By Dan Keeler, Ken Stibler, Noah Berman and Nojan Rostami

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

Nigeria prepares for presidential election. Voters will take to the polls in Nigeria next week for the country’s sixth presidential election since its return to civilian rule in 1999. Among a packed field, three candidates have emerged as contenders to succeed President Muhammadu Buhari: former governor of Lagos Bola Tinubu, opposition leader Atiku Abubakar, and businessman and social media star Peter Obi.

Tinubu and Abubakar are both septuagenarian establishment figures in Nigerian politics, while Obi has run as a political outsider and become popular with younger Nigerians, who have become increasingly disenchanted with a lack of economic opportunity under Buhari, according to the Carnegie Endowment for International Peace.

Bola Tinubu (L), Peter Obi (C) and Atiku Abubakar (R) are frontrunners to become Nigeria’s next president. Photo: Getty Images, via BBC

Frustration has boiled over in recent weeks, as the country attempted to execute a plan to swap old banknotes for new ones. A shortage in new notes has resulted in financial chaos in the cash-intensive economy, the Washington Post reports. Nigeria’s independent electoral commission has warned that a dearth of notes could derail payments necessary for presidential polling, Foreign Policy reports.Macro instability scares investors from West Africa’s largest markets. Political and economic instability are pushing equity investors away from West Africa’s largest economies according to data from The Africa Report and Business Ghana. Foreign portfolio participation in Nigerian stock trading slumped to 16% in 2022 from 51% in 2018, figures from the Nigerian Stock Exchange show, reflecting how foreign-exchange restrictions make it difficult for investors to access cash after equity sales.Foreign investors also have to deal with high inflation, political uncertainty and a complex currency regime with multiple exchange rates and a looming devaluation. Such factors both complicate investor execution and undermine corporate growth.

A man trades US dollars for Ghanaian cedis at a currency exchange office in Accra, Ghana. Photo: ReutersMeanwhile, the Ghanaian stock market has taken a hit despite the government’s claiming success in its domestic debt exchange. The country’s exchange shared that investors have pulled money out, reducing trading volume. According to the exchange, trading volume fell 95% in January compared with 2022 and value traded plunged 82%.Zambian chafes at delay in debt restructuring. Zambia’s finance minister, Situmbeko Musokotwane, has criticized delays in the debt restructuring process, the FT reports. The criticism comes in the wake of a Chinese request for multilateral lenders including the World Bank to take haircuts on their portion of Zambia’s debt.

Zambia is seeking to restructure $13 billion in external debt, Reuters reports. According to government data from late 2021, the southern African nation owes China about one-third of its total external debt. Chinese state banks are notoriously reluctant to take haircuts on debt, preferring to extend maturity dates to get back their principal investments.

Zambia’s Finance Minister Situmbeko Musokotwane at an IMF meeting in October 2022. Photo: James Lawler Duggan/ReutersZambia defaulted on its external debt in 2020 and is pursuing restructuring under the G20 Common Framework, a program that is intended to speed up debt restructuring in low-income countries.“Initially there was a lot of hope this would be done in a rapid way, that it would be relatively simple,” Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Bank, told FMN in our latest podcast. While it hasn’t played out that way, the election of a private-sector friendly government in 2021 is still cause for optimism for investors interested in Zambia, Khan says.

Asia

Cambodia cracks down on free press. Cambodian Prime Minister Hun Sen this week shut down the Cambodian Center for Independent Media. The organization published Voice of Democracy, one of the last independent news sources in the country.

VOD was one of the few outlets critical of Cambodia’s authoritarian government, CNN reports. Last week, Hun Sen criticized it for a report that alleged his son, Hun Manet, had overstepped his authority by authorizing aid for Turkey. The younger Hun has been viewed as a potential successor to the aging prime minister.

Ith Sothoeuth, media director of the Cambodian Center for Independent Media, in Phnom Penh. Tang Chhin Sothy/AFP/Getty Images

The move to close VOD comes ahead of elections planned for July, during which Hun Sen is expected to solidify his grip on power, according to analysts at the Center for Strategic and International Studies. Afterward, Hun Sen could hand over power to Hun Manet, but the elder Hun will have to contend with an increasingly vocal and young Cambodian base that is dissatisfied with the country’s governance.

