Frontier Markets Weekly, August 20 2023

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up at FrontierMarkets.co to receive FMN in your inbox every week.

By Dan Keeler, Ken Stibler, Noah Berman and Nojan Rostami

Africa

Nigeria backpedals on fuel price hike

In an attempt to cool rapidly rising inflation Nigeria is to stop raising fuel prices, months after President Bola Tinubu ended a longstanding subsidy that kept petroleum prices low but cost the government $10 billion a year.

The move to slow the subsidy’s removal highlights tensions between frontier economies and foreign investors. While the elimination of the subsidy—as well as another measure to normalize the country’s exchange rate—was lauded by investors and encouraged by economists, inflation has soared to an 18-year high, heightening a cost of living crisis, Reuters reports. Nigerian eurobonds have become the worst performers in emerging market credit amid fears that Nigeria would reverse its reforms, according to Bloomberg.

Tinubu is weighing alternative forms of fundraising. On Tuesday, government officials announced it would consider selling stakes in 20 state-run companies. These could include the Nigerian National Petroleum Corporation, which state media has called the largest company in Africa.

Kenya reinstates fuel subsidy

Kenya has also had to modify its strategy around fuel prices and this week reinstated a subsidy to stabilize prices for the next month, its energy regulator said.

As in Nigeria, a newly inaugurated president has been attempting to balance reforms required by the IMF with a cost of living crisis. President William Ruto removed popular fuel and maize subsidies shortly after taking office last September, and the IMF approved a $2.3 billion bailout package for the country in May this year.

The scrapping of the subsidies, in addition to higher petroleum taxes, have since prompted violent anti-government protests, Al Jazeera reports.

Critics accused Ruto of backtracking on his reforms, according to The Africa Report. The latest move could also draw pushback from the IMF, local outlet The Standard reports.

Mozambique preps for carbon credit projects

Mozambique will begin regulating carbon credit projects next year, Bloomberg reports.

The country has the potential to generate between 80 and 90 million carbon credits a year, with each credit representing one ton of carbon dioxide removed from the atmosphere or prevented from entering it. Mozambique’s finance ministry, which is currently creating a climate-finance unit, said the country could earn $1 per credit sold, although the revenue split between investors and the state has not yet been set.

Mozambique is also in talks with Belgium over a debt-for-nature swap, which could conclude by the end of this year, Belga News Agency reports,

Mozambique’s move follows similar announcements by Kenya, Mali and Zimbabwe, and Gabon this week finalized the continent’s first debt-for-nature swap.

Asia

Indonesia poised to launch high-speed rail link

After years of delays, Indonesia expects to open a commercial high-speed rail service in October, Nikkei reports.

The service’s first line will be between Jakarta and Bandung, a city of almost 2.5 million that lies 90 miles southwest of the capital. The Indonesian-Chinese consortium building the railroad, Kereta Cepat Indonesia China, had originally planned to begin high-speed operations in 2018, and some analysts question whether the project will attract enough riders to recoup its $7 billion cost, the Diplomat reports.

The new link is expected to be the first of a series of high-speed rail lines in Southeast Asia. Malaysia, Thailand and Vietnam are all reportedly considering projects.

Thai court rejects top candidate’s PM bid

The Constitutional Court of Thailand dismissed a motion on Wednesday to re-nominate Pita Limjaroenrat for prime minister. Limjaroenrat’s pro-democracy Move Forward Party won the most votes in May elections, but his ascent to prime minister has been blocked by unelected elites in the Thai senate.

The move follows a split between Move Forward and former allies Pheu Thai, previously a leading pro-democracy party in Thailand, over the power of the military. Move Forward has supported proposals that would curtail military power. On Thursday, the pro-military Bhumjaithai Party said it would join a coalition led by Pheu Thai to form the country’s next government, the AP reports.

