Frontier Markets Weekly, February 18th 2024

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Senegal’s top court says election must happen as planned

A day after Senegal’s Constitutional Court overturned his decree delaying this month’s planned presidential election, the country’s President Macky Sall said he would organize the poll as soon as possible.

It is unclear when the election will occur, and the court said it would be “impossible” to schedule the vote for its original Feb. 25th date, BBC reports. However, the court ordered that they be completed far sooner than December 15, the date approved by an opposition-less parliament after Sall’s decree.

- Senegal: Africa’s biggest gas finds hit by political turmoil and debt spirals (Bloomberg)

The country has been wracked by protests since Sall’s announcement, which critics compared to a coup. Sall has said that he does not intend to run for reelection. If he complies with the court order, he must step down by April 2, the last day of his term.

Somalia ruffles feathers at AU summit focused on unity

Somalia’s president Hassan Sheikh Mohamud accused Ethiopia of trying to annex a portion of his country through its deal with the breakaway region of Somaliland to lease land on the Red Sea coast for a port and naval base, DW reports. Mohamud made the accusation at the African Union’s 37th annual summit in Addis Ababa this weekend, where regional leaders are seeking to quell concerns of expanding conflict, mounting debt, and the “existential“ threat of climate change.

Mohamud also claimed he was initially denied access to the event, where African leaders discussed ways to resolve an emerging African debt crisis. About 30 of the continent’s economies are heavily indebted, African Business reports, with little hope for reversing their trade deficits or strengthening their currencies in the near term.

Meanwhile, a spate of military coups in countries stretching across the width of the continent has stressed regional economic cooperation. Extreme weather has wreaked havoc from north to south.

Asia

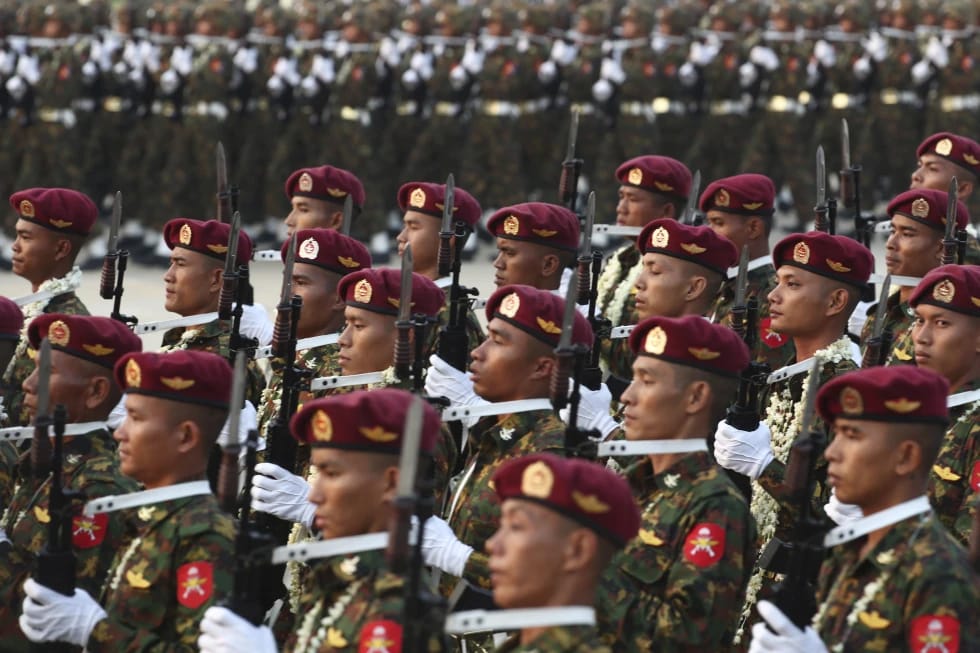

Myanmar begins conscription policy

Myanmar’s ruling junta will soon impose a military draft, seeking to reverse months of mounting losses to pro-democracy rebels and other armed groups.

Beginning in April, 5,000 people per month will be recruited into the military for “national defense duties,” AP reports. Critics said the regime is unlikely to put weapons in the conscripts’ hands, and that draftees were instead more likely to carry materiel. Myanmar’s military has a history of wielding porters as human shields, the New York Times reports.

