Frontier Markets Weekly, July 29th 2023

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Dan Keeler, Ken Stibler, Noah Berman and Nojan Rostami

Africa

Gabon rolls out $450m debt-for-nature swap

Gabon launched a so-called debt-for-nature swap on Tuesday that will enable the country buy back $450 million of its government debt at a discount and convert it into a bond which aids environmental protection efforts.

The country said it would repurchase two eurobonds for 85 cents on the dollar and an additional eurobond at 96.75 cents on the dollar, Reuters reports. The bonds rose on the announcement.

Debt-for-nature swaps are gaining popularity as a way for indebted countries to attain financial relief in exchange for preserving their environments. Gabon will become the first African country to pursue a debt-for-nature swap. Earlier this year, Ecuador launched the world’s largest debt-for-nature swap, repurchasing $1.6 billion in bonds for 40 cents on the dollar, according to the Global Green Growth Institute. Quito is using its $1.1 billion in savings to conserve the Galapagos Islands.

Mali buys discounted Russian wheat

Russia appears to be tightening its ties with the West African nation of Mali through a deal to sell it discounted wheat. According to Africa Intelligence, Mali is set to receive 75,000 tons of wheat at about $220 per ton, compared to the $292 per ton charged in Europe.

Mali was one of a handful of countries that voted against a UN resolution earlier this year calling on Russian forces to leave Ukraine. Last year, it expelled French troops stationed in the country amid an influx of troops from Russia’s mercenary Wagner Group.

News of the shipments, which arrived at a port in Guinea last month, follow Russia’s decision to end an agreement enabling Ukraine to export grain from its ports on the Black Sea. The move raised concerns of an African food crisis, African Business reports, particularly in countries such as Libya and Ethiopia, which rely on Ukraine for close to half of their wheat imports.

Coup in Niger

Soldiers in Niger seized power after detaining President Mohamed Bazoum on Wednesday. It remains unclear who is in control of the country, but the Nigerien Army Command tweeted a statement supporting the coup to avoid a “murderous confrontation,” Al Jazeera reports.

It is the ninth coup or attempted power grab in just over three years in West and Central Africa, Reuters reports. It follows recent military overthrows of leaders in Burkina Faso, Chad, Guinea, Mali, and Sudan.

“We now must confront the reality of an entire region under military rule—and one that is very different than 10 years ago,” writes Kamissa Camara, an analyst with the US Institute of Peace and the former foreign minister of Mali. “Despite billions of dollars spent there and across the region since then our approach has not quieted extremisms and insurgencies.”

Prior to this week’s events, US officials considered Niger the last opportunity for Western engagement in the turbulent Sahel. US Secretary of State Antony Blinken announced $150 million in new aid for the country in March, and it is one of the only countries in the region that host US drone bases and troops. If the coup attempt succeeds, Niger stands to lose millions in aid, the AP reports and Russian influence in the region could grow.

