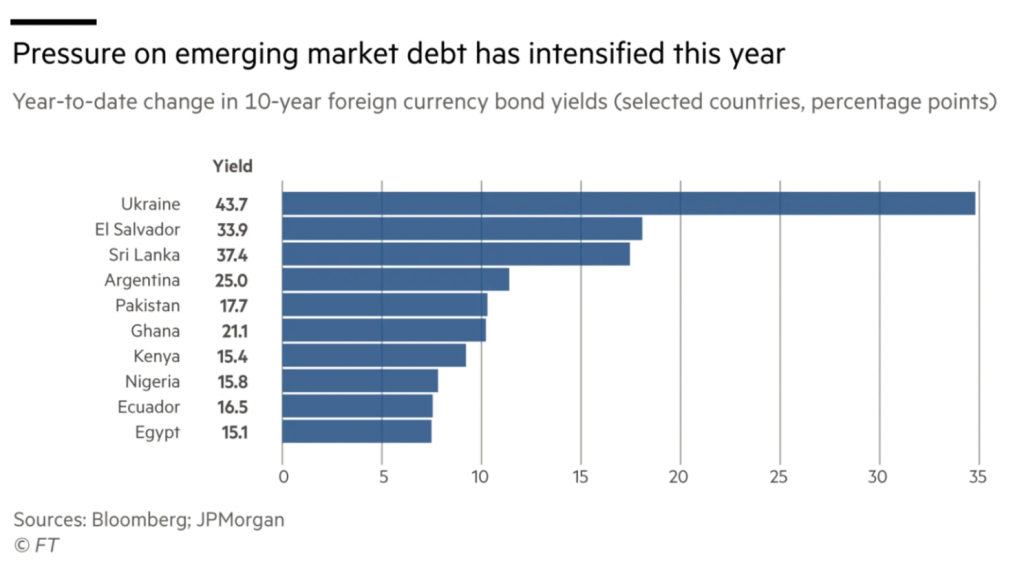

As El Salvador’s bitcoin experiment dramatically backfired and default risk spiked, the country’s democratic backsliding is making financial relief more difficult. Bukele’s government faces an $800 million bond payment in January 2023. The cash-strapped government lacks the funds for payment, with Bloomberg projections finding El Salvador the most likely defaulter in Latin America.

To make up for its funding shortfalls, San Salvador has been trying to obtain a $1.3bn loan from the IMF. However, the slow-moving talks reflect mutual antagonism with the Fund repeatedly calling for a reversal on Bitcoin and Finance minister Zelaya stating that the IMF would have the “least impact on the country”. Complicating talks, the administration’s increased authoritarianism has led the US to sanction “corrupt and undemocratic actors,” including a key Bukele’s advisors, congressional allies, and cabinet officials – until recently including the finance minister. If the badly needed IMF deal does not materialize, the Bukele administration is considering nationalizing pension funds, issuing new taxes, and going to other institutions like the World Bank and Central American Bank for Economic Integration, El Faro reported.

While being sanctioned by the US makes dealing with the IMF more difficult, not all investors are as pessimistic about the country’s future. In a recent research note, Morgan Stanley argued that El Salvador’s $7.7 billion in Eurobonds have been “overly punished”by the market, reported Bloomberg’s Maria Elena Vizcaino. The bank argues that the 2027 bonds, currently trading at 28 cents on the dollar, should trade at an average of 43 cents given the country’s primary surplus and smaller maturities relative to distressed peers like Argentina, Egypt, and Pakistan.