Frontier Markets Weekly, May 26th 2024

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Kenyan AI workers plead for assistance as Ruto visits US

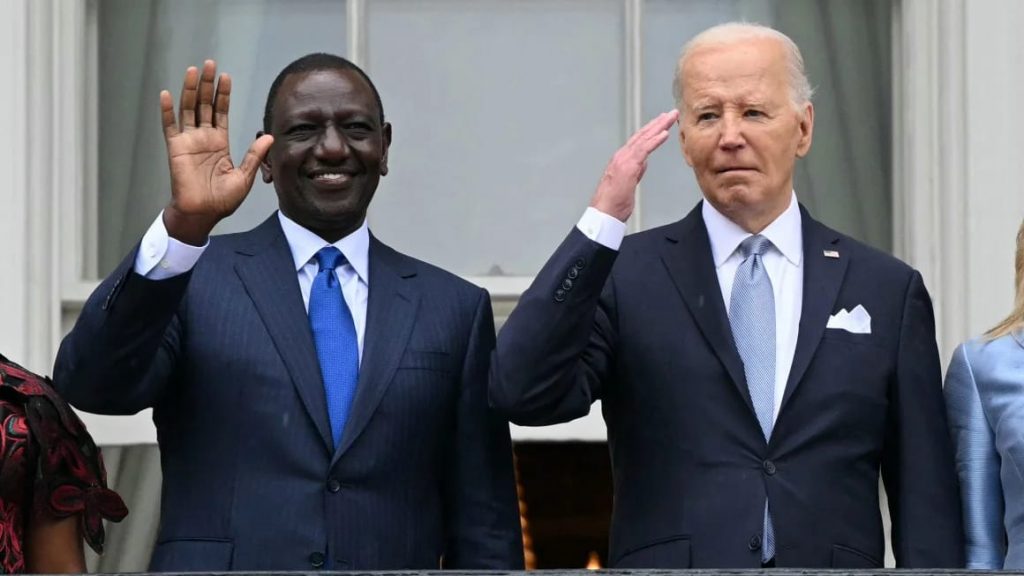

Low-wage tech workers in Kenya had a message for President Joe Biden as Kenyan leader William Ruto visited the White House this week: Help us.

Kenya is one of many African countries where tech giants pay contractors a small hourly sum to moderate content, correct confused chatbots, and label photos. A group of 97 workers in Kenya sent an open letter to Biden on Wednesday urging him to hold US tech companies accountable for their “unlawful operations abroad.”

- Kenya snags $3.6b highway deal in president’s US tour (Bloomberg)

As Biden and Ruto met in Washington, they agreed to a series of deals aimed at boosting technological cooperation. As part of this collaboration, Biden said he would work with Congress to make Kenya eligible for funding under the CHIPS Act, major legislation that directs some $39 billion into domestic semiconductor manufacturing. The US also pledged to designate Kenya as its first major non-NATO ally in sub-Saharan Africa.

South Sudan ‘close to oil-backed $13b UAE bailout’

South Sudan is close to landing a $13 billion loan from an Emirati firm, a panel of experts told the UN Security Council last week. If the deal with the Hamad Bin Khalifa Department of Projects (which does not have a functional website or phone number) closes, it would be South Sudan’s largest-ever oil-backed loan, AP reports.

The loan will be secured by 17 years’ worth of crude oil deliveries, according to the panel.

- South Sudan to downsize embassies and cut civil servant pay amid economic woes (Sudan Post)

The bailout would come at a crucial moment for South Sudan, whose economy is “nearing a meltdown“ as a result of the ongoing war in its northern neighbor Sudan, according to the International Crisis Group. South Sudanese oil flows through Sudan to reach tankers at Red Sea ports, but these exports have stalled for months after the primary export pipeline ruptured.

TotalEnergies launches $6b project in Angola

French oil giant TotalEnergies approved a $6 billion project to develop two new oil fields 60 miles off the coast of Angola on Tuesday. The company expects the project will begin producing oil in 2028, with a target of 70,000 barrels per day.

