Frontier Markets Weekly, March 10th 2024

Dear Reader,

Frontier Markets News is on a mission to bring unbiased insight and intelligence about key developments in small, emerging markets to a global audience. We are also committed to providing a platform for aspiring journalists to refine and master their craft.

If you are enjoying this newsletter and would like to help support that mission, please consider upgrading to a paid subscription today.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Senegal sets date for delayed presidential election

Senegal’s President Macky Sall announced that his country’s presidential election will take place in two weeks, ending—for now—a saga that began when he postponed elections indefinitely last month.

That decision was reversed by the country’s Supreme Court, and the term-limited Sall has recently said that he will leave office on April 2, the day his term ends. But with the election now scheduled for March 24, there will not be enough time to tally the votes and inaugurate a new president between the election and the end of Sall’s term, the New York Times reports.

It is unclear who will govern Senegal while it is in between leaders. The nineteen-candidate election may require a runoff, for which the government is yet to set a date.

Zimbabwe’s carbon offset strategy bears fruit

Zimbabwe has received 13 applications for carbon credit projects since last summer, the country’s information minister said on Tuesday. The proposals focus on energy efficiency, forestry and regenerative agriculture, Bloomberg reports.

The applications are the first since Zimbabwe announced last August that it would take up to a third of revenue from carbon offset projects, slowing down a market that had been gaining steam.

Sub-Saharan Africa has long been an arena for investors hungry for natural resources to duke it out with states looking to ensure they get their fair share. While this battle has historically favored investors, African leaders believe the carbon market presents an opportunity to redress the balance.

To tilt the scales back toward Africa, Zambia’s environment minister said on Tuesday that the continent should develop a universal framework on carbon credits.

Egypt snags IMF support after abrupt currency devaluation

Egypt secured a new $8 billion loan program on Wednesday, just hours after the country’s central bank announced that it would raise interest rates by six percentage points, to 27.25%, and let the Egyptian pound float freely.

The pound quickly sank almost 40% on Wednesday, but it has since stabilized.

The size of the program was more than double the $3 billion the IMF agreed to provide Egypt, its second-largest debtor, in October. The lender said in a statement that the increased size was due to the war in Gaza, which has dented Egyptian tourism revenue as well as Suez Canal fee collections.

