Frontier Markets New, March 31 2024

Dear Reader,

Frontier Markets News is on a mission to bring unbiased insight and intelligence about key developments in small emerging markets to a global audience.

If you are enjoying this newsletter and would like to help support that mission, please consider upgrading to a paid subscription today.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Zambia debt breakthrough prompts currency surge

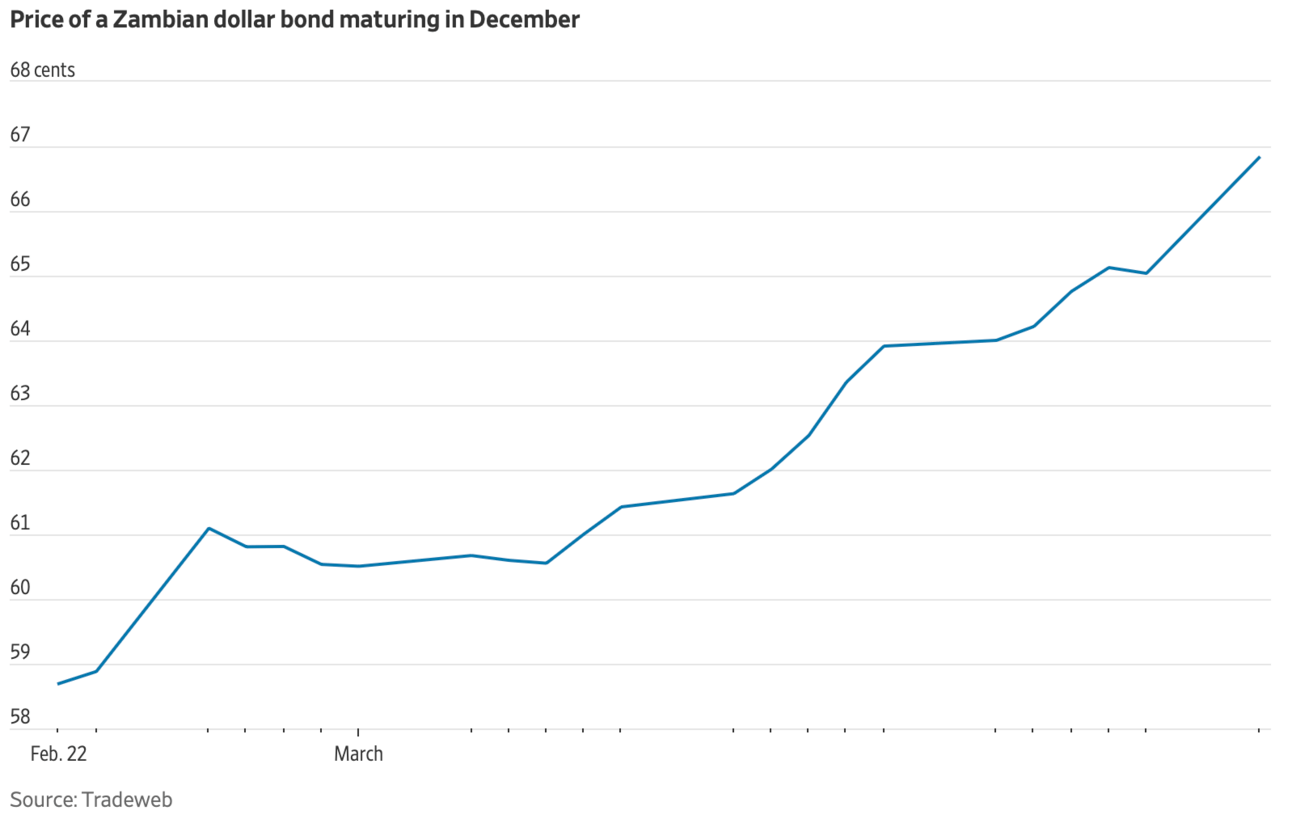

Zambia this week agreed to a deal that will see the country and private bondholders restructure $3.5 billion in debt. Zambia’s president Hakainde Hichilema described the breakthrough in the yearslong process as “historic” in an announcement on X.

As part of the deal, eurobond holders will take a 22% haircut, larger than the expected 16%. Zambia’s currency jumped 6% following the announcement, and dollar-bond spreads fell to their lowest level in almost two years.

