🌍 Frontier Markets News, September 17th 2023

A weekly review of key news from global growth markets

Welcome to the latest edition of Frontier Markets News. As always, we would love to hear from you at hello@frontiermarkets.co with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive FMN in your inbox every weekend.

By Ken Stibler, Noah Berman and Nojan Rostami. Executive editor: Dan Keeler

Africa

Natural disasters strike North Africa

Days after a 6.8-magnitude earthquake hit Morocco late last week, devastating floods ripped through eastern Libya. Almost 3,000 people died in the quake in Morocco, CNN reports, which began in the High Atlas Mountains and spread to Marrakech, about 44 miles to the north. It was the country’s worst earthquake in more than 60 years.

On Tuesday, the deadliest storm in Africa since 1900 made landfall in Libya, triggering a deluge of floodwaters that destroyed a quarter of the Libyan city of Derna, killing more than 11,000 people. In Libya, where rival administrations jockey for power, international aid efforts were thwarted in the two days following the disaster, the Guardian reports, potentially leading to a higher death toll.

Scientists say flooding is made significantly more likely by human-caused climate change.

While some international aid to Morocco has been hindered by its government, countries and nonprofits were able to send teams to initiate search and rescue operations soon after the quake struck, the Washington Post reports.

African Development Bank calls on IMF for climate funding

The Africa Development Bank said on Monday that wealthy nations should use their IMF special drawing rights (SDR) to fund projects that help Africa adapt to climate change, Bloomberg reports. The call comes amid increasing efforts on the continent to find solutions that limit the impact of a warming atmosphere.

Last week, the African Union made a similar request, calling for rich countries to redirect $100 billion in SDRs to the continent. The pleas come on the heels of the first-ever Africa Climate Summit, which ended with a unanimous declaration urging reform to international financial institutions to help the continent mitigate risks associated with climate change. Africa is the continent most at risk of climate catastrophe, according to the AfDB.

SDR’s are not currency, but they do represent claims on the currencies of IMF members, thereby providing a source of liquidity for their holders. Rich countries receive far more in annual SDR disbursements than developing nations. Last year, the US received $113 billion in SDRs, while all of Africa received just $33 billion, according to Bloomberg.

Nigeria drops out of frontier index

Index provider FTSE Russell this week bumped Nigeria out of its frontier markets index over concerns about foreign-exchange liquidity. The downgrade could result in a further decline in foreign investment into the country, The Punch reports, even as Nigerians struggle to pay for staple goods such as food and fuel. Foreign investment fell 33% last year, to a nine-year low.

Meanwhile, Nigeria’s power grid suffered a “total system collapse” on Thursday after a fire damaged a major transmission line, BBC reports. The outage resulted in nationwide blackouts.

But it wasn’t all bad news for Nigeria this week. On Tuesday, the United Arab Emirates lifted a visa ban on the country and announced an investment deal worth billions of dollars, potentially providing a template for future Gulf-Africa cooperation, African Business reports.

Asia

‘War crimes intensifying’ in Myanmar

Myanmar’s military is increasing its assault on civilians, independent human rights investigators appointed by the UN said on Monday. “The frequency and intensity of war crimes and crimes against humanity has only increased in recent months,” said Nicholas Koumjian, head of the UN team investigating the crimes.

Myanmar’s military seized power in a coup in February 2021. Since then, previously fragmented resistance forces have banded together in an attempt to drive the military out of power.

The result has been deadly for civilians. At least 4,000 have been killed by the junta and pro-military groups since the coup, according to the Assistance Association for Political Prisoners. The group estimates that 25,000 people have been arrested, with almost 20,000 still detained.