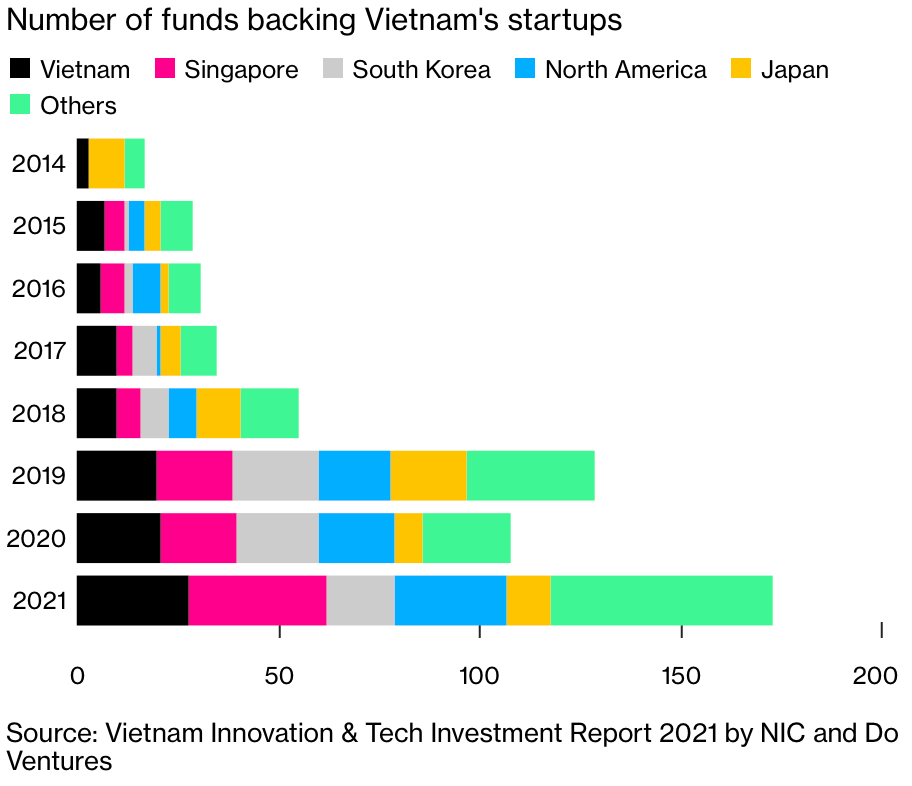

Start-up culture flourishes in Vietnam. The number of start-ups in Vietnam has nearly doubled since the start of the pandemic, according to a report by KPMG and HSBC. Another report, by Google, Bain & Co. and Temasek, found investment in private deals in Vietnam had tripled in 2021 from the prior year.

“Southeast Asia is going to be a global growth engine in the next 10 years and Vietnam will be at the center of it,” Vinnie Lauria, an American venture capitalist who relocated to Ho Chi Minh City last year, told Bloomberg.

Despite the influx of investment into the sector, regulations—including the requirement to store user data within Vietnam’s borders and complex foreign direct investment rules—have complicated its growth. Vietnam’s venture flows still trail behind Indonesia’s and Singapore’s.

Amid power crisis, Pakistan reverts to coal. Pakistan will not build new gas-powered plants in the coming years, instead opting to quadruple its coal-fired output, Reuters reports. The plan to switch from imported gas to coal, of which Pakistan has an abundance within its borders, reflects the latest challenge for low-income countries struggling to decarbonize their economies.

After Russia’s invasion of Ukraine last year resulted in skyrocketing natural gas prices, Pakistan has been unable to afford its gas imports. Natural gas, most of which is imported, typically accounts for about one-third of the country’s energy mix.

Power transmission towers in Karachi, Pakistan. Photo: Akhtar Soomro/Reuters

Pakistan’s foreign reserves fell to $2.9 billion last week, enough for just three weeks of imports. The country’s sovereign debt was downgraded further into junk territory by credit ratings firm Fitch.

While lower-income countries such as Pakistan are near-negligible contributors to global carbon dioxide emissions, they have borne the brunt of climate catastrophe. Last summer, devastating floods left half of Pakistan underwater.

Middle East

Iran’s president heads to China. Iranian President Ebrahim Raisi this week made the first Iranian state visit to China in 20 years. The trip is meant to follow up on a comprehensive cooperation agreement signed in 2021, deepening bilateral trade, investment and military cooperation between the two states.

During the visit, China’s President Xi Jinping denounced US sanctions on Iran, although a followup statement by the foreign ministry denied that China’s efforts to deepen its relationship with Iran were meant to counter US policy in the Middle East. Bloomberg reports that China has also proposed adding Iran to the BRICS group–an example of their deepening economic ties.

Raisi and Xi Jinping attending a welcome ceremony in Beijing. Photo: Iran president’s website via Reuters

In their joint statement, the two leaders called for the reimplementation of the 2015 Nuclear Agreement, with China promising to “participate constructively” in talks to resume negotiations on lifting sanctions and implementing the agreement. However, the FT reports it’s unlikely any firm economic commitments will be made, as Chinese companies remain cautious about violating US sanctions.

