Frontier Markets Weekly, June 30th 2024

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Kenya scraps tax bill after massive protests

Kenyan President William Ruto said on Wednesday that he will not sign a controversial tax bill that sparked deadly protests, the Guardian reports. The law sought to stabilize state finances by raising taxes on staple goods, threatening to exacerbate a growing cost-of-living crisis.

Demonstrators took to the streets in massive numbers to protest against the legislation, which reached Ruto’s desk after lawmakers pushed it forward on Tuesday. As the protests escalated, they were met with an increasingly violent police response that left at least 23 people dead and thousands injured, according to the Daily Nation.

The protests continued even after Ruto withdrew the bill, with many demonstrators calling for his resignation, Reuters reports. After sending the legislation back to parliament, Ruto said he would address concerns about his country’s finances by imposing austerity measures on the political elite, including by reducing his presidential budget.

Putin meets Republic of Congo leader as Russia tightens grip on Wagner in Africa

Republic of Congo President Denis Sassou Nguesso met with Russian President Vladimir Putin in Moscow on Thursday to discuss cooperation on finance, defense, and security, according to a Russian readout of the meeting. They also focused on ways to counter US sanctions, Russian state media reported.

Russia and the Republic of Congo have a long history of strong ties, but Russia has recently sought to expand its influence across Africa. This strategy was in part spearheaded by the mercenary Wagner Group until last June, when the group’s leader Yevgeny Prigozhin led a mutiny against Putin. He died in a plane crash two months later.

Many Wagner units have since been folded into Russia’s Africa Corps, which is a wing of the country’s government. Over the past several months, the Africa Corps has supplied military juntas in Burkina Faso and Niger with weapons.

ECOWAS defense chiefs urge sharp increase in security spending

Defense ministers in the Economic Community of West African States (ECOWAS) on Thursday proposed creating a joint 5,000-person security force to counter mounting threats in the region. With many West African states facing intensifying economic crises, though, experts questioned the viability of the $2.6 billion-a-year plan.

ECOWAS is reportedly also considering a smaller 1,500-person force that would cost $481 million annually, Reuters reports.

But nations across West Africa must contend with a mounting terrorist threat alongside economic distress. In some countries, militaries have responded to this threat by seizing power. Al-Qaeda affiliates are growing in strength in Burkina Faso, Mali, and Niger, all of which have experienced coups in the past five years.

Asia

Sri Lanka reaches $10b debt restructuring deals

Sri Lankan officials sealed a flurry of deals this week that will enable it to allocate more money in the coming years toward immediate needs, such as importing food, fuel and medicine.

The deals, including a restructuring of $5.8 billion owed to countries including France, India, and Japan and a $4.2 billion debt treatment with China’s Export-Import Bank, allow Sri Lanka to defer payments until 2028.

Sri Lanka defaulted on its debt in 2022 and has been seeking to restructure it ever since. The country is still working on a deal to restructure an additional $13 billion it owes to holders of dollar-denominated bonds and the China Development Bank. It needs to show restructuring progress to the IMF to continue receiving disbursements from the lender, with which the country has a $3 billion arrangement.

Bangladesh plays off India and China

Bangladesh’s Prime Minister Sheikh Hasina has been engaging in a round of shuttle diplomacy as she continues to try to balance the competing interests of the country’s giant neighbors, India and China.

On a state visit to India last weekend—her second trip there in a month—Hasina and Indian Prime Minister Narendra Modi discussed defense, energy, and trade cooperation. As part of the talks, India agreed to help Bangladesh launch a satellite into space, Nikkei reports. But disagreements persist over how to share water from the Teesta River, which flows through both countries.

In early July, Hasina will visit China, which has previously agreed to help Bangladesh develop infrastructure on the river. India opposes Chinese construction on the river, fearing that it could be a pretense for a port. That concern—which may grow after Hasina visits Beijing—could give Dhaka leverage in its negotiations with New Delhi.