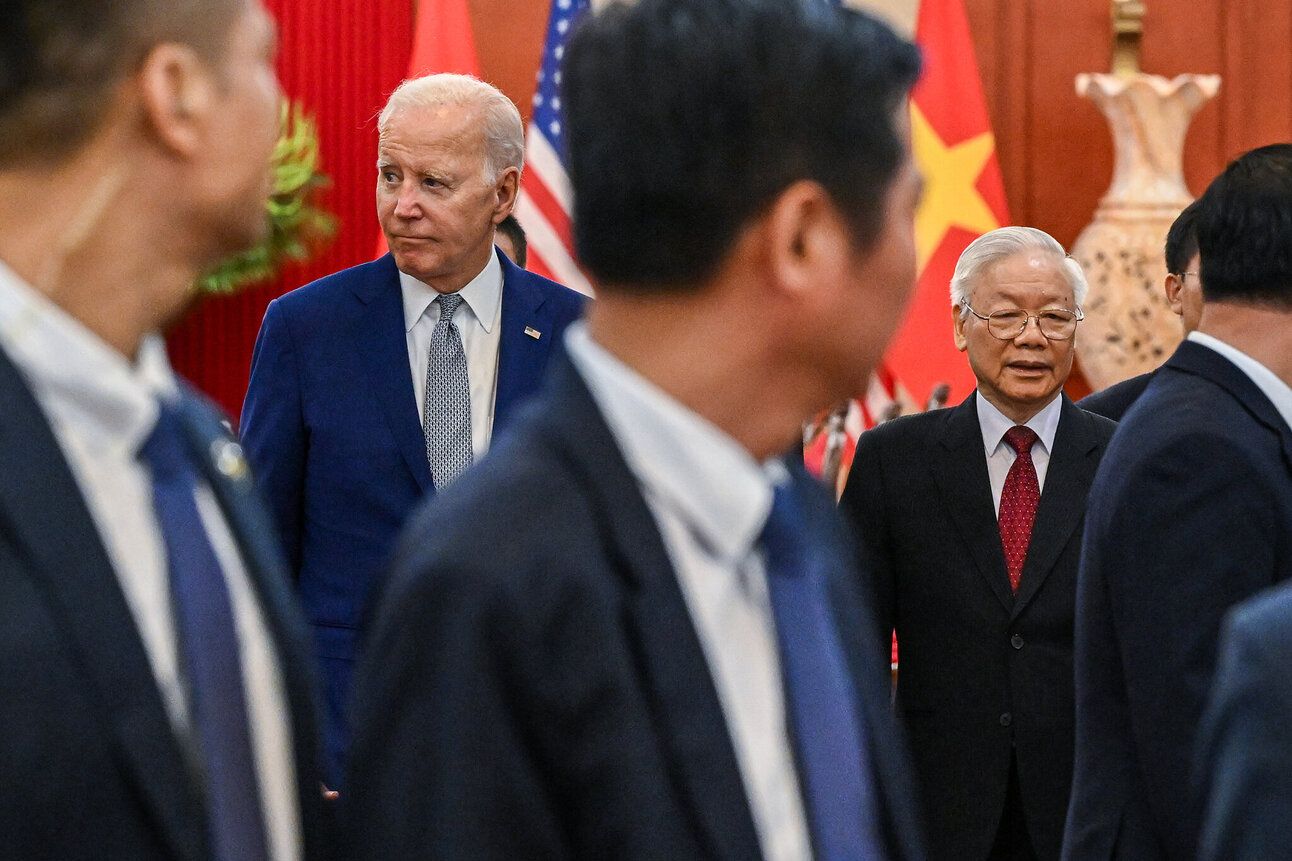

Vietnam deepens ties with US

The US and Vietnam this week established a “comprehensive strategic partnership,” upgrading their ties to the highest level in the history of their bilateral relationship. The partnership, announced during a visit to Vietnam by President Joe Biden, marks an elevation to the highest of three diplomatic levels Vietnam bestows upon non-neighboring partner nations.

The United States will join China, India, Russia and South Korea in the category.

Biden’s visit came amid mounting concerns shared by the two countries over China’s rise, providing a subtext for the visit that neither leader directly addressed, the New York Times reports. In a joint statement, Biden and Vietnamese leader Nguyen Phu Trong “reaffirmed the importance of economic, trade, and investment cooperation and innovation-driven inclusive economic growth as the core foundations and sources of momentum in the bilateral relationship.”

Sri Lanka edges closer to restructuring

Sri Lanka has exchanged some defaulted local debt for new bonds, according to a statement posted on the finance ministry’s website on Tuesday. The move brings the island nation one step closer to a full restructuring, which it is aiming to finish this year.

