Frontier Markets Weekly, February 13th 2022

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

US aims to thwart China’s plan for Atlantic Base in Africa. The Biden administration is intensifying its campaign to persuade Equatorial Guinea to reject China’s bid to build a military base on the country’s Atlantic Coast, Michael M. Phillips writes in the Wall Street Journal. A delegation of senior US diplomatic and military personnel plans to visit the small Central African nation next week, according to government officials, and is expected to discuss American counter-piracy assistance and other inducements intended to convince Equatorial Guinean President Teodoro Obiang Nguema Mbasogo to spurn Beijing’s advances.

The visit coincides with rising American concern about China’s global expansionism and its pursuit of a permanent military presence on waters the US considers home turf. The Wall Street Journal reported last year that classified US intelligence reports suggest China intends to build its first Atlantic base in Equatorial Guinea, likely in the city of Bata. Bata already has a Chinese-built commercial port with water deep enough to dock naval vessels.

A military base in Bata would fit the Chinese model of integrating commercial and political ends, China experts say, because it would both give China’s military a place to refit and rearm warships in the Atlantic and give Chinese companies access to the interior of Central Africa via Equatorial Guinea’s excellent highways.

Ghana accuses ratings agencies of bias against Africa. Ghana’s finance ministry this week accused ratings firm Moody’s of using incomplete information in its rating process that demonstrated it was biased against African nations, Reuters reported. Moody’s became the second ratings firm in recent weeks to downgrade Ghana after Fitch cut the country’s credit ratings on concerns that it would be difficult for Ghana to issue bonds this year. Ghana’s existing debt is already trading at distressed levels, according to Bloomberg.

Ghana joins a host of other African nations—and beyond—that have rejected or appealed against ratings decisions in recent years, including Nigeria, Namibia, Tanzania and Zambia. In October 2021, Sri Lanka’s central bank in October said the ratings firm had been “irrational” and “lacked understanding” of the country’s financial strategies in its ratings decisions.

Moody’s last week increased concerns among African issuers about its reach and impact when it announced it was acquiring leading Africa-based rating firm Global Credit Rating Company Investors Service.

Uganda ordered to pay DRC $325 million in reparations. The International Court of Justice has ordered Uganda to pay $325 million to the Democratic Republic of the Congo for the prolonged conflict that erupted between the two countries in the 1990s, the WSJ’s Talal Ansari reports. The ruling segmented damages into three distinct sections: $225 million for damage to persons; $40 million for damage to property; and $60 million for damage related to natural resources.

The Hague-based court, a United Nations tribunal that handles disputes between countries, said the judgment amounts were within Uganda’s capacity to pay. Congo originally asked for more than $11 billion in damages.

The country first brought its dispute with Uganda, which borders Congo to its northeast, to the International Court of Justice in 1999. The yearslong conflict between the countries had triggered a rush for Congolese mineral wealth, drawing in neighboring countries in a conflict that left more than five million people dead.

Asia

Sri Lanka teeters on brink of sovereign bond default. Investors are becoming increasingly sure Sri Lanka will default on its sovereign bond obligations this year, the Financial Times reports. Investors “expect Asia’s top high-yield bond issuer to restructure its debt and call on the IMF for assistance as its financial crisis worsens,” the FT said, noting that the island’s crisis began “after a cascade of rating downgrades following large tax cuts in 2019 and the loss of tourism during the pandemic, leaving it unable to tap global markets.”

