Frontier Markets Weekly, December 17th 2023

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Somalia wins long-sought debt relief

The IMF and the World Bank approved $4.5 billion in debt relief for Somalia on Wednesday, capping almost a decade of negotiations to allow the East African country to rejoin the global financial system.

The deal will reduce Somalia’s debt as a percentage of GDP from 64% to just 6%, according to a joint press release by the IMF and World Bank. The deal was heralded as a “milestone” by both lenders and the Somalian finance ministry. Decades of civil war, insurgency, famine, and economic morass have kept Somalia out of the global financial system for 30 years, the Economist reports.

The deal also includes $3.5 billion in debt forgiveness from bilateral and commercial creditors, the African Development Fund, and other multilateral institutions. It will allow Somalia to access concessional loans, which could help the country fund job-creation and poverty-reduction programs, FT reports.

Kenya seeks to boost tourism amid electricity woes

Kenya will drop all visa requirements for incoming visitors, Kenyan President William Ruto announced on Tuesday as the country recovered from its third major blackout in four months.

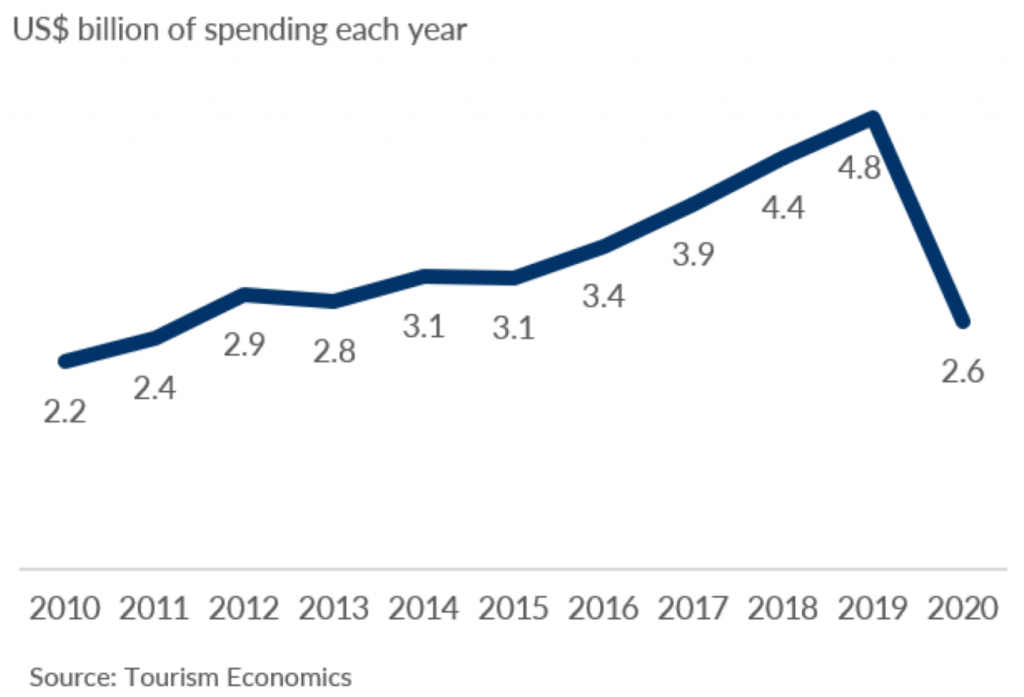

Beginning in January 2024, visitors to Kenya will need to receive only an electronic travel authorization. The country previously required visitors to complete an application process to receive an official visa. The move is aimed at bolstering tourism to Kenya, which remained at 72% of prepandemic levels in 2022, according to the country’s tourism ministry. Prior to the pandemic, tourism accounted for 8% of Kenyan GDP, according to a report by Oxford Economics.

The announcement of the visa program comes amid a worsening economic outlook in Kenya, highlighted by increasing blackouts. Darkness engulfed Nairobi last weekend, with power losses extending to two terminals at the country’s largest airport. Kenya is primarily powered by renewable energy, but aging infrastructure and corruption have made its electricity grid unreliable, even as power taxes have risen, the New York Times reports.

US-Africa trade hits record level

The US announced on Wednesday that it signed 550 new trade and investment agreements with Africa this year worth a total of $14.2 billion.

That marks a 67% increase in dealmaking from last year, when President Joe Biden said he would “pull out all the stops” for the continent, Africanews reports. Earlier this month, the US committed to investing $55 billion in Africa over the next three years.