It could also boost the country's odds in passing an IMF review of its restructuring progress as the lender implements a $3 billion bailout program, Bloomberg reports. If the review goes in Sri Lanka’s favor, the country could see a disbursement of $330 million in November.

“We expect the recovery to continue over the coming months, helped by the sharp drop in inflation, lower interest rates, a recovery in tourism and the scrapping of crippling import controls,” Gareth Leather, an analyst at research firm Capital Economics, said.

Sri Lanka will now turn to the task of restructuring its foreign debt, which is held by creditors including China and India.

Middle East

Iran’s regional trade surges despite international condemnation of morality laws

Trade between Iran and the UAE has reportedly surged in recent months as the neighbors have mutually eased business and capital restrictions, the FT reports. The UAE is now Iran’s second largest trading partner, after China, with flows recovering from pandemic lows to reach some $24 billion in the 12 months ending March 2023. Trade is targeted to increase to $30 billion in the next two years.

The increase in bilateral trade comes amidst a broader trend of regional de-escalation and detente between Iran and its chief rival Saudi Arabia, of which the UAE is a close partner. However, internationally, Iran risks drifting into further isolation, as a proposed update to its morality laws, which prescribes 10 years in prison for women who don’t veil, draws UN condemnation and calls for an Olympics ban.

This week also saw the US, UK, France and Germany accusing Iran of a general lack of cooperation and stonewalling the UN nuclear watchdog amidst reports of Iranian trace uranium found at unreported sites. Iran responded over the weekend by expelling several IAEA inspectors, a response the IAEA criticized as “disproportionate and unprecedented” and “another step in the wrong direction.”

US issues warning to Iraqi banks over dollar sanctions evasion

The US Department of the Treasury warned Iraqi banks over sanctioned dollar-denominated transactions with Iran, Reuters reports. The warning follows a July action by the US barring 14 Iraqi banks from dollar transactions due to fraud, money laundering and participation in Iranian sanctions-evasion activities.

Iraq—with some $100 billion in foreign reserves and dependence on US fiscal and monetary support—has apparently been cooperative to a degree, with the sanctioned banks urging the government to come into compliance. However, an anonymous US Treasury official told Reuters that a number of banks continue to operate with risks “that must be remediated.”

The official claims that of the 70 private banks operating in Iran, around a third are now officially on US blacklists prohibiting them from dollar transactions. The Iraqi government’s senior foreign affairs adviser Farhad Alaadin says it has taken “hard measures to make sure that Iraqi interests are protected while improving the banking sector and the transfer market.”

Europe

Populism surges in Eastern Europe as Fico looks set for reelection in Slovakia

With former prime minister Robert Fico in pole position to lead Slovakia’s government after the September 30 election, the stage is set for a return of populism across Western Europe. The ongoing rise of populist and far-right parties in countries such as Slovakia, Poland and Hungary could shift the balance of power in a region where successive governments have supported measures to counter Russian aggression, particularly in Ukraine.

Fico’s Smer party has tapped into discontent over pandemic measures and Slovakia’s aid for Ukraine to gain support. His party’s program emphasizes so-called traditional values and state intervention in the economy, challenging the liberal economic policies that have driven growth recently.

The broader return of populism across Eastern Europe carries implications beyond Ukraine support, potentially threatening the market-oriented policies that had become common across the region.