Instability triggered by the election of another pro-military candidate could deter foreign investment in Thailand, analysts believe. “If the current standoff over the prime ministership results in violent street protests, which is now a real possibility, it will only further scare off investors who are looking for options other than China,” writes Joshua Kurlantzick, Senior Fellow for Southeast Asia at the Council on Foreign Relations. The next vote for prime minister is scheduled for Tuesday.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Iran and Saudi Arabia continue diplomatic thaw

Iran’s Foreign Minister Hossein Amir-Abdollahian met with his Saudi counterpart Prince Faisal bin Farhan in Riyadh this week as the countries continue to normalize relations and restore diplomatic ties, The Guardian reports. An Iranian statement issued after the meeting on Thursday called it another step in a “regional dialogue” meant to “help the unity of the Islamic world” as relations between the two regional powers are progressing “on the right track.“

Amir-Abdollahian extended his trip, initially meant to be a one-day visit, to meet Saudi Crown Prince Mohammed bin Salman. However, despite rosy readouts of the meetings by Saudi Arabian and Iranian officials and state media outlets, no details were given on recent points of tension such as the disputed claims over the Al Durra gas field.

Protests erupt in Syria over subsidy cuts

Syria doubled public sector pay and simultaneously cut subsidies overnight as the Syrian pound sank to a new record low against the US dollar on the local parallel currency market, the BBC reports. The pay rise benefits civil servants, the military, and government contractors, and was accompanied by a more general increase in the national minimum wage as hyperinflation and currency depreciation have pushed some 90% of Syrians below the poverty line.

The end of subsidies–especially a popular fuel subsidy–had an immediate effect on price levels in Syria, counteracting some of the benefits of the pay rises and triggering protests across Syria—even in cities considered to be government strongholds.

While protests were especially intense in the ethnically Druze city of Sweida, they were also seen in Damascus, as transport workers organized limited work stoppages, slowing down the capital city.

Oman economic diversification gathers pace

Oman took several large steps in its plans to transform its energy industry this week, as it welcomed the world’s first liquified hydrogen transport ship, the Japanese tanker Suiso Frontier, to begin the process of familiarizing its blossoming hydrogen industry with the cutting-edge technology in hydrogen energy storage and transport.

Earlier this year, Japan and Oman signed a series of partnership agreements on green technology, as Oman looks to diversify its economy by investing in new fields such as hydrogen, ammonia fuel, and carbon recycling with the help of Japanese companies.

More traditional parts of Oman’s economy also saw progress, with the state-owned Oman LNG signing a milestone supply deal with German customers. And data released this week signaled a continuing employment boom as some 18,000 new jobs were created in the first half of this year, putting Oman well ahead on meeting its target employment numbers for the year.

