Frontier Markets Weekly, February 4th 2024

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

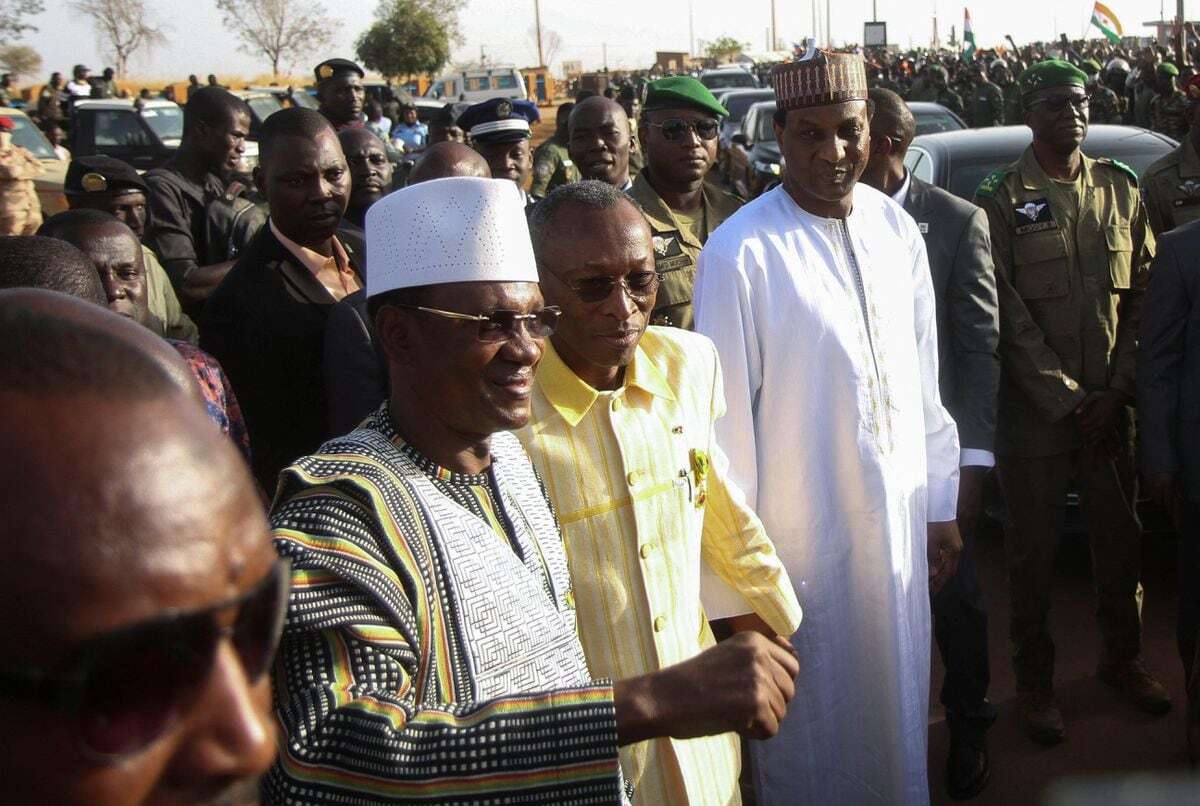

Coup countries leave ECOWAS

Burkina Faso, Mali, and Niger announced they plan to leave the Economic Community of West African States (ECOWAS) last week, citing the bloc’s sanctions instated after military leaders seized power in each of the three countries.

- African Union urges dialogue between ECOWAS and junta-led states (Reuters)

The departure could dent trade relations and threaten regional stability in the turbulent Sahel, which has seen eight coups in the past three years. ECOWAS has closed borders to the three countries and suspended financial transactions, and frozen assets held in the bloc’s central banks. The penalties have already caused financial hardship in the junta-run states—economic pain that would almost certainly deepen if they drop out of ECOWAS.

The decision to leave the bloc thus represents the “silliest own goal since Brexit,” FIM Partners’ head of macro strategy Charlie Robertson wrote in a guest post for FMN. “But unlike Brexit, this hurts the poorest in the world.”