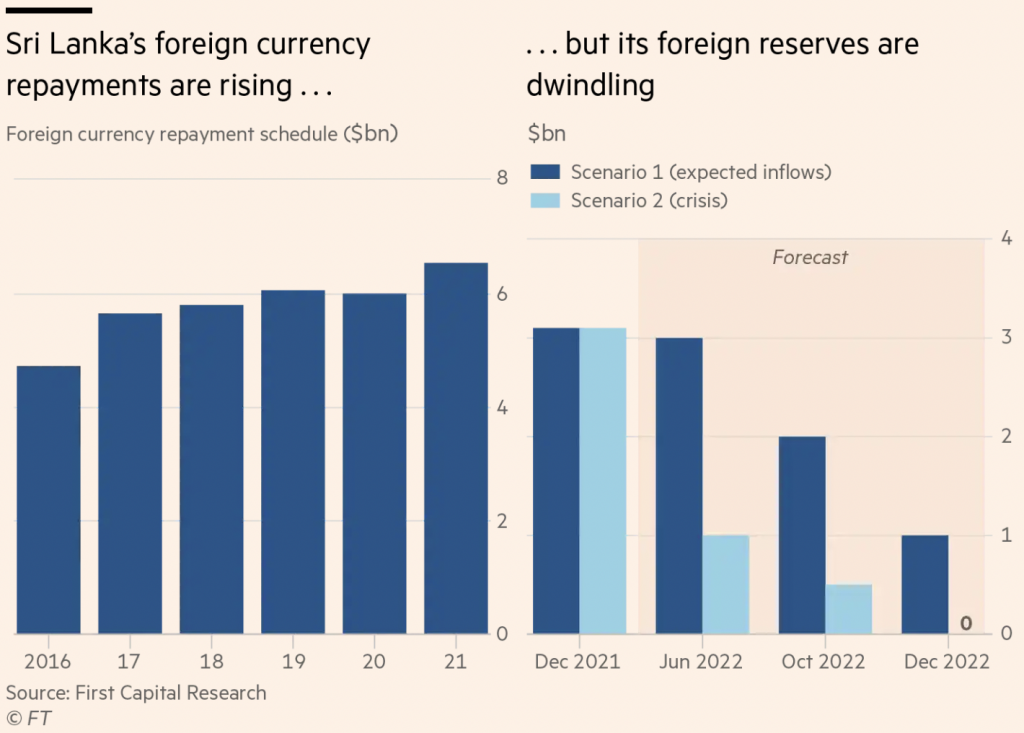

The numbers facing Sri Lankan authorities are daunting. With around $7 billion of debt obligations due this year and less than $3 billion in foreign reserves, the country has little chance of balancing the books without substantial external assistance.

Pakistan set to join MSCI FM100 index. Index provider MSCI on Thursday said Pakistan will be eligible for its Frontier Markets 100 Index and the Frontier Markets 15% Country Capped Index in May as part of its semi-annual review, The News Pakistan reports. Pakistan was dropped from the MSCI Emerging Markets Index in September 2021 after steady declines in both liquidity and market prices.

Pakistan’s benchmark KSE100 index has risen more than 50% since its early-pandemic low but it has still failed to recover to the all-time high it reached before its upgrade from frontier- to emerging-market status in 2017.

Europe

US and Russia pull out diplomatic staff from Ukraine. The US suspended consular services in the Ukrainian capital and ordered most embassy staff to depart after warning that a Russian military invasion could happen at any moment, Yaroslav Trofimov and Brett Forrest report in the WSJ. Moscow also began withdrawing its diplomatic presence from Ukraine.

The developments further ratcheted tensions after Washington warned on Friday that Russia could launch a massive military operation against Ukraine, with tens of thousands of casualties, in the coming days. President Biden in a phone call on Saturday warned his Russian counterpart Vladimir Putin of “swift and severe costs” if Russia moves against Ukraine.

The discussion didn’t bring any breakthrough and there was “no fundamental change” in the dynamic, a senior administration official said Saturday. Mr. Biden put more ideas on the table to help persuade Mr. Putin not to invade Ukraine, but officials were mum on how those proposals were received or if any of them were new.

US troops arrive in Romania to bolster eastern flank against Russia. The first contingent of a US troop deployment to Romania arrived last weekend, Reuters reports. The troops are part of a planned 3,000-person contingent heading to Polandand Romania that will help reinforce NATO allies on the eastern flank following the Russian military build-up on Ukraine’s border.