In declaring a draft, the military relied on a sixty-year-old law that has never been employed despite several previous decades of army dictatorship. Myanmar’s military retook power in a coup three years ago. It has since become embroiled in an increasingly costly conflict with a variety of armed groups, which have won a series of key battles against the military in recent months.

In the hours after the announcement, some people began queuing for visas at embassies and others fled to the Thai border, Radio Free Asia reports.

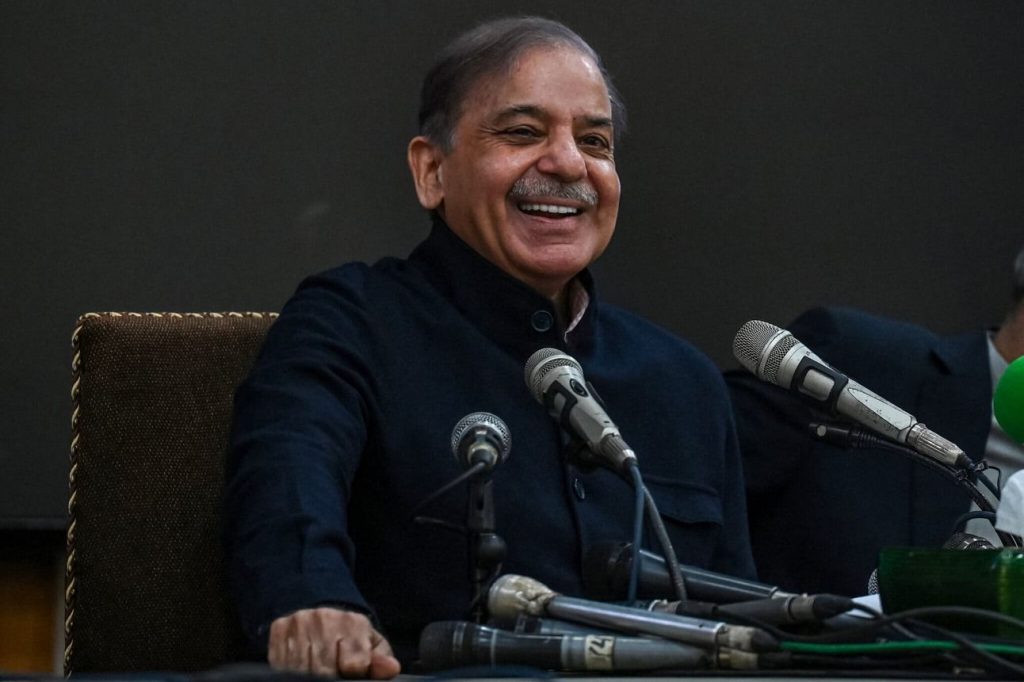

Pakistan’s establishment parties pick a PM

Cooperation between erstwhile political rivals in Pakistan has become the latest electoral maneuver to tip the scales away from former Prime Minister Imran Khan. Pakistan’s two dynastic parties agreed on Tuesday to form a coalition government, preventing candidates affiliated with Khan from governing despite having won the most seats in last week’s general elections.

Shehbaz Sharif, who was appointed prime minister by parliament after Khan was ousted in a vote of no confidence in 2022, will now serve an elected term. His coalition includes Pakistan Muslim League Nawaz, a party led by Nawaz Sharif (Shehbaz’s brother) and the Pakistan People’s Party. Perhaps most importantly, Shehbaz secured the support of the country’s military, the New York Times reports.

Khan was recently convicted on corruption charges and his party was barred from competing in the election. But the strategy has been far from successful at sidelining the competition. Independent candidates affiliated with Khan will now form the core of the parliamentary opposition.

Indonesia elects a new president

Current defense minister and former general Prabowo Subianto won a three-way election on Wednesday to become the next president of Indonesia. Prabowo won about 58% of the vote, Al Jazeera reports, eliminating the need for a runoff.

The election marks a remarkable resurgence for the 72-year-old Prabowo, who was removed from the army after being found guilty of kidnapping political opponents and banned from entering the US for two decades over human rights violations. His ascent was aided by his choice of running mate: Gibran Rakabuming Raka, the son of wildly popular outgoing President Joko Widodo.