The arrangement moves Zambia closer to exiting a period of default that began in 2020 and would make the bankrupt African nation the first country to successfully restructure its debt under the G20 common framework. Announced in 2020, the framework has been criticized for taking too long to be effective. Zambia will still need to agree to a deal with China, its largest bilateral creditor, before it can officially exit default.

“It’s been more than three years now since Zambia defaulted and only now is a restructuring deal within reach,” research firm Capital Economics said in a note this week. “That has forced the authorities to keep policy tight for longer, extending the economic pain.”

Nigeria prepares economic governance overhaul

Nigeria’s President Bola Tinubu this week announced a new management structure aimed at improving productivity and easing financial hardship within his embattled economy. The 31-member Presidential Economic Coordination Council will include members of the private sector and government officials and be tasked with “reengineering the nation’s economic governance framework,” The Punch reports.

A separate 19-member “emergency taskforce” will meet twice weekly and submit a list of proposed economic reforms to Tinubu later this year.

The move comes as Tinubu balances the costs of economic reforms that are aimed at stabilizing the Nigerian economy. Soon after taking office last year, he ended a fuel subsidy and devalued Nigeria’s currency, moves that helped spark one of the country’s worst-ever economic crises, Reuters reports.

Opposition candidate wins Senegal election

Senegal elected opposition figure Bassirou Diomaye Faye to the country’s highest office last Sunday, putting an end to a turbulent spell that raised concerns about the historically stable West African democracy.

Faye won 54% of the vote, according to the official tally, eliminating the need for a runoff. Former Prime Minister Aliou Mamadou Dia, who had the support of outgoing President Macky Sall, came in second with 36% of votes.

The victory caps a remarkable rise for Faye, who catapulted to the presidency from relative obscurity after receiving the support of firebrand opposition leader Ousmane Sonko. Both Sonko and Faye were in jail until just two weeks before the election on charges that supporters claimed were politically motivated.

Faye, a 44-year old former tax collector, is now set to become Africa’s youngest elected president, BBC reports. The presidential contest is Faye’s first electoral victory.

Guest Post

Egypt’s prospects, by Charlie Robertson, FIM Partners

Egypt has experienced a remarkable month. As well as drawing in $57 billion in promised investments and loans from a range of multilateral institutions it’s attracted some $8 billion in portfolio flows according to some estimates.

Just a few months ago, many investors were concerned the country would default on its loans. Now its economy seems to be on track for a strong rebound—and investors are piling in.

Read more in a fascinating guest post on FM News, in which FIM Partners’ head of macro strategy Charlie Robertson explains how Egypt has pulled off such a remarkable turnaround and why this time really might be different.

Asia

Sri Lanka rate cut highlights improving economic outlook

Sri Lanka lowered interest rates by half a percentage point on Tuesday, and the central bank indicated it could do so again soon, Reuters reports. The move, which comes ahead of elections scheduled for later this year, surprised economists polled by Reuters, who projected that rates would remain unchanged.

The decision comes on the heels of an IMF report that said the island nation’s economy was gradually improving, two years after its worst ever economic crisis.

- Sri Lanka’s cabinet approves 40% hike to minimum wage (Reuters)

Sri Lanka defaulted on its external debt in May 2022. It has since been involved in negotiations with a series of creditors, including the IMF, to restore economic stability. The country will need to restructure its debt before its next IMF review, central bank governor P. Nandalal Weerasinghe said this week.

Southeast Asia moves toward emissions reduction tech

The Philippines and Thailand are accelerating their efforts to develop nuclear reactors, Nikkei reports. And in Indonesia and Malaysia, some of the world’s largest oil companies are exploring ways to capture carbon and store it deep underground.

Fresh off a civil nuclear cooperation agreement it signed with the US last year, the Philippines is planning to open a nuclear power station by 2031. Thailand’s upcoming national energy plan is also expected to include plans for nuclear reactors, which will become operational by 2037.

Elsewhere in the region, oil giants including Chevron, Exxon and Shell are exploring places where they can store carbon—and Indonesia and Malaysia are among the few countries in the world with the necessary geology, Bloomberg reports. Pulling carbon from the atmosphere would theoretically allow large oil companies to preserve emissions-producing oil and gas production without raising global temperatures. But experts warn that the technology is currently too expensive to be viable and that it is too early to say whether it can scale quickly and cheaply enough to avert climate catastrophe.