Tunisia considers borrowing billions from central bank

The Tunisian government is seeking to resolve its economic crisis by borrowing billions of dollars from its central bank in a move that experts said could undermine trust in Tunisian institutions and stoke inflation, AP reports.

The move required President Kais Saied to dissolve laws intended to provide the bank with autonomy. Saied wants the central bank to buy about $2.25 billion worth of interest-free bonds to close a $3.2 billion budget deficit, Africanews reports.

Saied has concentrated power in his own hands since taking office in 2019, including by rewriting parts of the Tunisian constitution and briefly suspending Parliament. Financing government spending with central bank funds carries inflationary risks, but Tunis has few creditors willing to work on its terms; Tunisia has subsidies for flour, electricity, and fuel that are unpopular with multilateral lenders. Saied pulled Tunisia out of its IMF program earlier this year.

Egypt nears IMF deal

Egypt and the IMF are close to completing negotiations on a loan agreement that could provide much-needed foreign currency reserves to the indebted Arab nation. IMF Managing Director Kristalina Georgieva said negotiations had entered “the very last stretch” on an agreement that would supplement an existing $3 billion program.

Analysts said a new agreement could include the World Bank and be worth as much as $10 billion.

IMF officials said the recent resumption of talks was driven by the war in Gaza, which has threatened to upend Egypt’s economy. Attacks by the Iran-backed Houthis in Yemen on commercial ships in the Red Sea have scared much commercial shipping away from the Red Sea and the Suez Canal, which provides a significant portion of Egypt’s foreign currency. The Houthis have said they will continue attacking ships until Israel pulls out of Gaza, according to the Council on Foreign Relations.

Asia

Pakistan prepares for elections

Pakistan is poised to host elections on Thursday that analysts say are likely to be neither free nor fair.

Imran Khan, the country’s most popular politician, received multiple prison sentences this week, including 10 years for allegedly leaking state secrets and seven years for violations of Islamic law. Nawaz Sharif, a three-time former prime minister who recently returned from exile after mending ties with the kingmaking military, is the front-runner. Also running is Bilawal Bhutto Zardari, a scion of the Pakistani political elites.

Whoever wins the parliamentary vote will inherit a spiraling economic crisis and a worsening terrorism problem that has recently expanded into conflict with Afghanistan and Iran. But given their establishment credentials—and the decades of economic mismanagement between them—neither of the leading candidates is viewed as having the keys to solving Pakistan’s compounding crises, Deutsche Welle reports.

However, a bright spot could exist in Pakistan’s historically bellicose relationship with India. A Sharif victory could lead to the normalization of ties between the two nuclear powers, the Council on Foreign Relations reports.

Thailand and Sri Lanka sign free-trade deal

Thailand and Sri Lanka signed a free-trade agreement on Saturday during a visit by Thai Prime Minister Srettha Thavisin to the island nation.

The deal marks Thailand’s first new trade deal since Srettha took office last year and comes ahead of Sri Lankan elections expected this fall. The agreement could lead to an increase in the countries’ bilateral trade, which measured $476 million in 2021, according to MIT’s Observatory of Economic Complexity (OEC).

Thailand’s major exports to Sri Lanka include rubber products, fish and fabrics, while Sri Lanka’s to Thailand include precious stones and fabric, according to OEC. Thai officials said the contract is part of a broader policy to expand trade, Bangkok Post reports.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

India’s Iraqi oil imports reduce reliance on Russia

India has reportedly reduced its reliance on shipments of discounted Russian crude oil by importing more Iraqi crude. Maritime industry news agency Splash247 reports India’s imports of Iraqi crude hit a record high 1.3 million barrels per day in January. Russia became India’s top supplier of crude oil after it steeply cut prices in response to US-led sanctions imposed after its invasion of Ukraine.

Reuters reports that India received no cargoes of Russian oil in January, with only five expected in February—a precipitous drop from the 1.6 million barrelsper day imported in 2023. Houthi attacks on shipping lanes in the Red Sea are also to blame, having caused sharp increases in the cost of shipping oil from Russia, significantly reducing the relative value of the Russian discount.

