By Ken Stibler, Noah Berman and Dan Keeler

Welcome to the latest edition of Frontier Markets News. As always, I would love to hear from you at dan@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

If you’d like to receive this newsletter in your inbox every weekend, sign up at FrontierMarkets.co. Please also share this link with any friends or colleagues you think would enjoy it.

Africa

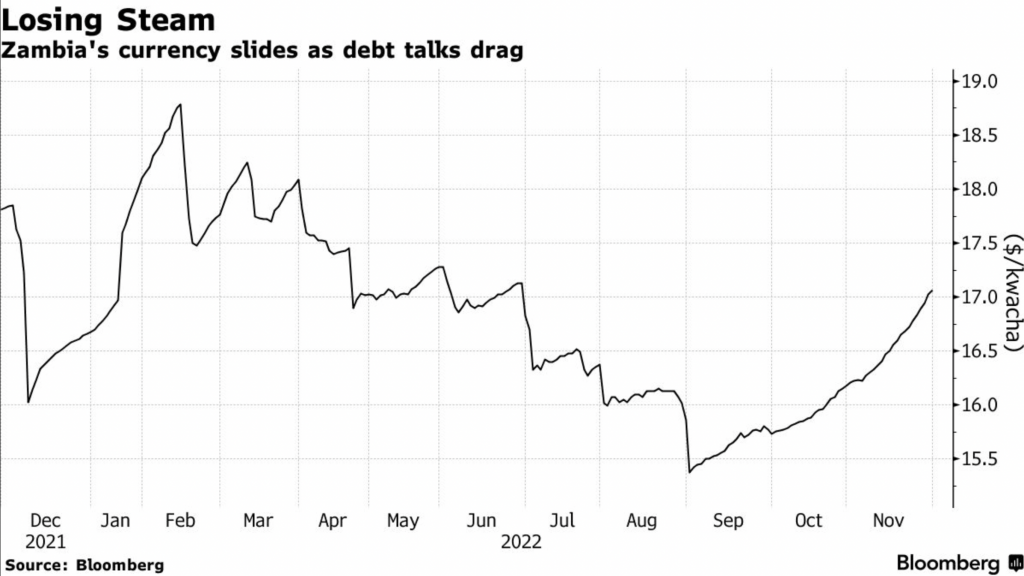

Zambia’s debt restructuring. The level of debt relief Zambia is seeking from its creditors is delaying a crucial restructuring process—and could derail its IMF agreement, Bloomberg’s Ama Tanoh reports.

The country has requested $8.4 billion in debt relief, nearly half the amount owed to creditors. Officials said the haircut is necessary to stay on track with the commitments to the IMF, which agreed to a $1.3 billion loan agreement with Zambia in August.

The Southern African country is pursuing restructuring under the G20 common framework, which brings together China and the so-called Paris Club of large Western economies. Zambia’s restructuring has been viewed by analysts as a test case for both the common framework and countries that are heavily indebted to China, which holds nearly a third of Zambia’s debt.

The question is especially thorny as Zambia’s ability to negotiate write-downs could set a precedent for other African countries that will need to restructure in coming years, Axios reports.

Asia

Indonesia plans digital currency. Indonesia’s central bank has revealed plans for a digital currency backed by the state, Reuters reports. The digital rupiah will be developed in three stages, beginning with wholesale use by banks. The bank did not specify a timeline for when the currency will go live.

Indonesia has banned other cryptocurrencies as a form of payment but does allow the purchase and sale of digital assets as an investment mechanism. Despite government hesitation, the country has seen a rapid increase in digital banking transactions and digital asset investment with transactions in 2022 set to exceed $3 trillion.

Indonesia joins a growing list of states to begin development of a central bank digital currency. China has championed the idea, and is poised to be the first major economy to launch a CBDC, according to the Economist.

Vietnam set to benefit as Apple looks to leave China. Apple is accelerating plansto shift some of its production outside China, promising a boost to manufacturers in Vietnam and India, Yang Jie and Aaron Tilley report in the WSJ. Turmoil at a place called iPhone City helped propel Apple’s shift. The Zhengzhou factory was convulsed in late November by violent protests by workers upset about wages and Covid-19 restrictions.

Apple’s longer-term goal is to ship 40% to 45% of iPhones from India, compared with a single-digit percentage currently, according to Ming-chi Kuo, an analyst at TF International Securities who follows the supply chain. Suppliers say Vietnam is expected to shoulder more of the manufacturing for other Apple products such as AirPods, smartwatches and laptops.

