Frontier Markets Weekly, October 22nd 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Nigeria to seek $1.5b World Bank loan after cash handouts

Nigeria’s cabinet approved a proposal to request $1.5 billion from the World Bank, Nigerian finance minister Wale Edun said on Monday. Nigeria expects the funding to be concessionary and available by December, Bloomberg reports. The country will also seek $80 million from the African Development Bank, Edun said.

Nigeria’s President Bola Tinubu has enacted a series of reforms to bring his country into compliance with conditions sought by international financial institutions, including the IMF and the World Bank. However, the reform process has been painful for many Nigerians, who are now contending with higher fuel costs after Tinubu scrapped an expensive fuel subsidy.

To cushion the impact of those reforms and soaring inflation, Nigeria dispensed $1.5 billion, the same amount as the World Bank loan, in cash handouts this week. “With inflation at historic highs, the support is no doubt needed for the vulnerable,” Capital Economics analyst David Omojomolo wrote in a note. “But by adding to demand, the handouts risk stoking inflation pressures even further.”

Middle East War looms over African economies

African economies were among the hardest hit by the fallout from Russia’sinvasion of Ukraine in February 2022. Now, as another conflict erupts in the Middle East, African countries are again preparing to bear the highest costs outside of the conflict zone.

- African policy-makers fear economic impact of Israel-Hamas conflict (North Africa Post)

The primary concern for African countries will be oil prices, which forecasters expect to rise in the coming weeks as a result of the war, Semafor reports. Many African countries are importers of oil, and high energy costs could contribute to already soaring inflation in many countries. However, the continent’s oil producers, such as Angola and Nigeria, could benefit from higher prices.

There is also concern that Hamas’ attack on Israel could embolden terrorist groups in Africa, which is struggling with an increase of extremism, the East African reports. The war could also draw international attention away from the continent’s conflicts, putting pressure on aid and humanitarian spending that has kept some countries afloat.

Asia

Taliban seek to join China’s Belt and Road Initiative

Afghanistan’s Taliban government announced plans on Thursday to formally apply to join China’s global ‘Belt and Road Initiative.’

The Taliban is also seeking to join the China-Pakistan economic corridor, a flagship BRI project in Pakistan. China has sought to develop ties with the Taliban since it took power in 2021, Reuters reports, even as no other country recognizes the Taliban government. China became the first country to appoint an ambassador to Afghanistan last month.

The request comes days after leaders of 23 countries gathered in China for the third Belt and Road Forum for International Cooperation. At the conference, Chinese President Xi Jinping reiterated his support for “South-South” solidarity. As one example of that, Xi and Ethiopian President Abiy Ahmed upgraded their relationship to an “all-weather strategic cooperation partnership,” signing 12 cooperation agreements and two letters of intent, Addis Standard reports.

Marshall Islands tightens ties with US

The US has signed an agreement to provide the Marshall Islands $2.3 billion in economic assistance over the next two decades, Reuters reports.

The Marshall Islands is one of three countries for which the US provides defense and economic assistance in exchange for exclusive military access. The United States agreed to new deals with the other two countries bound by such agreements, Micronesia and Palau, earlier this year.

The arrangement comes amid a renewal of US interest in the strategically important South Pacific, where China has made inroads in recent years. The deal with the Marshall Islands will give the US the right to deny China access to 2.1 million square kilometers surrounding the island nation, Voice of America reports.

Malaysia to consolidate state-backed VCs under sovereign wealth fund

Malaysia plans to integrate state-backed venture-capital firms into its Khazanah Nasional Berhad sovereign wealth fund, according to its recently released national budget. Prime Minister Anwar Ibrahim said the measure will help Malaysia develop one of the world’s top-20 startup ecosystems by the end of the decade, Nikkei reports.

As part of the same budget, the government announced it would impose a 10% tax on the net profit from sales of unlisted shares beginning in the second quarter next year. That could deter foreign investors concerned about exit strategies, especially as neighboring Singapore has no capital gains tax and a more-established start-up scene.

The first two firms to merge with Khazanah Nasional will be Malaysia Venture Capital Management (MAVCAP) and Penjana Kapital. Both firms were previously operated by government ministries. MACVAP has a $1.06 billion portfolio, and Penjana has a $270 million portfolio, Global SWF reports.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Iran, Arab states react to Israel-Hamas War amidst rising fear of a wider war

Tensions between Israel and its neighbors—particularly Lebanon—continue to rise two weeks into the war with Hamas, as sporadic exchanges of fire between Israel and affiliates of Hamas and Hezbollah prompted the US and allies to call for their citizens to leave the country, and civilians to evacuate villages on both sides of the border. Evacuations are taking place this weekend amidst reports that the US has been lobbying Israel to avoid major escalation with Hezbollah, a known proxy of Iran’s hardline Revolutionary Guards Corps, while simultaneously deploying a large naval presence to the Eastern Mediterraneanto deter Iran and its proxies from escalation.