Oman grows bilateral trade with China

Oman’s trade with China grew to a record $40.45 billion in 2022, the highest in the countries’ 45 years of diplomatic relations, according to China’s ambassador to the Sultanate this week. Calling Oman an “important partner in jointly building the Belt and Road,” she highlighted major recent investments, including a silicon alloy project, water desalination plants, and investments in green hydrogen and solar energy.

Bilateral trade with China, which is Oman’s third-largest trade and investment partner overall and the largest single contributor to its trade surplus, is supporting Oman’s Vision 2040 plan—a strategy to grow Oman’s economy by diversifying away from oil and gas toward domestic tourism, infrastructure and green-energy.

According to the IMF, it’s paying off: In its annual report on Oman the multilateral praised the country’s economic performance and its “progress on…structural reform,” its fiscal discipline, and commitment to an “ambitious climate agenda and investing in renewable energy.”

Europe

Hungary relents on €50B EU aid for Ukraine

The EU has approved a €50 billion ($54 billion) aid package for Ukraine after weeks of opposition from Hungary’s Prime Minister Viktor Orban. The 4-year package aims to provide Ukraine financial stability amid Russia’s continued assault on the nation, WSJ reports.

Orban dropped objections after pressure from EU leaders, although reviews in two years could potentially end assistance.

The aid comes as European officials increasingly view Ukraine’s defense as critical for the continent’s security. Germany warned that Russia could attack NATO in five years if not stopped in Ukraine. France said a Russian victory would mean “the end of European security.”

Turkey coal usage rises to the highest in Europe

Turkey is set to become Europe’s largest user of coal in 2024, surpassing Germany, Reuters reports. High inflation has led Turkish power producers to increase use of cheaper domestic coal and cut expensive LNG imports. Coal generation hit a record 117.6 TWh in 2023 while LNG imports dropped 8%.

Soaring inflation, nearing 65% in 2023, and a weakening lira have pinched power producers reliant on imported natural gas. As interest rates rose to over 42%, gas purchases slowed. To compensate, coal’s share of electricity generation climbed to 37%, boosting output to a new high.

With inflation projected to remain high in 2024, low-cost Russian coal will likely continue displacing gas in Turkey’s power mix. Russia accounted for 58% of Turkey’s thermal coal imports last year, up from 46%.

Latin America

Rising spending and debt signal steady erosion of Panama’s economic model

Panama’s long run as an investor darling in Central America could be coming to an end, according to Elias Hilmer, assistant economist at consultancy Capital Economics. GDP growth is slowing dramatically due to droughts disrupting Panama Canal traffic and the closure of a major copper mine. Slower growth will lead to lower government revenues and a rising public debt ratio, and could jeopardize Panama’s coveted investment-grade credit rating, although financial markets seem to have already priced in a potential downgrade.

Over the past two decades, Panama has been a regional success story, enjoying 6% annual GDP growth and implementing prudent fiscal policies that earned it the investment-grade rating. But the ongoing droughts have almost halved Panama Canal’s shipping capacity and the legal ruling that forced the closure of the giant Cobre Panama copper mine will further reduce GDP. Productivity has not kept pace with rising wages, hurting competitiveness.

With growth potentially slowing to just 1-2% annually in 2023-2025, Panama’s finances will suffer. Tax revenues will undershoot targets and the government may dilute its planned fiscal adjustments. As a result, the public debt ratio looks set to climb higher, potentially leading to further credit downgrades and more expensive borrowing right when countercyclical spending is needed.

Venezuelan political repression triggers renewed sanctions threat

The US has threatened to reimpose sanctions on Venezuela after opposition leader Maria Corina Machado was banned from running in this year’s elections, the BBC reports. The Biden administration’s move to wind down all business transactions between US entities and Venezuela’s state miner Minerven serves as a warning shot for further energy sanctions by April if President Nicolás Maduro’s government fails to adhere to an agreement for fair presidential elections.

