EM Meta-Forecast: Q1 2025

A comprehensive roundup of 2025 emerging and frontier market investment outlook reports

Executive Summary

The year 2024 epitomized the inherent volatility and resilience of emerging and frontier markets. It unfolded amid a perfect storm of global headwinds: “higher for longer” interest rates in key developed markets (DMs), escalating geopolitical tensions, and a likely resurgence of protectionist policies under the re-elected Trump administration. Despite the challenges, growth markets as a group delivered steady returns driven by high starting interest rates, structural reforms and shifting investor sentiment.

In 2025, cautious optimism pervades. Inflationary pressures have eased across most EM regions, paving the way for monetary easing and policy recalibrations. Countries such as Egypt and Nigeria, which undertook significant currency adjustments in 2024, are emerging as focal points of investment. Their lowered budget and trade deficits and improved macroeconomic metrics highlight a broader theme: the crucial importance of structural reforms and fiscal discipline for investors.

However, the path forward is fraught with complexity. Geopolitical hotspots such as Ukraine, the Middle East and the South China Sea continue to cast a shadow over global trade and capital flows. Meanwhile, the forceful reassertion of US interests in trade negotiations introduces a layer of uncertainty for economies heavily reliant on exports.

Against this backdrop, EMs are far from monolithic, of course. Latin America stands out for its unexpectedly strong economic performance, with Brazil and Argentina leading a regional recovery. Sub-Saharan Africa remains a story of unfulfilled potential, with reform-minded economies such as South Africa and Ghana making strides amid lingering infrastructural challenges.

Emerging Asia, a perennial growth driver, presents a nuanced picture. Robust domestic demand is offsetting external headwinds in countries such as India, while China’s attempt to stabilize its economy and move away from supply-side imbalances is testing the resilience of its economy.

In terms of asset classes, emerging market debt (EMD) continues to attract considerable interest, particularly in high-yield sovereigns and emerging-market corporates, where spreads remain enticing despite the narrowing gap with DMs.

Equities offer pockets of opportunity, particularly in sectors aligned with global megatrends such as technology, green energy and healthcare. Meanwhile, local currency debt, although riskier in a strong-dollar environment, could offer substantial upside for investors with a high-risk tolerance.

The interplay of global and regional dynamics will dictate the narrative for EM investments. Key questions loom: Will China’s stimulus measures translate into sustained growth? Can Latin America build on its nascent recovery? How will geopolitical risks shape investor sentiment? And critically, will EMs’ structural advantages—youthful demographics, resource wealth and technological adoption—outweigh the drag of external vulnerabilities?

This meta-forecast synthesizes insights from leading investment outlooks to provide a panoramic view of the coming year’s emerging and frontier market landscape. For investors, it offers not just an appraisal of where EMs and FMs stand but a roadmap for where they are headed.

2025 Projections

Promise amid a precarious external environment

EM/FM Macro

Emerging and frontier markets (EM and FM) entered 2025 on a precarious yet promising footing, shaped by a year of contrasting fortunes. In 2024, these economies navigated a global environment defined by restrictive monetary policies in advanced economies, heightened geopolitical risks and significant trade disruptions. Yet, they demonstrated a remarkable capacity to adapt, leveraging structural reforms, robust domestic demand, and external tailwinds in selective cases to outperform expectations.

Economic growth across emerging markets slowed slightly, with aggregate GDP decelerating from 4.1% in 2024 to an anticipated 3.8% in 2025. This reflects a divergence between the largest EM economies, where growth headwinds persist, and smaller, reform-oriented economies experiencing robust expansions. China, grappling with property sector instability and recalibrated growth policies, continues to exert outsized influence on the broader EM narrative. However, its transition toward domestic consumption, with its consequent increase in commodity demand and consumption of intermediate goods, presents opportunities for regional trade partners—and rivals. India remains a growth engine, although fiscal tightening and challenges in manufacturing competitiveness temper near-term optimism. Southeast Asia has emerged as a pocket of resilience, with economies like Vietnam and Malaysia benefiting from shifts in global supply chains.