Iran’s Supreme Leader Ayatollah Ali Khamenei declared Israel’s Gaza campaign a “genocide,” and called for “shocks against the Zionist regime” by the “axis of resitance” (an Iranian colloquialism for its network of proxies including Hamas and Hezbollah), while foreign minister Hossein Amirabdollahian called for an oil embargo against Israel and its allies. Iran-backed Houthis in Yemen fired cruise missiles at Israel–which were shot down by the US navy—and Shi’ite militias in Iraq and Syria targeted US troops with drones and missiles over the weekend.

Jordan voiced fears that “the worst is coming” as it claims its diplomatic overtures to end the conflict have yielded no progress, Reuters reports. Jordan’s King Abdullah and Egypt’s President Abdel Fattah al-Sisi, speaking at a joint press conference, drew a red line on accepting further Palestinian refugees.

Saudi Arabia concludes difficult diplomatic week

Saudi Arabia this week put normalization talks with Israel on hold—undoing months of diplomatic progress and dealing a major blow to a headline US policy goal for the region. The Israel-Hamas war prompted Saudi Crown Prince Mohammed bin Salman to hold direct talks with Iranian President Ebrahim Raisi, a move Saudi Arabia called part of a wider effort of “reaching out to all international and regional sides to end the current escalation.”

The Saudi prince also met directly with UAE President Sheikh Mohammed bin Zayed Al Nahyan, as part of a summit between the Gulf Cooperation Council and the Association of Southeast Asian Nations in Riyadh, Reuters reports. A joint statement by the GCC and ASEAN released after the summit called for a ceasefire, a de-escalation of regional tensions, the release of civilian hostages, and a two-state solution to settle the Israeli-Palestinian conflict.

Saudi Arabia also received the UK’s Prime Minister Rishi Sunak in a bilateral visit to discuss the crisis, and on Sunday, MBS is set to receive South Korea’s President Yoon Suk Yeol to discuss business cooperation (a follow-on from last year’s signing of energy and defense deals worth some $30 billion) as well as security conditions in the Middle East.

Europe

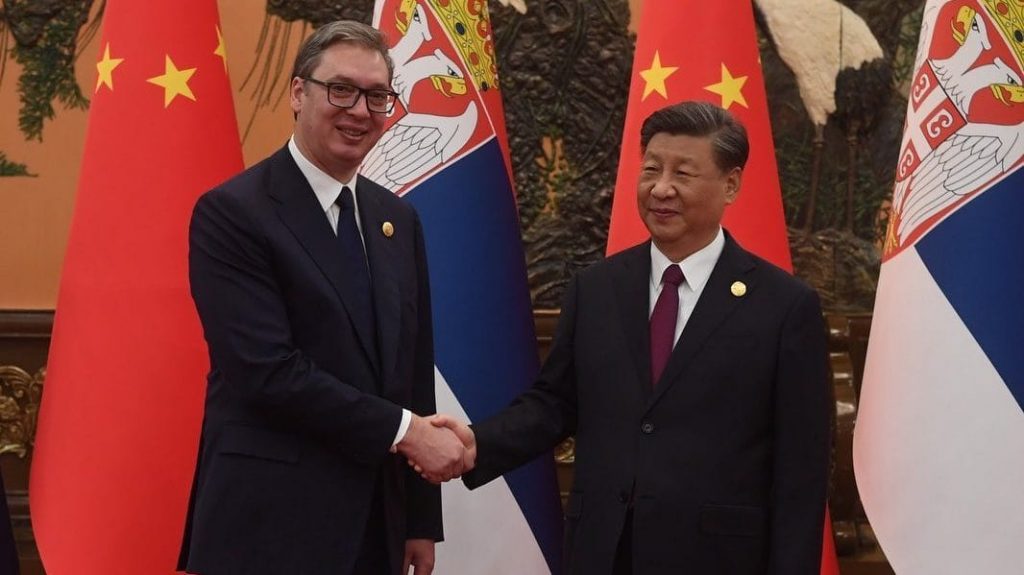

China’s footprint in Serbia and Hungary grows

Serbia signed a free-trade deal with China during the third Belt and Road Forum in Beijing. President Aleksandar Vucic emphasized the deal’s importance for Serbia’s future amid international consternation. The agreement came with €4 billion of additional contracts between Serbia and Chinese companies, the acquisition of five Chinese high-speed trains, and several more memoranda of understanding to enhance relations.

