Frontier Markets Weekly, May 5th 2024

Dear Reader,

If you are enjoying this newsletter please consider upgrading to a paid subscription today. As well as supporting our continued development of sharp, markets-focused coverage and new informational products, paid subscribers will gain exclusive access to our future quarterly EM/FM reports that will aggregate insights from 25 key EM-focused institutions.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Gabon hopes to woo investors after bond slump

Officials from Gabon met with bond investors in New York this week in an attempt to restore faith in a country whose dollar-denominated notes are some of the worst performing in the world this year. They fell 5.7% in the first quarter amid ongoing political instability stemming from a 2023 coup.

Delays in the country’s return to civilian rule, and moves such as a proposal this week to dissolve some 200 political parties, could make the prospect of an international bailout less likely, analysts say.

The New York meetings, coordinated by Citigroup, were aimed at convincing investors that junta-led, oil-rich Gabon is a safe place for investors to park their money, Prime Minister Raymond Ndong Sima told Bloomberg.

Sahel coup states take steps toward stability

Chad is gearing up for elections on Monday, the country’s first since the military seized power in 2021. The vote is all but guaranteed to confirm the reelection of Mahamat Idriss Déby, the coup leader and son of a Chadian dictator who died fighting insurgents three years ago, the New York Times reports.

Despite the coup and the stage-managed elections, Chad, which hosts significant French and US military presences, has largely avoided the international condemnation of coups in other Sahel states.

Elsewhere in the region, officials in Mali reached a staff-level deal with the IMF this week to secure $120 million in emergency financing. The disbursement will go a long way in Mali, where regional opposition to the country’s military leadership has resulted in its suspension from African trade groups, heightening an already-acute economic crisis. The IMF disbursement will be put toward food, water, sanitation, and shelter, Reuters reports.

Climate change prompts African leaders to push for record financing

At a summit in Nairobi this week, African leaders requested a record $120 billionin development aid from wealthy countries. The push comes ahead of a December conference at which donor nations will determine their contributions to the World Bank’s International Development Association (IDA), which finances grants and low-interest rate loans to low-income countries.

About one-third of those countries are worse off than they were before the Covid-19 pandemic, FT reports, as they contend with increasingly costly consequences of climate change and worsening debt crises.