Vietnam seeks to demonstrate stability to China

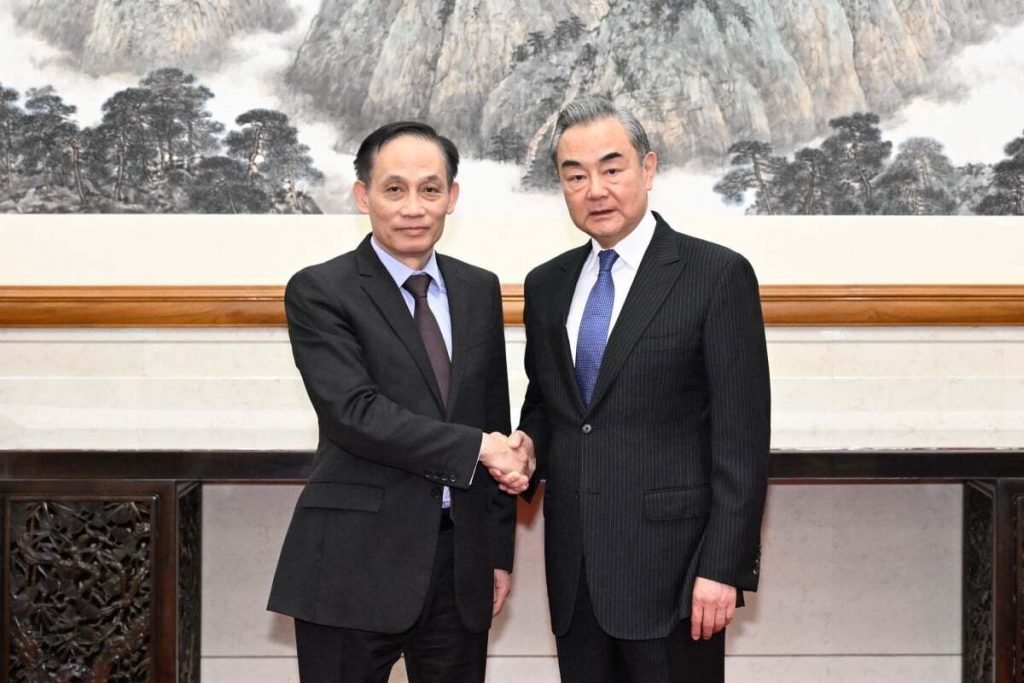

Vietnam is scrambling to maintain an aura of stability after the sudden departure of its president last week amid allegations of corruption, the South China Morning Post reports. Vietnam’s top diplomat was in China at the time of the announcement, and the two sides said they’d agreed to “intensify high-level exchanges.”

The trip also followed the reemergence of a long-standing territorial spat between the two countries in the Gulf of Tonkin, a body of water that is claimed by both Vietnam and China. Earlier this month, China published an official map showing expansive claims of the area.

Meanwhile, international pressure on Vietnam is mounting to ensure that the country’s electric grid can sustain periods of extreme heat. Western countries have increasingly turned to Vietnam as a manufacturing hub amid increasing geopolitical differences with China. Many of Vietnam’s factories suffered delays last summer amid power outages stemming from a heatwave.

But Vietnam’s efforts to make its grid more resilient may not satisfy a different source of Western pressure: the transition to renewable energy. Vietnam’s coal imports have increased since signing a $15.5 billion deal with G7 countries in 2022 to decrease its coal use, and have doubled so far this year over the same period in 2023, Reuters reports.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Oman reportedly new “hot spot” in Russia’s clandestine oil sales network

The US is stepping-up its scrutiny of ship-to-ship oil transfers in Oman, as the waters around the Gulf country’s ports are an increasingly popular transit hub for sanctioned Russian oil heading to India, Bloomberg reports. Ship-tracking by Bloomberg has identified at least four tankers carrying Russian oil idling in Omani waters before transferring their oil to ships listed as bound for India.

Ship-to-ship oil transfers are a common strategy in Russia’s game of cat and mouse with US and EU sanctions, which limit the sale, insurability and price of Russian oil.

It is not clear whether the transfers are occurring with the permission (or even knowledge) of Oman’s government, which conducts annual military drills with the US and the UK. However, despite its defense cooperation and procurement links with the West, Oman maintains an independent foreign policy, having recently conducted naval drills with Iran, and mediated talks between the US and Iran on the Israel-Palestine conflict.

