Gulf nations warm to Emerging Asia as Western alliances weaken

Saudi-China summit highlights Asia’s increased trade, energy, and security importance to traditionally Western-aligned countries across the Middle East

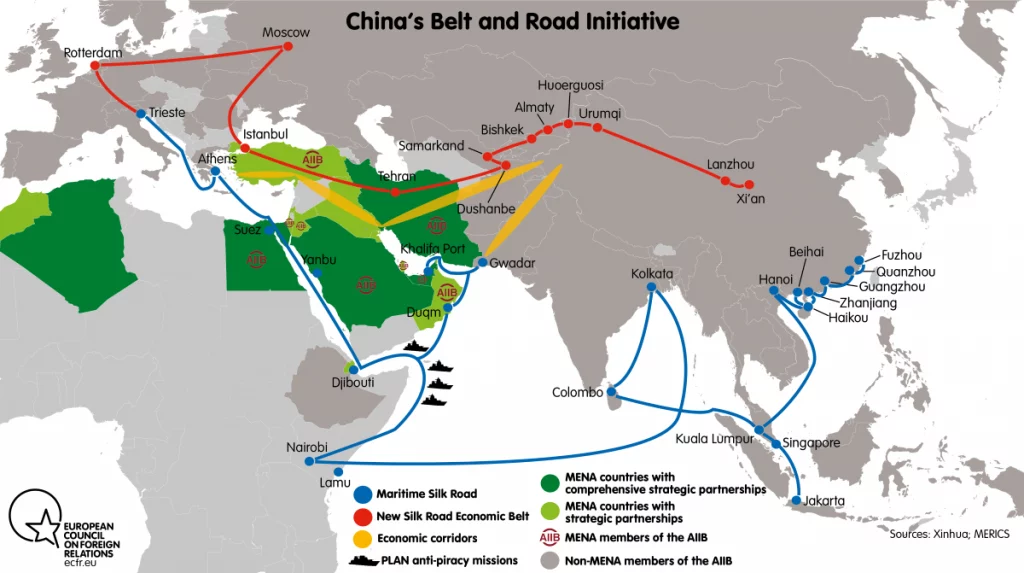

China concluded high-level meetings with Middle Eastern leaders this week in a bilateral summit with Saudi Arabia, at the China-Gulf Cooperation Council (GCC) Summit, and in the inaugural Arab-China Summit for Cooperation and Development. In the wake of its meeting with the Chinese, Saudi leadership upgraded the countries’ relationship, allowing Huawei to provide cloud computing services, further extending energy cooperation and commitment to summits every two years.

While the summit’s deliverables point to a strengthening of relations, cooperation had already been steadily increasing through drone and missile sales, expansion of telecommunications networks and pricing some Saudi oil sales in yuan. The meeting is also a substantial snub to the US, which had failed to prevent OPEC production cuts in October.

Saudi Arabia’s involvement in regional conflicts, its well-publicized human rights failures and its inconsistent support for key foreign policy objectives have soured relations with the West, raising concerns in the kingdom that the steady flow of arms and defense aid from Washington could dry up just as Iran pushes closer to acquiring nuclear weapons.

The interwoven inflation, energy and trade challenges driven in part by the pandemic have also increased insecurity for the region’s largest hydrocarbon producers. Fears of ‘peak oil’ and struggling tourism- and real estate-based diversification efforts exist alongside concerns over decarbonization efforts in once-key developed markets.

These challenges are prompting Gulf states to shift their focus to Asia. Riyadh’s warm embrace of Beijing exemplifies the trend across Middle Eastern monarchies to turn their focus towards increased trade, defense, and energy ties with Asia.

Seeking alternative sources of security

The mounting distrust between the US and its longtime Gulf allies has been a boost to emerging East Asian defense producers such as South Korea and China.

Saudi Arabia is expanding agreements with China to produce drones in the kingdom with China and expressed interest in purchasing air defense systems from South Korea. Qatar, a major non-NATO US ally, has acquired China’s SY-400 short-range ballistic missile. The UAE is also planning to purchaseChinese light jet fighters while approving the construction of a new Chinese military facility near Abu Dhabi.

This diversification reflects a desire to reduce dependence on any one provider in case Washington’s defense sales delays become perennial amid US dissatisfaction with Saudi and Emirati conduct.

Shifting energy markets

Recent decades have seen a steady shift in the poles of global energy markets, with both the US shale revolution and the green energy push dampening Western demand for Middle Eastern energy. While the EU’s current Ukraine-related woes have generated renewed interest in non-renewable resources from the Gulf, developed markets’ efforts to cut reliance on oil will continue.

For rapidly growing Asian economies, proximity, rising demand and concerns about price stability and supply security have led to a rush of deals with Middle East oil producers. December’s energy deals between China and Saudi Arabia come on the heels of several agreements between Sinopec and Aramco, which pledged to work together on carbon capture, hydrogen development and a new refining project in the kingdom. QatarEnergy also signed a $60 billion deal with Sinopec for liquefied natural gas, the longest deal of its kind in a scramble for supply.

Despite the demand boost Russia’s attack on Ukraine has prompted from Europe, Asian economies remain the biggest customer for Middle Eastern producers, taking three-quarters of all Gulf crude exports. Emerging Asian economies are expected to account for 90% of global demand growthbetween 2019-26, according to IEA projections.

