Frontier Markets Weekly, September 3rd 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Gabon coup sparks fears over debt payments

Military leaders seized power in Gabon on Wednesday after President Ali Bongo Ondimba won a third term in a disputed election. It was the eighth military putsch in Africa in the past three years.

The US, France and the EU condemned the coup, and the African Union suspended Gabon’s membership. However, analysts note that the US and its allies have limited leverage, and imposing sanctions or restrictions on Gabon’s oil exports could decrease the value of the country’s eurobonds without prompting a return to civilian rule.

Suspending aid could make such coups more likely by prolonging poverty and low literacy rates, Charlie Robertson, head of macro strategy at FIM Partners, wrote in a note. “If the global community wants to stop coups…they need to start sending more aid to support education,” he said.

Investors initially responded with cautious optimism. After a coup-induced slump, Gabon’s eurobonds rallied on Friday for the biggest gains across all emerging markets, Bloomberg reports. Investors pointed to the reduced debt load created by last month’s debt-for-nature swap, which makes upcoming coupon payments more manageable. Still, the coup could create cause for concern about other ESG-related bond sales on the continent, a BNP analyst said.

African Export-Import Bank signs deal with China

Afreximbank signed a $400 million loan agreement with the Chinese Development Bank on Monday. The deal is aimed at supporting financing for small and medium sized enterprises across the continent, Afreximbank said in a statement.

Afreximbank will distribute funding directly to African businesses and through local financial intermediaries. The loan, which has a seven year tenor, is Afreximbank’s seventh from the Chinese Development Bank over the past 15 years, the North Africa Post reports. The facility marks continued interest in Chinese financing from countries and supranational institutions on the continent, even as African countries in default struggle to reach restructuring agreements with Beijing.

The Chinese Development Bank has been especially active in Africa in recent weeks. At last week’s BRICS summit, the bank agreed to extend financing for South African state-owned enterprises, including troubled electricity utility Eskom and rail, port and pipeline company Transnet, Semafor reports.

Asia

Kazakhstan looks to play bigger energy role

Kazakhstan took a series of steps this week aimed at expanding its role in the global energy market.

On Monday, the head of the country’s state-run nuclear agency said Kazakhstan is prepared to send Europe more uranium, the most common fuel in nuclear energy, Politico reports. Kazakhstan is already the EU’s largest exporter of raw uranium, but the coup in Niger, another large exporter, could create a market opportunity. Kazakhstan announced on Friday that it will hold a referendum later this year on whether to build its first nuclear power plant, Nikkei reports.

Kazakhstan has also been diversifying its oil exports. A unit of the state run gas company recently bought two tankers, each with the capacity to ship 8,000 tons of petroleum across the Caspian Sea, Bloomberg reports. It plans to buy two significantly larger tankers, with the capacity to ship 80,000 tons of petroleum each, for the Black Sea. The investment marks a modal turn for exported Kazakhstan crude, most of which currently flows through a pipeline via Russia.

Malaysia announces economic transformation plan

Malaysian Prime Minister Anwar Ibrahim on Friday launched a $20 billion seven-year industrialization plan with an initial $2 billion in government funding to help spur private sector financing, Nikkei reports.

The plan has four pillars: digital transformation, net-zero emissions, protecting economic security, and “advancing economic complexity with innovation.” Aerospace, chemicals, electronics, electric vehicles and pharmaceuticals are priority sectors.

Separately, Malaysia announced a program last month aimed at generating more than $5 billion in investment in renewable energy.

The industrialization plan is the fourth that Malaysia has created since 1986. Previous iterations have sparked investment into industries such as automobiles and electronic components that helped turn the country’s economy into Southeast Asia’s third largest.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Iran turns focus to ‘global south’ to combat sanctions

Iran’s Supreme Leader Ayatollah Ali Khamenei reportedly said this week in a rare speech that the country is pursuing diplomatic efforts to remove the US-led sanctions regime affecting its economy, Iranian state media outlets report. Although the Ayatollah’s statement can be seen as an endorsement of diplomacy with the West, he also warned against “warm and intimate relations with a few Western countries” and said Iran should “dispose of this old and reactionary outlook and understand that having global ties means relations with Africa, Latin America and Asia”—possibly in reference to Iran’s recent invitation to join BRICS.

The speech comes on the heels of a widely-touted US-Iran prisoner swap in which five US citizens held in Iran were freed in exchange for the release of a number of Iranian prisoners and the unfreezing of some $6 billion in oil revenues. US Secretary of State Antony Blinken asserted, however, that the “US remain[s] committed to ensuring that Iran never acquires a nuclear weapon,” again raising the key issue in US-Iran relations: Iranian enrichment of weapons grade nuclear material.