Angola was Africa’s largest oil-producer in the 2000s, but it lost the top spot after failing to invest in aging oil infrastructure, according to Bloomberg. However, the petroleum industry still accounts for about three-quarters of the country’s revenue, according to the US International Trade Administration (ITA). “Angola has not unleashed the full potential of its hydrocarbon sector,” the ITA says.

Asia

Bangladesh records faster sea-level rise than global average

The seas bordering Bangladesh are rising faster than the world average, local news outlet the Daily Star reported this week.

Rising seas could have severe implications for Bangladesh, which is already prone to severe flooding. According to a new study by the South Asian nation’s government, sea level rise could displace more than one million people.

Bangladesh ranks ninth in the world for risk of climate disaster, according to a report by nonprofit Bündnis Entwicklung Hilft and Germany’s Ruhr University Bochum. The report estimates that Bangladesh will lose 17% of its territory and 30% of agricultural land by 2050. That would pose major challenges for food production in a country where more than 20% of people are chronically hungry or malnourished, according to the International Food Policy Research Institute.

Indonesia considers ban on investigative journalism

Indonesia’s parliament considered making investigative journalism illegal by changing the law that governs national broadcasting, Reuters reports.

Rights groups and journalists pushed back against the proposed law, arguing that it would set back media freedom in Indonesia to the 1990s, when the country was ruled by a military dictatorship. A key leader during that period, the former general Prabowo Subianto, won Indonesia’s presidential election in February; he is due to take office in October.

The International Federation of Journalists, a trade group that represents journalists at the UN, said the proposed changes to the broadcasting law represent a “significant danger to democracy.”

Cambodia conducts military exercises with China

Cambodia and China are conducting their-largest ever joint military exercisesthis week and next. The two countries host the so-called Golden Dragon exercise annually, but the current iteration is the largest to date, Radio Free Asia (RFA) reports.

The drills, which include 11 Cambodian ships and three Chinese ones, are taking place in part at the Ream Naval Base, a Cambodian military port on the Gulf of Thailand at which China has funded the construction of a new pier.

US officials are concerned that China could use the Ream base to host its own navy. While Cambodia has said that its constitution prohibits it from hosting a foreign military presence, Collin Koh, an analyst at Singapore’s S. Rajaratnam School of International Studies, told RFA that China’s naval presence in Cambodia was “unprecedented,” and that it is likely to last “for the foreseeable future.

Two Chinese warships have been docked at the Ream base since December.

Did someone forward this to you? Subscribe at FrontierMarkets.co

Middle East

Iranian president’s death in helicopter crash triggers tumultuous succession

Iranian President Ebrahim Raisi died last Sunday, May 19th, after his helicopter crashed due to a “technical failure” while flying through the country’s mountainous northwest, the NY Times reports. Raisi’s death automatically triggers an election to replace him on June 28.

While the election is expected to be carefully managed by the office of Iran’s supreme leader Ayatollah Ali Khamenei and the country’s powerful Revolutionary Guard (IRGC), a faction of conservatives associated with former president Hassan Rouhani could try to capitalize on the power vacuum, testing the unity of the political right-wing in Iran.Regardless of who wins the election, Iran-watchers seem unanimous in their belief that little will change about Iran’s foreign or national security policy, especially its position vis a vis Israel and the US, since ultimate control in that arena lies with the Ayatollah and the IRGC.

Also killed in last week’s crash was foreign minister Hossein Amir-Abdollahian. Just two days before his death his office was engaged in talks on the Middle East’s security dilemma with the US mediated by Oman. Abdollahian was personally deeply involved in Iran’s backchannel diplomacy on the Israel-Hamas conflict and on Iran’s nuclear program.

Saudi Arabia inks more deals on wind and solar farms in green energy push

Saudi Arabia signed a huge 1.1 GW wind energy power purchase agreementwith Japan’s Marubeni Corporation this week, reportedly setting a new world record for the lowest wind energy production cost. Under its Vision 2030 planSaudi Arabia aims to generate 50% of its energy from renewables by 2030, supported by subsidized land and construction costs, guarantees of power offtake from the government, and a streamlined permitting process.