Latin America

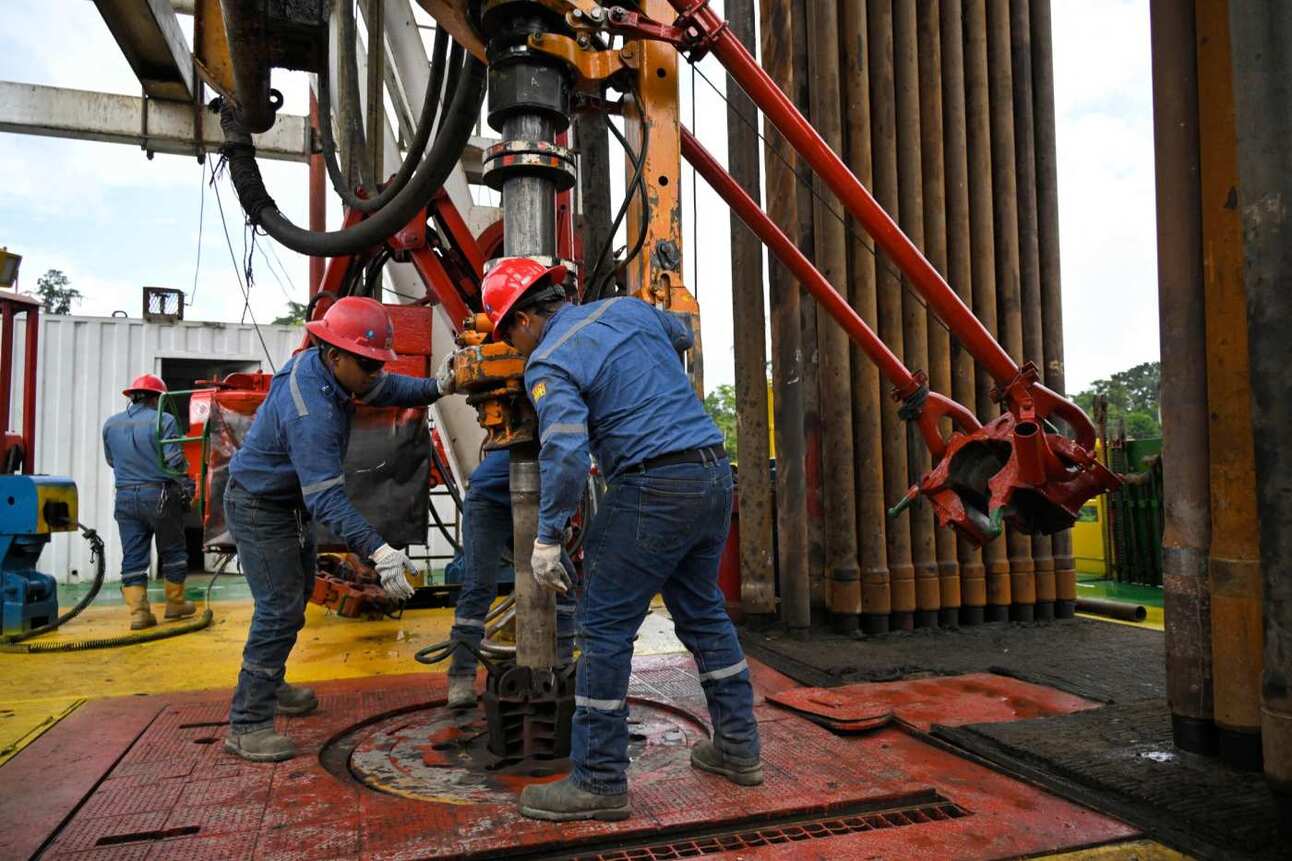

Ecuador could lose billions in extractives revenues

Ecuador’s recent referendum, which banned mining in some regions and cut oil drilling in the Amazon rainforest, is threatening the country’s economic model, the FT reports. While applauded by environmentalists and indigenous groups, the measures have cast a shadow over Ecuador’s fiscal outlook, potentially causing billions of lost export revenue.

Economists believe Ecuador might have to raise taxes and reduce fuel subsidies to bridge the fiscal gap, and industry leaders are worried the decision could deter foreign investment. National oil company Petroecuador estimates that the revenue loss from the mining ban could reach $13.8 billion over the next two decades. The central bank forecasts a cumulative reduction in GDP of 1.9 percentage points from 2023 to 2026 due to the ban.

This shift in strategy away from resource extraction comes as Ecuador faces political uncertainty, with a presidential runoff election scheduled for mid-October.

Peru bolsters growing debt-for-nature swap trend

Peru has entered into a $20 million debt-for-nature swap with the US, aimed at financing climate action and tropical forest protection over the next 13 years, Mongabay reports. This marks the third such agreement between the two governments, with the surplus from this deal set to fund the conservation of protected areas, natural resource management, and support sustainable livelihoods in Peruvian rainforest communities.

The US government has committed $15 million under the Rainforest Conservation Act, and four NGOs contributed $3 million to facilitate the arrangement.