Bloomberg reported this week the IAEA, the UN’s nuclear watchdog agency, is expected to announce its conclusion that Iran has slowed the rate at which it enriches weapons-grade uranium—a key condition the US has set for beginning talks on sanctions relief. Both US and Iranian officials have unofficially acknowledged that some talks about having talks—and some accompanying relaxed sanctions enforcement—have been taking place, although they appear far from a formal, conclusive deal.

Oman joins regional race to become a crypto hub

Oman this week announced a $1.1 billion investment in cryptocurrency infrastructure—especially Bitcoin mining facilities—despite concerns from its religious community about the compatibility of digital assets with Sharia law. Exahertz, Oman’s chosen national champion for a homegrown cryptocurrency industry, will use the funds to establish an 11 MW mining site with plans to expand to 800MW over time, piloting a modular design program that can scale rapidly without overburdening Oman’s developing energy infrastructure.

The chairman of the Authority for Public Services Regulations, Sheikh Mansour Bin Taleb Bin Ali Al Hinai, brushed-aside concerns about Sharia compliance, commenting that the initiative “aligns with our goal to diversify our economy, integrating modern technologies while upholding our commitment to ethical and sustainable practices.”

Not all of the money has been earmarked for local firms: Abu Dhabi-based Phoenix Group received some $300 million to develop a 150MW mining farm called “Green Data City,” the first licensed mining entity in Oman. The UAE has been a regional leader on crypto adoption, permitting foreign firms such as Bahrain’s Rain and more recently, Turkey’s crypto giant Bitay to operate exchanges.

Europe

Ukraine turns to France to counter Russian influence across EMs

Ukraine is intensifying its diplomatic efforts, with French assistance, to expand its alliances in the ‘global south’ after Russia bolstered its position during the recent BRICS summit, the FT reports. Building on previous talks held in Saudi Arabia and Denmark, Ukraine’s Foreign Minister Dmytro Kuleba, during a visit to Paris, highlighted a “new dynamic” in seeking allies beyond the US and Europe.

Kuleba also indicated that the upcoming UN General Assembly would serve as a platform for diplomatic engagement with developing nations in Africa and Latin America.

These diplomatic endeavors coincide with the sluggish progress of Ukraine’s counteroffensive to reclaim its territory from Russia, leading to tensions between Kyiv and its Western allies, particularly the US. Nevertheless, Ukraine sees its diplomatic outreach gaining momentum, especially after crucial countries, including China, convened in Saudi Arabia to discuss President Volodymyr Zelenskyy’s peace plan.

Latin America

‘Fiscal slippages’ in lead-up to Argentine election raise risks of IMF-induced default

In a review of Argentina’s bailout program the IMF criticized the crisis-ridden country’s failure to arrest large deficits and monetary financing. The Fund cautioned that the country needs “further expenditure control” throughout the election period.

Meanwhile, economy minister and Peronist presidential candidate Sergio Massa has announced a slew of new spending measures aimed at boosting support for his party amongst the country’s poor. Between a direct cash transfer to all registered workers, bonuses to retirees, and other benefits for the agricultural sector and the self-employed, Massa has blatantly—albeit unsurprisingly—ignored Argentina’s commitments under the current IMF program.

Massa has also been rushing to secure external sources of funding from China, Brazil and major development banks. Despite some success, though, the country is dependent on favorable IMF negotiations to unlock a $7.5 billion disbursement that is critical to avoid another default and unrestrained economic crisis.