In frontier markets, progress was marked by critical restructuring efforts and newfound stability. Sovereigns such as Ghana, Sri Lanka and Zambia made strides in restoring macroeconomic balance through debt restructuring and fiscal reforms. These initiatives, while painful in the short term, have laid the groundwork for potential ratings upgrades and increased investor confidence. Sub-Saharan Africa remains a mixed picture, with reformist economies gaining traction while others struggle under the weight of external debt and limited fiscal space.

Financial performance mirrored this divergence. Sovereign and corporate bond issuance gained momentum in 2024, reflecting strong investor demand for high-yield debt. Spreads tightened across both emerging and frontier markets, signaling improved market sentiment, though valuation concerns are beginning to emerge in certain segments, according to New York Life’s EM Debt Q1 forecast. The surge in US Treasury yields, a dominant factor throughout 2024, acted as a double-edged sword—providing competition for EM assets but also underscoring the relative value of EM debt given persistent high yields.

One of the standout stories of 2024 was the relative stability in EM external accounts, despite global trade disruptions. Many EMs benefitted from resilient commodity exports, a partial recovery in tourism, and improved remittance flows. However, structural imbalances persist, particularly in economies highly reliant on imported energy or food. The shift toward localized supply chains, spurred by US-China trade tensions, has opened new avenues for intra-regional trade within Asia and Latin America, though the transition remains uneven.

The outlook for 2025 hinges on a delicate interplay of global and local dynamics. On one hand, broad-based monetary easing in advanced and emerging markets could provide a supportive backdrop for growth. On the other, geopolitical uncertainties—including the ongoing Russia-Ukraine conflict and escalating trade frictions—threaten to undermine progress. For frontier markets, sustained improvement in fiscal and external metrics will be critical to attracting investment, especially as global financial conditions tighten.

As we assess the year ahead, it is evident that the emerging and frontier markets landscape is one of selective opportunities rather than broad-based gains. Investors will need to navigate a fragmented environment where country-specific factors and structural reforms hold the key to outperformance. The narrative for 2025 is clear: EMs and FMs are adapting to a new global paradigm, and those that succeed will be defined by their ability to balance short-term vulnerabilities with long-term potential.

Asset Class Outlooks

Global risks + regional opportunities = potential outperformance

Fixed Income

Emerging market fixed income remains a compelling opportunity for 2025, as high starting yields and easing inflation provide a supportive backdrop. Countries such as Brazil, South Africa and Indonesia offer attractive entry points for investors seeking real yield. Sovereign restructurings and improved credit metrics in high-yield segments add further optimism. Sovereign and corporate bond spreads also compressed significantly in 2024, with the average yield on hard currency sovereign bonds declining from 7.85% to 7.71%, and corporate bonds following a similar trend, tightening from 6.76% to 6.73%.

Despite these improvements, the yield levels remain competitive compared to developed market bonds, sustaining strong investor demand. The high starting yields on EM debt—combined with narrowing risk premiums—suggest that 2025 could deliver attractive risk-adjusted returns, particularly for investors in high-yield sovereigns such as Egypt, Ghana and Argentina. Furthermore, defaults in 2024 remained contained, and countries including Zambia and Sri Lanka are emerging from restructuring efforts, signaling potential ratings upgrades that could further compress spreads and broaden market access.

However, the outlook is not without its challenges. The strong US dollar, driven by elevated US interest rates and a robust American economy, poses a significant headwind for local currency EM debt markets. Real yields in key local markets remain enticing—Brazil at 12.8%, Mexico at 10.0% and Indonesia at 6.9%—but the currency risks associated with dollar strength may offset these gains, particularly in markets with weaker macroeconomic fundamentals.

Fiscal vulnerabilities are also likely to remain a key differentiator in 2025. While governments in Turkey and Nigeria have implemented reforms to stabilize external balances and reduce fiscal distortions, others, including Pakistan and Sri Lanka, face persistent external debt pressures and refinancing risks, with sovereign spreads in these markets remaining elevated. Investors will increasingly focus on countries that demonstrate commitment to structural reforms, prudent fiscal policies and diversification of funding sources.