Saudi Aramco, the kingdom’s state-owned oil supermajor, is also getting involved in the renewables push, apparently considering buying a stake in Spanish oil company Repsol’s renewables unit. Saudi Arabia is also reportedly seeking to engage China in collaborating on the green energy transition.

IMF says Lebanon’s reforms insufficient for recovery

The IMF said this week that Lebanon has made some progress on inflation and exchange-rate stability but its reforms so far are “insufficient for recovery.” The multilateral said deeper reforms were needed, particularly for the bloated and potentially corrupt public sector.

After visiting the country, IMF staff also raised concerns about the lack of a “credible [and] viable” plan for saving the country’s struggling banking sector, which as far back as March 2023 has been open about its dire liquidity position.

The IMF visit also found Lebanon had made insufficient progress in improving tax administration, which has exacerbated the country’s deep inequality. A World Bank report published this week found Lebanon a highly unequal economy, with poverty rates having tripled over the past decade to 44%. That rate would be as high as 73% if adjusted for “multidimensional poverty” like education and healthcare access, the report noted.

Europe

Moscow recalls Armenia ambassador as Russia’s loses control of its near-abroad

Russia has recalled its ambassador to Armenia, Sergei Kopyrkin, amid escalating tensions between the two long-standing allies, Radio Free Europe reports. The move comes after Armenian Prime Minister Nikol Pashinian accused two member states of the Russia-led Collective Security Treaty Organization (CSTO) of aiding Azerbaijan in preparing for the 2020 Nagorno-Karabakh war. Russian foreign ministry spokeswoman Maria Zakharova challenged Pashinian to name the countries, while also asserting that Russia had repeatedly attempted to halt the 2020 conflict.