Europe

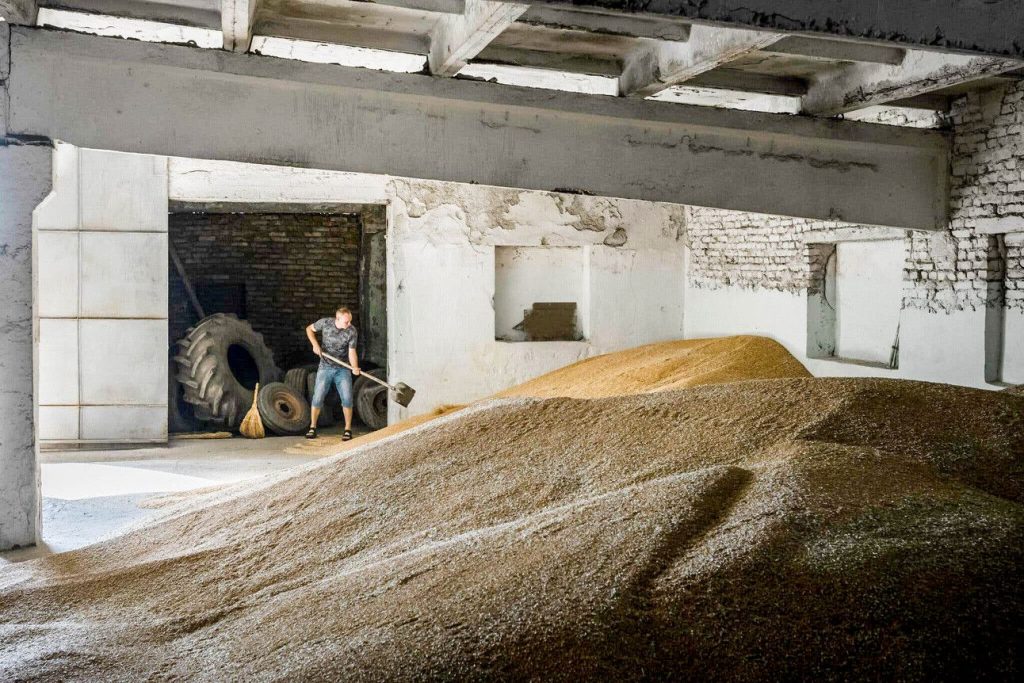

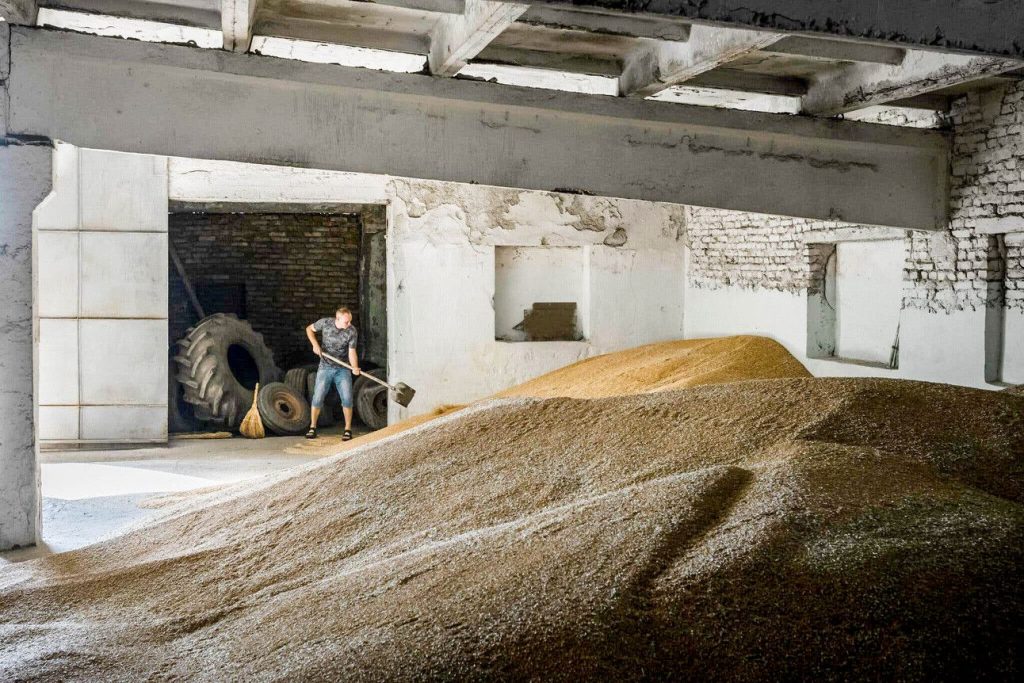

Romania finds a niche as the lifeline for Ukrainian grain exports

Approximately 60% of Ukraine’s grain exports could reroute through Romania following Russia’s abandonment of a UN-brokered safe passage deal through the Black Sea. Ukrainian grain exports are integral to the nation’s economy, and Romania’s Black Sea port of Constanta has already emerged as a major alternative shipping route, facilitating the transport of 8.1 million tonnes of grain in the first seven months of this year and 8.6 million tonnes in 2022.

Romanian Prime Minister Marcel Ciolacu highlighted efforts to improve connecting infrastructure, including rail, road, river, and sea, as well as border crossings, to accommodate the increased grain transit.

Given the risks associated with waterways around Ukraine, the Sulina Channel, situated within the Danube delta, has emerged as a pivotal conduit for grain shipments. This channel, under NATO’s protective cover, has served as a secure lifeline for Ukrainian exports.

While considerations are being made for exporting Ukrainian grain through Polish, Baltic, and Adriatic ports, the Danube link has proven most efficient, according to the European Commission’s top transport official, Magda Kopczynska.

Russia moves to prop up rouble as economy ‘hits its speed limit’

Russia’s central bank has suspended foreign currency purchases on the domestic market for the remainder of 2023 as part of a broader effort to mitigate the ruble’s volatility and bolster the currency, which this week hit a 16-month low against the dollar. The central bank is hoping the move will help insulate Russia’s economy from fluctuations in commodity prices.

The ruble’s value has been eroded by increased government spending, falling energy revenues and capital flight as individuals and foreign companies move money abroad. Major Russian exporters, a critical source of hard currency for the nation, have faced declining proceeds, impacting the inflow of foreign currency.

Russia’s central bank has raised its key interest rate 3.5 percentage points to 12 percent. With trade conditions showing no sign of improving, however, continued depreciation remains likely.

