Frontier Markets Weekly, May 19th 2024

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Chad’s military leader wins presidential election

The army in the Democratic Republic of Congo claims to have thwarted an attempted coup against President Felix Tshikedi, the BBC reports.

According to witnesses, some 20 men dressed in military uniforms attacked the house of Vital Kamerhe, the former chief of staff and close ally to President Tshisekedi early on Sunday morning. According to the BBC, the men also occupied the Palais de la Nation, the office of the President of the Republic, which is located in the center of the capital city Kinshasa.

A spokesman for the military Brig Gen Sylavin Ekenge said on the state-run broadcaster RTNC TV that several suspects have been detained and the “situation is now under control”.

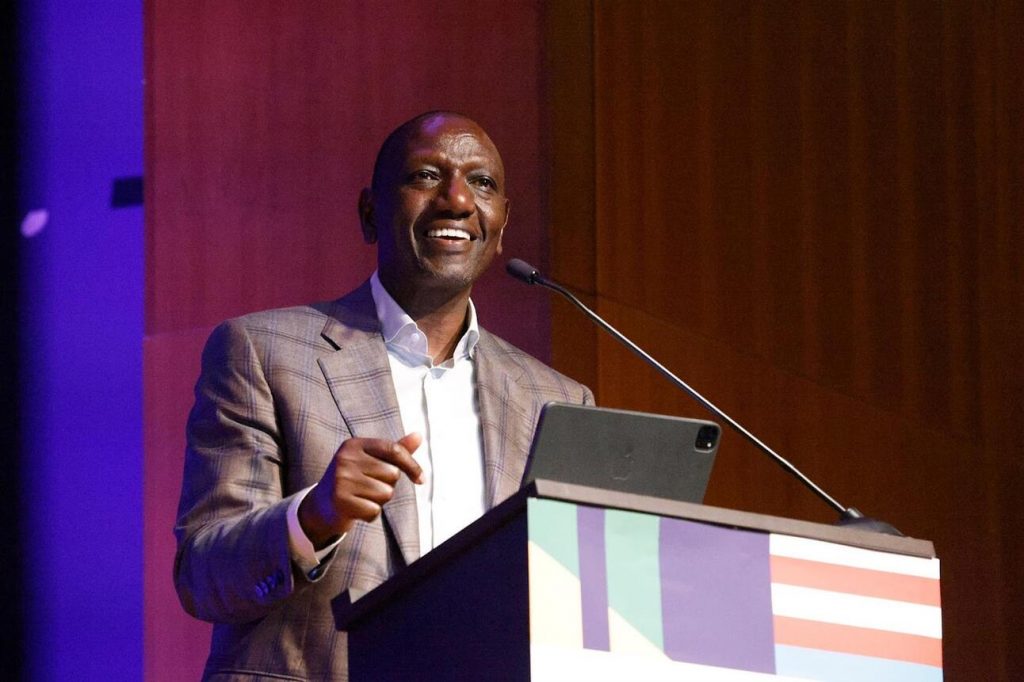

Kenya’s president pushes for sharp increase in AfDB funding

Kenya’s President William Ruto stepped up his push to almost triple fundraising for the African Development Bank (AfDB) this week. In a meeting with head of AfDB, Akinwumi Adesina, Ruto urged wealthy nations to provide the bank’s concessional lender with $25 billion.

Donor countries replenish the African Development Fund every three years. In December 2022, it raised $9 billion.

Ruto also plans to push the idea at a meeting in the US next week with Joe Biden—the first state visit by an African leader to the US since 2008. Among other topics, the two presidents are set to discuss trade and investment, technological innovation, and climate change, according to a White House press release.

IMF head urges progress on Zambia restructuring

IMF Managing Director Kristalina Georgieva on Tuesday urged Zambia’s international bondholders to do their part to finish restructuring the country’s debt.

Zambia, which defaulted on its external debt in 2020, is set to meet with eurobond investors in early June, and will seek to exchange $4 billion in debt, Bloomberg reports. Along with its $1.3 billion IMF program, the eurobond agreement will “provide significant external debt service relief and further contribute to Zambia’s efforts to restore debt sustainability,” Georgieva said in a statement.

Zambia is also attempting to rework its debt through the G20 common framework, a program designed to help low-income countries achieve debt relief. Zambia still has to restructure $3.3 billion in commercial loans, most of which is owed to Chinese creditors. It has already reached restructuring deals with its bilateral creditors.

Nigeria central bank to return to “orthodox policy”

The head of Nigeria’s central bank told the FT this week that he would keep interest rates high for as long as necessary to bring down soaring inflation. Central bank governor Olayemi Cardoso called the move a return to “orthodox policy.”

Economists including Standard Chartered’s Razia Khan have praised the commitment, saying that it has won Nigeria investors and that it is in line with IMF recommendations.

Cardoso faces significant challenges stabilizing Nigeria’s economy. Inflation remains at a three-decade high and the country’s currency hit an all-time low in March before recovering somewhat last month. It is now falling again.

Cardoso’s predecessor, Godwin Emefiele, is currently being tried on charges of corruption.