Asia

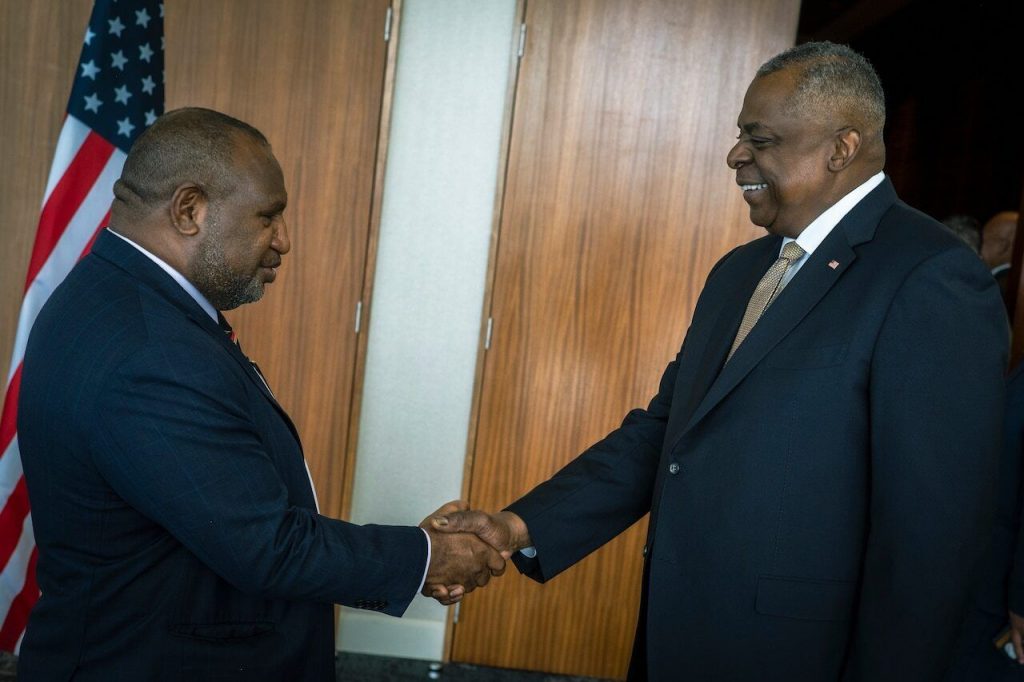

US officials step up Pacific diplomacy

High-ranking US officials visited the Pacific this week in a bid to strengthen ties to nations in the strategically important region.

In Tonga on Wednesday, US Secretary of State Antony Blinken became the first US cabinet official ever to visit the country. Defense Secretary Lloyd Austin discussed deepening security ties with leaders of Papua New Guinea in the country’s capital of Port Moresby on Thursday, and Interior Secretary Deb Haaland visited Micronesia and Palau.

The visits reflect intensifying competition with China in the region that the US had largely abandoned after the Cold War, the Washington Post reports. The United States rekindled its Pacific strategy last year after China signed a defense and policing agreement with the Solomon Islands. Blinken has toured the region twice since then.

Afghanistan’s Taliban seeks support in Southeast Asia

Officials representing Afghanistan’s Taliban government visited Indonesia and Malaysia in mid July, an unnamed Taliban source told Nikkei. The Indonesian government confirmed on Tuesday that Taliban representatives traveled to the country earlier this month.

The Taliban has few diplomatic partners, and Afghanistan’s economy has shrunk by 20% since they took power two years ago, according to the UN. The visit to Indonesia, the world’s largest Muslim-majority nation by population, reflects the Taliban’s desire to boost the Afghan economy and shore up recognition in the Islamic world, Voice of America reports.

However, those ties have been weakened by increasingly repressive policies the Taliban has imposed within its borders. The group announced on Tuesday that all beauty salons in Afghanistan must close within one month, saying that salons offered services which violate Islamic law. The move will bar women from one of the last places they can legally congregate outside of the home, the AP reports.

Cambodia’s leader sets date for power handover to his son

Hun Sen, Cambodia’s longtime autocratic prime minister, said in a televised address on Wednesday that he would step down next month and install his son in the country’s top office.

The announcement came four days after Hun Sen’s Cambodian People’s Party emerged victorious in elections that the US State Department described as “neither free nor fair.” Hun Sen, who has ruled the country since 1985, has long indicated that he would hand over power to his son, Hun Manet, but had not said when the transfer of power would take place.

- Hun Sen threatens Cambodians who spoiled ballots with legal action

- US pauses some aid, imposes visa bans after election described as ‘pantomime’

Some analysts speculate that Hun Manet, who attended the US Military Academy at West Point, could lead a less repressive regime, the BBC reports, although it’s expected that Hun Sen will continue to pull the strings, stifling any real prospects for change.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Oman wraps up week of significant economic, private sector developments

Oman this week made significant progress in planned public-private investments, lining up a deal with Saudi Arabia’s sovereign wealth fund to expand cooperation on regional infrastructure investment. The agreement earmarks an initial $5 billion commitment to investing in new, “promising sectors” of Oman’s economy as the two neighbors jointly attempt to diversify their economies away from a reliance on oil.

In a further effort to reduce its dependence on fossil fuels, Oman has set up an independent agency to oversee a $140 billion green hydrogen production project, which it hopes will supplant its gas export business in size on final completion in 2050. France’s Engie and South Korea’s POSCO have already won a contract to break ground on a first wave of green hydrogen infrastructure projects, and jointly announced this week their expectation of a long-term relationship with Oman on clean energy.

Oman has also announced an overhaul to its labor laws and practices, applicable to both Omanis and expats, as it seeks to attract new talent to facilitate the planned economic transition. The law introduces a mandatory 182-days sick leave, and 98-days’ paternity leave, with a special one-hour-per-day child care allocation for women in particular.