The flurry in investment comes amid increasing jostling for influence in Africa. Both China and Russia have made inroads in the continent in recent years, with China financing one-third of all African infrastructure contracts valued at $50 million or more last year, SCMP reports. Meanwhile, Russian mercenaries affiliated with the Wagner Group have become common in many African countries battling rebel insurgencies.

Asia

As fear of collapse grows, Myanmar turns to opium production

Myanmar has overtaken Afghanistan as the world’s largest producer of opium, the UN said in a report on Tuesday.

Opium cultivation in Afghanistan has fallen 95% since the country’s Taliban government introduced a drug ban last year, according to the UN report. Much of that global supply has shifted to Myanmar, where ongoing civil war has stoked instability and prompted speculation that the country’s ruling military could soon collapse.

Production of opium expanded most in Myanmar’s northern Shan state, which borders China. The state has also been home to the greatest battlefield challenge to the military, causing concern in Beijing of spillover. China brokered talks on Monday between rebel groups in Shan and the junta government, AP reports, but the rebels reportedly remain committed to ending military rule in Myanmar.

Vietnam upgrades China ties

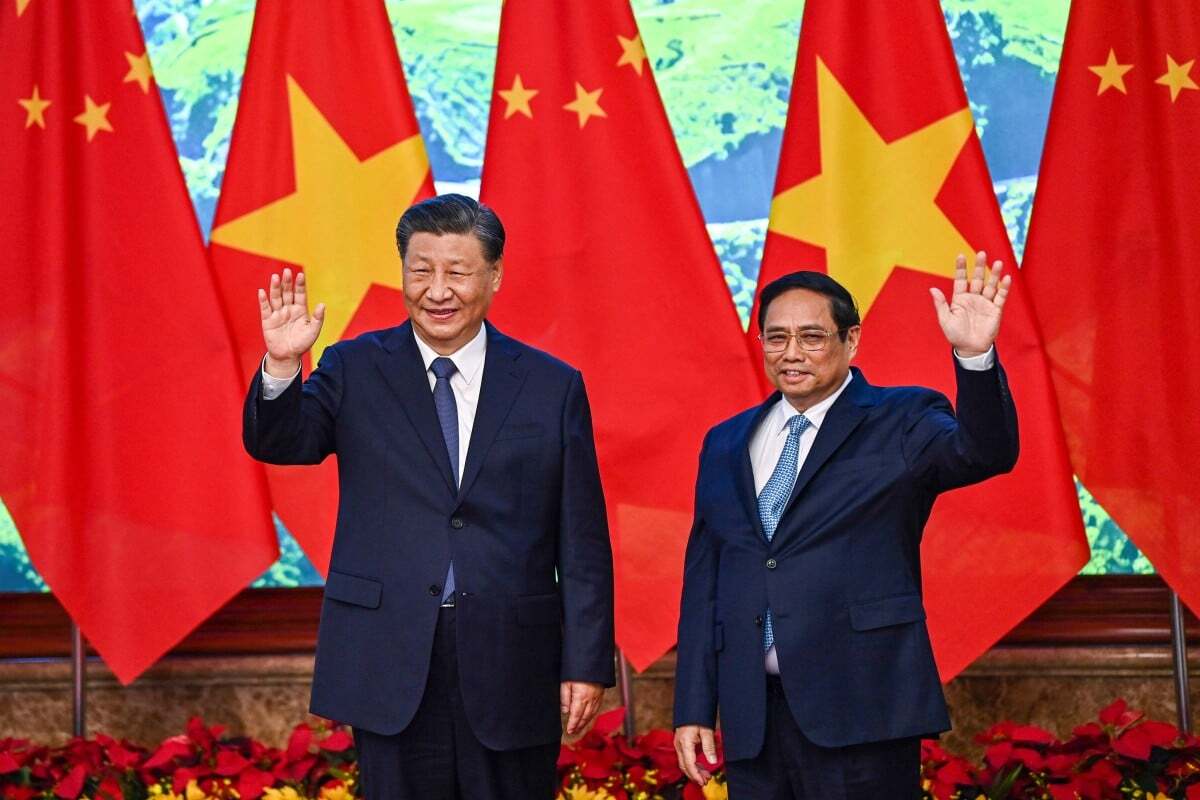

Vietnam and China announced plans to increase security cooperation and build a “shared future” during a visit by Chinese President Xi Jinping to the southeast Asian country this week.