Chinese manufacturers seek ‘impossible’ guarantees from Malaysia over US tariffs

Chinese executives are putting pressure on Malaysian officials to guarantee they won’t face US tariffs if they locate manufacturing facilities in the Southeast Asian nation, the FT reports. Malaysia is one of a number of countries, including Thailand and Vietnam, that Chinese firms are investing in to sidestep tariffs for goods made in China.

But according to one Malaysian government official “it is impossible for us to provide” the guarantees the firms are seeking. “We can…and do lobby but there is no way [of knowing] what the US will do in the future,” the official told the FT.

The US has levied $380 billion of tariffs on China since 2016. US companies have also moved manufacturing to Southeast Asia, seeking to diversify their supply chains beyond China.

Looking for more in-depth and actionable frontier markets intelligence?

Upgrade to a paid subscription today to gain access to our source mapping and to our future quarterly EM/FM reports, which aggregate forecasts and analysis from multilaterals, banks and consultancies.

Middle East

Hardliners and reformers to face-off in second round of Iran’s presidential election

Iran’s presidential election will head to a runoff after Friday’s vote failed to produce a first-round winner, the AP reports. Revolutionary hardliner and longtime ally of Supreme Leader Ayatollah Ali Khamenei, Saeed Jalili, came in second after splitting the conservative vote with parliament speaker Mohammad Bagher Qalibaf.

Reformer Masoud Pezeshkian, whose candidacy was something of a surprise given that the establishment usually blocks such candidates from running, came in first with some 42% of votes cast.

Despite his first-round success, Pezeshkian’s candidacy is still considered a long-shot because conservatives will almost certainly unite behind Jalili in the second round. Iran-watchers have suggested that Pezeshkian’s opposition candidacy was approved to bring some legitimacy to the elections and boost voter turnout, although the AP reports a dismal 40% of eligible voters cast ballots.

Iraq moves to attract more foreign investment

Iraq this week agreed to adopt a uniform set of rules aimed at creating a stable business environment that will be more appealing for foreign investors. The country signed the so-called Singapore Convention, a code of conduct for commercial dispute and settlement enforcement.

The convention still needs ratification to enter into force, though, something that few signatories have followed-through on.

Questions of stability linger over Iraq, as Turkey threatens a renewed offensiveagainst the Kurds, and Iranian proxies increasingly use it as a base to launch strikes on Israel. Amidst these challenges, Iraq is trying to attract foreign financing to develop an ambitious trade route connecting it to Europe via Turkey and its energy export hub on the Persian Gulf.

Houthis claim Saudi Arabia has asked China for mediation

Yemen’s Houthi rebels have claimed that Saudi Arabia has told China it is ready to negotiate with them for a halt to attacks on ships heading to and from Saudi ports through the Red Sea, the Times of Israel reports, citing Lebanese sources. The crisis in the Red Sea has become more dangerous in recent weeks, as missile and drone attacks have sunk and damaged ships.

China has been noticeably reluctant to get involved in the Middle East, even though it has made some token diplomatic moves like hosting intra-Palestinian talks, leading to recent semi-official criticism of its so-called “do nothing strategy”published in June’s Foreign Affairs by a US State Department China officer.

The Red Sea is important to China as a trade route for its manufacturing exports and its energy imports, but the Asian giant has largely sat back as the US and its allies counter the Houthis with a naval mission and air campaign.

Europe

Romania and Bulgaria fail tests to join the euro

Bulgaria and Romania, two of emerging Europe’s largest economies, have failed to meet the economic criteria required for them to join the Eurozone, according to a recent assessment by the European Central Bank and European Commission. The primary obstacle for Bulgaria, which had aimed to adopt the euro by 2025, was its inflation rate of 5.1%, exceeding the 3.3% threshold.

Romania faces even greater challenges, with inflation averaging 7.6% over the past year and a budget deficit of 6.6%, far above the EU’s 3% limit. Both countries also struggle with institutional weaknesses and face concerns about corruption, money laundering and governance.

The ECB suggested that challenging economic conditions stemming from Russia’s invasion of Ukraine could be partly responsible for the countries’ failure to meet the requirements. But while Bulgaria can request a reassessment before the next regular review in two years, Romania’s target of joining the euro by 2029 appears increasingly uncertain.