Iraq and Iran to develop US sanctions-evading oil fields

Iran has signed a deal with Iraq to develop six further joint oil fields, which would bring online an estimated 400,000 extra barrels per day of oil production at a price tag of over $13 billion. The announcement comes a week after Iran signed a separate $20 billion contract to greatly expand production in its South Pars field, per a press release by Iranian oil ministry’s Shana Agency.

Taken together, the projects indicate that Iran has confidence in its ability to increase oil production and exports despite increased tensions in the region due to the Israel-Palestine conflict, of which Iran’s “Axis of Resistance” proxy network is a key part. Possibly shoring-up its position with Iraq, Iran extended its gas export agreement with Iraq for another five years, following receipt of a US sanctions waiver.

Europe

Ukraine pushes to counter Russian diplomatic gains in Africa

Ukraine is ramping up efforts to strengthen its alliances and counter Russian influence in Africa, Semafor reports. President Volodymyr Zelenskyy is set to make his first state visit to Africa in the coming months amid plans to expand its grain shipment program and roughly double its embassies on the continent.

These moves come as Ukraine faces an existential battle to build geopolitical ties globally, particularly as its key ally, the US, wavers in its support. But Ukraine’s efforts to deepen its ties across Africa come in the face of a longstanding and multifaceted campaign by Russia to win over governments on the continent.

Moscow has sought to exert influence through its own grain delivery program, military assistance, media partnerships, language courses, and university scholarships. Russia has also recently increased its military cooperation with the juntas of three West African countries—Niger, Mali and Burkina Faso—battling jihadist insurgencies in the Sahel.

Latin America

Austerity policies take toll on Argentine consumer spending

Argentina’s consumer spending is expected to decline by nearly 5.5% in 2024 as high inflation and austerity policies dampen economic sentiment. The correction of macroeconomic imbalances has led to a significant decrease in purchasing power, resulting in a severe decline in retail sales across key sectors such as pharmacies, perfumery, food and beverages, and home appliances.

The automotive industry has also been hit hard, with more than a third fewernew vehicle registrations this month than in March 2023. The decline in the value of the peso, coupled with rampant inflation and high unemployment, has made big ticket purchases such as cars increasingly difficult to afford.

Government finances could also be hit, as falling consumer spending reduces tax revenues and company and market performance declines.

Panamanian debt downgraded to junk

Fitch Ratings has downgraded Panama’s credit rating to BB+ from BBB-, stripping the country of its investment grade status, Latin Finance reports. The move comes as Panama faces mounting fiscal and governance challenges, exacerbated by the closure of the Cobre Panama copper mine last year. The mine, which accounted for 5% of the country’s GDP—and around 1% of global copper production—was shut down following a Supreme Court decision to invalidate the contract between the government and mine operator First Quantum Minerals.

The loss of the mine is expected to significantly impact Panama’s economic growth this year and deprive the government of valuable royalties. Additionally, the country faces the threat of costly arbitration due to the mine’s closure.

- Podcast: What’s on the economic agenda for Panama’s next president? (Americas Society)

Investors appear to still be confident in Panama’s fundamentals, as evidenced by the country’s recent successful $3.1 billion bond sale. They also expect Panama’s fiscal and governance issues to be key areas of focus in the presidential election in May. However, the reopening of the mine remains uncertain, as it would require the new administration to navigate complex legal hurdles and shift public sentiment amid a challenging political and social backdrop.

Paraguay condemns US beef ban

Paraguay’s lawmakers this week condemned a US Senate decision to ban meat imports from the Latin American nation just months after the US had reopened its market to Paraguayan beef exports, MercoPress reports. The ban is likely to have far-reaching consequences for Paraguay, which had been looking to expand its export markets and strengthen its ties with the US.

While the move is unlikely to significantly damage Paraguay’s strong macroeconomic performance, the beef industry is a major contributor to GDP and a significant source of employment. The ban also represents a political setback for Paraguay’s pro-business, pro-US, and pro-Taiwan president, who had been looking to strengthen ties with the US and expand the country’s export markets.