Diversifying trade partners

Heeding the warnings of organizations such as the IMF, large producers are seeking to diversify their economies away from oil with increased urgency. The UAE, for example, has been working to reinforce its status as the region’s dominant hub, negotiating trade partnerships with India, the Philippines and Indonesia.

Saudi Arabia also sees a diversification play in trade, capitalizing on the region’s strategic position along key shipping routes between Asian manufacturers and Western consumers. In a move that has exacerbated intra-Gulf Cooperation Council (GCC) tension, though, it’s attempting to attract companies away from the Emirates with reforms and regulations to require a presence in the kingdom for continued operations.

Competition between the two for status as the dominant Gulf trade hub is likely to drive continued trade tensions—and supercharge the race to reach new Asian markets.

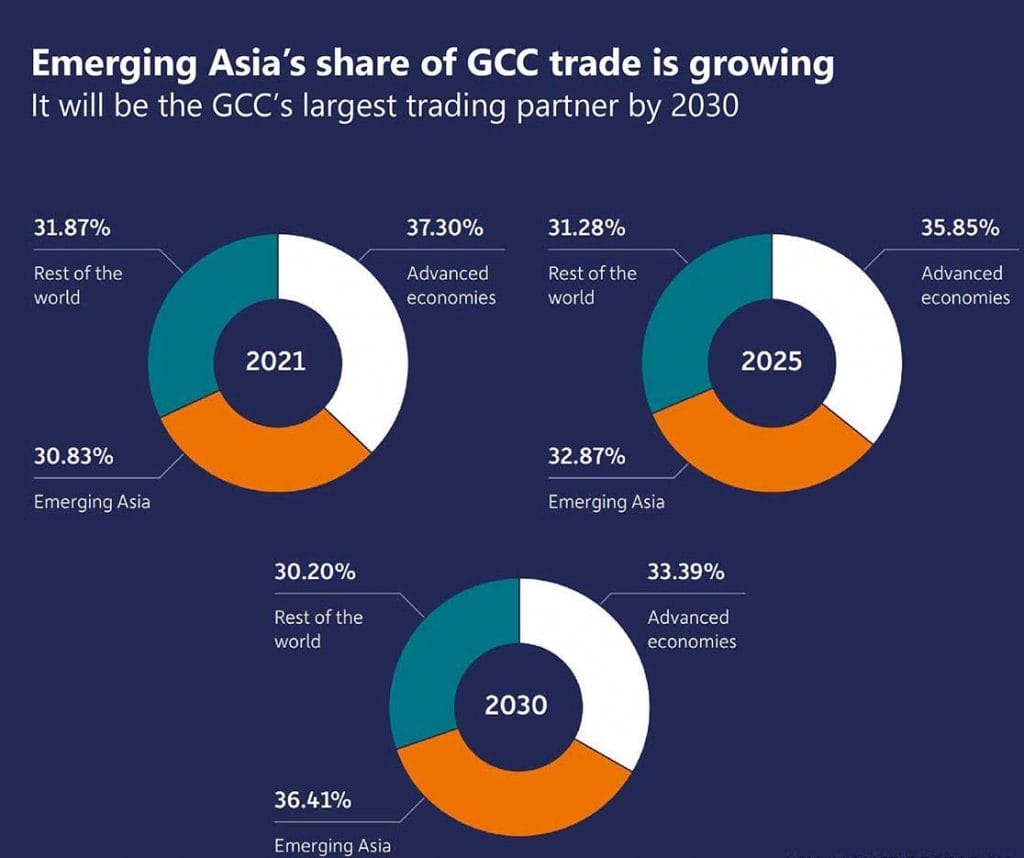

Meanwhile, the GCC itself is working to increase trade with China and India. Such efforts are expected to boost trade between emerging Asia and the Gulf nations by about 60% to $578 billion by 2030, up from $366 billion in 2021.

The record growth in Asia-Middle Eastern trade contrasts with the stagnation of trade with developed countries and the reflects the shift of global economic growth toward Asia. GCC trade with China, for example, hit $81.7 billion in 2021, surpassing trade with the US and Europe for the first time. If trade between the GCC and emerging Asia continues to grow at the 5.9% average rate seen over the past decade, it will surpass trade with all OECD-developed countries by 2028, according to Asia House, a UK-based think tank.

Realigning relations from West to East

As US interest in and ability to manage the region’s fractious internal politics continue to wane, more partnership hunting like this week’s summit is likely. China’s growing energy dependence on the region is forcing Beijing to get more involved to protect energy sources while picking spots to undermine US influence.

It’s not a straight swap, though. The Middle East is looking more to a role as a middleman rather than the exclusive partner of West or East.

And with the Chinese unwilling to provide the kind of security guarantees the region used to take for granted from the US Gulf states are likely to prefer a more diversified mix of sources such as cheaper and innovative alternatives from Turkey and South Korea.

Ken Stibler is the lead analyst at the Center for Emerging Economies and a global macro contributor to FMN.

Chris Muth is a Middle East analyst with experience in defense and counterterrorism policy at the American Enterprise Institute, Iraq’s embassy in the US and regional research initiatives.