France said it also plans to send troops to Romania and has offered to be the lead nation of a future NATO mission, which could see about 1,000 troops deployed from various countries, Reuters wrote.

Latin America

Costa Rica election rout highlights political cost of IMF involvement. Costa Rica’s ruling Citizens’ Action Party was “effectively erased” from the country in national elections, AP reports. According to preliminary results, outgoing President Carlos Alvarado’s party got less than 1% of the votes, failing to earn even a single seat in the Legislative Assembly. The massive defeat reflected frustrations around corruption scandals, a controversial fiscal reform, and elevated unemployment.

While the runoff for president pits two business-friendly candidates against one another, according to FrontierView, implementing additional tenets of an ongoing IMF arrangement will be difficult with no party gaining a majority in the legislature. Additionally, the effects of tax reform and government spending adjustment at a time when tourism revenues are weak will only add to popular resentment of the IMF deal. —Ken Stibler

Global

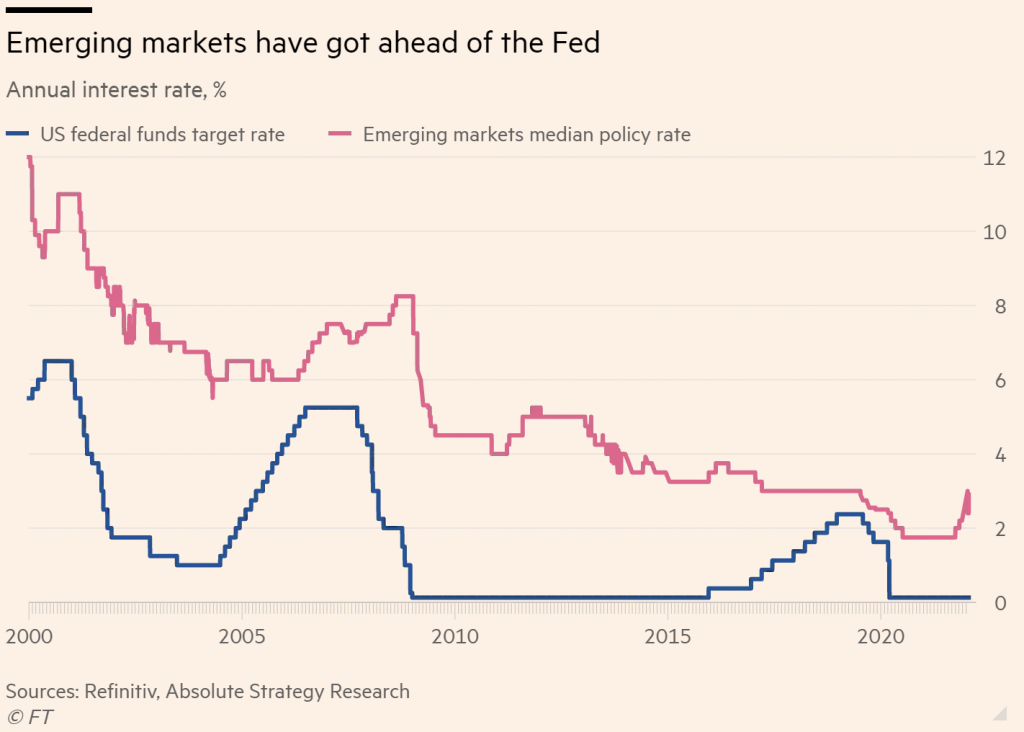

EM central banks tightening cycle slows. Emerging market central banks appear to be nearing the end of tightening cycles as the US Federal Reserve inches towards rate rises, the FT’s Jonathan Wheatley reports. While emerging-market central banks typically follow the Fed’s lead, high inflation, vulnerable populations and risks for large outflows prompted policymakers from Russia to Peru to begin raising rates in large increments last year.