While he has the support of Widodo, some analysts are concerned that Prabowo’s return is bad news for Indonesian democracy, and also potentially for the environment. He will now be tasked with developing a youthful economy at the forefront of the energy transition—Indonesia is the world’s largest nickel producer—and navigating the regional competition between China and the US.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Jordan’s king pushes for durable Israel-Hamas ceasefire

Jordan’s King Abdullah launched a diplomacy offensive this week aimed at raising international support for an immediate and “lasting ceasefire” in the war between Israel and Hamas. In Washington, speaking alongside US President Joe Biden, the King denounced Israel’s plans for an offensive into Rafah, where over a million Gazan refugees have sought refuge.

Biden also said he opposed an Israeli offensive in Rafah without a “credible plan” for the people taking refuge there. King Abdullah’s visit follows last weekend’s release of a video of the King personally airdropping humanitarian supplies over Gaza.

He also met with the UK’s Prime Minister Rishi Sunak and planned to meet France’s President Emmanuel Macron.

King Abdullah is popular and respected in the Middle East, despite his closeness to the US, but as the war in Gaza has shifted popular opinion in favor of Hamas and boosted anti-Israeli sentiment his vocal support for a ceasefire appears to be a bid to bulwark his credibility and potentially position Jordan as leading an Arab-owned, lasting peace and reconstruction process.

Path opens for Kuwaiti logistics firm’s $652m claim against Iraqi government

The International Centre for Settlement of Investment Disputes (ICSID) this week opened the door for a Kuwaiti logistics firm to press a claim for $652 million against Iraq for the alleged illegal expropriation of shares of a telecoms logistics and infrastructure joint-venture named Korek Telecom. ICSID annulled a previous ruling that dismissed Kuwait’s Agility Logistics’ claim of improper conduct and corruption around the 2014 expropriation.

ICSID annulments are rare—only 5% of ICSID awards are annulled despite 50% of awards receiving an annulment claim.

In May 2023, Agility won a separate $1.65 billion claim against Iraq Telecom and prominent Kurdish businessman Sirwan Barzani (related to the politically powerful Barzani family) for corruption and fraud in the same 2014 expropriation of Korek Telecom.

