Frontier Markets Weekly, June 23rd 2024

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Kenya’s tax hike spurs protests

Kenyan lawmakers moved forward with legislation this week to raise some $2.7 billion in tax revenue, sparking protests that were mostly peaceful but drew an increasingly forceful police response.

The bill, which calls for higher taxes on many staple goods, was prompted in part by the IMF, which has pushed Kenya to increase its revenue and reduce its debt levels. Some of the proposed levies, such as a 16% tax on bread and an annual tax on vehicles, were shelved on Tuesday in an attempt to appease the protestors.

- Kenya turns to international capital markets as IMF loan shrinks (The Africa Report)

- Kenya’s fiscal challenges persist as external risks ease (Fitch Ratings)

According to a statement co-authored by Amnesty International, police fired live bullets, tear gas and water cannons at the mostly peaceful protestors. On Thursday, one protestor died after being shot by police in Nairobi, the Daily Nation reports, and another died after being hit by a tear gas canister. The final vote on the bill is expected next week.

Guest post: The tide is turning in Africa

A stream of positive developments across Africa is creating new opportunities for investors that markets have not fully priced in, Charlie Robertson, head of macro strategy at frontier-focused fund manager FIM Partners, argues in a guest post on FMN.

From the creation of a coalition government in South Africa to currency reforms in Nigeria and Egypt to progress on debt negotiations in Zambia, Ghana and Ethiopia, a promising picture is emerging that should support economic recoveries in many of the continent’s key economies.

I’ve not seen such a stream of positive developments on the continent in at least a decade,” Robertson writes. “A truly remarkable year is unfolding.”

Read more on Frontier Markets News.

Ghana reaches deal with bondholders

Ghana came to an agreement with its bondholders on Friday to restructure $13 billion in debt.

The deal will see bondholders take a 37% haircut on their principal investment, Reuters reports. Maturities on the bonds will also be extended. Ghana’s outstanding dollar-denominated bonds rallied on the news, with bonds due in 2027 reaching their highest price in two years.

The agreement brings Ghana, which defaulted in 2022, closer to a full restructuring. The country reached an agreement with its official creditors earlier this month. It is now awaiting a review from the IMF, which could release the next $360 million tranche of a $3 billion program as soon as next week.

New South African government takes office

South African President Cyril Ramaphosa was sworn in for a second term on Wednesday. But unlike during his first six years in office, Ramaphosa will now govern as the leader of a coalition of centrist parties.

He faces the daunting task of restoring public faith in his African National Congress party’s ability to improve the lives of ordinary South Africans. The party made famous by Nelson Mandela has steadily lost popularity since it took power in 1994, culminating in a rebuke from voters during elections last month.

- Coalition government will boost growth but might be fragile (FrontierView)

Ramaphosa’s efforts will be challenged by divisions within the coalition on which his authority now depends. Its member parties have differing views on the economy, foreign policy, and race, which remains a divisive issue 30 years after apartheid ended.

Despite the storm clouds ahead, a bright spot emerged this week as investors reacted to Ramaphosa’s return. The rand gained against the US dollar, and the Johannesburg Stock Exchange soared 7%.

Asia

Vietnam welcomes Russian leader after North Korea visit

Russia and Vietnam agreed to strengthen their ties as Russia’s President Vladimir Putin visited Hanoi on Thursday, just a day after signing a defense pact with North Korea.

The presidents of Russia and Vietnam signed 11 agreements this week in areas including energy, education and health care, the Guardian reports. However, trade between the two countries measures less than 2% of Vietnam’s annual trade with its largest partners, China and the US.

Putin’s trip to Hanoi risked angering Washington, which upgraded ties with Vietnam last year. Amid the visit, the US embassy in the country wrote that ”no country should give Putin a platform to promote his war of aggression and otherwise allow him to normalize his atrocities.”

But later that day, senior US officials indicated that they were not dismayed. Treasury Secretary Janet Yellen said on Thursday that the US will not requireVietnam, which has emerged as an alternative for American firms seeking to reduce their reliance on China, to cut its ties with Beijing or Moscow.