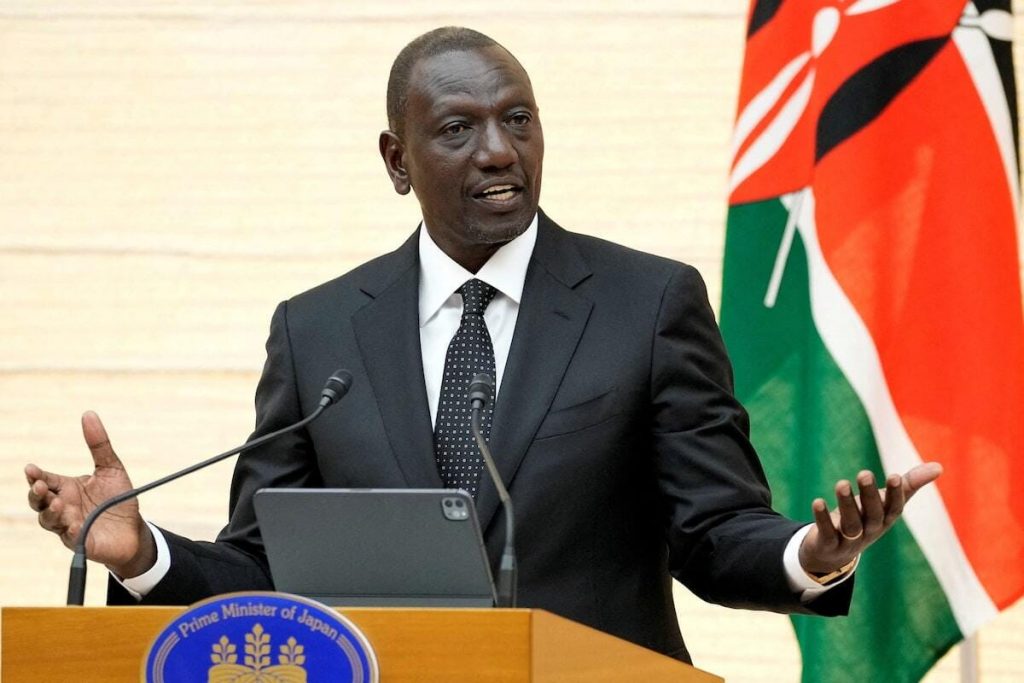

The IDA sets contributions every three years. In 2021, donor countries pledged $93 billion to the fund, then a record. At the meeting this week, Kenyan president William Ruto said that more funding was needed to resolve a “deepening development and debt crisis that threatens our economic stability, and urgent climate emergencies that demand immediate and collective action for our planet’s survival.”

Asia

Sri Lanka restructuring leads to new EM bond class

Sri Lanka’s ongoing debt restructuring negotiations are giving rise to an innovative new type of bond that links payouts to economic growth and governance reforms, a long-sought goal for emerging-market bond investors, the FT reports. The South Asian nation and its creditors have agreed in principle to replace the defaulted $13 billion debt with “macro-linked bonds” that would track the country’s recovery.

The inclusion of GDP-tied payouts in bonds eligible for major indices marks a significant step forward in developing debt structures that could lure international investors back to riskier emerging markets in need of financing. Under the proposed terms, creditors would take a roughly one-third haircut on their original debt in exchange for a new $9 billion bond with payments adjusted based on Sri Lanka’s average US dollar GDP performance.

The country is also considering a separate governance-linked bond that would cut coupon payments if tax revenue collection improves and anti-corruption reforms are passed. While some investors remain skeptical due to the checkered history of GDP-linked instruments, proponents believe these new bonds can bridge the divide between creditors and debtors, offering an attractive investment opportunity.

IMF urges continued discipline in Pakistan

The IMF has agreed to disburse to Pakistan the final tranche of a $3 billion loan negotiated last year.

As it confirmed the $1.1 million disbursement, though, the fund cautioned that the South Asian nation’s economy is far from out of the woods. “To move Pakistan from stabilization to a strong and sustainable recovery the authorities need to continue their policy and reform efforts,” the IMF said in a statement announcing the disbursement.

Some economists say that perceptions of Pakistan’s stabilization reflect positivity about the IMF loan, rather than structural improvements, Al Jazeera reports. They note that Pakistan has not seen an increase in exports or a rise in dollar inflows. Meanwhile, external debt has risen to $130 billion, and inflation is at 38%, the highest rate in South Asia, India Today reports.

Microsoft to invest billions in SE Asia

US tech giant Microsoft announced billions of dollars’ worth of investment in Southeast Asia this week as CEO Satya Nadella toured the region.

The largest sum will go to Malaysia where the company plans to spend $2.2 billion developing cloud and artificial intelligence infrastructure. The biggest-ever Microsoft investment in the country will fund the construction of a national “AI Centre of Excellence,” as well as training for 200,000 people.

Earlier in the week, the company announced a $1.7 billion investment in Indonesia, also for cloud and AI infrastructure purposes. Microsoft also announced this week that it will build a data center in Thailand.

Microsoft is one of many technology behemoths that have turned toward Southeast Asia in recent years. Amazon and Google are expanding in the region, as is the Chinese firm Alibaba. Amazon is spending even more than Microsoft. Last March, Amazon Web Services announced that it would invest $6 billion in Malaysia to build cloud infrastructure.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

EU gives Lebanon €1 billion in aid to curb refugee flows

The EU announced a €1 billion aid package for Lebanon in an effort to halt the flow of asylum seekers and migrants crossing the Mediterranean for Cyprusand Italy, the AP reports. Lebanon hosts some 780,000 registered Syrianrefugees—and possibly more than 1 million including unregistered migrants—but a deteriorating security situation and worsening economic crisis appear to be prompting more of them to try getting to Cyprus and Italy.

The EU package includes €736 million to help Lebanon manage Syrian refugees internally and €264 million in security aid, primarily for enforcing border controls. Since 2011, the EU has sent €3 billion to Lebanon for border and migration controls meant to keep refugees from crossing the Mediterranean to Europe.

