Frontier Markets Weekly, July 15th 2023

Welcome to the latest edition of Frontier Markets News. In this week’s issue, Uzbekistan’s president gets a win…kinda…the Solomon Islands double down, Nigeria’s leader backpedals and Zambia gets the goods. Saudi Arabia chalks up a loss, Pakistan chalks up a win, Latin America bucks a trend and investors find another reason to love emerging markets.

As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up at FrontierMarkets.co to receive FMN in your inboxevery weekend.

By Dan Keeler, Ken Stibler, Noah Berman and Nojan Rostami

Africa

Iran courts African countries

Iranian President Ebrahim Raisi visited Kenya, Uganda and Zimbabwe this week hoping to build economic partnerships amid stifling US sanctions. During his visit—the first to Africa by an Iranian leader in more than a decade—Raisi called Africa a “continent of opportunities” and said “none of us is satisfied with the current volume of trade,” the Washington Post reports.

In Kenya, Raisi signed five memoranda of understanding with President William Ruto to upgrade bilateral trade and the two countries’ leaders pledged to cooperate on information, communication, technology, fisheries, animal health, livestock products and investment promotion, Ruto told reporters.

In Uganda, Raisi assailed the West for supporting gay rights, noting the issue could bring Iran and Uganda together, and signed four cooperation agreements, according to Iranian state media. Raisi wrapped up his visit in Zimbabwe, which is also under US sanctions, and signed 12 deals to boost bilateral relations.

IMF approves Zambia payment

The IMF’s executive board approved the disbursement of $189 million to Zambia this week, the first installment of the country’s $1.3 billion bailout package. It comes weeks after Zambia reached a deal with Chinese and other international creditors to restructure $6.3 billion of external debt.

Zambia defaulted on its debts in 2020, but restructuring negotiations that were complicated by China had until now thwarted a bailout. Zambia reached a staff-level agreement with the IMF in April to unlock the disbursement, contingent on a debt treatment agreement with the country’s creditors.

“Timely implementation of this agreement, together with agreements with private creditors on comparable terms, should restore Zambia’s debt sustainability over the medium term,” IMF Managing Director Kristalina Georgieva said in a statement. The fund expects Zambian debt to fall to 88.5% of GDP within three years, down from 110% today.

Nigeria softens economic reforms

Nigeria’s President Bola Tinubu has pulled back from some of his planned reforms aimed at stabilizing the economy just weeks after taking office.

In June, the newly inaugurated Tinubu announced the central bank would no longer intervene to prop up the country’s currency, the naira. After the naira dropped to a record low, though, traders say the central bank is again intervening to prevent the losses from worsening

Tinubu also asked lawmakers this week to approve a $638 million spending package to ease the removal of a gasoline subsidy that kept prices at the pump low but cost the government $10 billion per year. Nigeria’s parliament granted the request on Thursday, reallocating spending that has already been approved by lawmakers, Premium Times reports.

Asia

Uzbek president reelected in ‘uncompetitive’ election

President of Uzbekistan Shavkat Mirziyoyev won a third term in office in last weekend’s snap election. Mirziyoyev won more than 87% of the vote in a contest that observers said was “lacking genuine competition,” Radio Free Europe reports.

Mirziyoyev called for snap elections in May after amending Uzbekistan’s constitution a month earlier to reset his term count and lengthen presidential terms from five to seven years. He has been in power since 2016 and under the revised rules, he could remain in power until 2037.

During his time in office, Mirziyoyev has introduced a series of reforms aimed at stimulating the country’s business environment. He has promised to increase tourismand open the country to foreign investment with the goal of doubling GDP in the near future, France24 reports.