The labor reforms also include a mandate to devise a plan on training-up and incorporating Omanis for leadership and tech roles, facilitating a process of “Omanisation” to develop a local talent base over time. An example of this Omanisation process is the Huawei-sponsored “seeds of the future” training program to groom young Omani graduates for leadership roles in the country’s growing telecommunications industry.

Kuwait to set up a second sovereign wealth fund to finance local “mega projects”

Kuwait is planning to form a second sovereign wealth fund, named “Ciyada,” to develop the local Kuwaiti economy and “spearhead megaprojects” Reuters reports. The stated goal of the Ciyada Fund is to diversify the country’s economy away from a dependence on oil, and to accelerate local infrastructure development—a plan not unlike that of other Gulf countries pursuing their own plans for a post-oil economy.

Kuwait’s main SWF, the KIA, has more than $800 billion under management, and serves as the state’s main treasurer and director of foreign investment. It’s not yet clear how much the Ciyada Fund will have under management.

Iran’s government media mouthpieces claim diplomatic progress in South Caucasus, wade into Armenia-Azerbaijan crisis

Iran’s state-mouthpiece media outlets The Tehran Times and Mehr News Agency widely reported this week on what the Iranian government claims is a new “constructive, positive path” in Iran-Azerbaijan relations. The government’s Mehr News Agency released a statement by Iranian Foreign Minister Hossein Amir-Abdollahian following a call with his Azerbaijani counterpart claiming that progress has been made on keeping open land routes between Armenia, Azerbaijan, and Iran, and a shared commitment to non-interference in the region by foreign forces.

The Tehran Times, another state-owned outlet, reported that high-level talks between Iran and Azerbaijan also resulted in a commitment to jointly develop a border bridge and power plant, which has been framed as a sign of diplomatic progress as Iran tries to play power-broker between Azerbaijan and Armenia.

News that Iran has been covertly routing arms shipments from India to Armenia, however, threw a wrench in the state media’s claims of diplomatic progress. Following the revelation, Azerbaijan reimposed a land-corridor blockade on Armenia, stalling deliveries of supplies and humanitarian aid.

Bahraini crypto exchange to expand to UAE

Bahrain-based cryptocurrency exchange Rain, backed by Coinbase, announced this week it has received clearance to begin operating in the UAE, Al Monitor reports. Through a new subsidiary based in the UAE, Emirati citizens and, more importantly, asset management companies, will be able to transact in crypto markets using Emirati dirhams as a base currency.

Rain’s entry to the UAE comes after a market downturn and wave of regulations caused rivals such as the US’ Kraken exchange, to exit the market. The UAE has long hoped to become a key digital-asset hub following a US civil and criminal crackdown on cryptocurrency exchanges and issuers operating in the country.

The UAE’s crypto market is expected to grow, with controversial exchange Binance already operating there, and the Winkelvoss twins’ Gemini eying a license agreement similar to that just secured by Rain.

Europe

Ukraine eases monetary policy in sign of nascent recovery

Ukraine cut its benchmark interest rate for the first time since Russia invaded in an effort to wind down the extraordinary monetary regime implemented to protect the wartime economy, Reuters reports. The central bank will reduce the interest rate by three percentage points to 22% on the back of a deceleration in inflation, projected economic expansion, and positive sentiment among Ukrainian companies.

Inflation has declined for six consecutive months, reaching 12.8% in June, significantly lower than the peak of over 26% last year. Additionally, Ukrainian companies are optimistic about the economy’s prospects for the first time since the war began, according to a National Bank of Ukraine survey.

The central bank is also considering other measures to ease the emergency monetary regime, including allowing foreign shareholders to repatriate 2023 dividends to attract investment and possibly raising the amount of foreign currency that individuals can exchange for the national currency, the hryvnia.

Latin America

Argentina buys time with the IMF to narrowly avoid default

Argentina and the IMF reached a last-minute deal on Friday to provide stability to the troubled South American economy ahead of presidential elections in October. The agreement comes after three months of intense negotiations, during which the Peronist government was reluctant to implement unpopular policies before the polls.

Under the deal, the IMF will disburse an additional $7.5 billion of its loan program to Argentina, including withheld funds from a June review and a September assessment. However, the fund rejected Argentina’s request to bring forward all remaining disbursements for this year.