Global

FMs seek alternative borrowing arrangements as dollar financing dries up

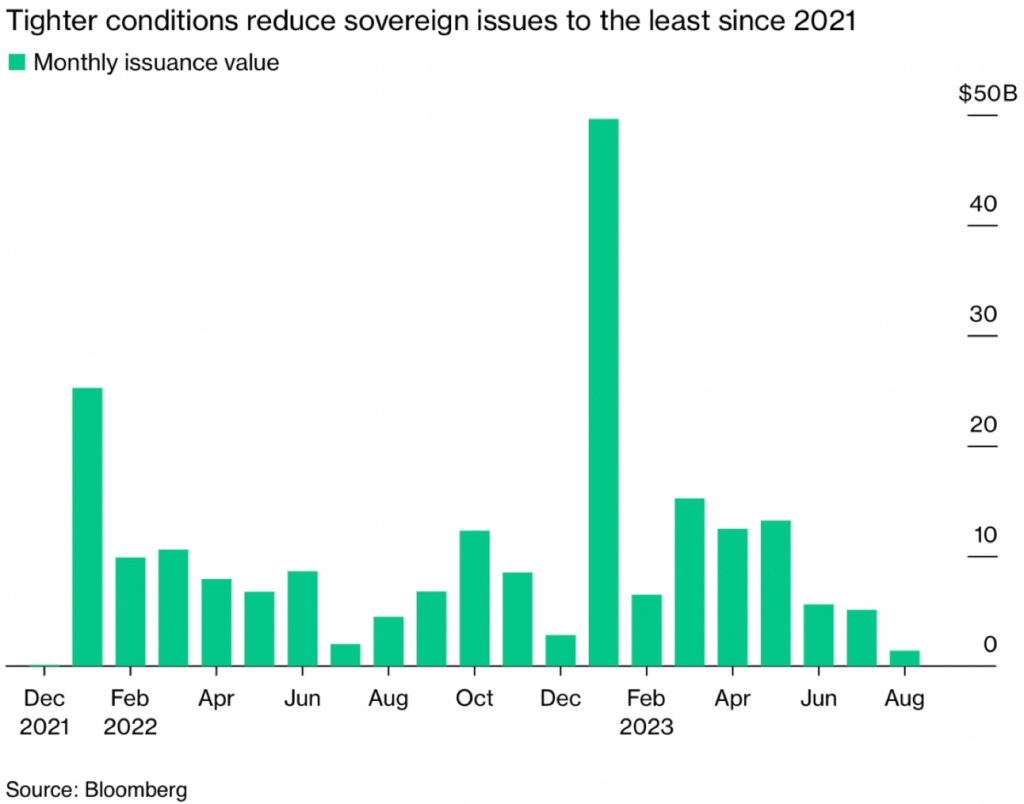

August saw emerging-market dollar-bond issuance fall to $1.6 billion from a roughly $16 billion monthly average as global yields climbed sharply and more frontier markets were locked out of borrowing. Tighter global financing conditions, stemming from central banks’ efforts to combat inflation, are hitting developing nations with riskier credit profiles particularly hard, prompting frontier nations to adopt austerity measures and prioritize debt sustainability, according to fund manager Vanguard.

The scarcity of dollar funding has also driven many developing economies to explore novel approaches to fundraising via ESG issuance, domestic borrowing and official-sector borrowing, as access to international debt markets remains limited.

According to the FT, countries such as Tanzania and Côte d’Ivoire are increasingly turning to funding from institutions like the IMF, while others, such as Nigeria, are actively pushing through economic reforms.

What we’re reading

Nigerian president recalls ambassadors worldwide (Reuters)

Why Nigeria wasn’t on the BRICS expansion list (The Africa Report)

Trade disruption to persist in northern Nigeria in wake of Niger coup (FrontierView)

Senegal reforestation camp aims to combat coastal erosion (Afrik21)

Russia vetoes UN resolution to extend sanctions and monitoring in Mali (Al Jazeera)

Kenya’s National Social Security Fund culls struggling firms (The Africa Report)

Zimbabwe creditors see debt restructuring talks resuming despite disputed vote (Bloomberg)

Libyan premier rules out normalization with Israel (Bloomberg)

UNCTAD focuses on Africa’s potential to ‘capture technology-intensive global supply chains’ (UNCTAD)

Vietnam, Philippines and Brunei to join cross-border QR payment scheme (Nikkei)

Indonesia and US begin expanded drills amid South China Sea tensions (Nikkei)

Bhutan halves $200 daily tourist tax to boost sluggish economy (Nikkei)

Pakistan seeks to reduce electricity prices after mass protests (Bloomberg)

China’s new national map sets off wave of protests (AP)

Turkey and Egypt outperform during EMs’ worst August in years (Bloomberg)

US could help settle Lebanon and Israel border dispute, White House adviser says (Reuters)

Iran says deal agreed with Iraq for disarming and relocation of Kurdish rebels (Al Jazeera)

Saudi man receives death penalty for online posts, latest case in wide-ranging crackdown on dissent (AP)

Kuwait and UK sign investment partnership after Crown Prince meets Rishi Sunak (The National)

Middle East digital economy to grow 20% per year to $780b by 2030 (TradeArabia)

Estonia start-up boom fuels EU’s biggest cost rises (FT)

Move to end Russian oil monopoly fuels new political crisis in Bulgaria (Euractiv)

Romania moves at slow pace to sanction Russia-owned businesses (BalkanInsight)

Germany will classify Georgia, Moldova as ‘safe countries,’ making rejecting asylum-seekers easier (AP)

US embassy in Haiti tells Americans to leave ‘as soon as possible’ (Washington Post)

Paraguay and Brazil agree on data exchange to expedite border crossings (Mercopress)

Uruguayan exports suffer 17% YoY drop (Mercopress)

New Guatemala leader slams ‘coup’ plan to block him from office (AFP via Barron’s)

New ETF tracks China’s growth separate from emerging markets (Nikkei)

IMF identifies rates, conflict and climate as top EM risks (Bloomberg)