India and Vietnam have their own challenges. Dan Panzica, a former Foxconn executive who now advises companies on supply-chain issues, said Vietnam’s manufacturing was growing quickly but was short of workers. The country can handle 60,000-person manufacturing sites but not places such as Zhengzhou that reach into the hundreds of thousands, he said.

Middle East

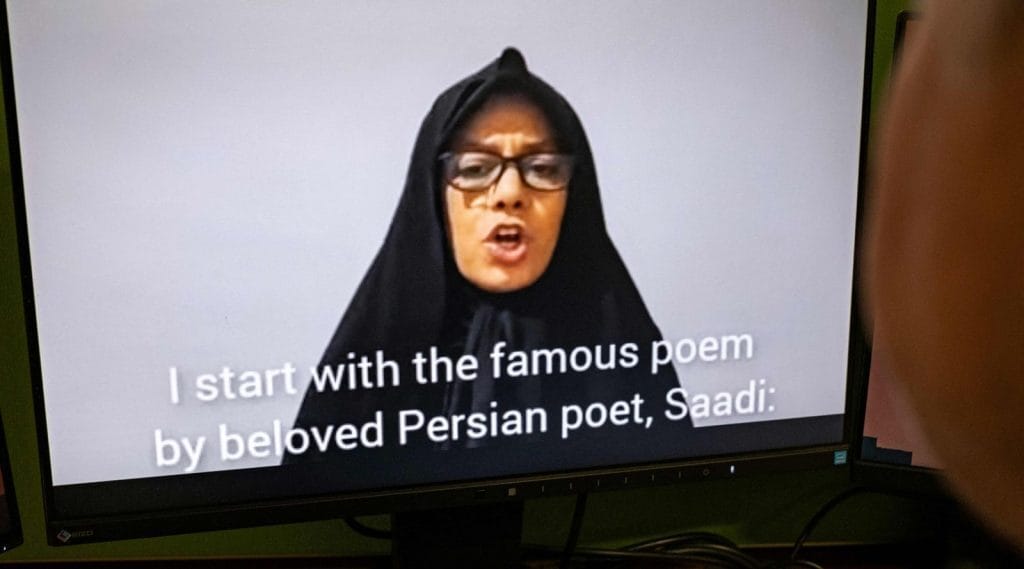

Iran arrests supreme leader’s niece amid crackdown on critics. Iran arrested a human-rights activist who is also the niece of Supreme Leader Ayatollah Ali Khamenei, according to her family, the Wall Street Journal’s Benoit Faucon reports. The move is part of a growing effort by the country’s regime to crack down on those who are critical of its response to a two-month-old protest movement.

Iranian authorities arrested human-rights advocate Farideh Moradkhani after she went to a prosecutor’s office following a summons, her brother said. Moradkhani, whose mother was Khamenei’s sister, comes from a branch of the family that has publicly opposed his rule.

In a video posted on YouTube by her brother on Friday, she called her uncle’s rule a “murderous and child-killing regime.” She also criticized what she says is the international community’s inaction and called on foreign governments to sever their ties with the Islamic Republic.

Over 15,000 people have been arrested since protests erupted in mid-September over the death of Mahsa Amini, a 22-year-old Kurdish woman who died while in police detention in Tehran after allegedly violating the country’s strict Islamic dress code.

Latin America

Cuban diplomatic push yields debt restructuring and energy support. China, Russia, Algeria, and Turkey have moved to restructure Cuba’s debt, provide new investment, and shore up its creaking energy sector, Reuters reports. The support was generated after President Miguel Díaz-Canel took a rare international tour to seek help tackling slowing economic activity, worsening blackouts and shortages of food, medicine and fuel.

Díaz-Canel said that Algeria and Russia had agreed to provide oil supplies to make up for reduced Venezuelan imports. The President also claimed to have finalized deals to fix decaying electricity infrastructure and finance wind and solar projects.

While China is Cuba’s most important commercial partner after Venezuela, trade and investment have declined by over $700 million over the past five years due to Cuba’s failure to meet debt payments.

“It was a beggar’s tour,” said John Kavulich, who headed the US-Cuba Trade and Economic Council in New York. “For the Cuban government to say this was a success is tortuous logic. It was somewhat embarrassing,” he added.

Mercosur faces more hurdles as Uruguay strikes alternative free trade deals.The Southern Common Market (Mercosur) is facing a crisis as Uruguay’s President Luis Lacalle Pou pursues several free trade agreements that violate the bloc’s rules. Montevideo has applied for membership in the 11-nation Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) to reduce trade barriers, tariffs and establish a common intellectual property framework.