This week’s package to Lebanon is the latest in a series of migration-control-for-aid deals the EU has struck with countries like Tunisia and Egypt. Last month, the EU sent $8 billion to Egypt in general macroeconomic and security assistance, with much of the aid earmarked for managing the 9 million migrants in Egypt eager to cross into Europe.

Saudi Arabia denies NEOM delays

Saudi Arabia’s economy minister Faisal F. Alibrahim announced this week that all NEOM megaprojects, including “The Line” megacity project, are going ahead as planned and will not be scaled back, CNBC reports. The report comes after a flurry of reports that the kingdom’s sovereign wealth fund, The Public Investment Fund, was scaling back its projects amidst a cash crunch that was also forcing it to tap capital markets to raise funds.

Alibrahim’s announcement this week follows reports that the PIF had hired financial advisers and had embarked on a road show to raise private capital and attract FDI to the Saudi Arabia.

The country is also pushing ahead with plans to develop an electricity interconnector to Greece. The two countries have formed a joint venture to deepen energy ties as a first step in their plan to supply Europe with cheaper green energy, the Greek energy ministry said.

Europe

Georgia pivot toward Russia prompts pro-EU protests

A sharp move toward a more pro-Russian stance by Georgia’s government has sparked widespread protests and a brutal police crackdown, marking a significant deterioration in the country’s civil rights and democratic aspirations, the FT reports.

The introduction of a controversial “foreign agents” law, reminiscent of similar legislation in Russia, has raised concerns about the suppression of dissent and the influence of pro-Russian oligarch Bidzina Ivanishvili, founder of the ruling Georgian Dream party. The violent police response to peaceful demonstrations, which included the use of water cannons, stun grenades, tear gas, and pepper spray, has drawn sharp criticism from the international community.

The political turmoil in Georgia has cast a shadow over the country’s hopes to join the EU, with the European Commission president urging the nation to stay the course on its path to Europe. The situation has put the EU in a delicate position, as punitive action against Georgia could boost Russian influence and play into the hands of the ruling party.

Media censorship accelerates across emerging Europe

Reporters Without Borders (RSF) says there’s been a substantial decline in press freedom across Eastern Europe and Central Asia over the past year, Radio Free Europe reports. The media watchdog’s annual world ranking highlights increasing suppression of free speech in countries such as Belarus, Georgia and Kyrgyzstan, where governments with authoritarian tendencies have adopted repressive methods similar to those employed by Russia.

RSF noted that media censorship in the region has intensified, with Belarus dropping 10 positions to 167th and Georgia falling 26 places to 103rd in the global rankings.

The report also underscored the deteriorating media situation in Serbia, which fell seven positions to 98th place, as an example of the Kremlin’s far-reaching influence. Pro-Russian government-affiliated media outlets in Serbia have been disseminating Moscow’s propaganda, while anti-war Russian journalists who sought refuge in the country following the invasion of Ukraine face threats of expulsion.

Latin America

Argentina’s lower house grants Milei extra powers in first legislative win

Argentina’s lower house has handed President Javier Milei a significant victory by approving a series of measures granting him temporary decision-making powers typically reserved for the legislative branch. After a marathon parliamentary session, which lasted over 24 hours, lawmakers passed the “Omnibus Law” bill, a cornerstone of Milei’s ambitious “chainsaw” economic policies.

The bill declares a one-year public emergency in various sectors and allows for the partial and full privatization of several state-owned companies, such as Aerolíneas Argentinas and Radio y Televisión Argentina.

The lower house also approved the repeal of the pension moratorium mechanism, tax incentives for employers who regularize unregistered workers, and a Regime of Incentives for Large Investments (RIGI). Additionally, the bill lifts export caps and price controls on hydrocarbons produced by YPF, effectively ending their status as a national priority for domestic supply.

Despite this initial success, the bill now faces a vote in the senate, which will be crucial in determining the extent to which Milei can implement his ambitious economic reforms and address Argentina’s ongoing financial challenges.

Specter of sanctions prompts Venezuelan government to look elsewhere for revenue

Venezuela’s oil exports took a significant hit in April, plummeting 38% as tanker owners and customers withdrew vessels awaiting loading in anticipation of the reimposition of US sanctions, Reuters reports. The Treasury Department’s decision not to renew a six-month license for Venezuela’s oil sector has led to loading delays and customer concerns, resulting in several supertankers departing empty after months of waiting.