Global

Opinion: Reforms pay off for weakest emerging markets

Some of the most troubled emerging economies are finally healing, as reforms in countries such as Turkey, Argentina and Egypt are bearing fruit, Rushir Sharma, head of Rockefeller Capital’s international arm, writes in the FT. Battered by high inflation, debt, and deficits, these countries had no choice but to change when global interest rates rose sharply in 2022, driving their debts deeper into distress.

The reforms, which generally align with the principles of the Washington Consensus, focus on budget discipline and heeding market forces, as these are the only policy choices that work when a nation runs out of money, Sharma argues.

In Argentina, for example, newly elected President Javier Milei has taken aggressive steps, including devaluing the peso by more than half, cutting government departments, downsizing the public payroll, and selling hundreds of state companies. Even Turkey, under the leadership of Recep Tayyip Erdoğan, has hired serious technocrats who have raised interest rates and are curbing excessive credit growth.

These efforts have started to yield positive results, attracting foreign direct investment and lowering bond premiums.

What we’re reading

Togo adopts a new constitution (Le Monde)

Togo’s opposition calls for protests to stop president from signing off on a new constitution (ABC)

Ghana to start debt talks with bondholders in coming week (Bloomberg)

Ghana set to lose access to bank loan as cocoa crisis deepens (Bloomberg)

Nigeria to grant mining licenses only to companies that process locally (Reuters)

Nigeria food banks cut back on handouts as prices soar (Reuters)

Nigeria raises interest rate to 24.75% to battle inflation and support currency (CNBC)

Sudan war causes stoppages on South Sudan oil pipeline, officials say (Reuters)

Ethiopia to open up real estate to foreign buyers (AFP via Barrons)

Struggling Ethiopia is looking to Russia for an economic comeback (The Africa Report)

As starvation looms, Ethiopia’s social safety net program faces a funding gap (The New Humanitarian)

Kenya and Uganda ‘resolve oil import row’ (Reuters)

Malawi follows Zambia in declaring drought disaster as El Niño brings hunger to southern Africa (AP)

EU to provide €165m for Tunisian security forces to curb migration (FT)

Deadly Pakistan attacks threaten China economic ties (Nikkei)

Pakistan remains ‘on watch for downgrade’ to frontier market (Dunya News)

Could Taliban canal spark water war in Central Asia? (Radio Free Europe)

Kyrgyzstan urges citizens not to travel to Russia (Radio Free Europe)

Thailand sends aid to war-torn Myanmar, but critics say it will only help junta (AP)

Philippines pushes back against growing Chinese ‘aggression’ (Reuters)

Indonesia to accelerate nickel output despite low global prices (FT)

Oman launches $5b ‘Future Fund’ (Al Monitor)

In Iraq, water crisis leaves farmers clinging to sidr trees for difficult growing season (Reuters)

Iraq, oil firms trade blame over shut Turkey pipeline (Reuters)

Iran’s currency hits a record low of 613,500 to the dollar (AP)

Workers still ‘drowning’ despite Iran’s minimum-wage hike (Radio Free Europe)

GCC banks on track for largest ever dollar debt issuance in Q1 2024 (Zawya)

Saudi Arabia’s net FDI at 13 billion riyals in Q4 of 2023 (Reuters)

Swiss find Lebanon’s biggest bank guilty of serious money laundering breaches (FT)

Russia supplies oil to North Korea as UN sanctions regime nears ‘collapse’ (FT)

Moscow attack raises questions about Russian security services’ competence (FrontierView)

EBRD urged not to fund Greece–North Macedonia gas pipeline (BalkanInsight)

Draft-dodging plagues Ukraine as Kyiv faces acute soldier shortage (Politico)

Bulgaria’s government talks blow up as former EU commissioner withdraws bid to be PM (Politico)

Russia orders oil companies to cut output to meet OPEC+ target (Reuters)

Texan bitcoiners start mining fueled by flared gas at Argentina’s Vaca Muerta (CNBC)

Ecuador’s youngest mayor killed in targeted shooting (Democracy Now)

China megaport builder hits back as Peru moves to scrap exclusivity deal (FT)

Strong local currency ‘hurts’ Uruguay’s rural producers (Mercopress)

Indian buyers of Venezuelan oil halt imports on sanction fears (Bloomberg)

Brazil and France launch $1.1b program to protect Amazon rainforest (Reuters)

Opinion: The rise of identity geopolitics (FT)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products.