The deal would provide new markets for Uruguay’s beef and soybeans to CPTPP members. Separately, Montevideo is seeking to conclude a trade deal outside of Mercosur with China.

Uruguay’s unilateral deal-making compromises the free trade area’s common external tariff and risks further compromising a bloc that has long been split over different positions on tariffs, a non-functioning representative body, and a longstanding inability to complete a free trade agreement with the EU. In an interview, Paraguay’s President Mario Abdo Benítez called Uruguay’s moves out as being detrimental to the South American bloc’s “essence.”

Global

EMs see best month in decades. Emerging markets surged in November, as debt and equity indices rode a wave of renewed optimism. Index provider MSCI’s EM equities index rose 14.6% in US dollar terms on its way to its best month since 2009, while a gauge of debt measured by JP Morgan climbed 7.6%, the fastest increase in over 20 years.

Inflows into emerging markets have been supported by the belief that the U.S. federal reserve will soon begin slowing interest rate hikes, the FT reports. Investors also responded with optimism to news that China could relax its zero-Covid policy, which investors expect will have positive ripple effects in Vietnam, Southeast Asia and beyond, Frontuara Capital founder Nick Padgett wrote in a note to clients.

Despite November’s gains, emerging markets bonds remain down 18% this year, while equities are down 21%. Economists forecast global growth will slow next year.

Global poor lose services as developing countries face higher debt payments.Across much of the developing world, cash-strapped governments are having to cut spending and freeze investments so they can pay creditors, as the Federal Reserve’s interest-rate hikes drive up borrowing costs, the WSJ’s Gabriele Steinhauser and Alexander Saeedy report. The cuts are now hitting some of the world’s poorest people at a time when many are already reeling from economic shocks brought on by Russia’s invasion of Ukraine and the coronavirus pandemic.

Aided by ultralow interest rates in the West and Chinese loans, emerging and developing economies over the past decade ran up record levels of government debt, which the IMF expects to reach 64.5% of gross domestic product at the end of 2022. In 2008, government debt in the same economies was just 33.6% of GDP.

Servicing the debt has become much more costly, as local currencies have lost value against the dollar and governments are facing high bills for food and fuel imports, which many governments subsidize for their citizens.

The long read: Guest Post

Clouds gather over Latin America’s future. Market dynamics are posing challenges to Latin America’s economies that look eerily like those that triggered major crises in the past, writes José Martinez Sanguinetti, who manages a $3.5 billion global portfolio as chief investment officer at Rimac Seguros.

Slowing global growth, a likely recession in the US and the ongoing impacts of the pandemic and Russia’s war on Ukraine are darkening the prospects for Latin America in 2023. With potentially difficult local conditions adding to the shock, the region is heading for the most challenging environment it’s seen in many decades.

Read more at FrontierMarkets.co.

What we’re reading

DR Congo army accuses M23 rebels of killing 50 civilians. (Al Jazeera)

Southern Africa’s biggest dam halts power generation for Zimbabwe. (Bloomberg)

UN panel accuses regional South Sudan officials of overseeing gang rapes, beheadings. (Reuters)

Moody’s cuts Ghana’s junk-rated debt on risk of creditor losses. (Bloomberg)

Philippines needs to find ways to exploit South China Sea resources, says Marcos. (Reuters)

Marcos’ cousin and son push $4.9 billion Philippine sovereign wealth fund. (Nikkei)

Thailand approves tax on financial trades to fill state coffers. (Nikkei)

Pakistan Taliban attacks police after calling off cease-fire. (WSJ)

India’s plan to take on China as South Asia’s favorite lender. (FT)

Saudi Arabia wealth fund secures $17 billion loan for megaproject push. (FT)

Good news in gloomy times: Georgia’s economy. (Euractiv)

Armenia and Hungary agree to restore diplomatic relations after 10-year suspension. (Radio Free Europe)

Lithuania proves prescient on risk of Russian energy. (FT)

Fresh electricity price hike hits Moldova hard. (Balkaninsight)

FDI strengthens Central and Eastern Europe’s economies. (Emerging Europe)

FTX tensions intensify as Bahamas blasts company’s new chief. (Bloomberg)

US Blocks Dominican Republic company’s sugar imports over alleged forced labor. (WSJ)

Honduras declares state of emergency against gang crime. (AP)

Eased US sanctions on Venezuelan oil provide weak supply boost. (FT)

Colombia to launch military operation against armed groups on border. (Reuters)

Peru opposition lawmakers launch third impeachment attempt against Castillo. (Reuters)

Chile leads the way in solar energy. (El Pais)

Caps on fuel prices announced to curb Argentina’s inflation. (Mercopress)