The two countries, which are closely linked economically but at odds over territorial disputes in the South China Sea, also agreed to boost multilateral coordination including intelligence sharing, their leaders said in a joint statement on Wednesday. They signed 36 cooperation agreements in total, including deals on the digital economy, infrastructure and green development, SCMP reports.

China has long been one of Vietnam’s closest partners, but Hanoi has bolstered its ties with other governments in recent months. In September, Vietnam and the US upgraded their relationship to a “comprehensive strategic partnership,” Vietnam’s highest diplomatic ranking and the same way Hanoi describes its relationship with Beijing. Two months later, Vietnam did the same with Japan.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

COP28 resolution on phasing out fossil fuels “acceptable” to Saudi Arabia

Climate representatives at the COP28 summit in the UAE this week agreed on a deal to transition away from fossil fuels in order to reach global net zero emissions by 2050, the FT reports. The agreement asks countries to set aggressive emissions targets over the next two years to limit global warming, but noted that targets should take into account fossil fuel use and be set “in light of different national circumstances.”

According to a Reuters report citing unnamed sources in Saudi Arabia, the specific inclusion of “different national circumstances” was key to making the accord more agreeable to the kingdom, which has in the past opposed such explicit language on phasing out fossil fuels. Earlier in the summit, Saudi opposition to the inclusion of such language contributed to a much-criticized draft agreement that avoided reference to fossil fuels.

Iran’s government in spotlight over $3.7 billion corruption case

Opposition leaders in Iran have increased criticism of the government for its handling of a record-breaking corruption scandal affecting the country’s limited official foreign reserves accounts. Some $3.7 billion in official subsidized foreign currency reserves, earmarked for use below the official exchange rate to support imports of key goods into Iran’s struggling economy, were instead diverted to a tea company, which then resold the dollars on the black market at a higher price.

Subsidized dollars such as the ones involved in this case are distributed by the government, and are supposed to be tightly controlled, leading opposition leaders to question the degree of official involvement in the scandal, which had gone undetected since 2017. No specific officials or government departments have been accused, but the timing is certainly inconvenient politically, given the Iranian government’s efforts this week to formalize deeper military and economic ties with Russia and China.

Reuters reported this week that Russia and Iran are working on a new “major new interstate agreement,” and Iranian state-media confirmed talks had taken place on a free-trade agreement between Iran and the Eurasian Economic Union. Iranian state-media also reported that Tehran and Beijing are advancing discussions on developing unified trade standards to expand trade to other sectors.

Europe

Bulgaria unwinds tax on Russian gas after Hungarian threats

Bulgaria scrapped a recently imposed tax on Russian gas transiting its territory, after Hungary threatened to block Sofia’s bid to join the EU’s Schengen area, the FT reports. The tax, introduced in October as an attempt to limit Russian gas access to the European market, faced opposition from Hungary and Serbia.

Hungary’s gas ultimatum comes as Orbán, perceived as Vladimir Putin’s closest partner in the EU and NATO, hinders EU cooperation on multiple fronts. The Bulgarian government, keen to advance its Schengen aspirations, swiftly responded to Hungary’s threat by reversing the gas transit tax, emphasizing the importance of not jeopardizing Schengen accession. Despite this concession, Bulgaria expressed its intention to seek an EU-level equivalent tax to maintain pressure on member states to reduce dependence on Russian hydrocarbon imports.

Approximately half of Russia’s pipeline supplies to the region transit Bulgaria, with Hungary as a major end customer.

Ukraine fails to secure long-term financial aid from US and EU

Ukraine’s President Volodymyr Zelenskyy faced disappointment this week as both the US Congress and EU leaders failed to secure approval for financial aid packages totaling $115 billion. The US Congress, despite Zelenskyy’s personal lobbying efforts in Washington, could not pass a $60 billion support package. Meanwhile, an EU summit ended without an agreement on a €50 billion four-year funding for Ukraine, though membership talks with Kyiv were initiated, the FT reported.

The inability to secure long-term financial stability for Ukraine comes at a critical juncture as its counteroffensive struggles against Russian occupation, and winter approaches with renewed aerial attacks on vital infrastructure.

While both the EU and US have been major suppliers of military and financial aid to Ukraine, recent pledges of significant new aid have diminished. Kyiv may be forced to print money to fund its budget, risking economic stability.

