Long-feared rate rises being to crush emerging and frontier markets

People block a main road as they wait for the gas trucks to arrive at the station to distribute for them, amid the country's economic crisis in Colombo, Sri Lanka, May 8, 2022. REUTERS/Dinuka Liyanawatte

Long-Feared Rate Rises Begin to Crush Emerging Markets.

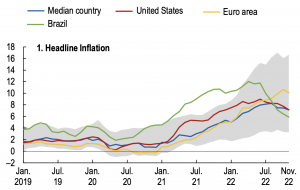

Emerging market debt loads, long elevated, appear increasingly unstable as a strong dollar, aggressive Fed tightening, and still-rising energy and food prices degrade the balance of payments across EMs. According to Bloomberg, the spread between JPMorgan’s EMBI index of dollar-denominated EM bonds and US Treasuries has surged over 100 bps. This has led to international investors increasingly shunning EM debt, with over $38bn in outflows in 2022, according to EPFR data.

The World Bank reckons almost 60% of the lowest-income countries were in debt distress before the Ukraine war this year. The rhetoric around EMs is similar to the false alarms during covid when mass defaults were avoided due to ample international liquidity. However, EMs can no longer count on this cheap money to paper over problems.

Sri Lanka offers a prime example of how these external shocks are driving crises. Its stock market has plummeted 64% in dollar terms this year. Public anger over rising food and energy prices triggered the collapse of the government last month and pushed the south Asian nation to default on its debt.

Facing over $5.5tn of bond and loan redemptions in 2022, the additional shocks of more expensive commodity imports, weakening local currencies, and a collapse of liquidity all make additional defaults likely. The most vulnerable countries, like Laos, Pakistan, Egypt, Tunisia, Ghana, Kenya, South Africa, and Ethiopia, have substantially elevated debt levels despite limited foreign exchange reserves. However, changes in creditor composition make fast and orderly debt restructurings unlikely. In recent years aggressive private creditors and opaque Chinese policy banks have replaced western ‘Paris Club’ bilateral lenders as the largest buyers of EM debt.