China’s Belt and Road Initiative has left a substantial footprint in the Balkans. Serbia alone has witnessed at least 61 projects worth €18.7 billion in cooperation with or implemented by Chinese entities over the past decade. The region has experienced significant engagement with China, with an estimated 135 projects valued at €32 billion by the end of 2021.

Hungarian Prime Minister Viktor Orbán and Chinese President Xi Jinping in a separate meeting focused on completing the Budapest-Belgrade Railway, cross-border e-commerce, and cooperation in various industries. Orbán also spoke with Russian leader Vladimir Putin, emphasizing Hungary’s commitment to maintaining contacts despite the war in Ukraine, and opposing further EU sanctions on Russia. Orbán is the first leader of an EU country to meet with Putin since the latter was indicted for Ukraine war crimes by the International Criminal Court.

Bulgaria tries to tax Russian energy giants out of the country

Bulgaria has introduced punitive taxes on Russian-owned oil and gas operations in an attempt to make them less profitable and encourage alternative energy sources for European buyers, the FT reports. One measure includes a €10 excise tax per megawatt-hour of transiting Russian gas, while another imposes a 60% tax on profits at the Russian-owned Lukoil refinery.

The drastic measures mark a U-turn in Sofia’s foreign policy after pro-Western parties came to power in May.

Serbia and Hungary immediately criticized Bulgaria’s actions, which could significantly increase gas pricesfor Serbian consumers and potentially disrupt gas supplies from Russia via the Turkstream pipeline. Hungary’s foreign minister also condemned the decision, but Bulgarian officials argued that the goal is to make shipping gas via Bulgaria less profitable for Gazprom rather than making gas more expensive for consumers in Hungary and Serbia.

The surprise move comes as Bulgaria has been rapidly diversifying its energy mix through interconnections and access to alternative sources such as Azerbaijan and Greek natural gas terminals. The European Commission is investigating the transit tax and a separate gas deal with Turkey over competition concerns, Radio Free Europe reports.

Latin America

Ecuador elects pro-business millennial for tough 18-month administration

Daniel Noboa, the 35-year-old heir to a banana business empire, secured victory in Ecuador’s presidential runoff election with 52% of the vote, the FT reports. His campaign focused on promises to combat violent crime and boost employment, tapping into a desire for change in a country troubled by security concerns.

With limited governing experience and a divided Congress predominantly composed of political opponents who may obstruct his agenda, Noboa faces an uphill struggle, according to FrontierView. The security situation has also reached a crisis level, with a politicization of violence and an absence of resources to combat violent gangs. Popular protests have historically hindered previous presidents, and public opinion is divided.

Severe fiscal constraints will also limit the government’s ability to invest in social programs and security, and raising taxes or cutting fuel subsidies is likely to face political roadblocks. The short 18-month term provides limited time for progress, and external factors like El Niño and global conflicts raising import prices further complicate economic recovery.