Equities

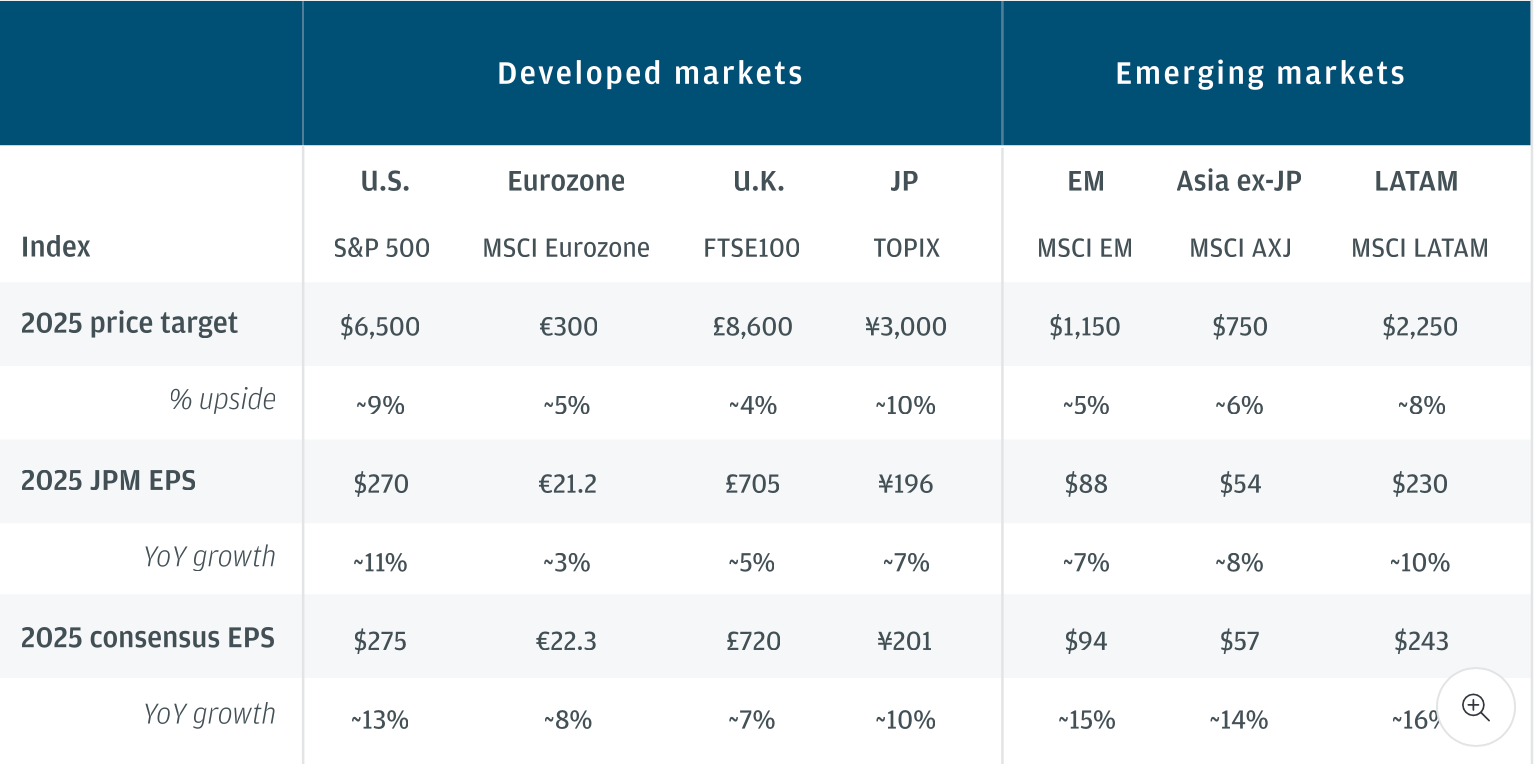

Entering 2025, EM equities elicited cautious optimism, driven by favorable macroeconomic conditions in select regions and improving corporate earnings growth. After outperforming developed markets in the latter half of 2024, supported by the Federal Reserve’s easing cycle and China’s stimulus measures, EM equities are poised for continued recovery, supported by an expected 15% growth in earnings per share (EPS) in 2025, compared to the 7% forecast for developed markets (DMs).