Asia

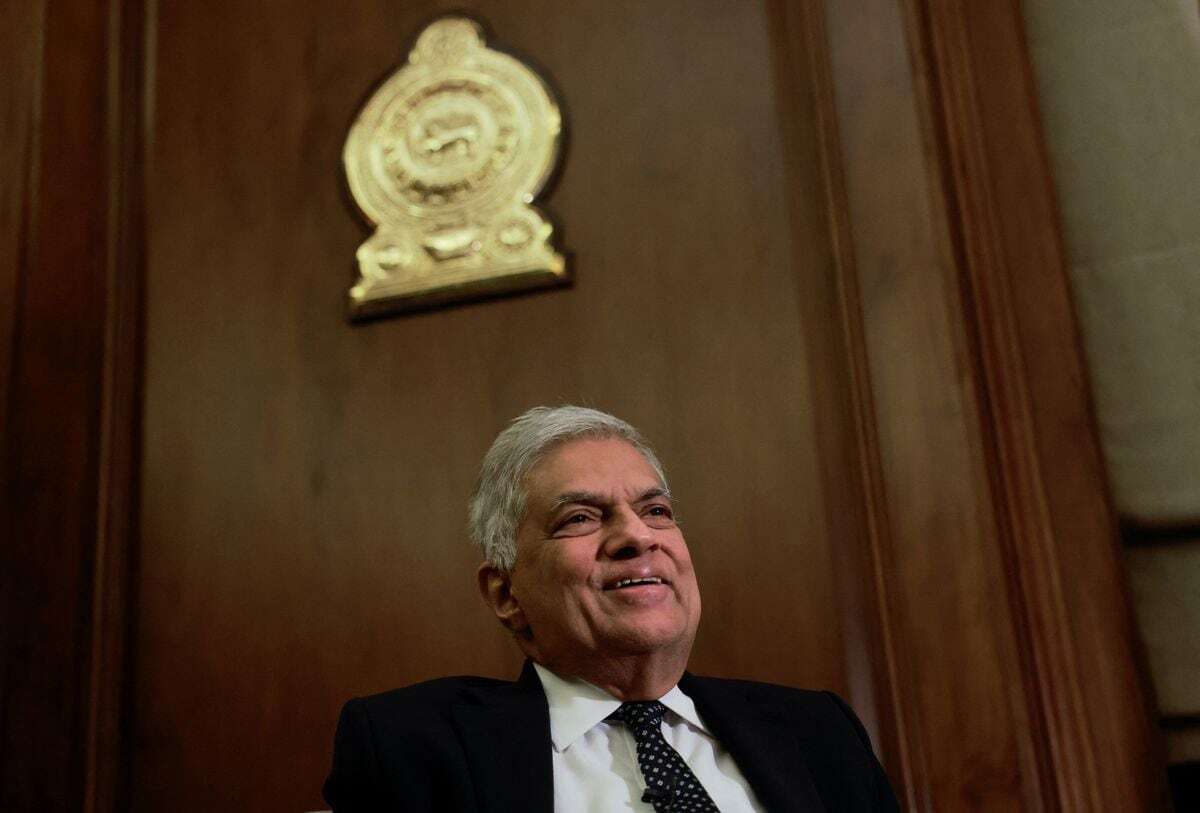

Sri Lanka looks to defer loan payments until 2028

Sri Lanka is seeking to suspend repayment on some $83 billion in outstanding loans until 2028, President Ranil Wickremesinghe said on Wednesday. He proposed a plan to pay off the country’s debts between 2028 and 2042.

Sri Lanka defaulted on its debt in 2022 amid compounding economic and political crises. High inflation and a shortage of foreign exchange reserves led to extensive power cuts and scarcity of essential goods such as food, fuel and medicine. Frustration boiled over when protestors forced out President Gotabaya Rajapaksa, who was replaced by Wickremesinghe.

Since taking office, Wickremesinghe has sought to right Sri Lanka’s fiscal ship, though critics say he has done too little to address a high cost of living. The country is now aiming to reduce debt payments to 5% of annual GDP from 10% in 2022, the AP reports.

Yet even as the broader economy recovers, the World Bank projects that more than a quarter of Sri Lankans will remain in poverty over the “next few years,” up from just 9% in 2019, before the Covid-19 pandemic disrupted the country’s finances.

Australia seeks to boost SE Asia with $1.3bn fund

Australia will create a $1.3 billion trade and investment fund to increase economic cooperation with Southeast Asian nations, Australian Prime Minister Anthony Albanese said on Tuesday. The program will concentrate on infrastructure and climate-change mitigation projects, NIkkei reports.

Speaking at a summit in Melbourne with countries from the Association of Southeast Asian Nations (ASEAN), Albanese said he wanted to “support regional growth and to realize mutual benefits” between Australia and Southeast Asia.

Australia also announced during the summit that it would provide ASEAN states with $42 million for maritime security to realize a “free and open” South China Sea, Al Jazeera reports. ASEAN countries including Indonesia, Malaysia, the Philippines and Vietnam have each feuded with an increasingly assertive China in the South China Sea in recent years.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Iran-Algeria relationship at ‘turning point’

Iranian President Ebrahim Raisi made a landmark visit to Algeria this week, signing a series of gas, tourism and technology-transfer agreements in a bid to improve the countries’ historically-complicated relationship, Al Monitor reports. Meeting on the sidelines of the Gas Exporting Countries Forum in Algiers, Raisi and his counterpart President Abdelmadjid Tebboune discussed collaborations including the formation of a joint fundto support knowledge and technology transfer.

Algeria and Iran do not presently have strong political ties or trade flows, but have since 2020 steadily improved the relationship. Both Algeria and Iran have robust political and trade cooperation with Russia, and are thought to be well-aligned on other areas of foreign policy, given their joint opposition to Israel and fraught relations with the US, whose recognition of Moroccan sovereignty over Western Sahara in 2020 is thought to have severely damaged US-Algerian relations.

Iran’s official presidential website states that Raisi hopes the trip will be a “turning point” in the relationship and declared the countries’ alignment on foreign policy, hailing Algeria as leading in “the fight against hegemony and colonialism.” State-owned Mehr News emphasized Raisi and Tebboune’s common aim of “defending the oppressed Palestinian people” as an “unalterable” foreign policy principle.

Oman and Saudi Arabia team up to boost tourism

Oman’s and Saudi Arabia’s tourism authorities this week launched a cooperation program to oversee the implementation of several joint tourism ventures, the Times of Oman reports. The program will develop and market “a series of pioneering tourism packages” to attract visitors from major developed markets.

Oman is also working with other neighbors in the private sector, this week announcing a $200 million Trump Organization-branded housing and golf club development in Muscat, to be funded by a UAE firm and built by a Saudi developer. Private investment is a growing part of the Sultanate’s economic diversification strategy, which includes a target of $31 billion in public-private investment into Oman’s tourism infrastructure by 2040.