Emerging Europe pushes ahead with transition to green energy

The green transition is gaining steam in Central and Eastern Europe. This week, the EU disbursed a record €2.967 billion ($3.2 billion) to 10 lower income member states for ‘energy modernization’.

This fund, which derives its resources from the EU Emissions Trading System, has now released a total of €12.65 billion to projects in renewable power generation, energy storage, grid modernization, and energy efficiency improvements.

Romania, Hungary, Czechia and Poland are the largest beneficiaries from the current round, with Romania alone receiving over €1 billion. Public spending appears to be galvanizing private sector interest in the green transition, too. This week North Macedonia announced the country’s largest renewable energy investment in a $500 million wind farm project which is expected to power over 100,000 households.

Latin America

Bolivia coup attempt highlights economy-driven instability

A failed coup attempt this week in Bolivia, in which an army general led several hundred troops to storm the presidential palace in La Paz, has underscored the political instability stemming from the country’s ongoing economic crisis, the FT reports. The coup attempt was swiftly quashed by President Luis Arce’s government, but occurs against a backdrop of dwindling foreign reserves, fuel shortages and a collapsing currency peg, which have put severe strain on Bolivia’s economy—and Arce’s administration.

Arce’s administration is facing multiple challenges. The country’s central bank has nearly exhausted its gold reserves, after selling about half to avert a financial crisis in 2023. Bolivia’s natural gas exports have plummeted, depriving the government of crucial revenue, and a compounding economic crisis has eroded Arce’s popularity and strained the government’s ability to maintain key subsidies on food and fuel.

Political fragmentation has further complicated Bolivia’s economic management. A rift between Arce and former president Evo Morales has split the ruling socialist party, depriving the government of its congressional majority and blocking the approval required for overseas borrowing.

Argentina’s push to rebuild FX reserves stalls

The Argentine central bank’s effort to rebuild foreign exchange reserves is stalling as the pace of dollar purchases dramatically slowed in June, Bloomberg reports. After accumulating over $2 billion monthly through May, the bank has only managed to purchase $39 million this month, signaling a shift towards defending the peso.

A widening gap between official and parallel exchange rates, now at 32%, is exacerbating the central bank’s challenges. Market analysts predict potential reserve losses of $3 billion in the third quarter without policy adjustments.

The situation is further complicated by agricultural exporters holding back sales, with only a quarter of the soy harvest sold compared to the usual half by this time of year. As investors price in a higher likelihood of devaluation, some speculate that the mounting pressure could force an earlier-than-expected end to currency controls, potentially leading to a significant peso depreciation.