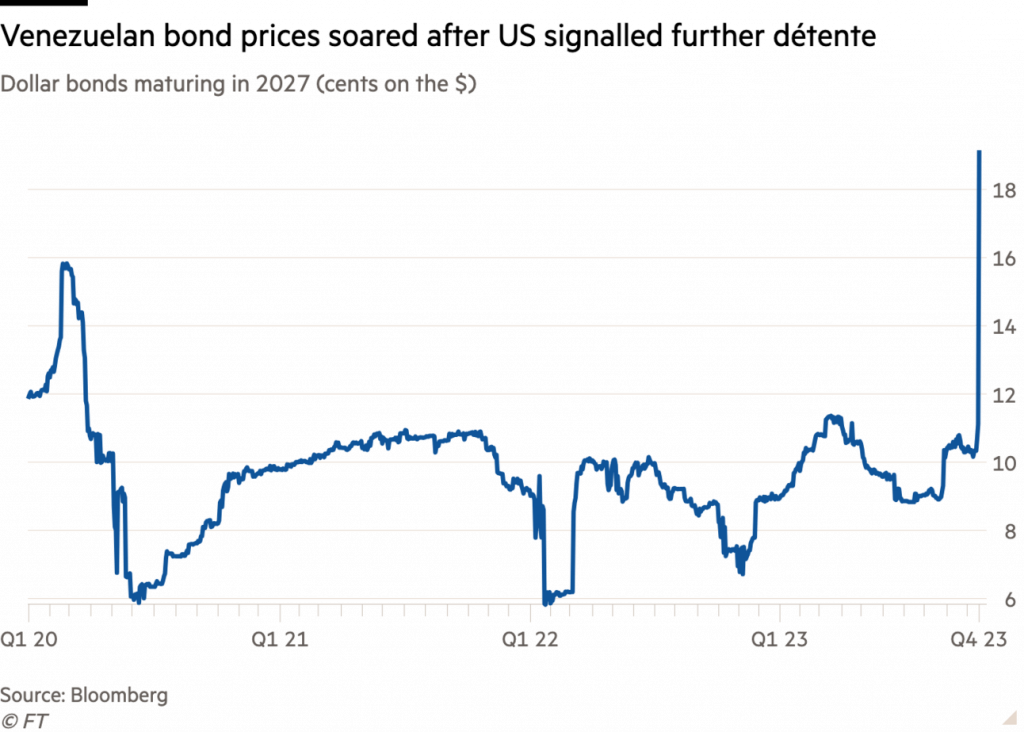

Venezuelan sanctions relief creates bond rally

Venezuelan government bonds rallied after the US agreed to lift a ban on secondary trading of certain Venezuelan bonds and Petróleos de Venezuela (PDVSA) debt. The sovereign dollar bond maturing in 2027surged over 70% to 19 cents on the dollar, as investors view the move as a potential catalyst for the restructuring of Venezuela’s debt and an opportunity for Wall Street investors to enter a market with bonds that have been trading at distressed levels.

The decision is part of a broader package of sanctions relief the US has offered Venezuela in exchange for promises of open elections that would give the US-backed opposition a chance. Among the moves, the US Treasury department issued a six-month license permitting transactions in Venezuela’s oil and gas sectors, along with a separate license for dealings with the national gold mining company Minerven.

- As sanctions lift on Venezuelan oil, China’s refiners will face stiffer competition (Bloomberg)

- UN greenlights massive new humanitarian fund for Venezuelans (The New Humanitarian)

While the sanctions relief aims to address Venezuela’s economic crisis and increase oil supplies in response to rising energy prices, analysts note that the long-term normalization of the oil industry and financial access to capital markets may pose challenges. The success of the lifted ban on bond trading hinges on whether it can lead to a successful restructuring of Venezuela and PDVSA debt.

What we’re reading

IFC doubled its commitments in Sahel despite challenges (The Africa Report)

Ghana greenlights first lithium mine with eye on electric vehicle boom (Reuters)

Zimbabwe worker exodus intensifies with economy in meltdown (Bloomberg)

Ethiopia and China announce ‘all-weather strategic cooperation partnership’ (Addis Standard)

Netherlands and Denmark join South Africa’s Just Energy Transition Partnership (Bloomberg)

Turkey’s arms industry takes off in Africa (The Africa Report)

Turkey pushes $25b Iraq transport route over India-Europe corridor (Nikkei)

China’s Xi offers to buy more Sri Lankan exports and promote investment (Reuters)

Pakistan stock market surged on back of IMF deal (Bloomberg)

Kazakh ministry appeals court ruling against $5 billion Kashagan lawsuit (Reuters)

Israel-Hamas war tests China’s Middle East ambitions (FT)

US warship and bases in Syria and Iraq come under drone attack (WSJ)

Turkey extends operations in Syria and Iraq by another two years (France 24)

ChatGPT creator OpenAI partners with Abu Dhabi’s G42 as UAE scales up AI adoption (Reuters)

Aid convoy enters Gaza Strip from Egypt (Reuters)

Saudi prince breaks ranks to condemn Hamas (The Telegraph)

Military training surges in Armenia amid invasion fears (Radio Free Europe)

Opinion: What Poland’s surprise election means for the EU (Time)

As US pivots to Middle East, Kosovo looks more vulnerable (BalkanInsight)

Rush by West to back Israel erodes developing countries’ support for Ukraine (FT)

Moldova says energy diversification prevents Russia ‘blackmail’ (Radio Free Europe)

Georgia’s pro-EU president Salomé Zourabichvili could face impeachment (EuroNews)

Border dispute deepens Haiti crisis (El País)

Colombia to spend $4.25b to buy land for poor farmers (Reuters)

Israel halts security exports to Colombia over president’s support of Hamas (The Times of Israel)

Russia expects Venezuela’s Maduro to visit as relations deepen (Reuters)

China lets Argentina tap extra $6.5b from swap line (Bloomberg)

China’s Xi touts close relationship with Chile in talks, announces lithium investment (Reuters)

As global debt worries mount, is another crisis brewing? (Reuters)