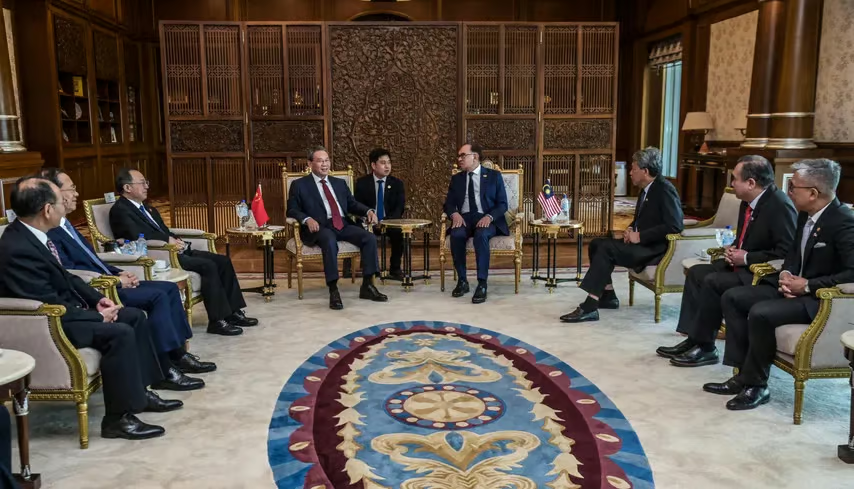

Malaysia-China relationship warms

Chinese and Malaysian firms signed deals worth up to $2.8 billion as Chinese Premier Li Qiang visited the Southeast Asian country. Li is the highest-ranking Chinese official to visit Malaysia in almost 10 years.

The proposed investments include cooperation in energy, education and infrastructure. The leaders also agreed to extend a mutual visa-free travel program and explore a high-speed rail project that would connect Malaysia to China, Straits Times reports. Malaysian officials say that the rail line could go through Thailand, which last week agreed to integrate its own rail network with the Laos-China high-speed railway.

Malaysia also requested membership in the so-called BRICS group during Li’s visit. It is the second Southeast Asian state to request to join the bloc this year, after Thailand also indicated that it is angling for membership.

Myanmar revives China-and Russia-backed infrastructure projects

Myanmar is resuming work on long-stalled infrastructure projects as its ruling military junta loses ground to splintered rebel groups across the country, Nikkei reports.

In the northern Kachin state, the junta has revived plans for a hydroelectric dam financed by Beijing. Work on the project began 15 years ago, but it stalled amid protests in Myanmar that most of the generated electricity would go to China. It is unclear whether the project’s resumption would be affected by the intense fighting that rages in the area, where Myanmar’s military committed apparent war crimes in October, according to Human Rights Watch.

A stalled deep-sea port project in the western state of Rakhine has also drawn renewed interest from a joint venture headed by China’s CITIC.

Across the country, in southeast Myanmar, military leaders are negotiating with Russia to build a deep-sea port, Nikkei reports. The two countries launched their first-ever joint naval exercises in the area last November.

Looking for more in-depth and actionable frontier markets intelligence?

Upgrade to a paid subscription today to gain access to our source mapping and to our future quarterly EM/FM reports, which aggregate forecasts and analysis from multilaterals, banks and consultancies.

Middle East

Gulf region rocked by lethal heatwave

A week-long heatwave that has seen temperatures soar above 125 degrees Fahrenheit in the Persian Gulf region is stretching government services and wreaking havoc on the annual Hajj Pilgrimage in Saudi Arabia, the WSJ reports. Over 1,000 pilgrims have died so far as the Saudi government scrambled to respond.

In neighboring Iran the extreme heat is straining the power grid and prompted the closure of government buildings in at least one city. Iranian cities like Tehran and Isfahan are already experiencing severe water shortages, which have been worsened by the heatwave, increasing their risk of land subsidence, which could damage critical infrastructure.