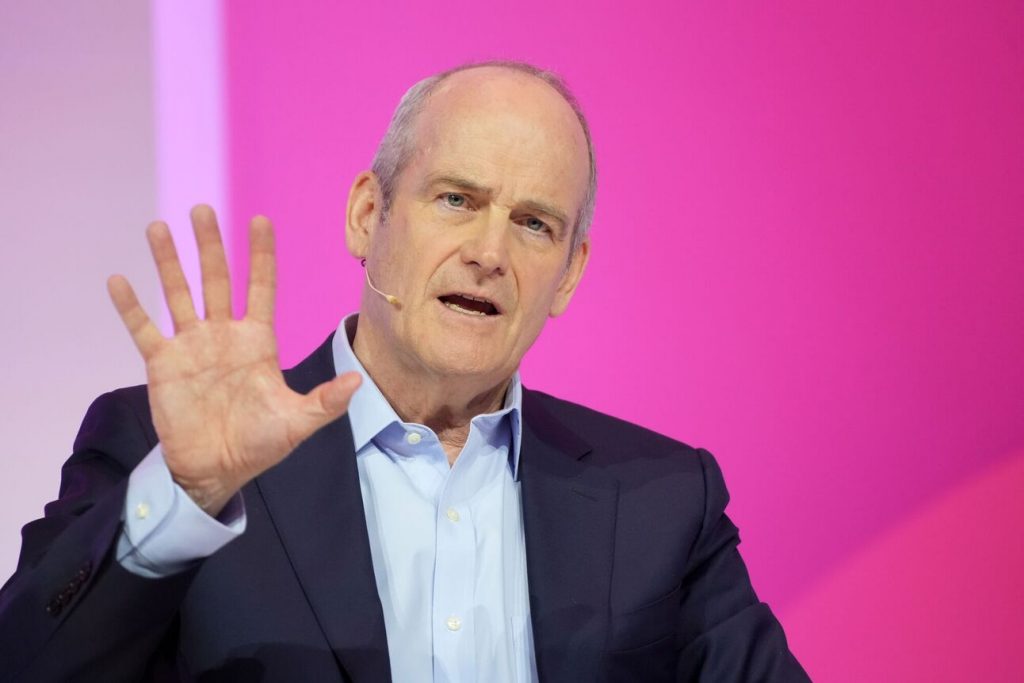

Chinese companies use BRICS expansion to sidestep challenges at home

Chinese tech firms are capitalizing on the recent expansion of the BRICS grouping to grow their business in the Middle East and reduce their reliance on the domestic Chinese market, Bloomberg reports. E-commerce giant Alibaba, for example, is partnering with companies in Saudi Arabia and the UAE, partly, according to the company’s president, Michael Evans, in response to shifting policy initiatives. Chinese President Xi Jinping’s years-long crackdown against the perceived growing power of private tech companies in China has slashed more than a trillion dollars off the valuations of Chinese tech companies.

Also this week, Abu Dhabi’s leading AI firm G42, which is backed by the UAEstate-owned Mubadala Group, said it was paring back its China exposurefollowing reports that the US is investigating the company for its ties to Chinese “military, intelligence services and state-owned entities.” In an interview with Bloomberg News, G42’s president said the firm has “already divested” all of its China investments, has “no need anymore for any physical China presence,” and has “pursued a commercial strategy since 2022 to fully align with our US partners and not to engage with Chinese companies.”

The UAE formally joined BRICS in January 2024. Saudi Arabia, which was scheduled to join the same month, has yet to formalize its membership.

China and GCC countries have been building their economic ties beyond BRICS membership, memorialized in an October 2023 China-GCC Economic and Trade Ministers meeting that identified “eight major steps to support the joint pursuit of high-quality…cooperation” and “greater development of bilateral trade and investment.”

Europe

German economic weakness undermines eastern neighbors

A sluggish economy in Germany is dragging down growth in Hungary, Poland, and Romania, Bloomberg reports. The EU’s largest economy accounts for 20-25% of exports for the region, but with German expansion forecast to remain tepid in 2023, Eastern European economies will rely more on shaky domestic demand for growth.

Hungary has been hit especially hard as its economy contracted for a fourth straight quarter at the end of last year. EU funding cuts over rule-of-law disputes exacerbated the impact of slowing German trade. Poland and Romania also stalled, defying expectations of expansion.

Eastern European nations’ hopes that consumers can pick up the slack might well prove ill-founded, as high inflation and interest rates will constrain household spending.

Latin America

Wall street battles against Venezuela sanctions despite Caracas’ broken promises

A group of powerful Wall Street investors lobbied to end US sanctions banning purchases of Venezuelan debt. They warned the ban allowed opaque Middle East buyers to accumulate bonds, likely as a front for Russia seeking influence in Latin America. When the ban was lifted last year, Venezuela’s bond prices surged, rewarding the investors with windfall gains.

Caracas has since reneged on promises of freer elections that led the US to ease sanctions. Opposition candidates have been banned and arrests of activists resumed. Just this week President Nicolás Maduro ordered the closure of the country’s UN human rights office. In response, Washington has reimposed some penalties, with more expected in April, but strong Wall Street pressure could again spare the sanctions on critical capital market access.

Critics argue the investors put profits over principles in Venezuela, while the regime remains repressive. The debt-trading ban aimed to choke off financing to the authoritarian government. Lifting it may have aided Moscow despite scant progress toward reforms.

Milei’s shock therapy delivers results—good and bad

Argentina recorded its first budget surplus in over a decade in January under President Javier Milei’s austerity plan, as tax revenues surged over 250% while public spending was slashed in half. But the reforms have also prompted a surge in inflation after Milei rapidly devalued the peso and removed subsidies.

The sharp rise in prices has prompted a reversal of an earlier trend that saw residents of neighboring countries travel to Argentina to buy key products. Residents of Argentina’s border regions are now heading to neighboring Boliviaand Paraguay, where prices can be 30-40% cheaper, to buy basic goods like rice and sugar, MercoPress reports. Local merchants report consumption down 50% or more.

Analysts expect the deep recession triggered by Milei’s shock therapy to persist through 2024. With poverty already above 40%, any Argentines face more hardship before any recovery emerges.