Latin America

Investors cautiously optimistic over Argentina’s first round of shock therapy.

Argentina’s new government, led by President Javier Milei, began a series of widely anticipated—and in some cases feared—shock therapy measures to address the country’s deepening economic crisis. Economy minister Luis Caputo unveiled a comprehensive nine-point plan that included devaluing the peso by over 50% and cutting government spending by around 2% of GDP while raising transfers to the poorest Argentines.

The government’s goal to stabilize the economy and stimulate private-sector-led growth has garnered praise from the IMF, The Guardian reports. Kristalina Georgieva, the managing director of the IMF, said the policy changes were “an important step toward restoring stability and rebuilding the country’s economic potential.”

While investors also expressed confidence in the government’s moves, concerns linger about the potential short-term pain associated with the austerity measures.

Brazil reforms region’s most complex tax system

Lawmakers have successfully passed a landmark constitutional amendment to revamp Brazil’s notoriously complex tax system, a move long-awaited by businesses and investors who viewed the existing rules as barriers to economic growth, the FT reports. The reform, approved by the lower house of Congress, aims to simplify levies on goods and services by replacing five separate consumption taxes with a dual Value-Added Tax (VAT) system which will rank as one of the world’s highest consumption taxes.

The new system, to be phased in over eight years starting in 2026, comprises federal and regional components designed to enhance efficiency and reduce legal uncertainty. Proponents believe that the reform could significantly boost economic growth, potentially adding up to 2.39% to GDP over the next eight years.

President Luiz Inácio Lula da Silva and Finance Minister Fernando Haddad see the passage of the reform as a political victory, breaking a decades-long deadlock on comprehensive tax reform. Some are concerned, though, that the passage of the tax reform followed record allocations of funds to lawmakers for projects in their home states, revealing the government’s reliance on grants to drum up votes to advance its economic agenda, AP reports.

What we’re reading

ECOWAS extends olive branch to Nigerien junta as threats of invasion fail (The Africa Report)

Why consumer goods multinationals are fleeing Nigeria (Semafor)

Niger aims to start oil exports from Benin pipeline in January, leader says (Reuters)

Ethiopia bondholder call scheduled for Thursday as default looms (Reuters)

Analysis: The Sahel continues to burn as the world focuses elsewhere (Soufan Center)

Nearly 50 million facing hunger in West and Central Africa as conflict spreads (Reuters)

Bboxx lands $100m investment for African ‘electrification platform’ (Press release)

Pakistan leads Asia’s frontier markets in 2023 (PT Profit)

Myanmar economy to stagnate as fighting escalates at border (Nikkei)

Indonesian coral reefs to get UN-backed weather insurance (Nikkei)

Papua New Guinea in advanced talks with Chinese banks to fund its stakes in LNG megaprojects (Reuters)

Sudden influx of Venezuelan fuel oil shaking up Asian markets (Bloomberg)

IMF approves $900m payout for Ukraine (Bloomberg)

EU agrees to open membership negotiations with Ukraine and Moldova (Radio Free Europe)

Iran lifts visa rules for 33 countries including Gulf states (Reuters)

Iraq links Baghdad US embassy attackers to security services (Al Jazeera)

Oman’s $47b sovereign wealth fund eyes IPO spree after record listing (Bloomberg)

India and Oman begin talks on free trade pact (Economic Times)

Shipping firms suspend Red Sea traffic after Yemen rebel strikes (France24)

Diplomatic spat erupts over claims UAE shipped weapons to Sudan(Bloomberg)

IMF approves $900m payout for Ukraine (Bloomberg)

EU agrees to open membership negotiations with Ukraine And Moldova (Radio Free Europe)

EU to unblock €10b for Hungary after Orban threatens to block Ukrainesupport (FT)

Poland’s new PM Donald Tusk vows to ‘chase away the evil’ after parliament backs him as new PM (The Guardian)

The US is restricting visas for nearly 300 Guatemalan lawmakers, others for ‘undermining democracy’ (AP)

How coal giant Colombia is trying to wean its economy off fossil fuels (Bloomberg)

Venezuela and Guyana agree not to use force over Essequibo dispute (Mercopress)

Brazil to resume electricity imports from Venezuela after four years (Reuters)

The world’s poorest countries buckle under $3.5 trillion in debt (Bloomberg)

Poor countries’ debt costs to hit ‘crisis’ levels, as interest rates force repayment or investment decisions says World Bank (FT)