As a result, PDVSA’s exports to Asia plunged by 64%. Shipments to the US rose 34% due to increased output from joint ventures with Chevron.

With the reimposition of sanctions, Venezuela’s government faces a potential monthly oil-revenue loss of around $370 million, which it hopes to offset by increasing tax receipts. The tax agency, Seniat, has been more efficient in tax collection and meticulous with audits, leading to a 57% increase in tax take during the first quarter compared to the previous year. Officials have set a target of $8 billion in tax revenue for this year, up from the initial budget estimate of $5.87 billion.

What we’re reading

Burst dam in Kenya pushes flood death toll past 120 (Al Jazeera)

Uganda ‘to get $295m loan’ from Islamic Development Bank (Reuters)

Rwanda reportedly dismisses the “conflict mineral” accusation against Apple (Techpoint)

UN peacekeepers close eastern DRC base as they move to end mission (Semafor)

Tanzania tightens mining policy to push more value-addition (The Citizen)

Zimbabwe’s president seeks constitutional changes and abandons third term bid (The East African)

Black market for Zimbabwe’s new ZiG currency is thriving (The Africa Report)

Botswana’s diamond industry gets boost amid global uncertainty (VoA)

Drought-stricken Zambia turns to Uganda for maize (Monitor)

Climate-tech startups in Nigeria see uptick in private funding (AfricaNews)

Nigeria civil servants get pay rises up to 35% (BBC)

Senegal tapestry production finds new lease of life (AFP via France24)

Opinion: A weak, Kremlin-influenced Libya is a threat to European security (Euronews)

Funding gap hampers African climate startups (AP)

African sovereigns at high risk of debt distress (Economist Intelligence)

Investment arm of UK international development plans to boost Africa spending (FT)

Vietnam’s parliament accepts chair’s resignation (The Diplomat)

Cambodia blames heatwave for deadly ammo blast (BBC)

Myanmar junta bans all men from working abroad (Radio Free Asia)

Indonesia volcano eruption spreads ash to Malaysia and shuts airports (The Guardian)

Malaysia’s KFC closes over 100 stores amid consumer boycott (Nikkei)

US and Philippines eye agreement to cut China nickel dominance (Bloomberg)

Tajikistan summons Russian ambassador over Moscow’s treatment of Tajiks (Reuters)

Tajikistan and Kyrgyzstan consider swapping territories to ease border tensions (Times of Central Asia)

Kyrgyzstan looks to Azerbaijan to replace Russian fuel (Times of Central Asia)

Taliban plan regional energy trade hub with Russian oil in mind (Reuters)

Solomon Islands chooses China-friendly ex-diplomat as new PM (The Guardian)

Booming trade, ‘expansion’ rumors on Kazakhstan’s Chinese border (Radio Free Europe)

Extreme heat forces school closures across Asia, affecting millions of students (NBC)

ASEAN and partners take aim at disaster insurance protection gap (Nikkei)

EDF and Fortescue among winners of Oman’s second land auction for green hydrogen projects (Hydrogen Insight)

UAE may surpass goal of tripling renewable energy capacity by 2030, minister says (The National News)

BlackRock is opening a Saudi investment firm with initial $5 billion from PIF (CNBC)

Bahrain is said to seek investors for key Saudi oil pipeline (Bloomberg)

What’s behind Iran’s ambitious push for influence in Africa? (Al Monitor)

UAE to help post-war reconstruction in Ukraine (Al Monitor)

Light at the end of the tunnel for Central European nations, but challenges persist (FrontierView)

Russia can’t match a Western asset seizure, but it can inflict pain (Reuters)

US senate passes Russian uranium imports ban, sending prices higher (S&P Global)

Turkey’s trade with Russia drops after US pressure (FT)

China woos Argentina, Bolivia and Peru to advance Belt and Road (Nikkei)

Austerity measures sink Cuba further into near-collapse (Global Americas)

Ecuador’s IMF deal eases financing risks, but governability challenges remain (Fitch Ratings)

‘Fed up’ Panamanians head to the polls (The Economist)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.