Special Economic Zones created in Oman to channel foreign investment notched a significant milestone in 2023, achieving a cumulative $9 billion in commitments since their inception.

Europe

Moldova signs defense deal with France amid continued destabilization fears

Moldova signed a defense cooperation agreement with France amid heightened concerns over Russian efforts to destabilize the pro-European nation. The deal, inked during Moldovan President Maia Sandu’s visit to Paris, is part of a broader Western push to support Ukraine’s vulnerable neighbors in the face of Russian aggression.

- Questions raised over alleged Balkans ‘arms race’ (BalkanInsight)

- Criticism grows over Moldovan president’s EU-accession referendum proposal (BalkanInsight)

The pact will facilitate intelligence sharing, military training programs, and potential arms supplies from France. Notably, it paves the way for the deployment of a French military representative in Moldova. This enhanced cooperation is aimed at shoring up Moldova’s modest defense capabilities following stark warnings from Moldova’s intelligence service about alleged Russian strategies to foment instability ahead of key elections and a referendum on EU membership later this year.

However, foreign investors have pulled back ahead of March elections, waiting for political uncertainty to clear. Analysts say this retreat presents a buying opportunity once the elections pass. With stocks cheap and earnings estimates rising, investor optimism looks likely to keep fueling Turkey’s continued economic expansion.

Ukraine prioritizes security over prosperity in push to end EU farmer protests

Ukraine has expressed its willingness to accept restrictions on agricultural exports to the EU to ease tensions and strengthen defense relationships with critical Eastern European allies. The move to sacrifice an economic lifeline for diplomatic support comes as Russia gains momentum in the war and violent farmer protests have inflamed tensions over cheap Ukrainian grain imports with key allies.

Ukrainian trade minister Taras Kachka now acknowledged the need for a “managed approach” to trade flows, suggesting Kyiv’s priority is maintaining unity with its European partners in the face of Russian aggression, even if it comes at the cost of reduced agricultural revenues.

Ukraine also rejected the notion of agreements to allow Russian gas through Ukraine after the current transit deal expires at the end of 2024. This decision could potentially deprive Ukraine of hefty transit fees but aligns with the country’s goal of reducing dependence on Russian energy and strengthening its security posture against Moscow. Despite well-publicized battlefield setbacks, recent moves to shore up its position demonstrate that Ukraine is committed to the war, whatever the cost.

Chinese trade proves a medicine and poison for the Russian economy

After being isolated from Western financial systems due to its invasion of Ukraine, Russia has increasingly turned to China for economic support. However, this reliance on Beijing is proving to be a double-edged sword, providing some relief but also creating new challenges for the struggling Russian economy.

On the one hand, trade with China has surged, with Russia becoming Beijing’s fifth-largest trading partner last year. Chinese exports to Russia rose 12.5% in the first two months of 2023, and Moscow has benefited from Chinese investments in key sectors such as energy and automotive. This influx of capital and goods has been a much-needed lifeline for Russian businesses facing Western sanctions.

However, Russian companies are also grappling with the limitations of financial ties with China. Yuan financing has become increasingly costly and scarce in Russia, leaving major corporations including Norilsk Nickel and Rosneft with difficult choices between expensive ruble debt or rising yuan borrowing costs. Attempts to issue yuan bonds or secure loans directly from China have faced barriers, highlighting the constraints of Russia’s economic pivot to the East, Bloomberg reports.

Latin America

Gangs run rife as Haiti’s government nears collapse

US officials have grown alarmed that the Haitian government could fall within days as the National Police continue to dissolve as an effective counterforce allowing the airport or presidential palace to be captured. The grave warnings of imminent collapse come as major gangs unite to take down the unpopular government of Prime Minister Ariel Henry, who has been unable to return from Puerto Rico.

In an all-out assault on the international airport the alliance of gangs halted all flights in and out. While the airport attack was eventually repelled, the gangs took over large parts of the city and attacked Port-au-prince’s largest prison, freeing some 4,000 prisoners.

The situation has added pressure to expedite the deployment of the Kenya-led Multinational Security Support mission, or MSS, that has been in the works for over a year-and-a-half. However, the committed force looks to be too little too late, with one US official suggesting even 1,000 well armed well trained troops are unlikely to meet the demands of the crisis.

Panama bars ex-president Martinelli from race

Panama’s electoral tribunal annulled former President Ricardo Martinelli’s candidacy for May’s presidential election due to his recent conviction and nearly 11-year prison sentence for misappropriating public funds. Despite the populist being widely seen as the frontrunner and being fondly remembered by poorer Panamians for strong economic growth under his government, Martinelli has been dogged by corruption accusations for decades.