The Power grid in Kuwait is also struggling, unable to keep up with record demand for energy driven by increased air conditioning use, Bloomberg reports. The government has introduced load-shedding, a controversial practice of using rolling blackouts to balance supply and demand, as a temporary emergency measure to prevent degradation and breakdown of its grid.

Yemen’s Houthis using sea drones to disrupt Red Sea shipping

Yemen’s Houthi rebels have had their first success using sea drones to attack shipping lanes in the Red Sea, the WSJ reports. A Greek-owned coal transport was abandoned by its crew and sank after being struck by Houthi drones. A Ukrainian cargo vessel was also abandoned after it was damaged in a missile attack.

In response to the attacks the commander of the EU’s naval operation protecting shipping lanes in the Red Sea said the task force needs to more than double in size to carry out its mission effectively. Naval drones used by the Houthis are a “cost-effective and versatile” weapon which pose an unique challenge to advanced navies, evidenced by the fact of the Houthi’s continued success and rising shipping costs despite the months-long EU and US efforts to secure the Red Sea.

Europe

Russia uses nuclear power to win friends in emerging markets

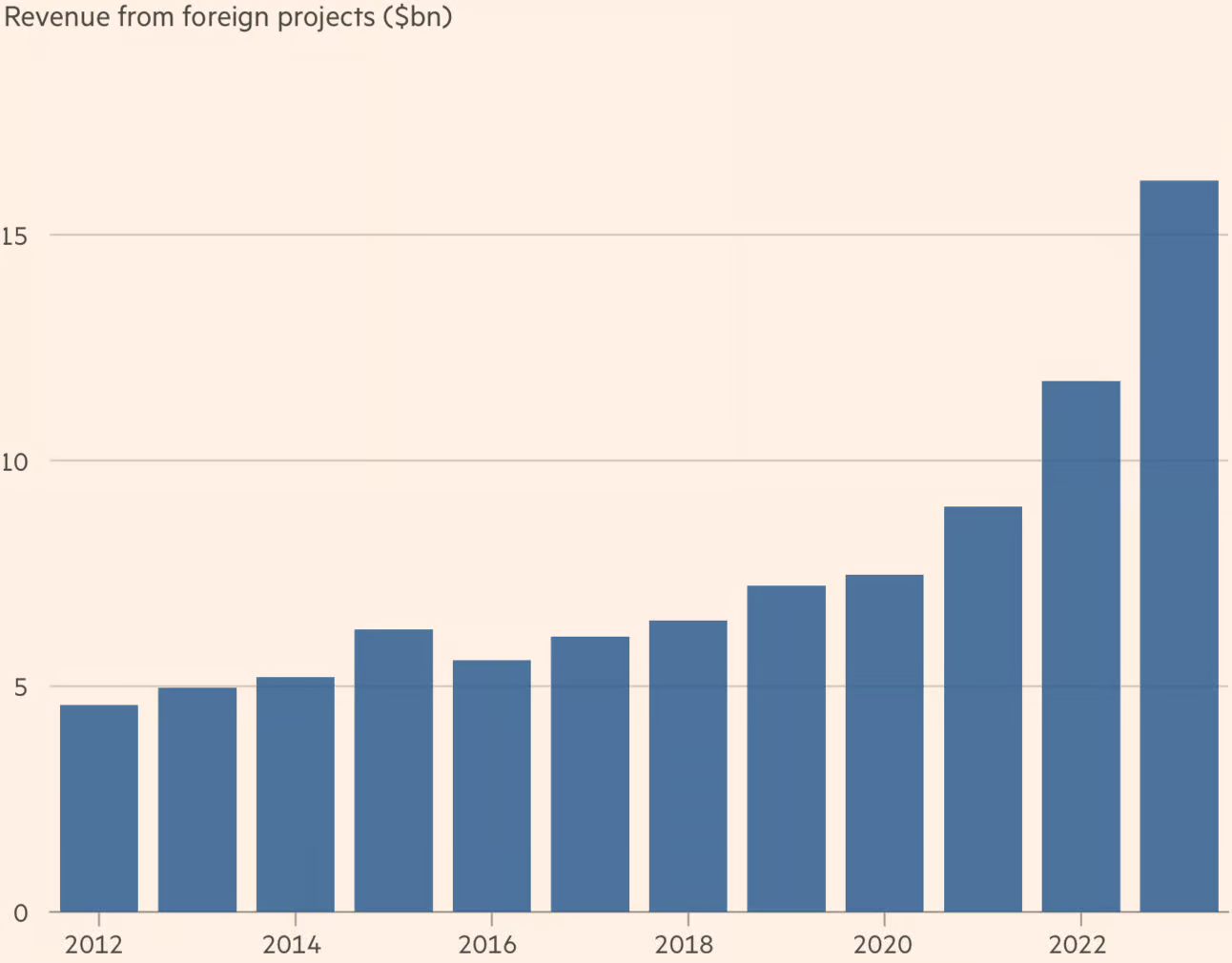

Russia’s government is leveraging state-owned power firm Rosatom’s expertise in nuclear energy to expand its global influence, particularly in emerging markets, the FT reports. Even as sanctions continue to hamper the Russian economy and business, Rosatom is aggressively expanding its footprint around the world.

The company’s $12 billion project in Bangladesh, set to generate 10% of the country’s electricity within a decade, exemplifies this strategy. Rosatom has been able to offer attractive financing terms, including up to 90% project funding with low interest rates, giving it a significant advantage over Western competitors in securing contracts with developing nations—and helping to establish a long-term relationship between Russia and Bangladesh in the process.

Rosatom is involved in more than a third of the new reactors being constructed around the world, including in Turkey, China, India, Iran and Egypt, and the geopolitical implications of the deals extend far beyond energy production. By engaging in long-term projects that can span over 60 years, Russia is creating lasting political and economic ties with host countries.