Politics and poor infrastructure worsen impact of earthquake in Syria. As the death toll from the Turkey-Syria earthquake soared above 40,000 the UN opened four border crossings between Turkey and Syria to help get humanitarian aid into Syria’s Idlib province, Al-Jazeera reports. Aid workers on the ground say a lack of medical supplies and inadequate facilities are compounding the crisis. Idlib now appears to be in the early stages of a cholera outbreak after the earthquake further damaged critical water and medical infrastructure.

Tents dot the hillside overlooking former homes in Al-Haram, Syria. Photo: Alessio Mamo/The Guardian

Leaders of Idlib’s de-facto government have come under criticism this week for refusing aid directed through Damascus and failing to adequately conduct rescue efforts. And Human Rights Watch reports that Syrian President Bashar al-Assad’s slow authorization of exceptions for UN aid across the Turkish-Syrian border highlights the urgent needs for alternative aid mechanisms for Syria.

The NGO also reports that Syria’s government and various rebel groups are still fighting in the region, leveraging control over humanitarian aid corridors to try to gain an advantage.

Saudi Arabia’s SWF looks to boost local infrastructure. The Saudi Arabia Public Investment Fund is channeling funds into local construction firms as it seeks to support the kingdom’s move away from dependence on oil exports, Reuters reports. The sovereign wealth fund this week revealed it had invested $1.3 billion in four firms in an effort to engage the private sector more deeply in developing infrastructure.

King Salman Park gardens and canals development in Riyadh, Saudi Arabia. Photo: Tasneem Alsultan/Bloomberg

The announcement of the investment coincides with the award of several major contracts for some of Crown Prince Mohammed bin Salman’s ambitious infrastructure projects. According to Bloomberg, the Saudi Arabian government is looking to massive infrastructure spending to stimulate the domestic economy.

Europe

Go deeper: Read the full Europe focus at FrontierMarkets.co/Europe

New details have been released about an alleged Russian plot to destabilize Moldova’s pro-Western government. The country’s president shared intelligence apparently showing Moscow had instructed “diversionists with military training and camouflaged in civilian clothes” from Serbia, Russia, Belarus and Montenegro to enter Moldova disguised as Serbian soccer fans.

The EBRD has warned that Russia’s attack on Ukraine will slow growth across Eastern Europe this year, causing energy prices, borrowing costs and inflation to remain elevated while deterring foreign investment. Hungary and Latvia are expected to see especially deep contractions. Energy-intensive factories across the region faced reduced competitiveness as input costs remain elevated.

Russian consumers are putting pressure on Western corporates hoping to maintain their operations there. According to a poll by Morning Consult, Russians have become less eager to welcome foreign-owned businesses, more likely to favor tariffs on foreign goods and more likely to go out of their way to buy domestic products.

A woman shops at a supermarket in Moscow. Photo: Natalia Kolesnikova/AFP/Getty

Albanian police dismantled over 500 illegal surveillance cameras that were apparently used by gangs to monitor citizens and law enforcement, reports the FT. With its gangs increasingly displaying capabilities once exclusive to the state, Albania risks following in the footsteps of Guinea-Bissau and Paraguay, becoming a key node in global smuggling hubs where the government is effectively subordinated by powerful criminal enterprises.

Go deeper: Read the full Europe focus at FrontierMarkets.co/Europe

Latin America

IMF commends El Salvador’s government and eases stance on bitcoin. The IMF appeared to soften its stance on El Salvador, saying that risks from bitcoin “have not materialized,” during yearly consultations that have been fiercely critical of the country’s crypto policies in previous years. While the lender reiterated its concern over El Salvador’s adoption of bitcoin as legal tender, it presented more measured recommendations to improve transparency and monitoring.

Nayib Bukele at the closing party of “Bitcoin Week” in November 2021. Photo: Jose Cabezas/Reuters

The IMF’s apparent shift could reflect the slow adoption of bitcoin by Salvadorans and the fact that President Nayib Bukele’s government passed a law regulating the issuance of digital assets by both the state and private entities. Additionally, two rounds of debt buybacks have minimized investor concerns over the Central American nation’s financing sources and fiscal policy in the medium term.

The fund’s full statement highlighted the “full recovery” of El Salvador’s economy to pre-pandemic levels, “driven by the effective government response to the health crisis.” But while real GDP growth for 2023 is projected to be above historical averages at 2.4%, the multilateral lender expressed concern over a rising current account deficit and possible spillover effects from a US recession.

Petro’s ambitious reforms run into Colombian polarization and stagnation. Thousands of Colombians took to the streets both to support and protest against President Gustavo Petro’s controversial health reform, which eliminates areas of private sector management, raises salaries and overhauls how care is provided. The bill comes on the heels of contentious tax, energy and security reforms that have inflamed long-running political tensions.

While Petro’s broad congressional coalition helped push through a tax reform last year, plans to remove healthcare from private management caused tensions with prominent coalition members and within his cabinet.