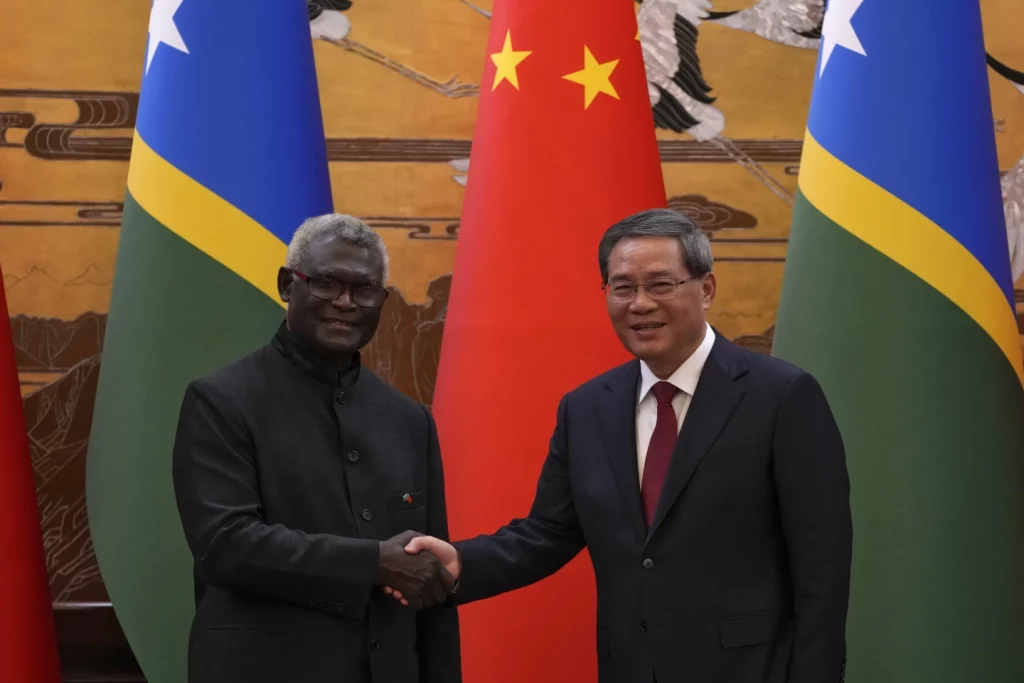

Solomon Islands upgrades deal with China

The Solomon Islands and China this week agreed to upgrade their cooperation on “law enforcement and security matters,” AP reports. In his first visit to China since the two countries signed a security pact that caused alarm in the US and Australia, Solomons’ Prime Minister Manasseh Sogavare signed the deal and eight others aimed at increasing bilateral ties.

Both Washington and Canberra have urged the Solomons to release details of the newly signed policing deals, Voice of America reports.

The US and Australia have each sought to reaffirm its ties with the Solomons in the wake of its earlier China deal. The US opened an embassy in the country last year, and Australia provided more than $160 million in official development assistance, according to the Australian Department of Foreign Affairs and Trade.

During the visit, Australia also announced a $33 million investment aimed at attracting private climate finance to Indonesia, which is also set to receive billions in assistance as part of a Just Energy Transition Partnership launched late last year.

Thailand’s political turmoil

Thai senators appointed by the country’s powerful military blocked opposition leader Pita Limjaroenrat from becoming prime minister in a legislative vote on Thursday.

Pita, whose Move Forward Party won a sizable majority in May’s elections, fell 51 votes short of the majority he needed from Thailand’s bicameral assembly. He won 311 votesfrom coalition partners in the country’s lower house, but just 13 votes from the senate, which was created by Thailand’s military after it took power in a coup in 2014, CNBC reports.

The Move Forward Party has advocated for reforms that would reduce the power of both the military and the monarchy.

The Move Forward Party’s surprising electoral success instilled hope in many Thais that the country, which has seen two coups depose elected leaders in the past two decades, could move toward liberal democracy, Bangkok Post reports. Now, with the royalist senate poised to reject the people’s choice for prime minister, violent protests and even another coup are not out of the question, according to the Council on Foreign Relations.

Another vote will be held next week.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Saudi Arabia’s sovereign wealth fund reports $11 billion loss

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, reported this week an $11 billion loss for 2022 resulting from global downturns in stock and bond prices, Bloomberg reports. The PIF, which manages about $778 billion in assets, has since 2016 transitioned from an inward-looking domestic investment vehicle into a more transparent fund with a global remit.

The PIF has a mandate to diversify Saudi Arabia’s economy away from oil by investing in regional infrastructure, tourism and international investments in diverse consumer industries like sports, automotive, and gaming. Its most recent investments in EV manufacturer Lucid and the acquisition of the PGA Tour via its wholly-owned LIV Golf have generated significant attention and controversy.

Gulf countries offer monetary support to embattled Pakistan

Pakistan this week received much-needed monetary support from its allies Saudi Arabia and the UAE ahead of a critical IMF meeting on a $3 billion bailout. Saudi Arabia deposited $2 billion and the UAE another $1billion in Pakistan’s central bank to shore-up depleted foreign exchange reserves, which were considered insufficient to continue to cover critical imports.

Following the announcements, Pakistan’s Prime Minister Shehbaz Sharif tweeted that the support “reflects the growing confidence of our brotherly countries and the international community in Pakistan’s economic turnaround.” The deposits do not wholly end Pakistan’s money troubles, as it is reportedly slated to sell-off fighter jets to Iraq to raise further funds.

Iraq reaches agreements on infrastructure, energy imports

Iraq this week announced the completion of an agreement with neighboring Iran on swapping Iraqi oil for Iranian natural gas, potentially a clever workaround to US sanctions, Bloomberg reports. US sanctions on Iran have prevented Iraq from purchasing Iranian natural gas, putting stress on Iraq’s power grid after the country passed an ambitious $153 billion budget earmarking significant spending on regional infrastructure and energy projects.