Global

EM oil producers test OPEC+ unity

OPEC is facing renewed compliance issues as key producers such as Iraq and Kazakhstan pump above agreed quotas. Iraq implemented just a third of its pledged cuts in January, while Kazakhstan conceded it exceeded limits.

With demand growth slowing, OPEC also slightly raised forecasts for non-OPEC supply. But the group’s unity is being tested. Angola’s exit from OPEC in late 2023 saw the oil cartel control less than half of output for the first time in decades.

- Three COP summit hosts unite to raise climate ambitions (Reuters)

- Saudi Arabia cites energy transition for oil capacity U-turn (Reuters)

Key to OPEC’s challenge is that emerging-market oil producers want to drill as much as possible before the energy transition leaves them with trillions in stranded assets. With alternatives to Gulf supply expanding in Latin America and Africa, OPEC’s ability to enforce market discipline and keep frontier producers in line is declining.

Fed policy hints at increasingly attractive EM local currency bond play

With the dollar at elevated levels after a decade-long rally, emerging market local currency bonds may be poised for a bull run, argues GMO Portfolio Manager Victoria Courmes in the FT. The dollar appears overvalued on many metrics, suggesting its strength may be peaking. Past dollar peaks have preceded rallies in foreign assets, especially EM debt, as currency translation effects boost returns.

High nominal interest rates in EM economies also enhance the appeal of local bonds, Courmes writes. And growth differentials that long favored the US are narrowing as countries such as Brazil and Indonesia gain ground. This improves the diversification value of EM debt versus equities. Frontier markets are also joining key bond benchmarks.

Given attractive valuations, growth trends realigning in EMs’ favor, and possible Fed policy pivots, investors are increasingly compensated for EM currency risks. The stage may be set for local EM debt to shine.

What we’re reading

Kenyan shilling soars after $1.5b bond issue eases default fears (FT)

Zimbabwe’s government considers using gold to back its currency (Bloomberg)

Zambia to buy all domestic agricultural output as drought threatens food production (Bloomberg)

Ghana replaces finance minister who negotiated $3b IMF bailout (FT)

Cocoa shortages force shutdowns at Ghana’s top processors (Bloomberg)

Nigerian nurses reject rules attacking job migration overseas (Semafor)

UK and Nigeria agree to boost trade and investment (Punch Nigeria)

Can Niger, Mali and Burkina Faso maintain growth outside ECOWAS? (The Africa Report)

African development lender looks beyond the continent for investors (Semafor)

IMF debt rules hinder Africa’s clean energy dreams (BNN)

Vietnam’s workers cash out pensions early ahead of new law (Nikkei)

World Bank approves shift to channel funds to Afghanistan humanitarian aid (Reuters)

Erdogan says Turkey ready to cooperate with Egypt on Gaza (Reuters)

Three dead, over 100 rescued in rains in Oman (Times of Oman)

US lawmakers pass anti-Assad Syria Anti-Normalization Act (The New Arab)

Santander denies breaching US Sanctions on Iran (Bloomberg)

Majority of Iranians shunning workforce amid rise in discontent (Radio Free Europe)

ACWA Power to build 1,000-megawatt solar power plant in Iraq (Iraqi News)

Two explosions rock Iranian gas pipelines (Radio Free Europe)

China’s oil imports from Iran ‘hit 11-month low’ (Bloomberg)

Romania growth slowed to 2% in 2023 (Romania Insider)

Russian gas will not flow via Ukraine in 2025: EU (Upstream Energy)

Russia puts Estonian prime minister Kaja Kallas on wanted list (The Guardian)

Russia lures migrant workers into Ukraine, only to put many on the front line (Bloomberg)

Russia ‘using Elon Musk’s Starlink in Ukraine’ (FT)

Georgia’s political shuffle comes at critical moment before elections (FrontierView)

Ecuador government weighs delaying closure of controversial ITT oil block (Mongabay)

Ecuador VAT hike narrows 2024 deficit (Fitch)

Venezuela troop build-up breaches international law, warns Guyana. (FT)

Peru’s president shuffles cabinet, tapping new economy and energy chiefs (Reuters)

Bitcoin and rule-of-law concerns ‘hinder El Salvador’s access’ to international markets (Americas Quarterly)