Latin America

Ecuador to suspend visa deal with China over migrants

Ecuador is suspending of its visa waiver agreement with China in response to a surge in undocumented Chinese migrants, the FT reports. The decision comes as Ecuador emerges as a crucial waypoint for global migrants en route to the US, with officials reporting that nearly half of Chinese travelers entering the country fail to depart through regular channels or within the permitted 90-day period.

Last year saw a dramatic increase in Chinese nationals attempting to cross the US southern border, with detentions rising tenfold compared to 2022. This trend has placed strain on the immigration system in Ecuador, whose relatively lax visa restrictions have made it an attractive entry point for those seeking to reach the US border.

- Ecuador’s president faces opposition over oil drilling in the Amazon (The Guardian)

- Power back on in Ecuador after massive outage blamed on transmission failure (Reuters)

The visa waiver suspension marks a potential cooling in Ecuador-China relations at a time when the two nations have been strengthening economic ties. China, Ecuador’s largest non-oil trade partner and a key source of infrastructure financing, has expressed concern over the decision.

Honduras mimics El Salvador-style crackdown with ‘megaprison’ plan

Honduran President Xiomara Castro has unveiled plans for a 20,000-capacity “megaprison” as part of a comprehensive security overhaul, AP reports. The initiative, reminiscent of El Salvador’s controversial approach to tackling gang violence, comes amid growing pressure to tackle narcoviolence and improve the country’s overburdened prison system.

Honduras’ prisons are severely overcrowded, with the current inmate population of 19,500 far exceeding the system’s designed capacity of 13,000.

The proposed security measures include expanding the military’s role in combating organized crime and prosecuting drug traffickers as terrorists and aim to build on an already aggressive approach. But while the government reports a 20% decrease in homicides during the first five months of 2024 compared to the previous year, skeptics question the long-term viability of adopting El Salvador’s model in Honduras, which faces unique challenges, including deeply entrenched gangs and pervasive corruption.