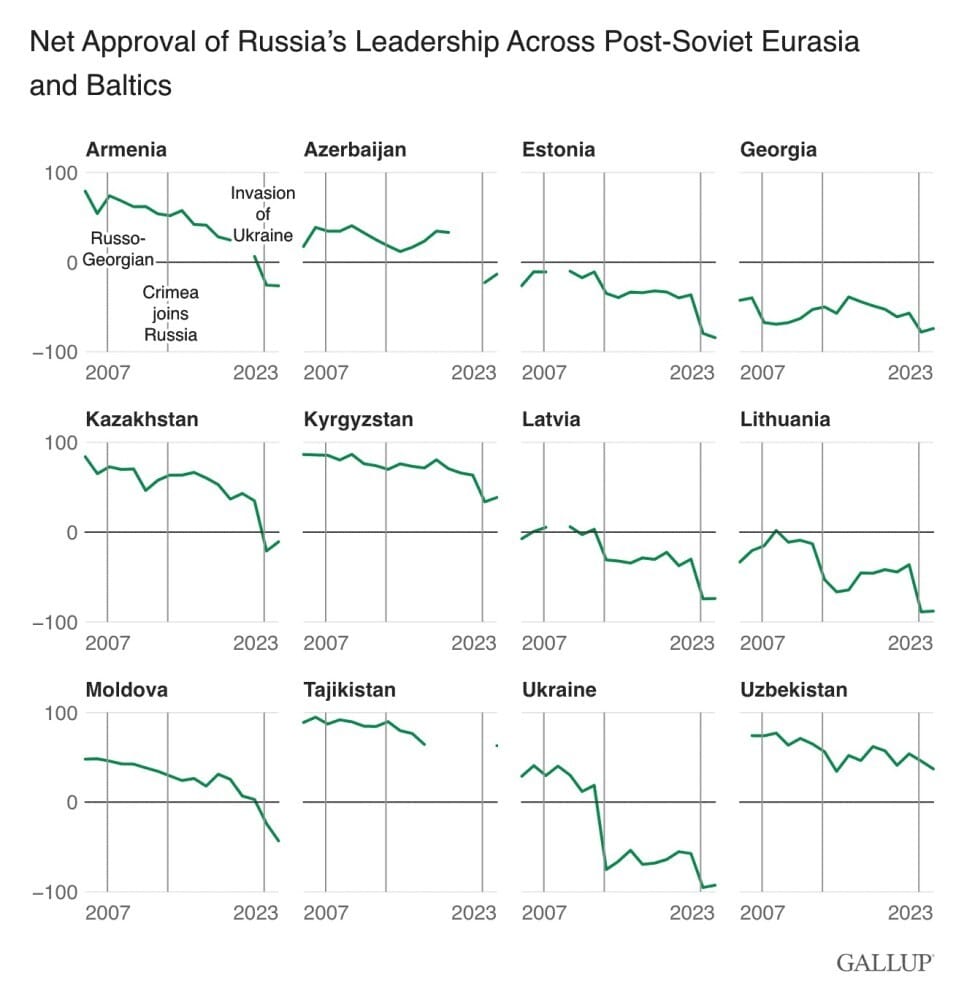

The deterioration of Russia-Armenia relations is part of a broader trend of Russia’s declining influence in its neighboring countries, as evidenced by a recent Gallup poll. Over the past decade, positive views of Russia’s leadership have decreased in all 12 post-Soviet states, with the war in Ukraine accelerating this shift in perception. As a result, Russia has lost its relative approval advantage over China and the US in the region, maintaining an edge only in Kyrgyzstan and Uzbekistan in 2023, compared to eight countries in 2013.

Even among the Russian diaspora in countries such as Estonia, Latvia, and Kazakhstan, support for Russia’s leadership has waned considerably in recent years.

Turkey becomes Europe’s largest coal-fired power producer

Turkey has surpassed Germany to become Europe’s largest producer of coal-fired electricity in the first four months of 2024, generating 36 terawatt hours compared to Germany’s 34 and Poland’s 31, Reuters reports. While Germany and Poland have significantly reduced their coal-fired output since 2019, Turkey’s coal-fired generation remains near record levels due to its rapid economic growth, which is more than three times the European average.

- Surge in Turkish bank issuance suggests investor confidence has recovered (Fitch Ratings)

Turkey’s reliance on coal is further supported by its slower clean-energy capacity growth compared to wealthier European nations, as well as recent hydropower shortfalls caused by drought.

Turkey emitted over 36 million metric tons of carbon dioxide from January to April, surpassing both Germany and Poland. This high emissions pace, coupled with the steady emissions from nearby Bulgaria and Serbia, positions Southern Europe as a major source of coal emissions on the continent.

Latin America

Crackdown on migration and strong economy propel incumbent’s re-election in the Dominican Republic

The Dominican Republic’s incumbent President Luis Abinader won a resounding victory in the presidential election, securing nearly 60% of the vote in a time when incumbency is being punished across emerging markets. Abinader’s pro-business policies have attracted record levels of foreign direct investment and tourism, positioning the Dominican Republic as the seventh-largest economy in Latin America, surpassing Ecuador.

Abinader’s popularity also stems from his aggressive measures to curb illegal immigration from neighboring Haiti, which is grappling with a severe security crisis following the assassination of its former president and the collapse of its government. The Dominican Republic has begun constructing a 164-kilometer wall along the border, deported 175,000 Haitians last year, and suspended visas for Haitian nationals, despite calls from humanitarian organizations to provide asylum.

The country’s GDP per capita has doubled over the past 15 years, and economic growth is projected to reach 5.1% this year on the back of tourism, despite global headwinds.

As Abinader enters his second term, analysts and investors are closely watching for potential reforms to public finances, such as widening the tax base, phasing out energy subsidies, and introducing a fiscal responsibility law to reduce the public debt ratio. However, observers widely expect policy continuity to define his term.

Guyana emerges as a substantial global oil supplier

Guyana has rapidly risen to prominence as a significant contributor to global crude oil supply growth, with production increasing at an average annual rate of 98,000 barrels per day between 2019 and 2023, reaching 645,000 barrels per day last year, according to data from the US Energy Information Administration.

The country’s oil output, currently originating from the Exxon, Hess, and Chinese-operated Stabroek Block, is expected to reach 1.64 million barrels per day by 2030, as the government rushes to capitalize on its hydrocarbon resources before the global energy transition saps demand.