Colombian President Gustavo Petro. Photo: Manuel Cortina

Health reform is just the start of a busy legislative season in the Andean country. Petro’s government also plans to pass major pension and labor market reforms. Such expensive reforms are costing Petro political capital amid an environment of slowing economic growth and an uncertain outlook for the key energy sector.

Paraguay-Taiwan commercial relations deepen as ties come under election pressure. Paraguayan President Abdo Benitez reaffirmed Taiwan’s importance as a partner and emphasized Tapei’s continued healthcare, education, and economic support during a visit to Taipei. The visit comes shortly before an election that pits pro and anti-Taiwanese parties against each other in one of the 14 remaining countries with formal diplomatic relations with the self-ruling island.

Paraguay’s Taiwan ties have been under growing pressure from Beijing and the country’s own agricultural industry, which sees the relationship as an obstacle to accessing Chinese markets. Benítez’s delegation celebrated the arrival of the first pork shipment to Taiwan after President Tsai Ing-wen’s government increased exports to try and keep Asunción as an ally.

Paraguay’s President Mario Abdo Benítez (second left) is greeted by Taiwan’s Foreign Minister Joseph Wu. Photo: CNA, via Focus Taiwan

While Paraguayan producers are reportedly excited about access to a market that pays a premium compared to other markets, it is unlikely that Taiwan can match the volume of exports that mainland China could.

Global

Uncertainty weighs on investment flows to frontier and emerging markets. China’s abandonment of its so-called Zero-Covid policy prompted strong inflows into emerging markets, but as renewed questions arise over the prospects for interest-rate cuts in developed markets investors are becoming increasingly picky about which markets they are prepared to put money into.

“Until markets are more certain about just how calm the developed market rates environment is we probably will not see sustained flows across the board into all emerging and frontier markets,” Razia Khan, chief economist for Africa and the Middle East at Standard Chartered bank, said in this week’s FMN podcast.

“Early this year, China was expected to recover and market sentiment had focused very much on how quickly the Fed would be able to start cutting interest rates. Everything was in place for more risk on behavior,” she says. “But we’ve seen a tightening of conditions [and] we know this will bring about new concerns around debt sustainability,” she added.

The good news? “Despite having to cope with myriad external shocks, there is still a growth dynamic in Africa that is surprising positively. And I think that’s probably a good point for investors to focus on investors who are really looking to the long term.”

Learn more: Subscribe to FMN’s weekly podcast

What we’re reading

Ghana’s northern conflict re-ignites as jihadists come knocking. (The Africa Report)

US Congress members seek halt to $1 billion Nigeria weapons deal. (Reuters)

Sudan’s leader agrees to host Russian naval base on Red Sea. (Maritime Executive)

Vast refugee camp in Kenya swells as drought hits Somalia. (WSJ)

Kenya: NGOs accuse EU’s lending arm of due diligence failings. (FT)

Uganda: Gold exports thrive under the radar. (The Africa Report)

Rwanda says Congolese soldiers attack its border army post. (AP)

Egypt arrests social-media influencers in deepening crackdown. (WSJ)

Tunisia launches crackdown on opposition with wave of arrests. (FT)

Diabetes ravages emerging nations in Asia and Africa. (Nikkei)

The twin factors behind Pakistan’s growing Taliban problem. (The Diplomat)

Pakistan set for tax hikes in return for massive IMF bailout. (AP)

China and Iran call on Afghanistan to end restrictions on women. (AP)

East Timor faces economic challenges ahead of joining ASEAN. (Nikkei)

Sri Lanka and India ‘to sign power grid linking pact’ within two months. (Reuters)

Chevron to exit Myanmar with sale of natural gas assets. (Nikkei)

Thailand’s big corporations scramble for virtual bank licenses. (Nikkei)

Thai pandemic borrowing binge prompts calls for repayment delays. (FT)

Philippines raises key interest rate to 6%, Indonesia holds steady. (Nikkei)

Marcos says ‘hard to imagine’ Philippines can avoid Taiwan conflict. (Nikkei)

Indonesia seeks closer India ties to strengthen Global South role. (Nikkei)

Syria’s Assad uses disaster diplomacy to inch back onto world stage. (NYT)

Turkey quake cost put at $84b and 72,000 lives. (Balkaninsight)

Arab leaders warn Israeli actions threaten regional turmoil. (AP)

Russia’s growing trade in arms, oil and African politics. (FT)

Lukashenko says Belarus will only fight alongside Russia if it’s attacked. (Reuters)

El Salvador vows gang crackdown will go on as citizens cheer safer streets. (Reuters)

Colombian government and rebels resume peace talks in Mexico. (AP)

Argentina pushes for Mercosur–Singapore free trade agreement. (Mercopress)

Argentine savers ‘drown’ under spiraling prices as inflation hits 99%. (Reuters)