Thirty-three developing countries have raised rates since the start of last year by a combined total of 84.55 percentage points, according to Central Bank News. Latin America’s experience with debilitating inflation means the region’s independent central banks have been tightening even more aggressively than many of their peers. Brazil last week pushed up rates to 10.75% after inflation ended 2021 in double digits, while Mexico, Peru, and Colombia have also recently tightened policy sharply.

Such policies have bolstered market confidence, but additional increases would risk triggering recession as radical tightening has been ineffective at addressing supply-side issues, which risk becoming entrenched. The economic and political threat of inflation appears to have prompted such an aggressive response that high-interest rates might be jeopardizing recovery amid slowing growth and high debt levels. —Ken Stibler

Efforts to stem inflation get unorthodox. As monetary policymakers struggle to rein in inflation around the world, some emerging economies have begun adopting price controls. Last week, Colombia announced measures such as capping costs for agricultural imports and launching new subsidies after inflation doubled its 3% target for January.

Hungary, Serbia, and North Macedonia are also experimenting with price controls, freezing prices for energy, food and mortgages. But some consider such controls extreme. A policymaker in Poland, for example, prompted uproar with a proposal to regulate bread, sugar and flour prices.

These policies, now adopted by right-wing administrations facing restive electorates, were previously derided by the right and by mainstream economists as ineffective and distortionary. But embattled presidents facing upcoming elections are increasingly considering price controls, despite the risks—just like with over-accommodative monetary policies—of causing hangovers for economies already dealing with supply-side issues. The economic and political threat of inflation appears to have prompted such an aggressive response that high-interest rates might be jeopardizing recovery amid slowing growth and high debt levels. —Ken Stibler

What we’re reading

Nigeria goes after illegal oil refineries to curb pollution. (Reuters)

China built Congo a toll road that led straight to the ruling family. (Bloomberg)

Chinese funding of sub-Saharan African infrastructure dwarfs that of West, says think tank. (Reuters)

Xi says Egypt and China hold similar visions and strategies. (Al Jazeera)

Taliban detain Westerners in Afghanistan, damaging relations with foreign capitals. (WSJ)

Tensions rise on Afghanistan-Pakistan border. (The Guardian)

Calls to boycott Hyundai rise in India after social-media post about Kashmir. (WSJ)

Bangladesh sees 6.94% economic growth in 2020-21 fiscal year. (Business Standard)

Thai central bank prioritizes growth over taming inflation for now. (Nikkei)

Cambodia shoots for ‘green ASEAN.’ (Phnom Penh Post)

Six opposition parties mull alliance to challenge Cambodia’s ruling party. (Radio Free Asia)

Uncertainty grows in Iraq following postponement of the presidential election. (FrontierView)

US-backed forces hunt for Islamic State militants who fled Syria prison. (WSJ)

Israel launches investigation into ballooning spyware scandal. (WSJ)

Biden’s elevation of energy-rich Qatar stuns Japan. (Nikkei)

Russia moves to recognize crypto as a form of currency. (Blockworks)

Russia’s Gazprom hails new 30-year gas deal with China as sign of strengthening ties. (Caixin Global)

Lithuania seeks permanent US Military presence. (Radio Free Europe)

Romania wants new talks with Russia on unreturned gold. (BalkanInsight)

A who’s who of Daniel Ortega’s critics are on trial in Nicaragua. (WSJ)

Argentina joins China’s Belt and Road initiative, eyes $23 billion investment. (Buenos Aires Times)

Venezuela’s Guaidó, opposition seek to unite under big tent. (AP)

Former Honduran President Hernández Barred From Entry Into U.S. (WSJ)

China is building a nuclear power plant in Argentina as it looks to Latin America. (South China Morning Post)

IDB Approves $200 Million to Support Paraguay’s State Transformation Process. (IDB)