Global

Islamic world drives change in EM bond markets

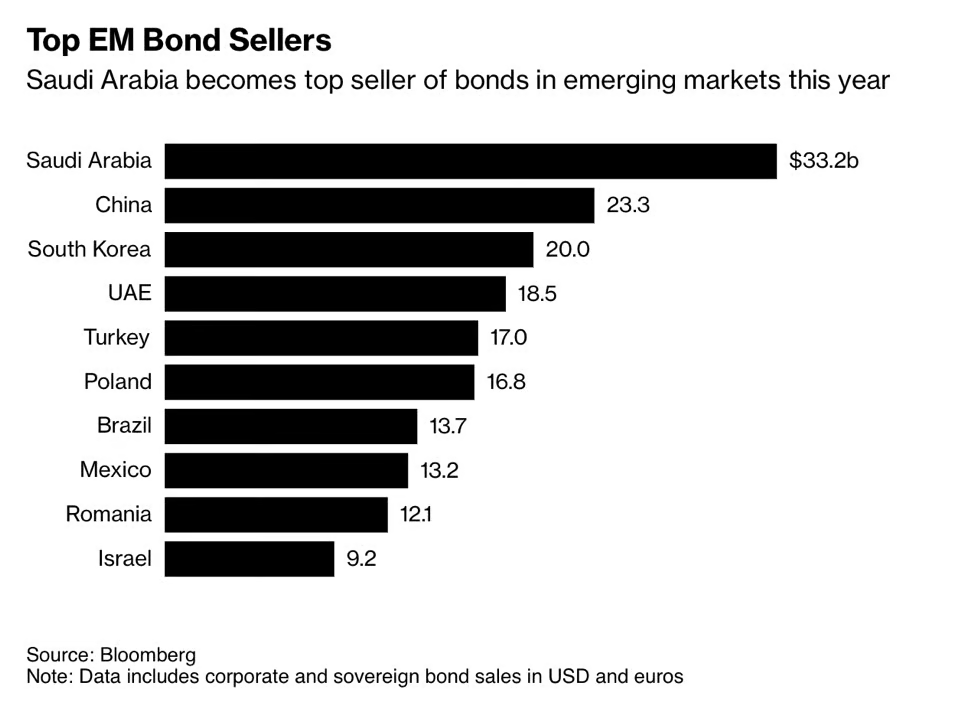

Gulf Cooperation Council (GCC) countries, along with Malaysia, Indonesia and Turkey, accounted for 51% of all US dollar debt issued by emerging markets (excluding China) in the first five months of 2024, according to a recent note by Fitch. This trend is driven by government initiatives to develop debt capital markets, diversify funding sources and finance fiscal deficits.

Notably, sukuk issuance has grown significantly, representing 12.4% of all EM dollar debt issued so far in 2024.

The inclusion of GCC countries and others in global bond indices has bolstered demand from international investors. Meanwhile, recent credit-rating upgrades for several countries in the region, coupled with expectations that US interest rates will fall, are likely to further support investor appetite for higher-yielding debt.

Saudi Arabia has emerged as the leading EM issuer of international debt in 2024, displacing China from its 12-year reign at the top, Bloomberg reported earlier this month. The kingdom’s record-breaking pace of borrowing, driven by Crown Prince Mohammed bin Salman’s Vision 2030 plan, has pushed its bond sales to over $33 billion this year.

What we’re reading

Egypt allots $1.2b for energy imports to end power cuts (Bloomberg)

Drought gripping Morocco is bad omen for global food supplies (Bloomberg)

Mauritania goes to the polls with regional security and economy among the issues (AP)

Ghanaian banks’ strong profitability offsets depreciation risks (Fitch Ratings)

Nigeria’s external debt balloons as naira loses 70% under Tinubu (The Africa Report)

Nigeria’s parliament plans new levy despite exodus of multinationals (The Africa Report)

At least 18 killed in suspected suicide attacks in Nigeria (BBC)

Rwanda-backed M23 rebels seize key town in east DRC (Barron’s)

TotalEnergies acquires license offshore São Tomé and Príncipe (Hart Energy)

Angola’s rising oil exports validate decision to quit OPEC (Bloomberg)

G42-Microsoft partnership in Kenya ‘just the beginning,’ says UAE trade minister (Al Monitor)

Ecobank takes strategic bet on intra‑African trade (The Africa Report)

Remittance flows in Pakistan ‘to hit $30 billion in 2025’ (Daily Times)

Philippines and Bangladesh push Asian migrant numbers to record high (Nikkei)

India set for billions of dollars of inflows as bonds join JPMorgan EM index (FT)

Mongolia’s ruling party set for narrow election win (AP)

Chinese megaprojects back in fashion in Central Asia’s poorest states (Radio Free Europe)

Turkish and Syrian presidents consider restoring diplomatic relations (AP)

Iran energy shortages ‘have cost economy $6-7 billion’ this year (Donya-e-Eqtesad)

US Treasury imposes sanctions on Iranian shadow banking network laundering oil money (S&P)

Saudi Aramco bets on AI to thrive after ‘peak oil’ era (Fortune)

Dominican Republic issues $750m green bond (Latin Finance)

Opinion: Venezuela business hopes rest on shaky foundations (FT)

Peru’s government drops challenge to China port rights (Bloomberg)

Milei wins final approval for bold economic reforms in Argentina (Bloomberg)

Emerging-market bonds ‘set to deliver attractive volatility-adjusted returns’ (UBS Wealth Management)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.