Also this week was a followup meeting between transport ministers of Iraq and the UAE on steps to carry out completion of the Development Road, an infrastructure network connecting the Al-Faw Grand Port in southern Iraq, oil fields in northern Iraq, and regional rail and port trade infrastructure.

The project is one of several infrastructure projects designed to transform Iraq from a primarily oil-exporting economy to a regional transit hub.

UAE lays out plan for COP28

Sultan al-Jaber, head of the UAE’s state oil company ADNOC and president of the UAE-hosted COP28 climate conference, laid out plans this week for a “brutally honest”summit in Dubai in November, Reuters reports. In a meeting of climate ministers in Brussels, al-Jaber said that COP28 participants “must be brutally honest about the gaps that need to be filled, the root causes and how we got to this place here today” vis-a-vis international emissions reductions commitments made in Paris.

On the agenda for November are what al-Jaber calls the Four Fs: fast-tracking the transition to low-CO2, fixing climate finance, focus on “people, lives and livelihoods” and “full inclusivity.” Also on the agenda is getting members to commit to doubling energy efficiency, tripling global renewable energy capacity to 11,000GW, and doubling global hydrogen production to 180 million-tonnes-a-year by 2030.

The UAE is a controversial host for COP28, and has been criticized for its economic dependence on fossil fuel exports as well as its warning against protesting or “criticizing corporations” at the summit. Also noted is the agenda’s inclusion of the phrase “the phase down of fossil fuels”, which underscores an important distinction between “phase down” and “phase out” in the climate change debate, and which critics say demonstrates the inappropriateness of a major fossil fuel producer hosting a climate change mitigation summit.

Europe

Demographics haunt Eastern Europe’s biggest economies

Poland is grappling with a declining population despite attracting record numbers of immigrants, according to Poland’s social security agency, ZUS. In a report, the agency said Poland would need nearly two million additional workers over the next decade in order to maintain its current working-age population-to-retirees ratio. Although the country has been drawing increasing numbers of immigrants in recent years, the target of over 200,000 new foreign workers annually for the next 10 years is considered unrealistic.

Ukraine is also suffering a decline in population exacerbated by the war, which is causing sustained labor shortages, according to a report by the Vienna Institute for International Economic Studies. The country has seen an outflow of well-educated women of working and childbearing age, as well as the departure of many children and young people. Even in 2040, Ukraine is projected to have around 20% fewer inhabitants than before the conflict, with a severe decline in the working-age population.

These demographic challenges have long-term implications with Poland’s struggle to attract enough foreign workers hindering its ability to maintain economic growth and cope with an aging population in the near future. Meanwhile, Ukraine’s population decline and labor shortage following the war pose significant obstacles to reconstruction and economic recovery.

Latin America

Record Latin American FDI bucks global trend

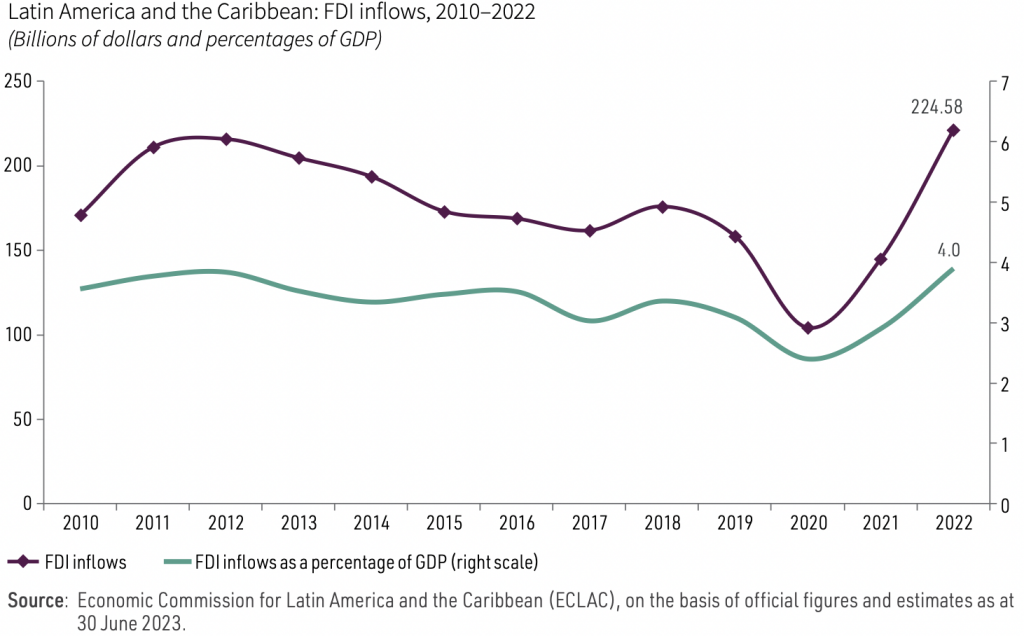

Foreign direct investment (FDI) into Latin America and the Caribbean surged by 55% last year to a record $224 billion, despite global FDI falling, according to a UN report.