- Analysis: Martinelli is out. Hang onto your hats! (Aurora)

The 71-year-old millionaire businessman, who led Panama from 2009 to 2014, was granted asylum in Nicaragua’s embassy after losing his final appeal against the sentence last month. He still faces a separate bribery trial over Odebrecht contracts awarded during his presidency.

Colombia’s Petro purges investment-friendly technocrats

Colombian President Gustavo Petro’s hardening economic agenda has generated staunch opposition both inside and out of his administration, triggering an exodus of experienced technocrats and cabinet ministers, Bloomberg reports. Key centrist figures including former finance minister José Antonio Ocampo and planning chief Jorge Iván González have been ousted, replaced by Petro loyalists.

Mid-ranking officials across ministries, seen as obstacles to reform, have also been sidelined or forced out, often to be replaced by inexperienced activists.

The loss of institutional knowledge has raised concerns among investors, credit rating agencies, and international organizations about the executive branch’s ability to implement sound public policies. With few moderating voices left in Petro’s inner circle, critics are concerned the president will make decisions that energize his base but prove unfeasible, undesirable or unconstitutional.

What we’re reading

Kenya moves to issue debt-for-nature swaps (Bloomberg)

Kenya signs deal with UAE for first-ever geothermal-powered data center (Citizen Digital)

Kenya accelerates growth of Ethiopia electricity imports (The Africa Report)

Somalia gains full membership of East African Community (Africa News)

Turkey and Somalia ink energy accord amid Somaliland tensions (Al Monitor)

US sanctions Zimbabwe president Emmerson Mnangagwa over human rights abuses (AP)

Zimbabwe’s Ncube sees $18b debt talks on course despite US exit (Bloomberg)

Big Oil’s success in Namibia will push others to drill for growth (FT)

Investment fund targets $1.3b for power transmission links across Southern Africa (Reuters)

Junta-led Sahel states to form joint force to fight insurgents (Reuters)

Côte d’Ivoire’s economic reform spurs Africa’s highest sovereign rating by Moody’s (Africa Finance Review)

Nigeria’s Tinubu touts ‘$30b FDI’ commitments (Premium Times)

Nigerian businesses increasingly skip traditional banks and turn to Moniepoint (Rest of World)

Eni has another barnstorming oil discovery in West Africa ‘hot spot’ (Upstream)

Brussels to pay Mauritania for stopping Europe-bound migrants (FT)

Tunisian Banks Can Help Meet Growing Sovereign Financing Needs (Fitch Ratings)

Libya’s central bank governor pushes for more unified government (Reuters)

Multi-billion Gulf power play focuses on Egypt (Bloomberg)

Indonesian palm oil output pressured by weak global economic growth (Nikkei)

Nickel producers fear growing Indonesian pricing power (Reuters)

Chinese investment in Asia rose 37% in 2023, led by Indonesia (Nikkei)

IMF backs new Pakistan program, boosting bond rally (Reuters)

Kazakhstan pushes on with privatizations but policy framework remains a weakness (Fitch Ratings)

Three Red Sea data cables cut as Houthis launch more attacks in the vital waterway (Washington Post)

Hard-liners dominate Iran parliamentary vote (AP)

Saudi Arabia moves $164b Aramco stake to wealth fund (Bloomberg)

Iran defies US sanctions with surging exports of LPG (Bloomberg)

Armenia asks Moscow to remove Russian border troops from Yerevan airport (Radio Free Europe)

Albania’s Soviet-Era ‘Stalin City’ air base reopens for NATO jets (Radio Free Europe)

Russia oil fleet shifts away from Liberia, Marshall Island flags amid US sanctions crackdown (Reuters)

Foreign love affair with Croatian real estate market nears end (BalkanInsight)

Russia using Serbian agent to infiltrate EU bodies, Western intel says (Politico)

Analysis: Türkiye’s incredible balancing act (The Overshoot)

Turkish oil terminal halts Russian trade amid tightening of US sanctions (Offshore Technology)

Argentina black market peso back under 1,000 as Milei measures spur markets (Reuters)

Argentina’s Milei pledges to lower taxes soon (Mercopress)

Argentina’s neighbors come to its defense in fight over $16b US judgment (FT)

Ecuador bonds rise after IMF says new program under discussion (Reuters)

Peru set for moderate recovery (FrontierView)

Rift develops in Bolivia’s political left (Jacobin)

Brazil’s Lula takes wait-and-see stance on fairness of Venezuela’s election (Bloomberg)