Latin America increases use of tariffs to counter Chinese supply glut

Latin American countries, including Mexico, Chile, and Brazil, are imposing substantial tariffs on Chinese steel imports, following the lead of the US and Europe, Bloomberg reports. This move comes as a surprise given China is the largest buyer of raw materials from the region and is a major investor in Latin America. However, the flood of Chinese steel imports, which have surged from 80,500 tons in 2000 to nearly 10 million tons in recent years, threatens to put local producers out of business and jeopardize 1.4 million jobs.

China has previously demonstrated its willingness to suspend purchases and investments in response to perceived unfair measures, but Latin American nations appear to be betting that China’s deep entrenchment in the region will prevent Beijing from engaging in severe reprisals.

The upcoming visit of President Xi Jinping to South America for the APEC and G-20 leaders’ summits may provide an opportunity for renewed focus on Sino-Latin American relationships. While the steel tariffs are more limited compared to those implemented by the Trump administration, China is likely to defend the cases in the World Trade Organization rather than retaliate aggressively, as it focuses on curbing its own steel production to address the global supply glut.

What we’re reading

UAE’s ADNOC invests in Mozambique’s natural gas in first African foray (Al Monitor)

Rwanda deploys another 2,500 soldiers to help Mozambique fight insurgency (Voice of America)

New taxes threaten to stifle Kenya’s growing EV sector (Semafor)

Microsoft and UAE firm to invest $1b in Kenya data centers (Reuters)

How soda, chocolate and chewing gum are funding war in Sudan (WSJ)

Syrian mercenaries sent to Niger to ‘protect Turkish interests’ (North Africa Post)

Tunisia cracks down on dissent ahead of vote (FT)

Huawei launches Egypt public cloud service as China ties grow (Al Monitor)

French, Russia and Chinese firms vie to build Ghana’s first nuclear power plant (Reuters)

Election hopes prompt surge in investor interest in South Africa (Bloomberg)

South Africa’s SARB says EU carbon taxes may cut exports by 10% (Bloomberg)

Southern Africa bloc appeals for $5.5b in aid to counter effects of El Niño (Bloomberg)

Pakistan weighs 10 bids for national airline sale (Nikkei)

Pakistan stock market hits record (News International)

Pakistan scrambles for relief on $15b energy debt owed to China: UAEsurprises with $10b investment (Nikkei)

Nepal PM Prachanda wins vote of confidence (The Hindu)

Top Mongolian politician stresses commitment to eliminating corruption (Nikkei)

Vietnam’s new president, the third in two years, is inaugurated (NYT)

Thai PM avoids suspension as court takes up ethics case (Nikkei)

Indonesia expects water infrastructure investment bonanza after World Water Forum (Nikkei)

Indonesian leaders court Musk for Starlink access (SCMP)

UN flags attacks on Myanmar’s Rohingya minority (UN News)

Goldman becomes first Wall Street bank to get Saudi HQ license (Bloomberg)

Saudia Group orders 105 Airbus aircraft to support Saudi Arabia’s aviation goals (Airbus Press Release)

US and Saudi Arabia close to defense and civil nuclear deal (FT)

Iraq announces inception of a five-year climate investment plan (UNDP)

Oman to expel dozens of ex-Guantanamo detainees (Washington Post)

Turkish inflation remains stubbornly high (FT)

With Europe’s support, North African nations push migrants to the desert (Washington Post)

Mulino faces tough path to address challenges behind Panama downgrade (Fitch Ratings)

Colombia aims to boost oil production to 1m bpd (Oilprice.com)

Argentina’s Milei lays out blueprint toward dollarization (Bloomberg)

How Argentina’s provincial governments are shaping mining opportunities (Southern Pulse)

Argentina’s peso plunges in warning light for Milei (FT)

We are committed to providing FMN readers with a free weekly digest of politically unbiased, succinct and clear news and information from frontier and small emerging markets.

Please consider becoming a paid supporter to help cover some of our costs and support our continued development of sharp markets-focused coverage and new informational products. Paid subscribers will also gain exclusive access to our quarterly EM/FM report that aggregates EM insights from 25 major banks, international institutions and consultancies.