Brazil emerged as the top destination for FDI in the region, doubling its 2021 inflows and attracting nearly 41% of all investment. Mexico followed in second place, receiving 17% of the investments while experiencing a more modest 14% growth from the prior year. The surge in FDI reflects the combination of rebounding investment, relative stability and tailwinds from supply chain ‘de-risking’ and ‘near-shoring’ trends.

However, despite the surge in FDI, Latin America still only accounted for 8% of global flows, the lowest share compared to other regions such as Europe, Asia-Pacific and North America.

Caribbean Community agrees to free movement of people

Caribbean Community (CARICOM) leaders announced a landmark decision to allow free movement within the region by March next year, Loop Caribbean News reported. Currently, only specific categories of people, such as university graduates, nurses, teachers, musicians and agriculture workers, are eligible for employment in CARICOM member countries under the Caribbean Single Market and Economy (CSME).

Alongside free movement, certain contingent rights will be granted, including access to primary and emergency healthcare and free primary and secondary education.

While details of the agreement were not fully disclosed, Barbados’ Prime Minister Mia Mottley explained that leaders are approaching the minimum set of rights cautiously to avoid potential lawsuits against governments. Existing visa arrangements for Haitiannationals will also remain unchanged.

Global

Gap between emerging and developed markets yields falls to multidecade low

The gap in government borrowing costs between emerging and developed markets has reached its lowest level since 2007, as investors anticipate interest rate cuts in major emerging economies and further tightening in the West, the FT reports. This divergence has been attributed to the narrowing credibility gap between policymakers, with emerging markets successfully navigating the inflation shock while some western central banks struggled.

Central banks in Latin America and Eastern Europe responded swiftly to inflationary pressures, resulting in their bond markets outperforming others. Meanwhile, US and German government bonds have yielded relatively low returns this year.

JPMorgan Asset Management’s Iain Stealey expects emerging market local currency bonds to continue performing well due to high real rates, central banks concluding their hiking cycles, and decreasing inflation. Bank of America predicts that emerging economies will experience an average growth rate of 4.1% in 2024, outpacing the anticipated 0.5% growth in the US.

What we’re reading

Mozambique ex-minister set for US extradition over $2b ‘tuna bonds’ scandal (FT)

Wagner faces challenge in Africa stronghold (FT)

Russian CO2 credits find pathway to western trading via Zimbabwe (Bloomberg)

Deadly protests rock Kenya over new taxes, high living costs (The Africa Report)

Egypt launches new Sudan mediation bid at neighbors’ summit (Reuters)

Egypt announces $1.9b asset sale (FT)

Philippine central bank wants lenders to disclose climate assets (Bloomberg)

Russia pitches use of local currencies in appeal to ASEAN (Nikkei)

Ferdinand Marcos Jr defies sceptics in Philippines but economic challenges persist (FT)

Raffles, bonds and crypto are funding Myanmar’s armed resistance (VOA)

Myanmar urges citizens to work abroad to ease forex shortage (Nikkei)

China’s woes are boosting Asian emerging market (WSJ)

Agritourism offers brighter prospects for Albania’s small farmers (FT)

US sanctions Serbian security chief for alleged corruption, drug trafficking (Radio Free Europe)

Wagner no longer significant in Ukraine, Pentagon says. (The Washington Post)

Erdoğan looks west as Turkish economy stutters (FT)

Populist spending in Turkey triggers new inflationary taxes (FrontierView)

UAE announces major change in Emiratisation rules (The National)

Oman plans to construct strategic port in Masirah (Times of Oman)

Yemen: Transfer of oil from decaying ship expected to start next week (UN News)

Former Iranian welfare official warns of looming ‘catastrophe’ over malnutrition (Radio Free Europe)

China’s pivot to the Middle East set to fuel investment boom (WSJ)

Argentina’s negative net reserves signal extremely high vulnerabilities (FrontierView)

Latin America’s answer to Venmo helps Argentines survive sky-high inflation (Rest of World)

Honduras probes Chinese interest in investing in $20b rail line (Reuters)

China has been secretly fueling a renewable energy boom in Latin America (Fortune)

DHL invests €500m in Latin America as clients expand supply chains beyond China (FT)