This risks curbing the OPEC member’s 2022 sanctions-relief gains. Venezuela’s oil exports and revenues climbed with eased restrictions, but the potential withdrawal of this relief threatens to undo the economic gains made, reduce government revenue from oil sales, and push Venezuela back into deeper economic isolation and turmoil.

Venezuelan oil revenue, which recently hit an over-four-year high, could quickly fall by up to 30% if sanctions are reimposed, analysts believe.

Global

EM optimism surges on renewed rate-cut bet

Bets that the Federal Reserve will soon cut interest rates are igniting optimism among emerging-market debt investors. They anticipate a Fed pivot would strengthen the case for EM central banks to also ease rates, which could spark an additional rally in local currency bonds, even after the asset class gained 6.4% last year, Bloomberg reports.

Latin America is attracting particular interest given aggressive early rate hikes. With inflation peaking, central banks such as Brazil’s are already trimming rates. Further cuts are expected across the region if the Fed pivots.

Some investors call it a “once-in-a-generation opportunity.” Bond funds are attracting fresh inflows as Wall Street cuts short positions. Countries embracing orthodoxy, such as Turkey, also lend appeal.

What we’re reading

Namibian President Hage Geingob dies in a hospital where he was receiving treatment (NPR)

DRC’s worst floods in decades leave tens of thousands in temporary shelter (The Guardian)

Mozambique seeks to end 50-year South Africa hydropower pact (Bloomberg)

Ethiopia Requests Regional Summit to Discuss Red Sea-Access Plan (Bloomberg)

Demand for Nigerian passports soars by 107% amid mass exodus (The Africa Report)

Nigeria to offer investors 75% stake in proposed solid minerals firm (Reuters)

IMF ‘very close’ to fresh Egypt loan deal (FT)

Russia hires its own Africa army to succeed Wagner’s mercenaries (Bloomberg)

US touts alternatives to Russia’s Wagner for security in Africa (The Africa Report)

Italian leader Meloni unveils plan to promote Africa development and curb migration (AP)

Saudi Arabia pursues deals across Africa (The Africa Report)

Philippines and Vietnam agree to expand cooperation as tensions with Chinarise (AP)

Philippines discord with China deepens over Taiwan (FT)

Indonesia’s flood of nickel sparks ‘Darwinian’ battle for survival among miners (FT)

China upgrades diplomatic ties with Afghanistan’s Taliban (Radio Free Europe)

Saudi Aramco drops expansion plan, raising demand questions (Bloomberg)

UAE ambassador to Syria takes post after nearly 13 years of cut ties (ABC)

Mideast corruption rankings: UAE least corrupt, Lebanon and Iran close to bottom (Al Monitor)

Kuwait faces alarming 87% surge in government debts (Zawya)

Red Sea attacks force firms to test new land routes via UAE and Saudi (Bloomberg)

US launches air strikes against Iran-linked targets in Iraq and Syria (FT)

Hopes for Gaza ceasefire as Hamas ‘agrees deal to return Israeli hostages’ (Times of London)

Moldova vows to ‘accelerate’ efforts to comply with EU’s Russia sanctions (Radio Free Europe)

Slovakia’s Robert Fico under pressure to ditch plan to close anti-corruption office (FT)

Ethnic Serbs in Kosovo unsettled by looming ban on Serbian dinar (Radio Free Europe)

EU offers Balkan states ‘taste’ of accession (BalkanInsight)

Panama’s Martinelli vows to run for presidency despite recent money-laundering conviction (AP)

Guatemala’s new president appeals for society’s help to overcome entrenched powers (AP)

El Salvador’s bitcoin-loving strongman heads for second term (FT)

Short on cash, El Salvador doubles down on Bitcoin dream (Reuters)

Cuba delays 500% fuel price hike over ‘cybersecurity’ incident (AFP)

Argentina’s Milei seeks Tinder hook-up with global Big Tech (Reuters)

Argentina gets funds from the IMF (LatinFinance)

India and China open doors for Global South in space competition (Nikkei)