Asia

Pakistan ramps up privatization drive

Pakistan will privatize almost all of its government-owned business, Prime Minister Shehbaz Sharif said on Tuesday. The plan does not include enterprises the government considers strategically-important.

Previously, the government was planning to auction only unprofitable firms.

Sharif’s announcement came one day after Pakistan began negotiations with the IMF, which has long recommended privatization to the country, the Times of India reports. The prime minister did not specify which businesses would be considered strategic, but announced 25 companies that it would privatize.

The first to go could be Pakistan’s national airline, which for years has operated at a significant loss. Most of the other firms are in the power sector, Reuters reports. If the sales proceed, they could bring in a windfall of cash for Pakistan, which is recovering from one of its worst ever economic crises.

Japan and Thailand increase engagement with Myanmar rebels

Both Japan and Thailand took steps to engage with Myanmar’s splintered rebel forces this week.

In Tokyo, a minister from Myanmar’s exiled National Unity Government joined leaders from three ethnic armed groups at a press conference aimed at demonstrating the unity of Myanmar’s resistance groups. The groups operate independently in their fight against a common enemy: the military junta that took power in Myanmar in 2021.

The visiting delegation also met Japanese members of parliament, whom they urged to help prevent the junta from importing aviation fuel and other supplies that have military uses, Nikkei reports.

Thai officials also this week engaged with Myanmar’s government-in-exile, as well as several ethnic militias, Nikkei reports. Thailand has also urged its internet service providers to crack down on scam centers in Myanmar.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Kuwait partially suspends constitution

Kuwait’s Emir Sheikh Meshal al-Ahmad al-Sabah has created a new government, just days after dissolving the country’s parliament and suspending parts of the constitution for as long as four years, The National reports. The moves follow years of political gridlock and turmoil, which the Emir cited as the reason for what he calls his “difficult decision to save the country and secure its highest interests.”

Last week’s decision not only dissolved parliament but also transferred some National Assembly powers to the emir—some directly and personally, and others indirectly, via a cabinet stacked with familial appointments.

The emir did not specify exactly which parts of the constitution he was suspending, but FMN believes it’s possible he will be assuming some control over fiscal policy, as the decade-plus of political gridlock in parliament has left Kuwait unable to tap debt markets or implement reforms to its bloated public sector and welfare systems.

Kuwait has long been considered one of the most democratic Gulf states.

India signs port deal with Iran despite US warnings

India has ignored repeated US warnings of deepening economic cooperation with Iran by going ahead with a major port infrastructure deal with the Islamic Republic, the BBC reports. The deal, a 10-year cooperation agreement to develop the giant Chabahar port close to Iran’s border with Pakistan, is part of an effort by India to strengthen and diversify its regional trade links, underscoring its historically independent foreign policy tilt.

Under the agreement, Indian companies will directly invest $120 million and provide an additional $250 million in financing. The US, which has for some years been developing closer ties with India as a regional counterweight to help contain their mutual rival China, has gone as far as threatening sanctions in response to the deal.

Europe

Hungary inks deals with China as Xi tours Eastern Europe

Turkey’s government this week announced a comprehensive three-year austerity program aimed at cutting public spending to combat soaring inflation, which reached nearly 70% year-on-year in April and is expected to peak this month. The wide-ranging plan includes budget cuts for “the entire public service,” with some measures requiring legislative changes to be submitted to parliament.

The austerity package includes a 15% reduction in public works investments, limiting them to infrastructure and other projects that are at least 75% completed, as well as earthquake-related measures. The new measures are expected to reduce public spending by 100 billion liras ($3.1 billion), with funds allocated for state institutions’ purchases of goods and services being cut by 10%.

The moves are expected to complement interest rate increases which have made the lira the best-performing EM carry trade in 2024, with investors borrowing in US dollars and investing in Turkish assets. The trade has yielded gains of more than 12% during this period, but some believe this could be just the beginning of Turkey’s run, provided that the country maintains orthodox policies and successfully curbs inflation.

Slovakia rocked by PM assassination attempt

An attempted assassination of Slovakia’s Prime Minister Robert Fico has sent shockwaves through the country’s already fractured political landscape, the FT reports. The attack, believed to be politically motivated, is the first assassination attempt against a sitting EU leader in more than 20 years.

Fico, a divisive figure who has dominated Slovak politics for nearly a quarter-century, remained in serious condition this weekend after undergoing two surgeries.

Concerns are growing over the stability of Slovakia’s fragile coalition government. With Deputy Prime Minister Robert Kaliňák expected to take interim charge, Western diplomats fear that the absence of Fico’s steadying influence could lead to further political turmoil. The shooting has also cast a shadow over the upcoming European Parliament elections, with Slovak parties suspending their campaigns in the wake of the attack.

Latin America

IMF urges Argentina to continue reforms

Argentina has made significant progress in its economic recovery under the leadership of libertarian President Javier Milei, meeting all performance criteriaset by the IMF and securing a staff-level agreement for the release of nearly $800 million in funds. Milei inherited a challenging economic and social situation, but his decisive implementation of the stabilization plan has resulted in faster-than-anticipated progress in restoring macroeconomic stability.