Latin America

Colombia angles for trade concessions from US

Colombia’s President Gustavo Petro this week launched an effort to improve the terms of an 11-year-old free trade deal with the US that he believes has disadvantaged Colombia. Petro said the deal effectively limits Colombia’s corn production, leaving it relying on imports.

If the country’s agriculture sector were to produce all the corn it currently imports, Petro believes it could create 1.2 million jobs. This move reflects Petro’s belief that Colombia should focus its economy on production rather than extraction.

The US remains Colombia’s largest trading partner: Colombia sold 25% of its $57 billion exports to the US last year, and the FTA has fostered increased trade between the two countries, with over 11,000 Colombian products enjoying zero tariff access to the US.

Markets wobble after anti-establishment candidate wins Argentina presidential primary

Javier Milei’s unexpected win in Argentina’s presidential primary poll has sent shockwaves through the nation’s financial landscape, hinting at a pronounced rightward shift ahead of the October election. A radical libertarian economist and former TV personality, Milei clinched 30.1% of the vote—narrowly beating his two main rivals who received 28% and 27%.

Advocating extreme austerity and the dollarization of Argentina’s economy, Milei aims to push boundaries, threatening to overshoot IMF targets and institute sweeping reforms.

The immediate market response to Milei’s triumph was swift and intense. Both equities and bonds sank in Monday trading and the central bank devalued the currency by 20% and raised the basic interest rate by 21 percentage points to reach an annual rate of 118%. This move was aimed at instilling market confidence but led to immediate consumer price hikes.

Global

Russia’s ghost fleet highlights EM’s first loyalty trade

A sprawling fleet of ships, many under ownership from Greece, India, UAE, and Turkey, forms a pivotal part of Russia’s global oil supply strategy while bankrolling its Ukraine conflict, the WSJ reports. To skirt Western sanctions, these vessels operate outside industry norms, sidestepping insurance from P&I Clubs, a global network that typically insures 90% of commercial shipping.

The ships, often aging and frequently changing hands, raise concerns about safety, environmental impact, and Russia’s responsibility in case of accidents.

In the midst of this intricate landscape, US and allied officials are scrambling to tighten sanctions enforcement, focusing on countries like Turkey, which have expanded trade with Russia. At the same time, the fleet’s operations are helping reshape oil markets globally, allowing Russia to bolster its position during the ongoing conflict.

This raises concerns within NATO, where Turkey’s actions are undermining its efforts to mend ties with the US. But despite initial success, American-led sanctions on Russia’s oil sales seem to be faltering, and recent price surges suggest that Russia continues to export at higher prices, bypassing restrictions.

What we’re reading

South Africa’s opposition parties team up in bid to unseat ANC (AP)

Kenya in talks with World Bank to boost ‘hustler fund’ lending (Bloomberg)

Foreign powers jockey for position in Niger (Bloomberg)

Release of detained commander eases tensions in Libya’s Tripoli (Al Jazeera)

Bangladesh debt to China and Russia fuels forex fears (Nikkei)

ASEAN markets grow cautious as China’s property crisis worsens (Nikkei)

US asks Iran to stop selling drones to Russia (FT)

Iran grapples with unintended consequences of ultra-cheap petrol (FT)

UK invites Saudi crown prince Mohammed bin Salman to visit (Reuters)

Iraq’s National Security Council approves joint strategic agreement with US (Al Araby)

US envoy visits Gulf to help expand Yemen truce and launch peace process (Reuters)

Drilling rig arrives in Lebanon to begin offshore exploration (Reuters)

Kosovo presses Montenegro not to allow Serbia to sell its assets (Balkaninsight)

Romania vows long-overdue deficit showdown (Balkaninsight)

Hungary’s recession drags on (Bloomberg)

‘People feel let down by Russia’: disputed Caucasus enclave choked by blockade (FT)

Ukraine seeks to restore Black Sea shipping despite Russian threats (FT)

Ortega regime seizes Catholic university in Nicaragua (WSJ)

Chilean wine exports suffer ‘unprecedented’ declines (Mercopress)

Chile economy contracts less than forecast on mining boost (Bloomberg)

Ecuadoreans to vote on oil drilling (NYT)

BRICS creator slams ‘ridiculous’ idea for common currency (FT)