Global

China moves away from commodity-backed loans

China’s approach to lending in Latin America and the Caribbean is undergoing a significant shift, according to a recent study by the Inter-American Dialogue and Boston University’s Global Development Policy Center. Large Chinese lenders are pivoting from the large-scale, commodity-backed loans that characterized China’s financial engagement with the region over the past decade towards smaller, more targeted loans aligned with both Chinese and host country development objectives.

Between 2005 and 2023, Chinese state banks provided $120 billion in loans to LAC countries, with energy projects accounting for 78% of the total. Now, though, traditional multilateral lenders including the World Bank and Inter-American Development Bank have surpassed Chinese institutions in lending to the region.

The pivot is part of a recalibration of China’s financial engagement in a region where many Chinese companies are now well-established and less reliant on development finance institution loans for infrastructure projects. Meanwhile, smaller Chinese commercial banks are increasingly filling the gap through syndicated loans to Chinese or LAC companies.

What we’re reading

UN warns CAR at risk of Sudan war spillover (Africanews)

Sudan accuses UAE of supplying rebels (AP)

TotalEnergies to invest $550m in Nigeria (Punch)

Somalia asks peacekeepers to slow withdrawal, less than a year after kicking them out (Reuters)

Côte d’Ivoire plans to triple oil output by 2027 (Offshore Technology)

Eni to sell $1.1b stake in Côte d’Ivoire exploration operations. (WorldOil)

The Singaporean firm betting on Nigeria amid multinationals’ ‘exodus’ (FT)

Ghana halts power exports to Burkina Faso and Togo amid domestic crisis (The Africa Report)

Niger group claims attack on China-backed pipeline, threatens more (Reuters)

Opinion: Sudan is tumbling into the ‘Somalia trap’ (FT)

In Burundi, shortages and power cuts slow a return from international isolation (AP)

Uganda signs deal with UAE to build third international airport (Reuters)

Zambia needs copper rethink to achieve sustainable debt, economists say (The Africa Report)

Africa’s Copperbelt sets off investment race for EV metals (Nikkei)

New Europe-funded initiative set to increase Africa’s vaccine production (Euronews)

EU pledges $507m for Europe–Africa grid interconnector (Rigzone)

Pakistan rice exports at all-time high amid Indian rice export ban (FT)

Vietnam’s ‘bamboo diplomacy’ triumphs (FT)

Philippines accuses China of using bladed weapons in major South China Sea escalation (CNN)

Philippines plans 17 new ports to boost agricultural supply chain (Nikkei)

Thailand considers recriminalizing marijuana (Nikkei)

Multiple court cases threaten to destabilize Thailand’s government (FrontierView)

Is Kyrgyzstan’s hard-line leader going soft? (Radio Free Europe)

Komatsu opens Central Asia hub to tap mining rush for EV metals (Nikkei)

Bahrain attracts record FDI inflows of $6.8b in 2023 (Gulf Business)

Saudi Arabia dethrones China as top emerging-market borrower (Bloomberg)

Saudi Arabia still craves cash despite $54b haul (WSJ)

Iran hardliners pushed to unite as reformist shakes up campaign (FT)

Georgia probing closer ties with Iran as relations with West fray (Eurasianet)

EU considers visa restrictions on Georgia (Radio Free Europe)

Erdogan wins over foreign investors, but Turks pay the price (Bloomberg)

Montenegro’s illegal dumping problem tarnishes its ‘eco’ aspirations (Radio Free Europe)

Serbia to give green light for Rio Tinto lithium mine, FT reports (Reuters)

UK’s NatWest to close Polish operations (FT)

Ukraine urges bondholders to accept markdown on more than $20b of debt (FT)

EU imposes first ever sanctions on Russian LNG (FT)

Caribbean islands eschew GDP as metric to win access to aid (Bloomberg)

Cuba, the ‘safest country in the world,’ is increasingly insecure (El Pais)

Peru tees up global bond sale (Latin Finance)

Brazil joins race to loosen China’s grip on rare earths industry (Reuters)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.