Debt-for-nature swaps are part of a growing public finance trend across emerging markets, with multiple Latin American countries, including Belize, Brazil, Ecuador, Colombia, Guatemala and Paraguay, having engaged in similar deals to lower the risk of default while simultaneously promoting biodiversity and addressing climate change.

Critics warn the deals need effective monitoring to ensure the they achieve positive environmental impacts, but studies on Peru’s previous swaps indicate that funding has been successfully used for conservation and community-focused initiatives.

Guatemala’s president-elect halts participation in transition after electoral agency raids

Guatemalan President-elect Bernardo Arevalo has announced a temporary suspension of his participation in the transition of power after the top prosecutor’s office in Guatemala conducted raids on the country’s main electoral tribunal. Arevalo has characterized these actions as part of an attempted coup and has criticized them as “flagrant crimes of abuse of authority for electoral purposes.”

Arevalo has stated that he will resume his participation in the transition process once the necessary institutional and political conditions are reestablished.

The Organization of American States (OAS) said the raids violated Guatemalan electoral law and were aimed at raising questions over the electoral process and intimidating electoral authorities and personnel. The growing potential for the ruling party to try and undermine the election results comes after Arevalo scored a resounding victory in the August 20th runoff election, where he campaigned on promises to address corruption in one of the most corruption countries in the region.

The long read

In a guest post this week, Jose Pedro Martínez Sanguinetti, chief investment officer at Rimac Seguros, explores the implications of Javier Milei’s libertarian revolution in Argentina—and what it means for the Latin American region as a whole.

Milei’s promises include less taxation, less government spending, complete elimination of the central bank, adoption of the US dollar as legal tender and a tough hand on crime amongst many other things. His freshness vis a vis the ruling “casta” of politicians has earned him great popularity.

But can it work? Read on to find out.

What we’re reading

Ghana: Domestic debt swap leaves core financing issues insecure. (The Africa Report)

South Africa, Zimbabwe secondary exchanges open deeper African markets. (The Africa Report)

Experts wary of Mali’s new mining code despite Barrick Gold’s involvement (The Africa Report)

Malawi president takes steps toward eliminating food shortages (VOA)

Walmart goes all in on Africa (WSJ)

US and Vietnam unveil billions in semiconductor and AI deals (FT)

Myanmar’s forests fall victim to conflict (Nikkei)

Hun Manet visits China in first foreign trip as Cambodian PM (The Diplomat)

Malaysia plans to ban exports of rare earth minerals (Nikkei)

Pakistan says prize money to be given to informants against smuggling, hoarding. (Dawn)

Saudi Arabia investment fund ‘linked to human rights abuses’ (Human Rights Watch)

Saudi Arabia invites Yemen’s Houthi delegation to Riyadh for ceasefire talks (Reuters)

Saudi-UAE rift threatens US effort to end Yemen war (Bloomberg)

US, India, Saudi and EU unveil rail and ports deal on G20 sidelines (Reuters)

Lebanon central bank will limit access to new currency-exchange platform (Reuters)

US allows release of $6 billion to Iran before prisoner swap (Bloomberg)

Ukraine thanks Bulgaria after parliament lifts food-export restrictions (Radio Free Europe)

Ukraine makes progress on anti-graft probes (FT Opinion)

Viktor Orban has Georgia on his mind ahead of Hungary demographic summit (BalkanInsight)

Bosnia risks return to money laundering ‘grey list’ (BalkanInsight)

Influx of Russian fraudsters gives Turkish cybercrime hub new lease of life (FT)

Argentine president suggests Celac joins G20 (Mercopress)

Argentina spares millions from paying income tax as vote nears (Bloomberg)

Trinidad and Tobago approves indefinite extension of economic sanctions against Haiti (Jamaica Observer)

Guyana’s economy set to grow 38% this year (Bloomberg)

El Salvador is imprisoning people at triple the rate of the US (Bloomberg)

Colombian cocaine production sees record surge (WSJ)

Colombia’s Petro recruits Mexico’s López Obrador to rethink war on drugs (El País)

Venezuelan bonds rally as investors bet on detente with Washington (FT)

Maduro wants China to help Venezuela join BRICS (Mercopress)

China upgrades relationship with Venezuela to ‘all weather’ partnership (AP)