In an effort to address the IMF’s demands for devaluation, Argentina is set to introduce tax and currency measures that will effectively devalue the peso. These measures include a new preferential exchange rate for agricultural exports and levies on imports. While the IMF has accepted some of these workarounds to support Argentina during its painful drought, the fund remains staunchly in favor of large deficit reduction, exchange rate simplification, and the lifting of currency controls.

The IMF’s financial support is essential for Argentina to make loan repayments to the fund, given the country’s fragile economy. The current IMF package—a restructuring of a failed 2018 loan—requires about $8.7 billion of payments by the end of the year. However, delays in the disbursement process may force Argentina to use its yuan swapline with China to make $3.4 billion worth of repayments due by August 1. The country has already used the swapline for previous payments to the IMF, but such measures have been indirectly criticized by the IMF.

Chile cuts interest rates, highlighting further easing to come

After seemingly successfully taming inflation Chile’s central bank slashed interest rates by one percentage point on Friday. Many Latin American countries rapidly hiked rates in late 2021 and throughout 2022. However, with inflation slowing across the region, a wave of rate cuts is now expected.

Uruguay has already cut rates by 25 basis points in April and 50 basis points in July. Brazil, the largest economy in the region, is also expected to follow suit and start cutting rates in August.

Global

Debt trajectories diverge in frontier markets

Continuing investment flows into emerging markets that have shown resilience in the face of global shocks is masking a debt crisis unfolding in some smaller economies, Fitch warns. In its latest frontier-markets recap, the ratings firm said frontier markets are generally in a weaker position compared to previous years, despite the fact that two-thirds of frontier markets have a stable or positive outlook.

Around half of all Fitch-rated frontier markets are currently rated ‘B-‘ or below, with some sovereigns even reaching restricted default levels.

The rise in debt over the last decade, combined with multiple shocks such as the pandemic, the war in Ukraine, global inflation, and monetary tightening, has weakened many frontier markets. Those with thin buffers have particularly struggled to cope, leading to rising interest-to-revenue ratios due to growing government debt.

What we’re reading

Economic malaise and poor government drives coups in Niger and across West Africa (Bloomberg)

Liberia overtakes Panama as world’s largest flag state in tonnage terms (TradeWinds)

East Africa ‘to be continent’s fastest growing region’ (Bloomberg)

Zimbabwe’s central bank reforms seen as unsustainable as president readies for election (Semafor)

Zambian inflation at 15-month high sets stage for rate hike (Bloomberg)

Algeria’s energy outlook appears dimmer in 2024 (FrontierView)

European tourists flock to Mauritius to escape heat waves—and war (Bloomberg)

Bangladesh to benefit from ‘China Plus One’ policy (Daily Star)

Sri Lanka considers accepting Indian rupee for local transactions (Economic Times)

China rolls over $2.4b loan to Pakistan (Outlook India)

Indonesia’s generative AI market booms as entrepreneurs embrace risk (Nikkei)

Will Mongolia’s crackdown on graft unlock its mineral riches? (FT)

Turkish central bank predicts inflation will approach 60% by year-end (FT)

Russian defence minister vows to strengthen military ties with North Korea(FT)

Romanian oil giant OMV Petrom to install over 400 ultra-fast EV charging points (Romania Insider)

Moldova to sharply reduce number of Russian diplomats amid ‘destabilization’ fears (Radio Free Europe)

Russia raises conscription age as fighting intensifies in Ukraine’s south (FT)

Protesters, banks demand action after Iraqi dinar plunges post-US sanctions (Al Jazeera)

Saudi Arabia opens doors to Bangladeshi professionals and investors (Arab News)

Jordan adopts cybercrime law seen as threat to free speech (Reuters)

Condition critical: Desertification threatens to turn Iran’s future to dust (Radio Free Europe)

Argentina hits milestone on path to gas export bonanza (FT)

Poverty in Chile hits historic low (Mercopress)

Bolivia says it is interested in obtaining Iranian drone technology to protect its borders (AP)

Collapse of coca business has ‘crushed’ rural Colombia (El País)

US steps up warnings to Guatemalan officials about interference in country’s election (ABC)

China’s push to expand BRICS membership falters (Bloomberg)

Opinion: It’s time to retire the ‘emerging markets’ label (FT Editorial Board)