However, the IMF has damped expectations of an imminent new loan for Argentina, emphasizing the need for further reforms to ensure the sustainability of Milei’s economic policies, the FT reports. The fund has highlighted the importance of a more flexible exchange rate policy, structural and tax reforms, and measures to attract private investment and increase formal employment.

Despite the progress made, some of Argentina’s challenges have deepened, with real wages and consumer spending tumbling, and powerful unions staging increasingly frequent protests against the government. The IMF predicts that the country’s gross domestic product will shrink by 2.8% in 2024, and some of the government’s measures, such as setting negative real interest rates and implementing a preferential exchange rate scheme for exporters, run counter to the IMF’s advice.

Bolivian farmers adopt TikTok to broaden market

In a bid to bypass intermediaries and resellers, Bolivian farmers have taken to social media platforms including TikTok and Facebook to promote their products and establish direct connections with consumers, El Pais reports.

The Southern Integration Market in Cochabamba, a self-managed space by agricultural producers, has become a beacon of hope for over 2,000 farmers who can now sell their fruit, vegetables and other products directly to customers.

By leveraging the power of social media, these farmers are not only creating awareness about their offerings but also sharing their stories and the challenges they face, such as drought, high temperatures, and competition from smuggled agricultural products.

Uruguay tops regional ranks for governance

Uruguay has emerged as the top-performing Latin American nation in the 2024 Chandler Good Government Index (CGGI), climbing two spots to rank 31st globally. The country’s rise was driven by substantial progress in the ‘Leadership and Foresight’ and ‘Attractive Marketplace’ pillars, solidifying its position as an economically dynamic nation with effective governance.

Uruguay’s strong performance stands in contrast to the mixed results of other Latin American countries, with some showing steady progress while others, such as Argentina, grapple with the impact of political and socio-economic crises on their overall state effectiveness.

What we’re reading

Nigeria ramps up production capacity after losing top producer spot to Libya (Rigzone)

Liberia’s new president promises “it’s not going to be business as usual” for foreign investors (The Africa Report)

Benin provisionally reverses ban on oil exports from Niger (Reuters)

IMF notes “substantial progress” in Ethiopia bailout negotiations (The Reporter Ethiopia)

Debt restructuring in sub-Saharan Africa ‘will generate…opportunities for MNCs’ (FrontierView)

Kenya’s 15% infrastructure bond tax may dent foreign demand (Bloomberg)

Kenya and Uganda to extend oil pipeline from Eldoret to Kampala (The East African)

Kenya: Uproar as Ruto government proposes 16% bread tax (The Africa Report)

Japan’s $107m loan deals for Kenya oust China as dominant lender (The Africa Report)

Zimbabwe unleashes police, intelligence services on people rejecting new ZiG currency (Addis Standard)

US bid for Zambian copper mines part of global rush to acquire key metal (WSJ)

African Development Bank pledges $2b for clean cooking (Bloomberg)

Bangladesh acts to tame inflation as IMF pledges $1.1b loan (Nikkei)

Bangladesh banks in liquidity crisis, hit by forced merger plan (Nikkei)

At least 68 dead in Afghanistan after flash floods caused by unusually heavy seasonal rains (CBS)

As US hikes China tariffs, imports soar from China-reliant Vietnam (Reuters)

Vietnam pledges more energy supply as chip race heats up (FT)

Indonesia offers five oil and gas blocks, pledges to boost exploration (Reuters)

Malaysia overtakes Thailand as ASEAN’s second-biggest auto market (Nikkei)

Dollar strength prompts Asian governments to boost currency protection (Nikkei)

Kuwait and Oman ink deals on investment, climate cooperation and education (Oman News Agency)

Yemeni terrorist financing probe blocks Red Sea cable repair (Bloomberg)

Iranian president feared dead after helicopter crash (Al Jazeera)

Iranian parliament aims to restrict online activity and block VPNs (Tech Radar)

Chinese companies win more bids to explore for Iraq oil and gas (Reuters)

US, Egypt, Saudi Arabia, Qatar and France tell Lebanon it can’t participate in peace talks until it elects a new president (Al Arabiya)

US gives Saudis green light to try to revive peace deal with Houthis (The Guardian)

US rate hikes make Gulf sovereign wealth funds go-to source for capital (Al Monitor)

Georgia approves controversial ‘foreign agent’ law, sparking more protests (BBC)

Georgia unrest highlights governance rather than economic risks (Fitch Ratings)

Russia’s war on Ukraine raises debt costs for EU’s east (Bloomberg)

Russian troops leave Karabakh, now back under Azerbaijan’s control (Reuters)

Ukrainian visit to Serbia yields pledges to revive trade (BalkanInsight)

Venezuela moves to ‘perpetual prewar footing’ at Guyana border (CNN)

Despite recent credit downgrade, Peru’s fiscal landscape remains stable (FrontierView)

Inter-American Development Bank to sell more sustainable bonds (Latin Finance)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.